Revocation Living Trust Form With Irs

Description

Form popularity

FAQ

Form 8855 is used to elect to treat a revocable trust as a qualified revocable trust for estate tax purposes. This is important because it allows the trust to avoid higher estate tax rates while still benefiting from certain tax advantages. Knowing how the Revocation living trust form with IRS interacts with Form 8855 can help you make informed decisions. US Legal Forms can assist you in understanding and completing this form accurately.

For a trust, you generally use Form 1041 to report income, deductions, and tax liability. If your trust is revocable, it may have different requirements, so understanding the nuances of the Revocation living trust form with IRS is crucial. This ensures that you abide by IRS regulations and avoid penalties. You can leverage US Legal Forms to simplify this process and access the right forms.

A revocable trust typically files Form 1041 if it has generated income that is taxable. This form allows the IRS to assess tax on the trust's income. Comprehending the Revocation living trust form with IRS is essential for accurate tax reporting. US Legal Forms can provide guidance on how to fill out this form effectively to avoid any issues.

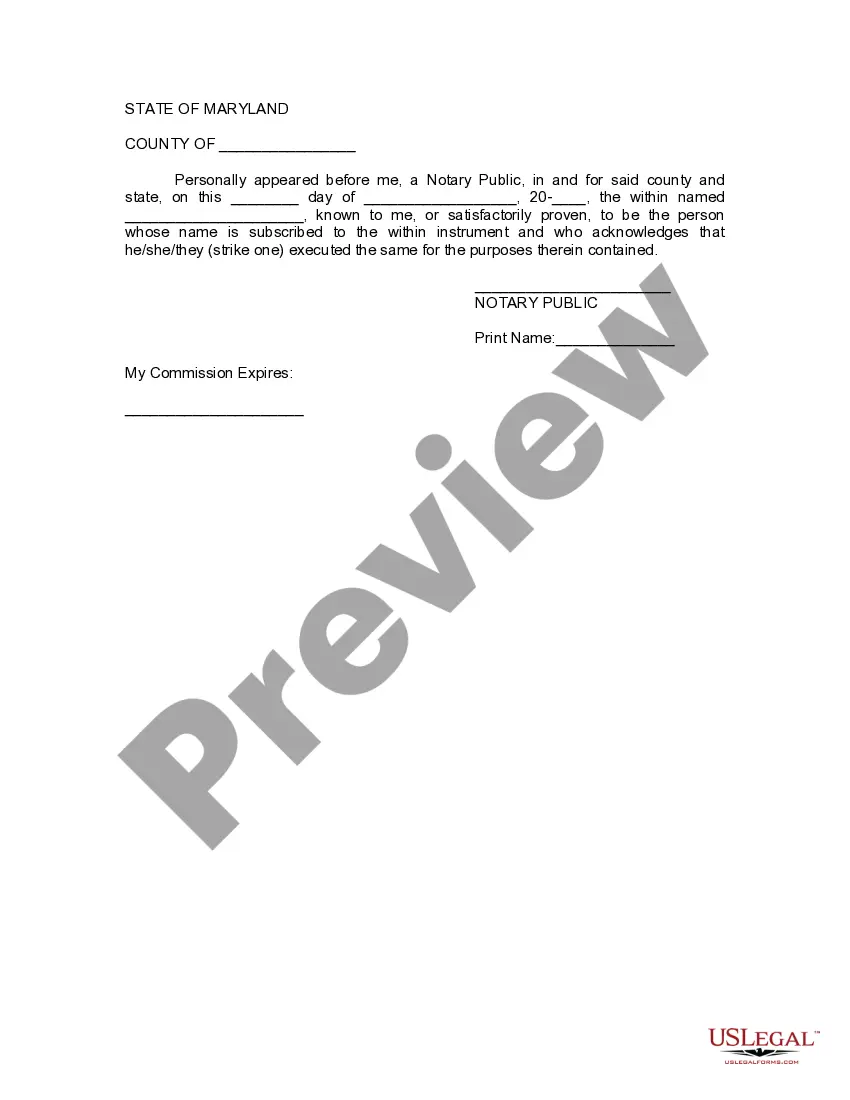

Notifying the IRS of a trust termination involves submitting a final tax return using the appropriate forms. You should also send a letter stating the trust's termination date and the final distribution details. This process is critical for maintaining compliance with tax obligations regarding the Revocation living trust form with IRS. Consider using US Legal Forms to help with the necessary paperwork.

The 8453 form is used by trusts to authenticate an electronic filing of income tax returns with the IRS. When you prepare your taxes for a revocable trust, you may need this form to validate your submission. Understanding the Revocation living trust form with IRS can help streamline your filing process. You can find resources on US Legal Forms to ensure you fill out this form correctly.

Submitting Form 56 to the IRS requires completing the form and sending it directly to the IRS address listed in the instructions. It’s important to check that all information is correct before mailing it. Additionally, consider tracking your submission for peace of mind. Our solutions help streamline this process alongside utilizing the Revocation living trust form with IRS effectively.

You can send Form 56 to the IRS by mailing it to the address specified on the form’s instructions. Ensure that you have completed all sections accurately to avoid delays. You might want to keep a copy for your records in case you need it later. Our platform provides a step-by-step guide for submitting the Revocation living trust form with IRS efficiently.

To file a tax return for a revocable trust, you must complete Form 1041, assuming the trust has taxable income. Ensure you include all income and deductions related to the trust. When filling out the necessary forms, referencing the Revocation living trust form with IRS can be beneficial for proper documentation. If you need assistance, we offer tools to make this process easier.

If you do not file Form 56, the IRS may not recognize the new trustee's authority over the taxable matters of the trust. This oversight can lead to confusion during tax evaluations and could trigger penalties. It’s best to file this form to ensure all parties are compliant with tax regulations. Our platform can guide you through the Revocation living trust form with IRS, making this step straightforward.

To submit a Power of Attorney (POA) to the IRS, you should use Form 2848. This form must be completed thoroughly and sent to the appropriate IRS address. Including the Revocation living trust form with IRS alongside your POA can clarify the trustee’s authority. Ensuring clear communication with the IRS is vital for smooth transactions.