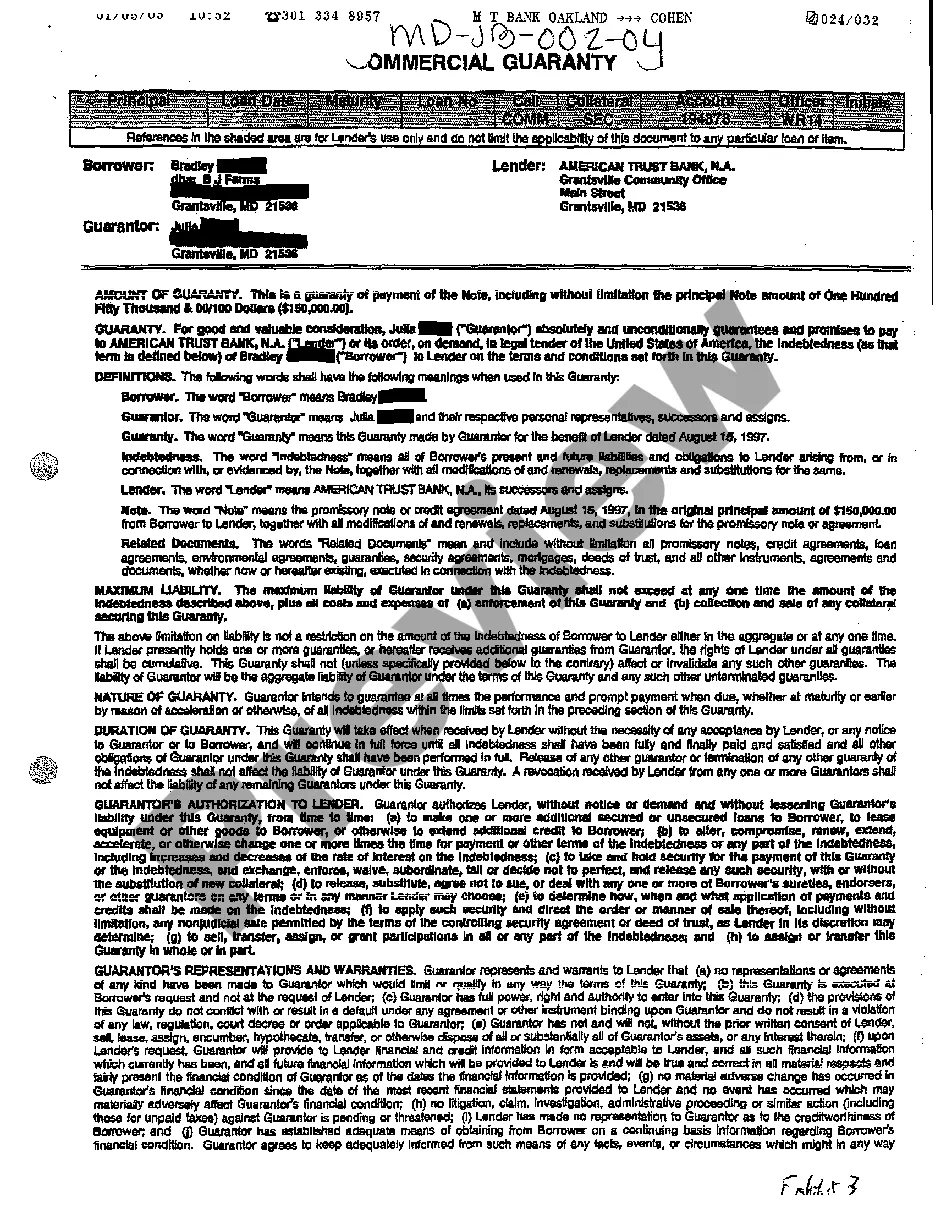

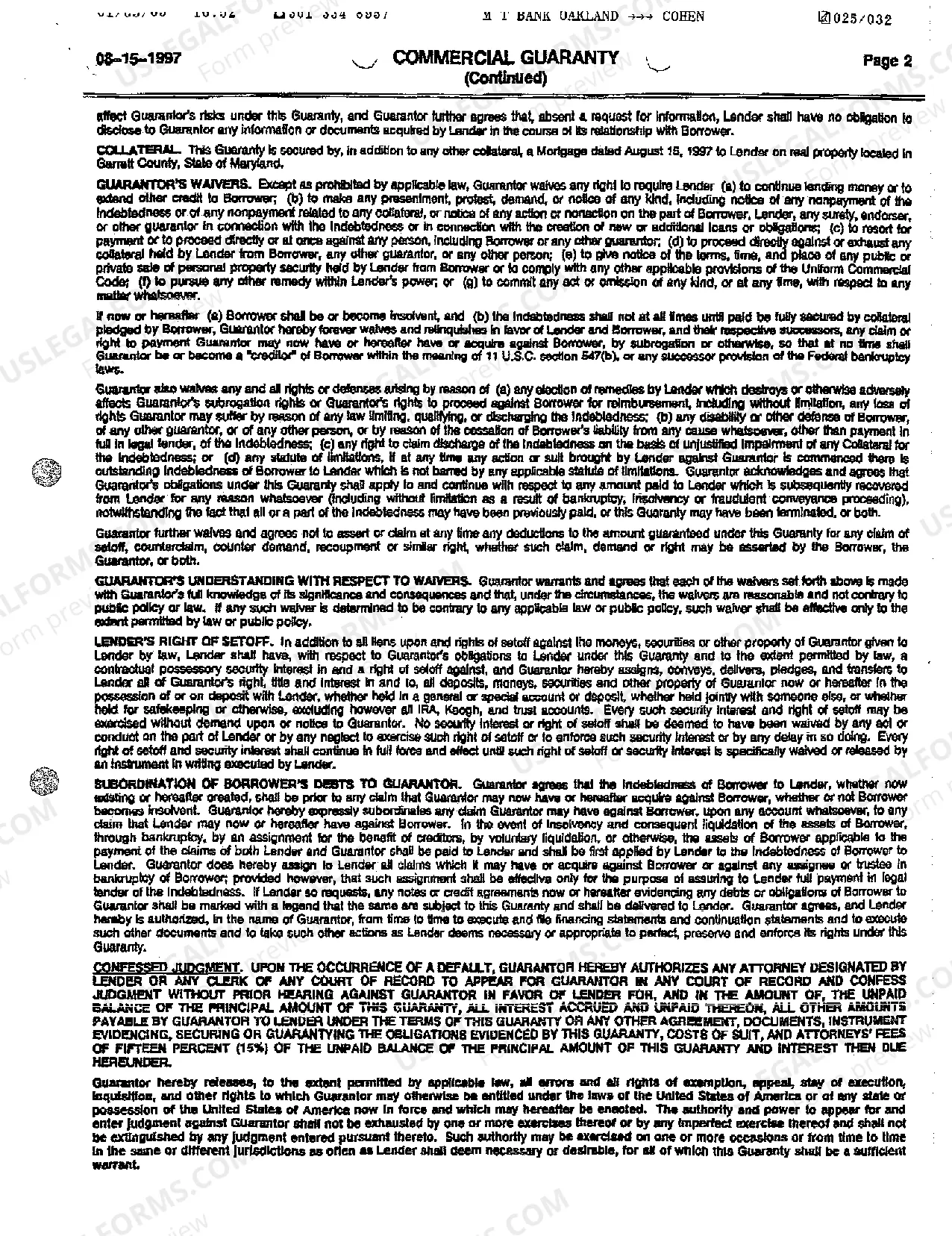

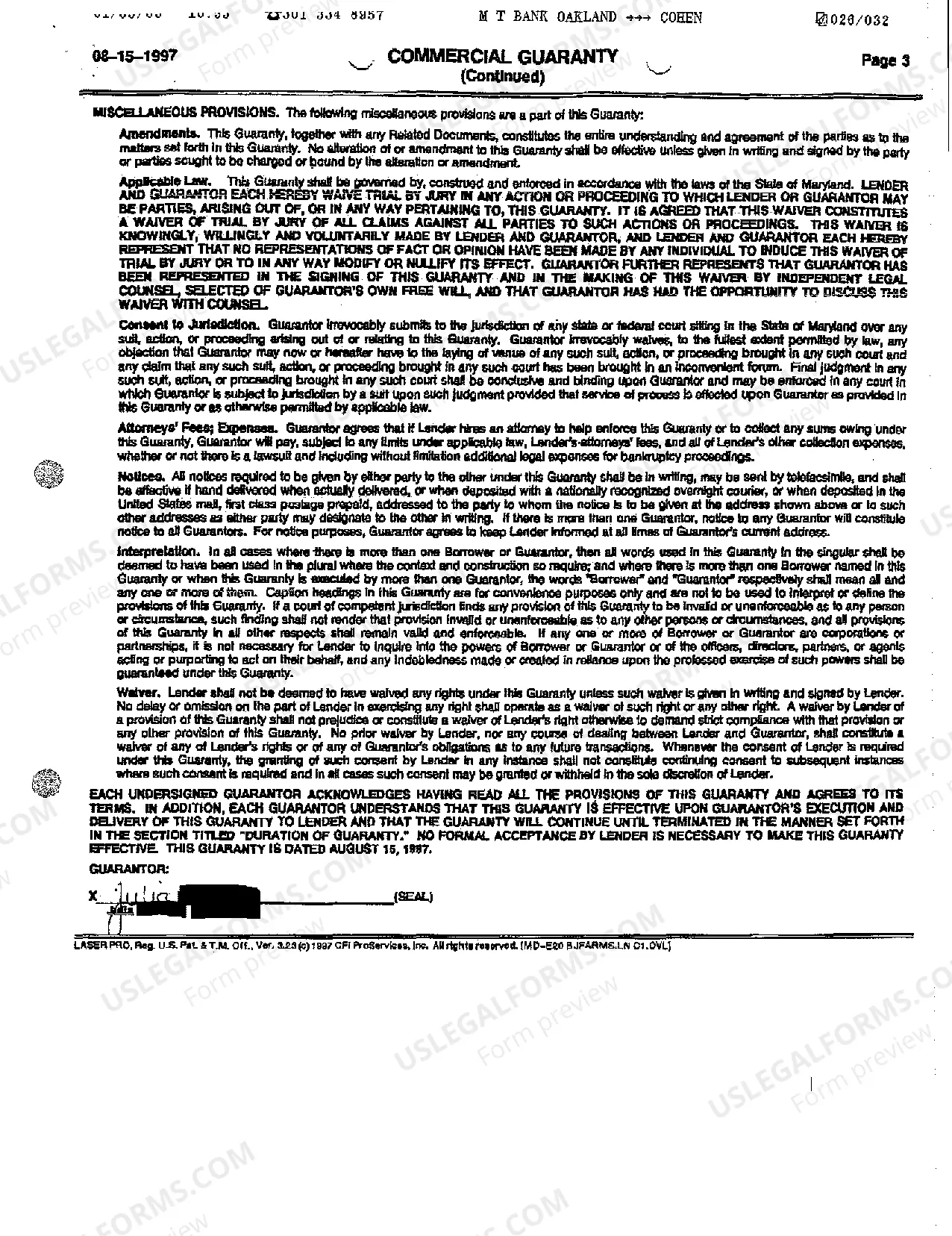

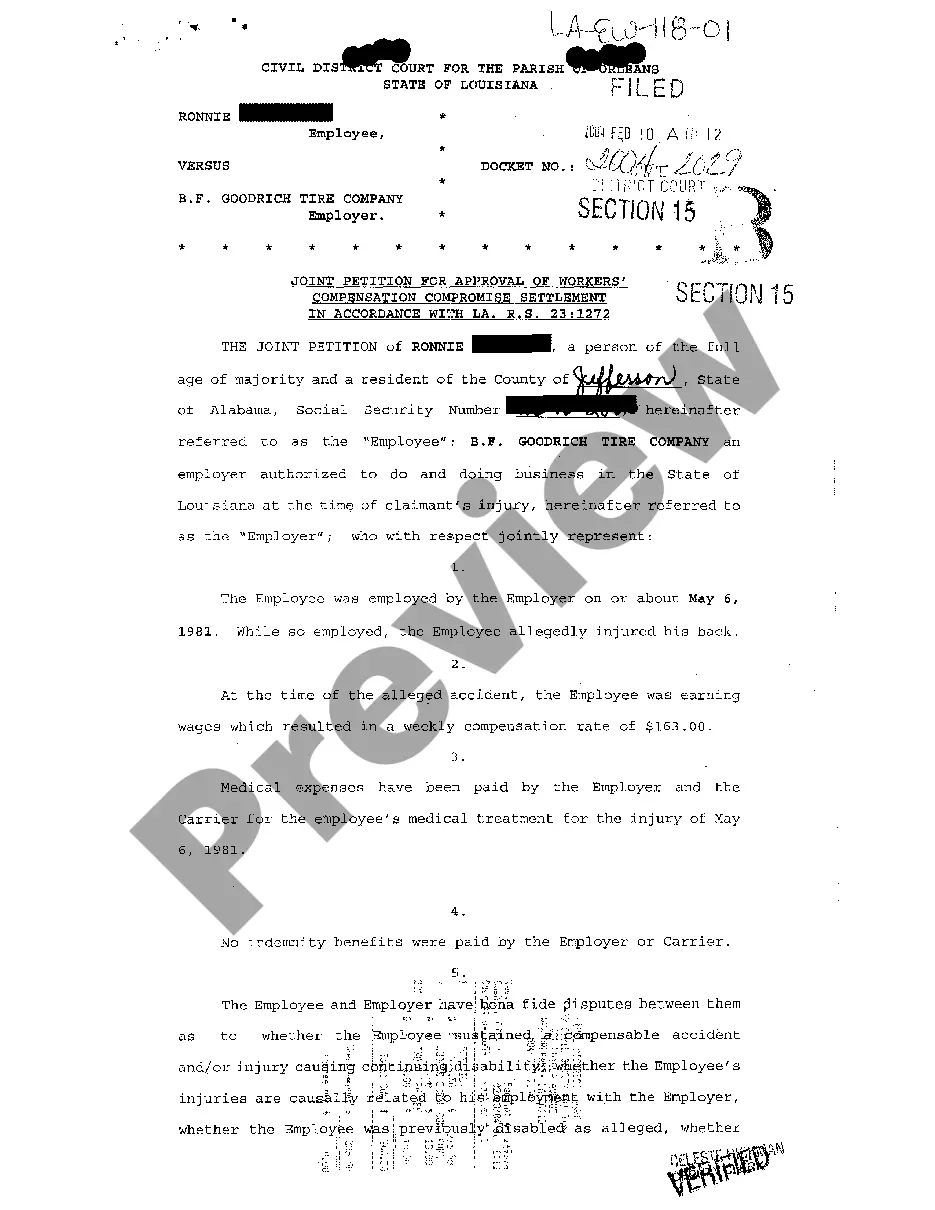

Commercial Bank Guarantee Application Form

Description

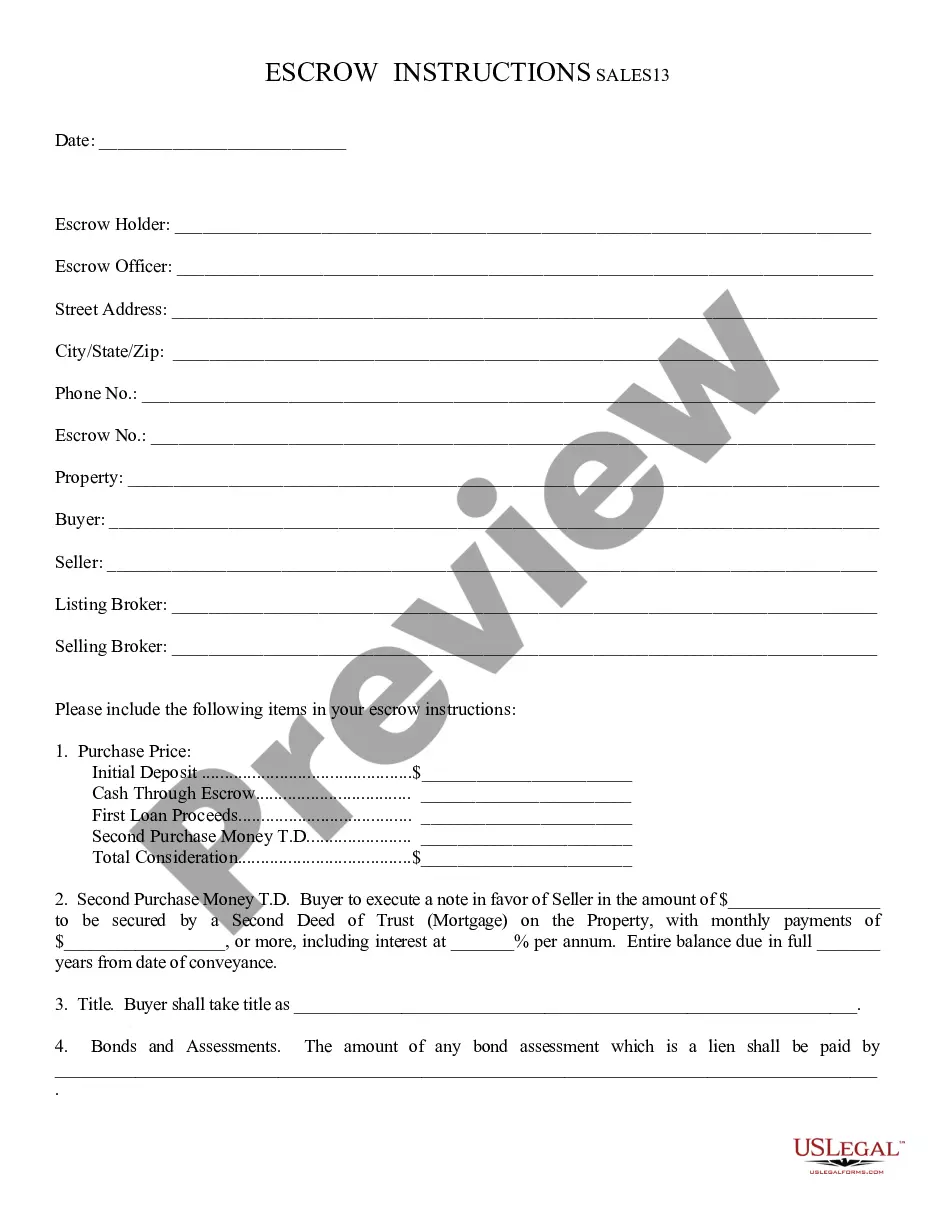

How to fill out Commercial Bank Guarantee Application Form?

Whether you deal with documents frequently or need to submit a legal report occasionally, it's crucial to have a reliable source of information where all the samples are interconnected and current.

One essential task for a Commercial Bank Guarantee Application Form is to ensure that it is the latest version, as this determines its eligibility for submission.

To streamline your quest for the most recent document examples, look for them on US Legal Forms.

Refer to the search menu to locate the form you need. Review the preview and description of the Commercial Bank Guarantee Application Form to confirm it is the precise one you seek. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to an existing one. Utilize your bank card details or PayPal account to finalize the purchase. Choose the file format for download and confirm it. Eliminate any confusion when dealing with legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents comprising nearly any document sample you might seek.

- Search for the templates you require, quickly assess their relevance, and learn more about their application.

- With US Legal Forms, you gain entry to approximately 85,000 document templates across various fields.

- Obtain the Commercial Bank Guarantee Application Form samples within a few clicks and save them in your account at any time.

- A US Legal Forms account will provide you with easy access to all the samples you need, enhancing convenience and reducing hassle.

- Simply click Log In on the website header and navigate to the My documents section to have all the forms at your fingertips, eliminating the need to spend time searching for the best template or verifying its authenticity.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

A letter of guarantee is a document that ensures payment to a beneficiary if the principal fails to fulfill their obligations. For example, if a contractor does not complete a project, the letter guarantees payment to the project owner. In practical terms, you can refer to a commercial bank guarantee application form to understand the structure and contents typically found in such letters, ensuring you create a legally sound document.

Writing a guarantee requires you to be clear and specific about what you are guaranteeing. Begin with your name and contact information, followed by the name of the person or entity you are guaranteeing. Define the terms, conditions, and any limits to the guarantee. To ensure all bases are covered, utilize the commercial bank guarantee application form to provide a thorough account of your agreement.

To write an effective guarantor letter, start by introducing yourself and explaining your relationship to the principal party. Clearly outline your commitment to cover any debts or obligations and specify the limits of your guarantee. It's beneficial to refer to the relevant commercial bank guarantee application form to ensure accuracy and completeness. Remember, clarity and transparency are key in establishing trust.

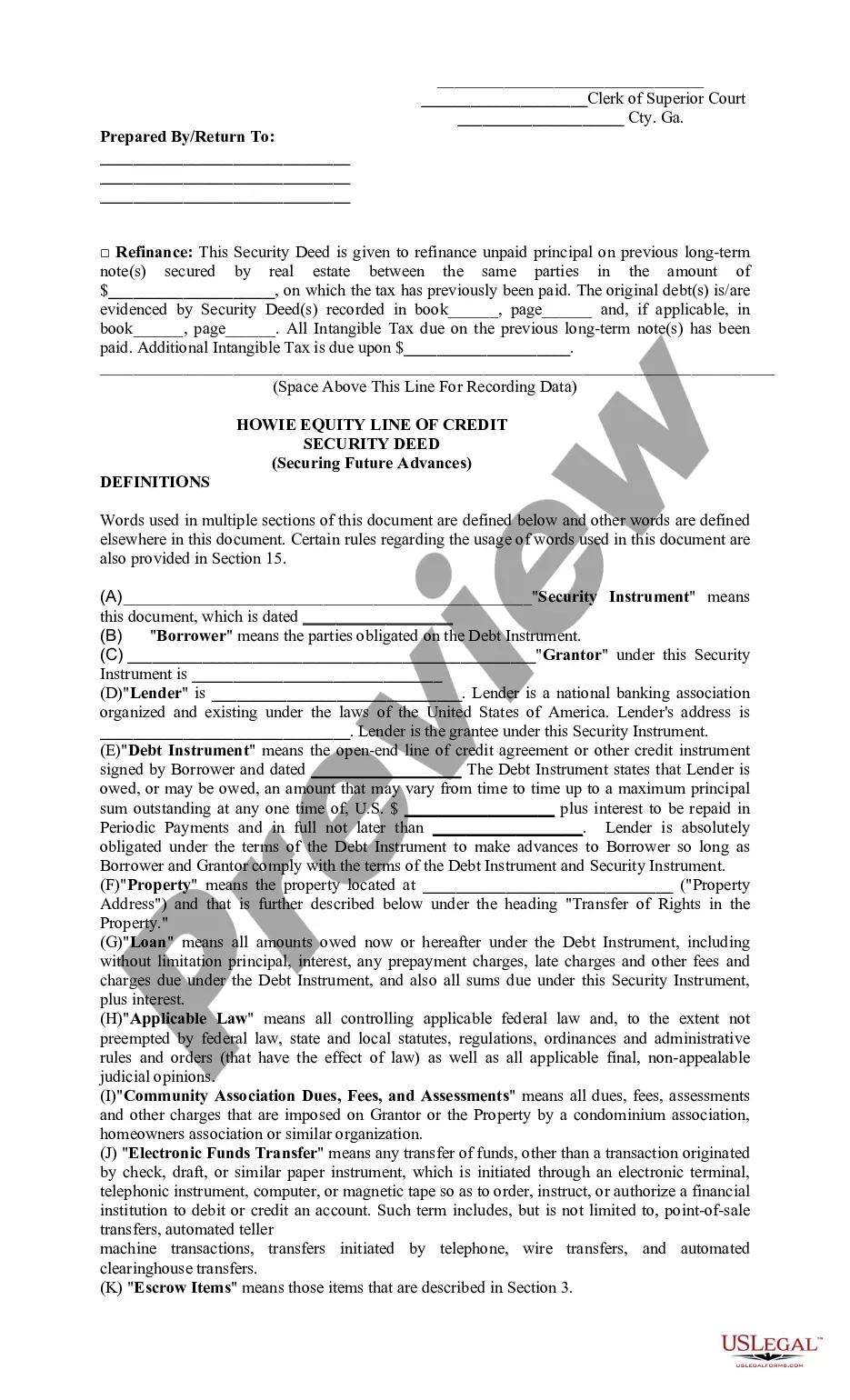

Preparing a bank guarantee involves gathering the necessary documents and completing a commercial bank guarantee application form. You'll need to provide details about the transaction, the parties involved, and the amount of guarantee. Once you have the information ready, submit it to your bank for review and approval. Always communicate with your bank to ensure you meet all their requirements.

To fill out a letter of guarantee effectively, start by including the names and addresses of all parties involved. Clearly state the obligations that the guarantor agrees to cover in the event of default. Additionally, include the term of the guarantee and any conditions that need to be met. It's also essential to reference the commercial bank guarantee application form to ensure all necessary details are included.

The three main types of bank guarantees are performance guarantees, payment guarantees, and advance payment guarantees. Each type serves different purposes, such as ensuring contract performance or safeguarding advance payments. To explore these options, you can refer to the commercial bank guarantee application form for detailed descriptions.

Filling a performance bank guarantee is similar to completing the commercial bank guarantee application form. You will need to provide information about the contract, the parties involved, and other specific conditions. Make sure to follow the specific format required by your bank to avoid delays.

To apply for a guarantee, you must complete the commercial bank guarantee application form. This includes entering essential details such as the beneficiary, amount, and the reason for the guarantee. Once completed, submit it with any requisite documentation to your bank.

Filling out a bank guarantee format requires attention to detail in the commercial bank guarantee application form. Start with the date, followed by the names of the parties and the amount guaranteed. Always double-check the format and conditions to ensure compliance with your bank’s requirements.

To fill out a letter of guarantee, include key details in the commercial bank guarantee application form. You should mention the parties involved, the purpose of the guarantee, and the amount. Ensure clarity and completeness to avoid confusion during processing.