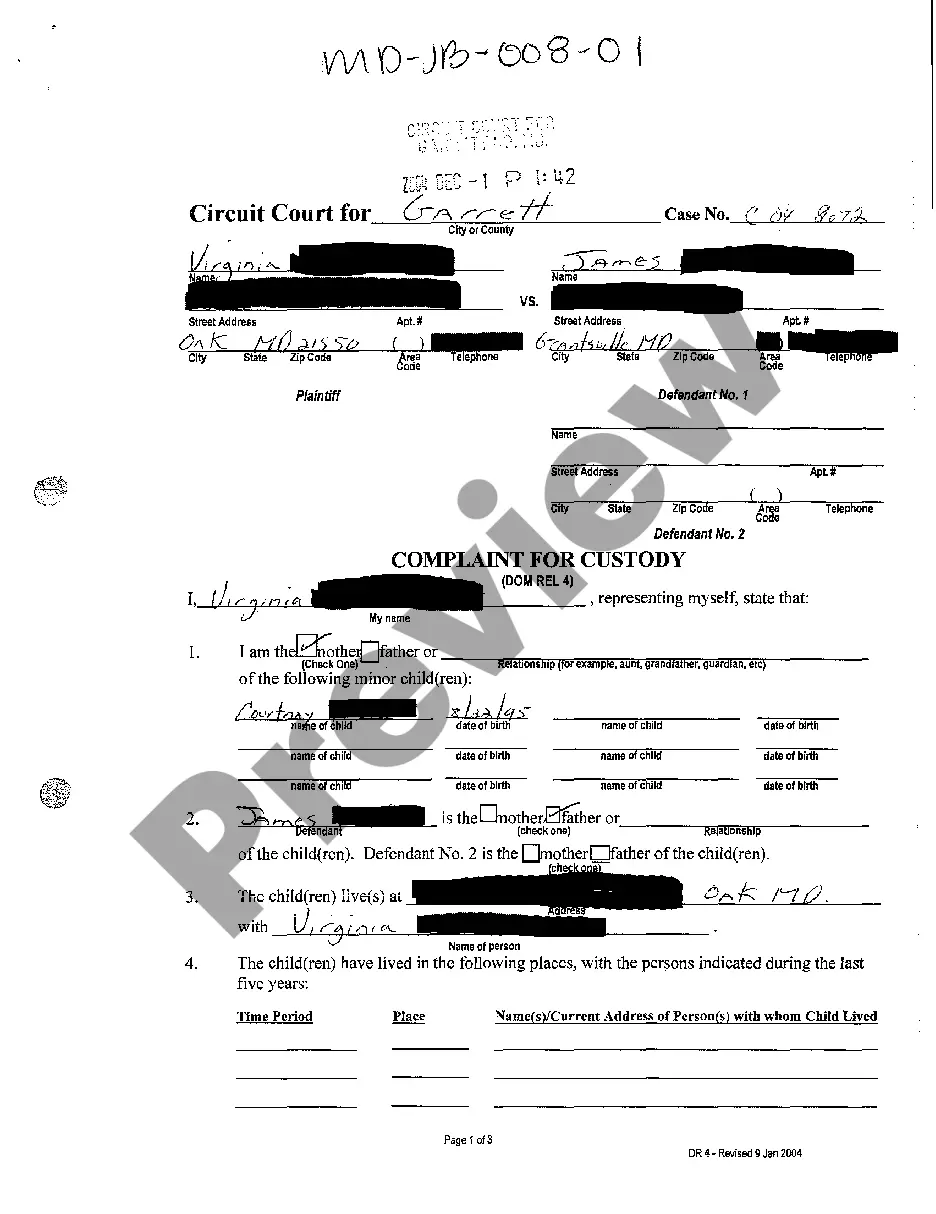

Grandparent For Grandchildren

Description

How to fill out Maryland Complaint For Custody By Grandparents?

How to obtain specialized legal documents that comply with your state's laws and prepare the Grandparent For Grandchildren without hiring an attorney.

Numerous online services offer templates for various legal situations and requirements. However, it may require some time to determine which available samples meet both your needs and legal standards.

US Legal Forms is a trusted service that assists you in finding official documents crafted in accordance with the most recent state law revisions, helping you save on legal fees.

If you do not have an account with US Legal Forms, please follow the steps below: Review the webpage you've opened to confirm if the form suits your needs. To do this, utilize the form description and preview options if available. Search for another template in the header providing your state if needed. Click the Buy Now button once you find the right document. Choose the most suitable pricing plan, then sign in or register for an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Grandparent For Grandchildren and click Download. The obtained documents remain in your control: you can return to them anytime in the My documents section of your profile. Sign up for our library and create legal documents independently like a skilled legal expert!

- US Legal Forms is not just an ordinary online library.

- It's a compilation of over 85k validated templates for different business and personal scenarios.

- All documents are categorized by region and state to expedite your search and streamline the process.

- Moreover, it features robust tools for PDF editing and eSignature, allowing users with a Premium subscription to conveniently complete their documents online.

- Obtaining the required paperwork demands minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is current.

- Download the Grandparent For Grandchildren using the associated button next to the file title.

Form popularity

FAQ

The best account for a grandparent to open for a grandchild depends on the financial goals. A custodial account allows grandparents to save for a child's future but comes with specific regulations. Additionally, a college savings plan can be an excellent way to contribute to educational expenses, ensuring a brighter future for their grandchildren.

When writing in a grandparents card, you can express love, gratitude, and appreciation for their support and presence in your life. Personal anecdotes, shared memories, or wishes for health and happiness can make your message meaningful. Remember, a heartfelt message strengthens the bond between generations, making it a special keepsake.

Yes, a grandparent can file for a grandchild in various contexts, such as custody, adoption, or even for benefits. The procedures vary by state and issue, so it is essential to understand local laws. Using tools like USLegalForms can simplify the necessary paperwork and help ensure proper filing.

In California, grandparents have certain rights, including the right to seek visitation if it serves the child's best interests. However, claiming legal custody involves a different process that requires proving specific circumstances. Consulting with a family law attorney can help clarify these rights and assist in navigating the legal landscape.

To obtain guardianship of a grandchild, a grandparent must file a petition with the court in their jurisdiction. This process usually involves demonstrating that guardianship serves the child’s best interests. It's beneficial to seek legal assistance from services like USLegalForms to ensure all paperwork is properly handled and filed.

Yes, a grandparent can apply for a US visa for a grandchild if they have legal guardianship or if the parents provide consent. The visa application process requires various documents, including proof of the relationship and financial support. It is advisable to work with an immigration lawyer to navigate the complex visa requirements efficiently.

A grandparent can claim a grandchild on taxes if the grandchild lived with them for more than half of the year and meets the other qualifying criteria. The grandparent must provide more than half of the child’s financial support. Remember, it is crucial to consult a tax professional to ensure eligibility under IRS regulations regarding claiming dependents.

Claiming a grandparent as a dependent can lead to various tax benefits, but the amount you receive may vary based on your tax situation. The IRS allows you to claim a dependent exemption and may offer additional credits that can reduce your tax burden. Understanding the specifics of these benefits is crucial for accurate financial planning. Resources from USLegalForms can guide you through the tax implications and necessary documentation.

A grandparent can claim their grandchild on taxes if they satisfy specific criteria. The grandchild must live with the grandparent for more than half the year, and the grandparent must provide significant financial support. This can lead to financial benefits such as tax deductions or credits. Accessing resources from USLegalForms can assist grandparents in understanding the requirements and finding the necessary forms.

Yes, Nebraska recognizes grandparents' rights, allowing them to seek visitation and, in some cases, custody. There are specific legal avenues grandparents can pursue to establish these rights, primarily based on the child's best interests. To initiate this process, grandparents should consult with a legal expert who can guide them through the necessary steps. Platforms like USLegalForms can provide essential resources for understanding these rights.