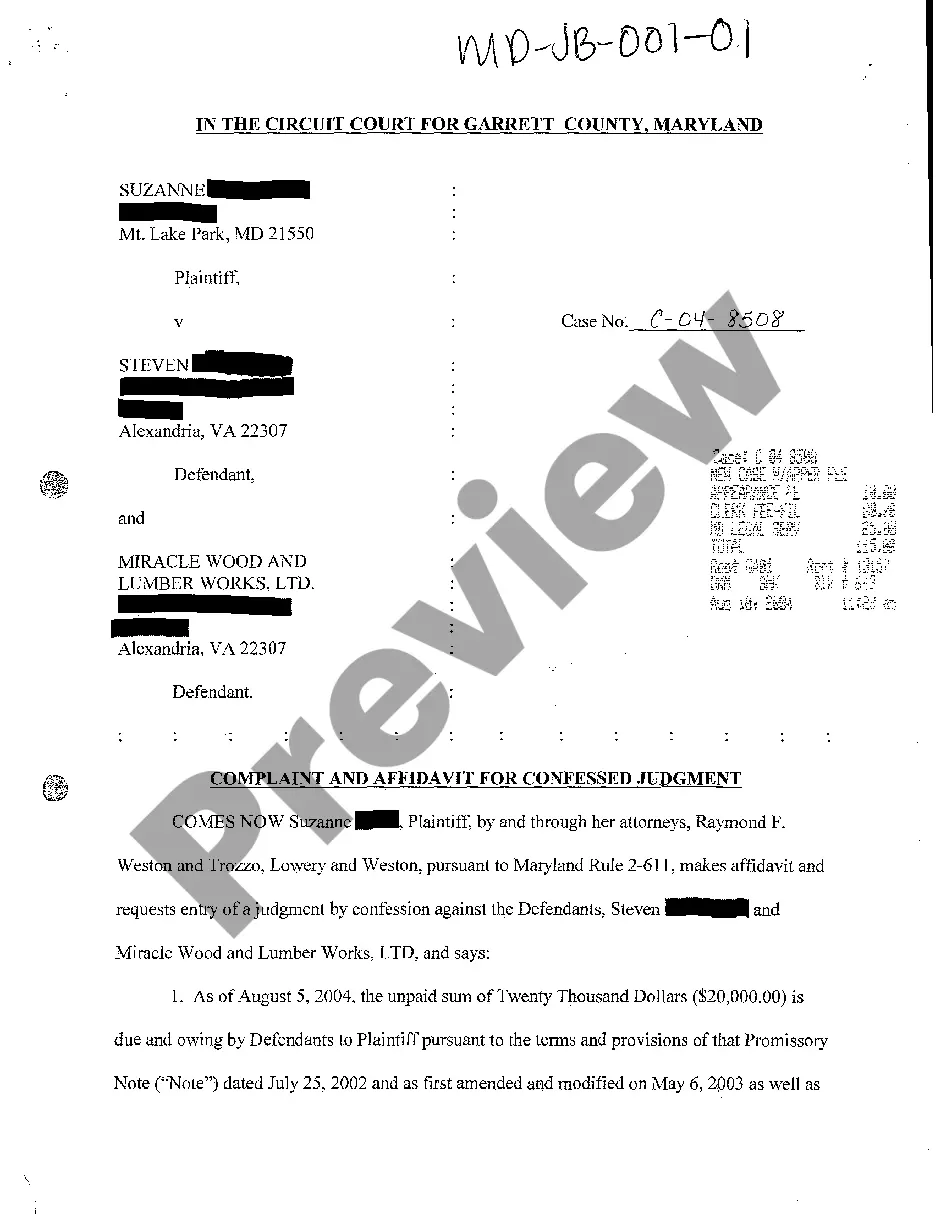

Confessed Judgment Promissory Note Maryland Withholding

Description

How to fill out Maryland Complaint And Affidavit For Confessed Judgment?

Individuals often link legal documentation with a concept that is intricate and requires a professional's handling.

In some respects, this is accurate, as preparing a Confessed Judgment Promissory Note Maryland Withholding necessitates considerable expertise in the pertinent regulations, encompassing both state and municipal laws.

However, thanks to US Legal Forms, the process has been simplified: a collection of ready-to-use legal templates tailored to specific state legislation is assembled in a single online repository and is now accessible to everyone.

All templates within our library are reusable: after purchase, they remain saved in your profile. You can access them whenever necessary via the My documents section. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms boasts over 85,000 contemporary documents categorized by state and area of utility, making the search for a Confessed Judgment Promissory Note Maryland Withholding or any other specific template a quick task.

- Prior registered members with an active subscription must Log In to their account and select Download to obtain the form.

- New users to the platform are required to create an account and subscribe prior to downloading any documents.

- To obtain the Confessed Judgment Promissory Note Maryland Withholding, follow these instructions.

- Carefully review the page content to confirm it aligns with your requirements.

- Read the form description or examine it using the Preview feature.

- If the previous sample does not meet your needs, locate another sample with the Search field above.

- Once you find the appropriate Confessed Judgment Promissory Note Maryland Withholding, click Buy Now.

- Choose a pricing plan suited to your needs and budget.

- Create an account or Log In to move on to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

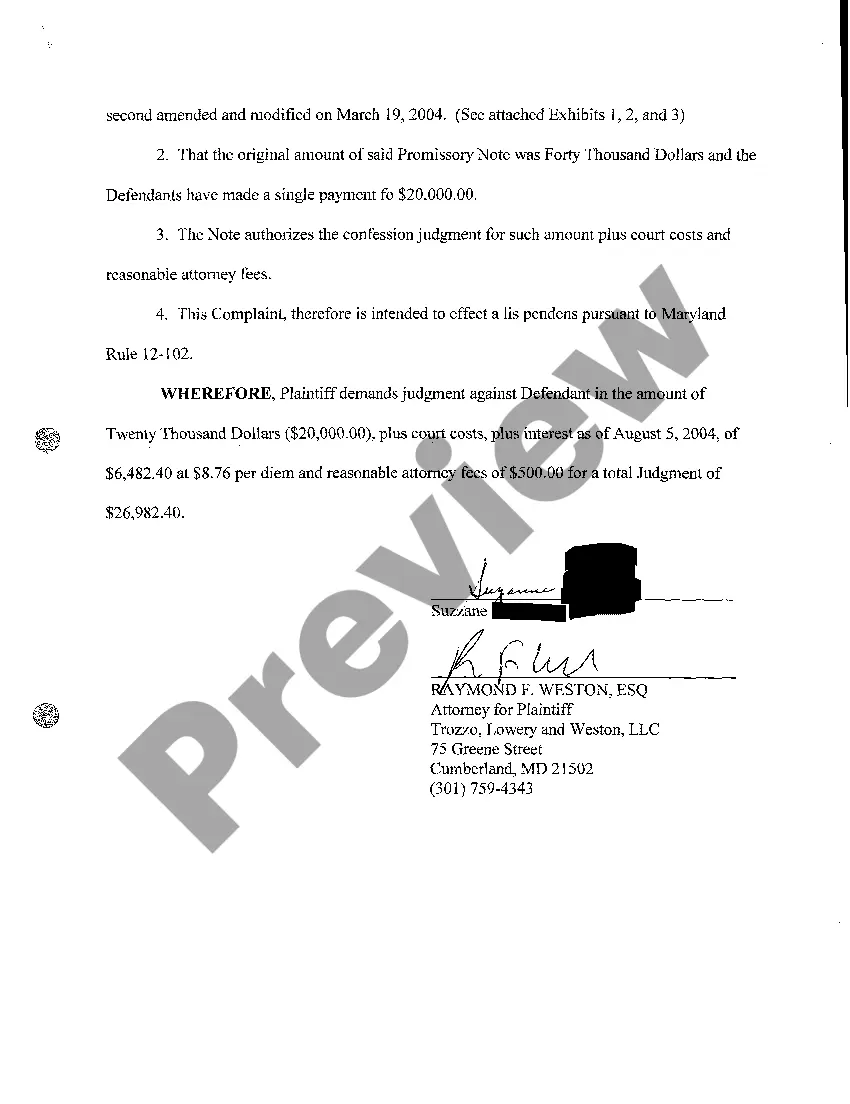

Once the waiting period passes, there are three different ways you can collect on the judgment:Garnishing the other person's wages;Garnishing the other person's bank account; or.Seizing the other person's personal property or real estate.

One tool used may be confessed judgments which are disfavored in Maryland. These clauses are illegal in consumer contracts in Maryland. However, that may not stop an unscrupulous creditor or debt collector from trying to use one as a negotiation mechanism.

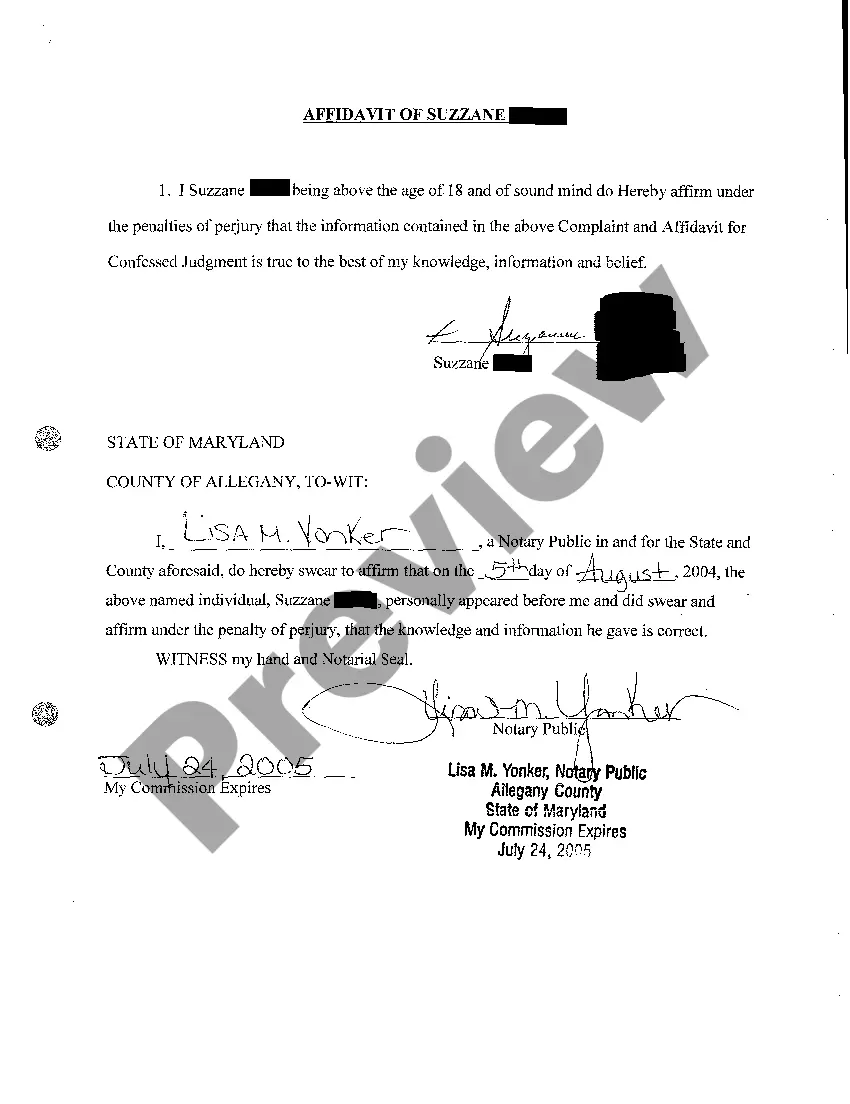

Primary tabs. A confession of judgment is a legal device - usually a clause within a contract - in which a debtor agrees to allow a creditor, upon the nonoccurrence of a payment, to obtain a judgment against the debtor, often without advanced notice or a hearing.

A typical confession of judgment provision in a commercial contract (e.g., a promissory note) authorizes the creditor upon a default under the agreement to obtain a judgment for the amount owed without notice to the debtor(s) or guarantor(s), and allows the creditor to immediately execute on the judgment.

Confessions of Judgment are permitted in Maryland, Michigan, Illinois, New Jersey, Minnesota, Ohio, Pennsylvania, Virginia, and Texas. Pennsylvania allows these judgment clauses specifically in UCC transactions.