Maryland Affidavit Of Residency 2021

Description

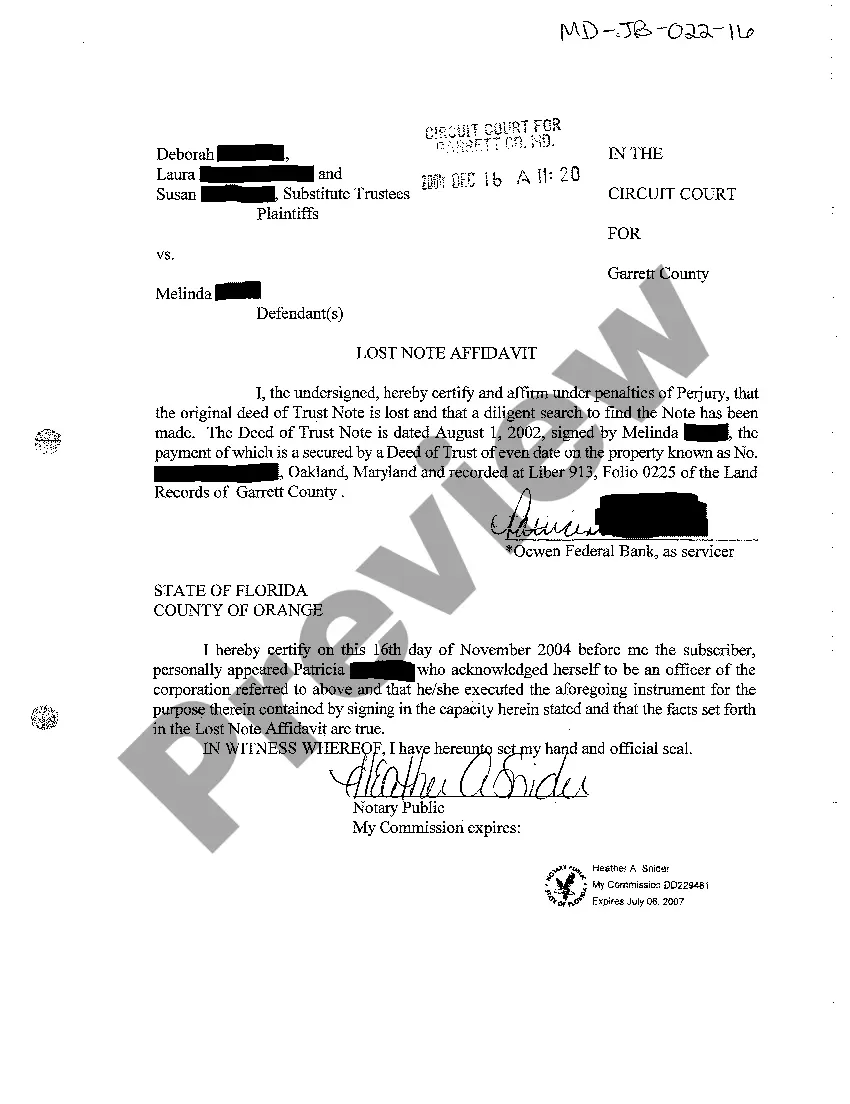

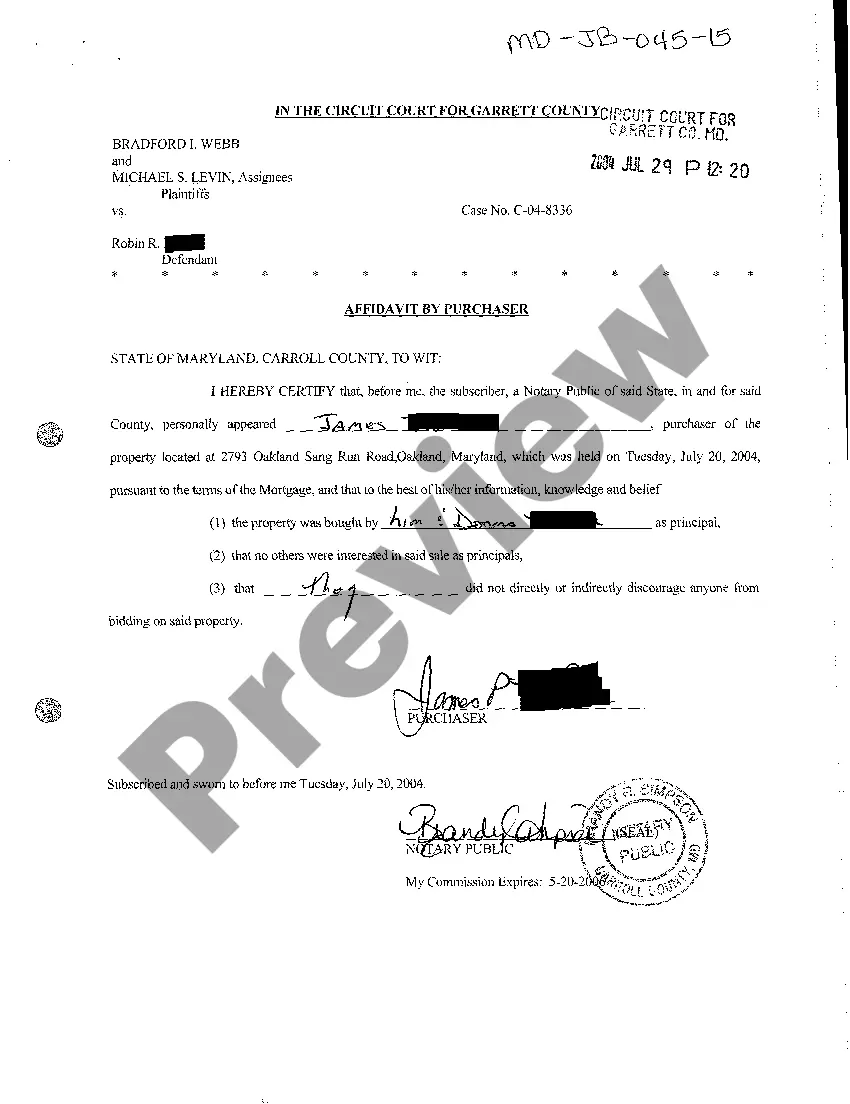

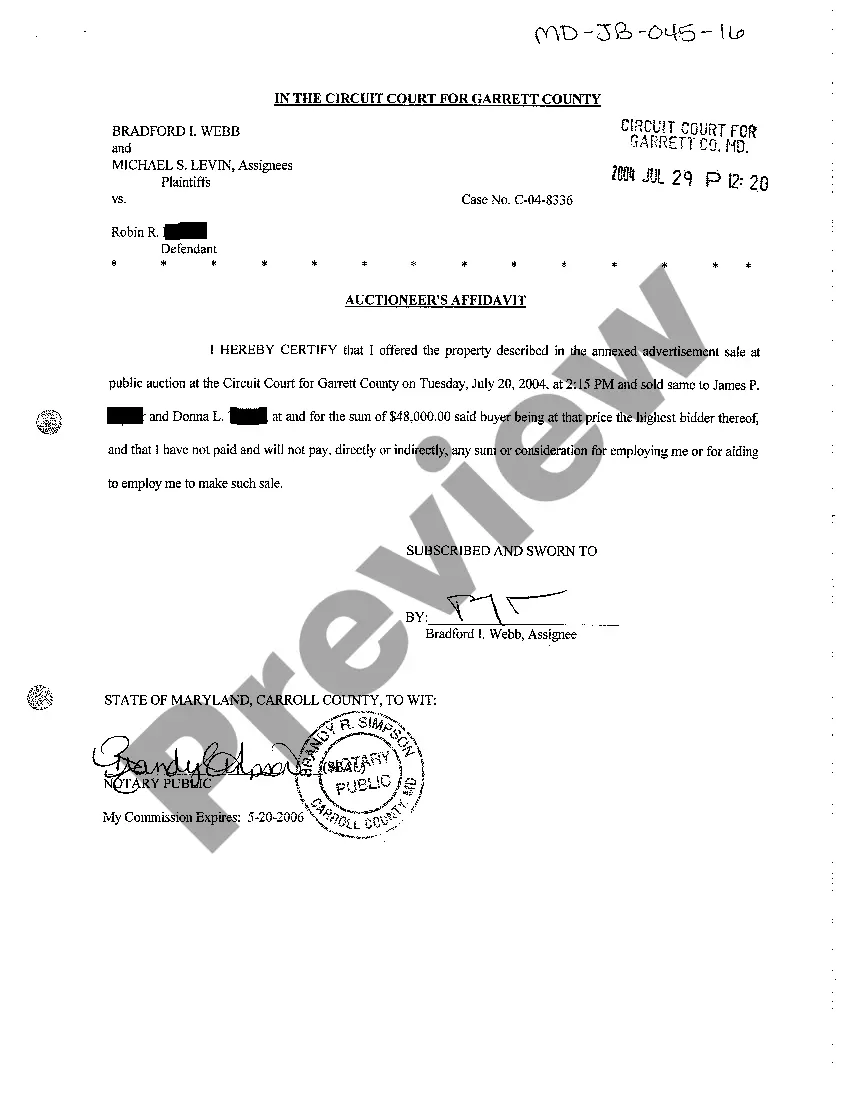

How to fill out Maryland Auctioneer's Affidavit?

Whether you deal with documents frequently or occasionally need to file a legal report, it is essential to have a valuable resource where all the samples are pertinent and current.

One important thing you must do regarding a Maryland Affidavit Of Residency 2021 is to ensure that it is indeed the most recent edition, as this determines its eligibility for submission.

If you wish to streamline your quest for the most recent document examples, search for them on US Legal Forms.

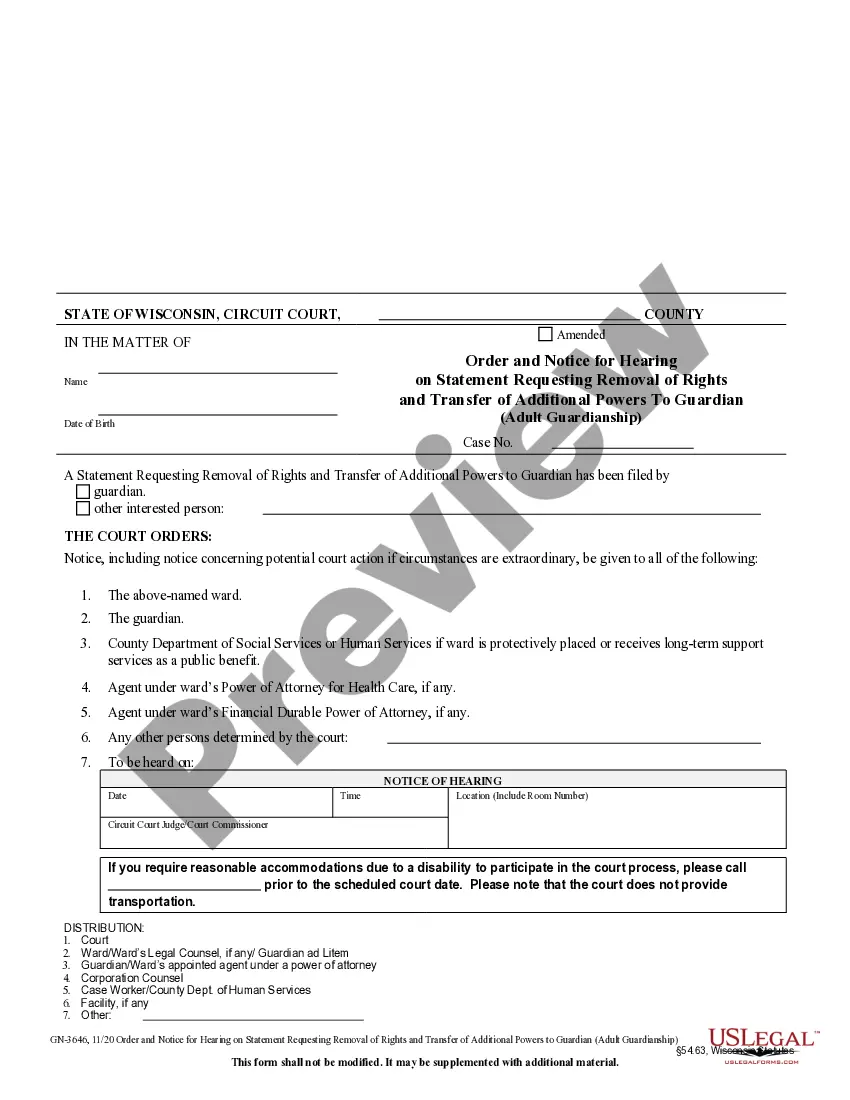

To obtain a form without an account, follow these steps: Use the search option to locate the desired form. View the Maryland Affidavit Of Residency 2021 preview and outline to ensure it is exactly what you need. After confirming the form's accuracy, simply click Buy Now. Choose a subscription plan that suits you. Create a new account or Log In to your existing one. Enter your credit card details or PayPal account to complete the transaction. Select the document format for download and confirm. Eliminate the hassle of managing legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a collection of legal templates that includes nearly every document example you might be seeking.

- Look for the necessary templates, instantly verify their relevance, and discover more about their applications.

- With US Legal Forms, you can access over 85,000 document templates across various fields.

- Find the Maryland Affidavit Of Residency 2021 samples within a few clicks and save them in your profile at any time.

- A US Legal Forms account enables you to access all the needed samples with greater ease and without stress.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need will be readily available.

- This way, you won’t waste time searching for the right template or verifying its authenticity.

Form popularity

FAQ

Purpose. Complete Form MW507 so that your employer can withhold the correct. Maryland income tax from your pay. Consider completing a new Form MW507. each year and when your personal or financial situation changes.

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. spouse - An additional $1,000 may be claimed if the taxpayer and/or spouse is at least 65 years of age and/or blind on the last day of the tax year.

If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter EXEMPT in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507. In addition, you must also complete and attach form MW507M.

If the decedent was domiciled in Maryland on the date of death, the fiduciary is a resident fiduciary and the personal representative can sign an affidavit of residence (WH-AR), thereby exempt from the withholding requirement.