Maryland Affidavit Of Residency

Description

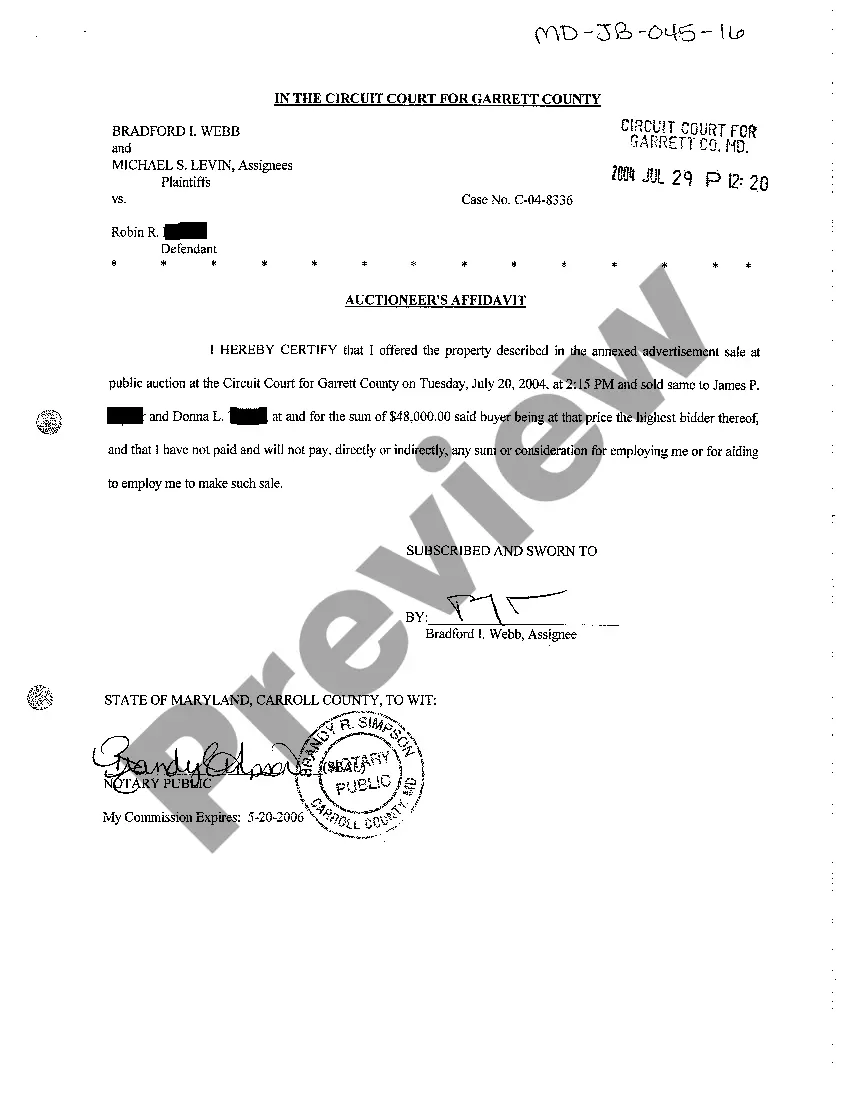

How to fill out Maryland Auctioneer's Affidavit?

Well-crafted official paperwork is one of the essential safeguards against problems and legal disputes, but obtaining it without a lawyer's support may require time.

If you need to swiftly locate a current Maryland Affidavit Of Residency or various other templates for employment, family, or business situations, US Legal Forms is always available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the desired document. Additionally, you can access the Maryland Affidavit Of Residency at any time, as all documentation ever obtained on the platform is stored within the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

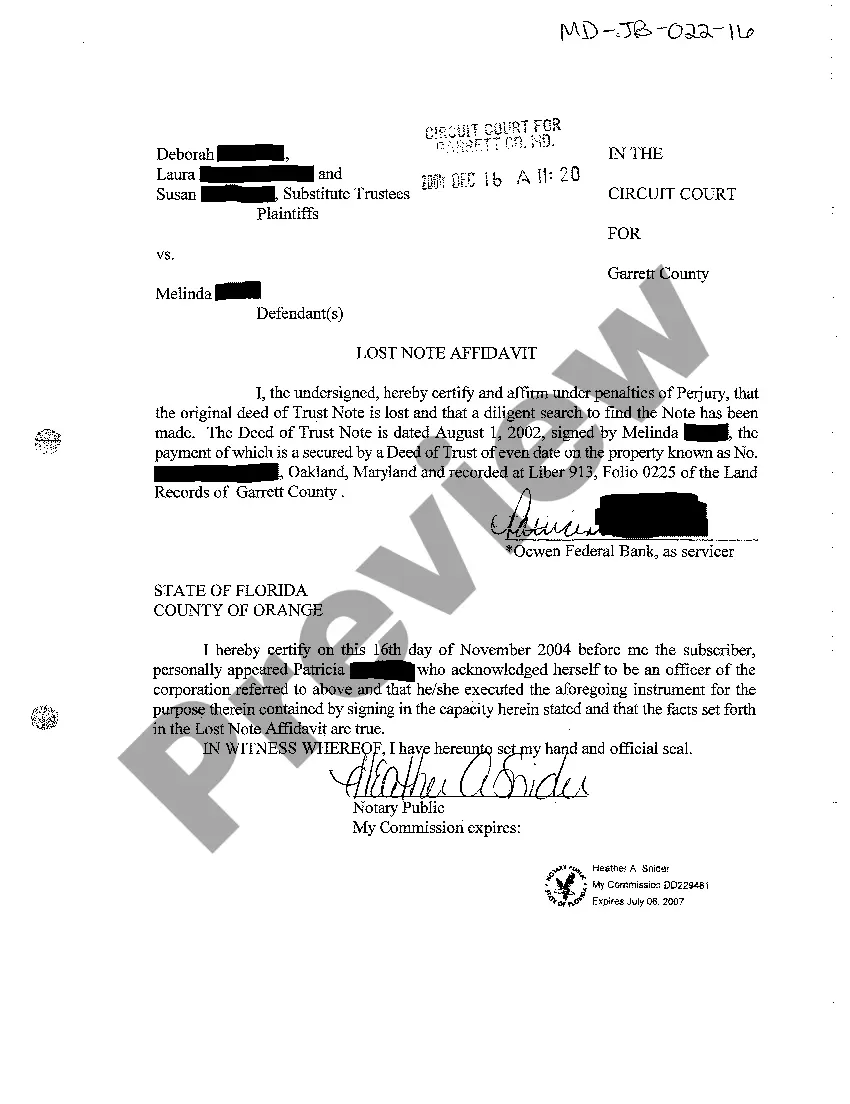

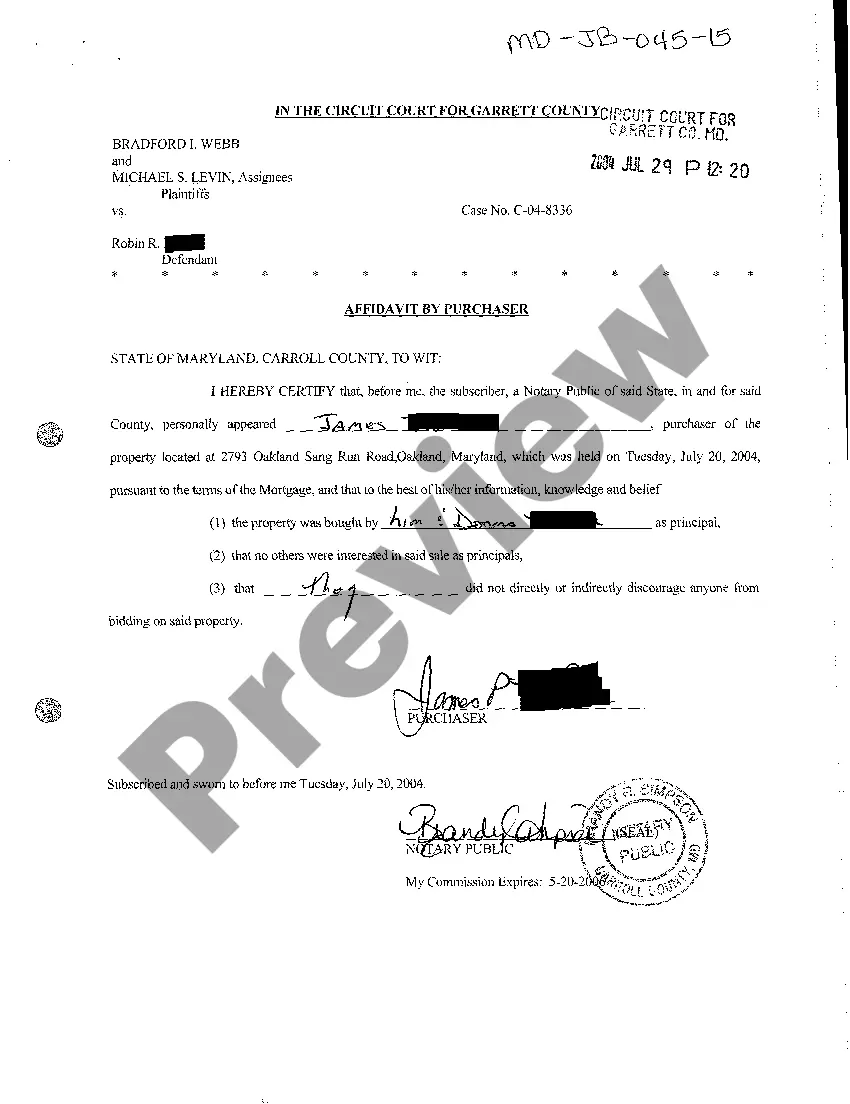

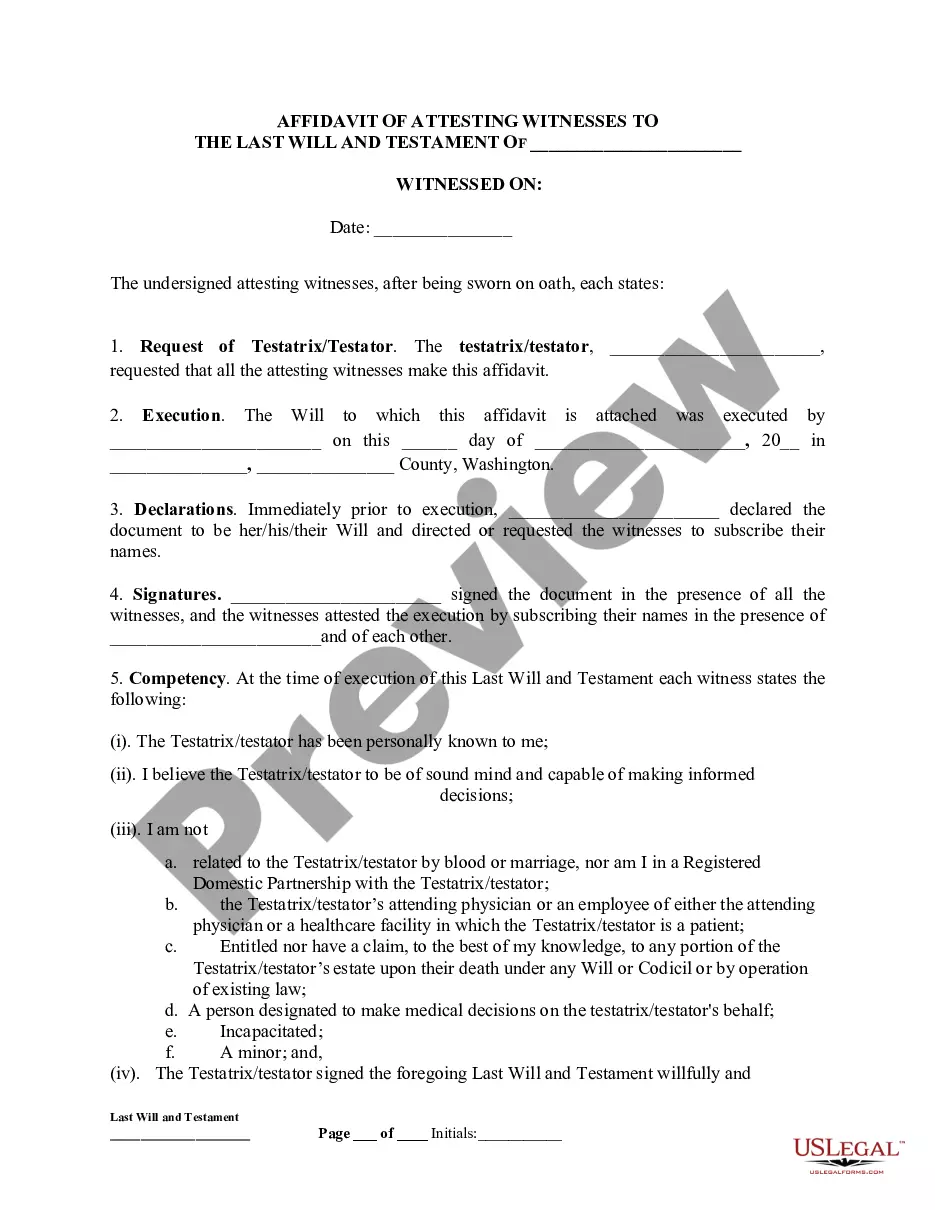

- Ensure that the form matches your circumstances and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the suitable template.

- Select the pricing plan, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Maryland Affidavit Of Residency.

- Click Download, then print the document to complete it or add it to an online editor.

Form popularity

FAQ

If the decedent was domiciled in Maryland on the date of death, the fiduciary is a resident fiduciary and the personal representative can sign an affidavit of residence (WH-AR), thereby exempt from the withholding requirement.

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.18-Dec-2019

Purpose of Form Form MW506NRS is designed to assure the regular and timely collection of Maryland income tax due from nonresident sellers of real property located within the State.

On the W-4 Form complete the following and write legibly.Section 1 Payroll System RG Regular. Agency Code: 220100.Section 2 Federal Taxes Complete line 3; and then either line 5 or line 7.Section 3 State Taxes -- Marital status and then line 1, or 3, or 4, or 5.Section 4 Sign and date the form.