Maryland Child Support Forms For Child Support

Description

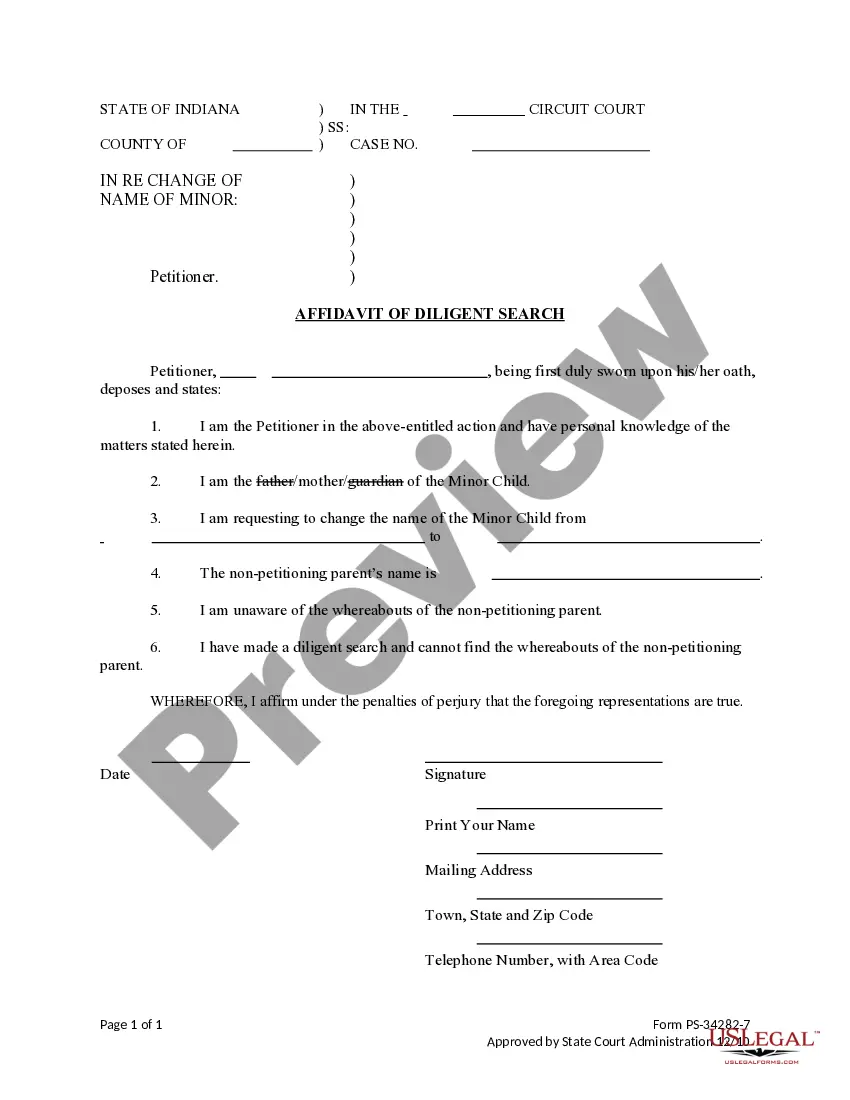

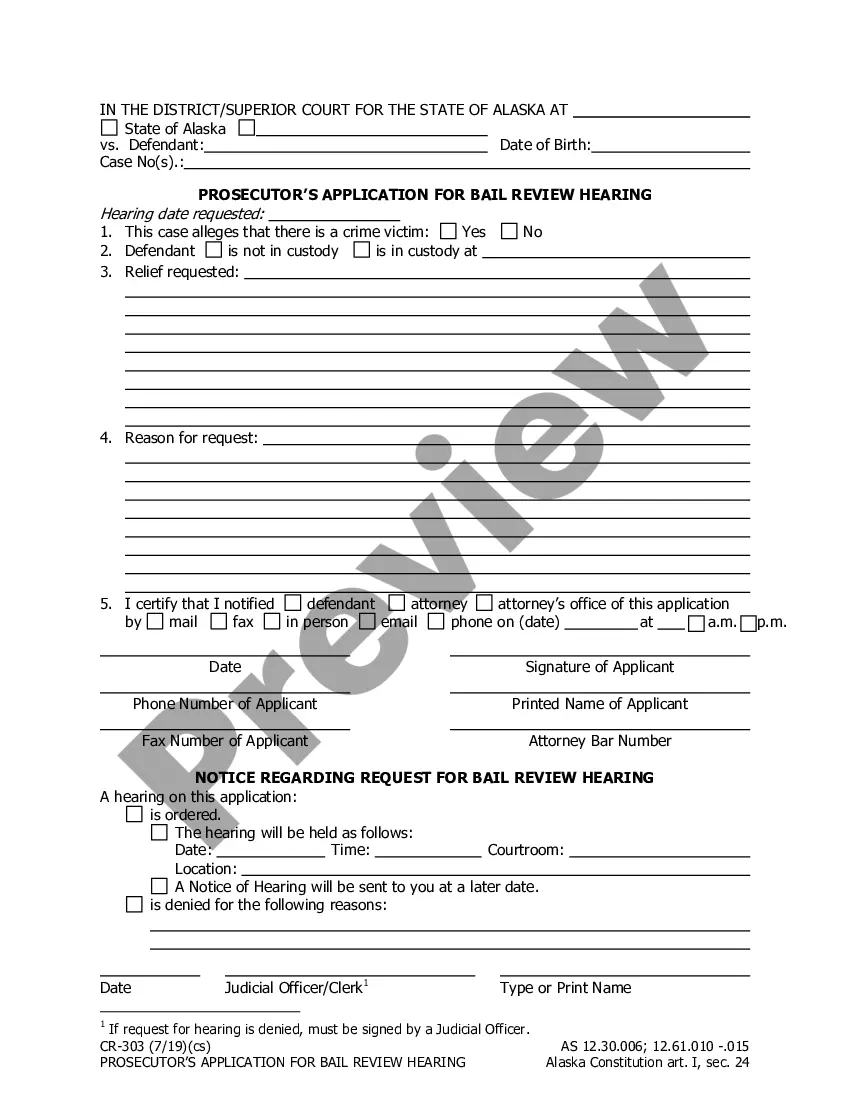

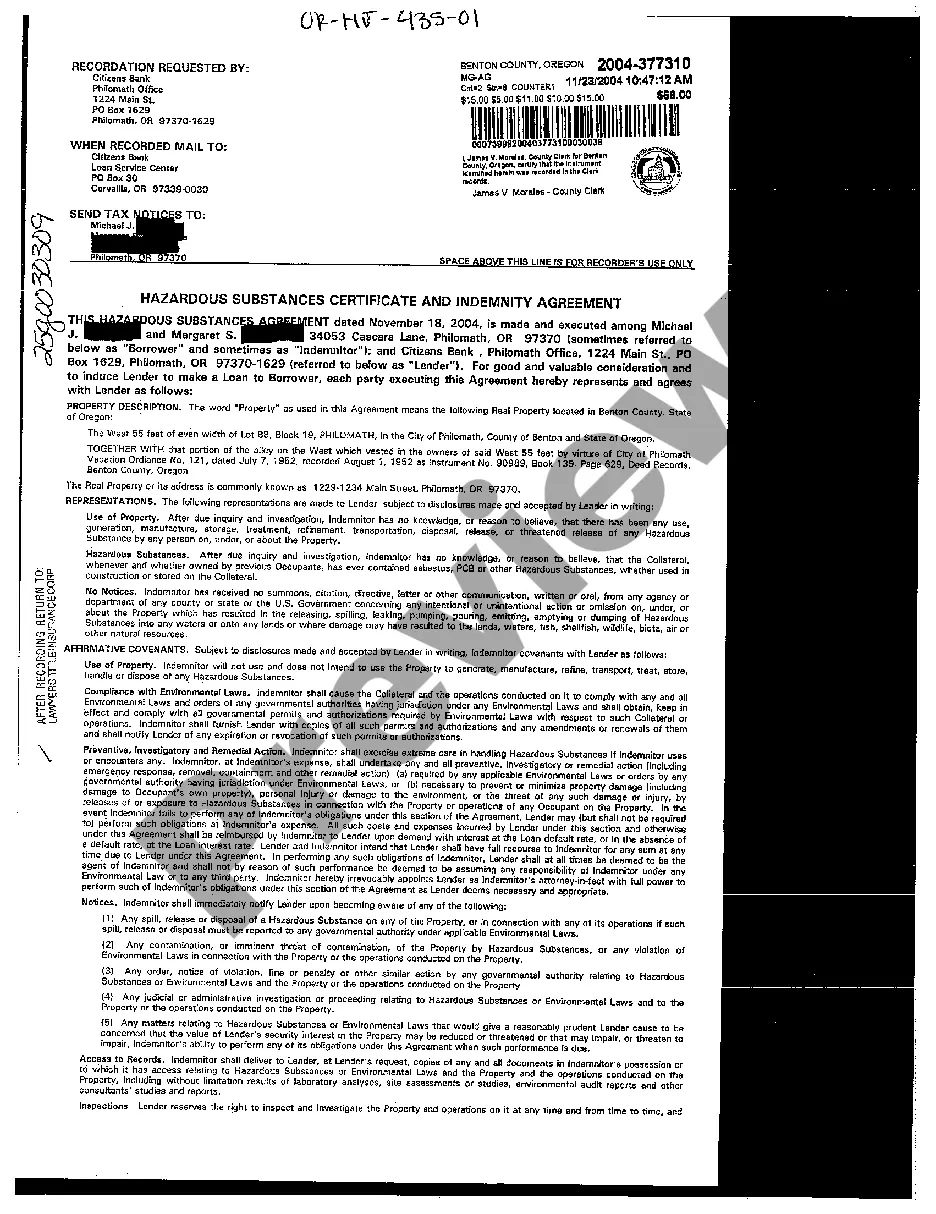

How to fill out Maryland Motion To Modify Custody And Child Support?

Creating legal documents from the beginning can occasionally feel daunting.

Specific situations may require extensive research and significant financial investment.

If you’re searching for a more straightforward and cost-effective method of preparing Maryland Child Support Forms For Child Support or any other documents without unnecessary complications, US Legal Forms is readily available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal issues. With just a few clicks, you can swiftly access templates that conform to state and county standards, carefully crafted for you by our legal experts.

US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and simplify the document completion process!

- Utilize our platform whenever you require dependable services to quickly find and download the Maryland Child Support Forms For Child Support.

- If you’re already familiar with our services and have set up an account before, simply Log In to your account, find the form, and download it right away or re-download it anytime later in the My documents section.

- Don’t have an account? No worries. It only takes a few minutes to register and browse the library.

- Before proceeding to download Maryland Child Support Forms For Child Support, make sure to follow these guidelines.

- Review the document preview and descriptions to ensure you have the correct document.

Form popularity

FAQ

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

To make a living trust in Vermont, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Create a trust agreement: To make sure you do this correctly, you should hire an attorney. But if you want to do this cheaply, you can use an online program. Sign the trust document: You must do this before a notary public. Transfer assets to the trust: This can be done by retitling them or deeding them to the trust.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.