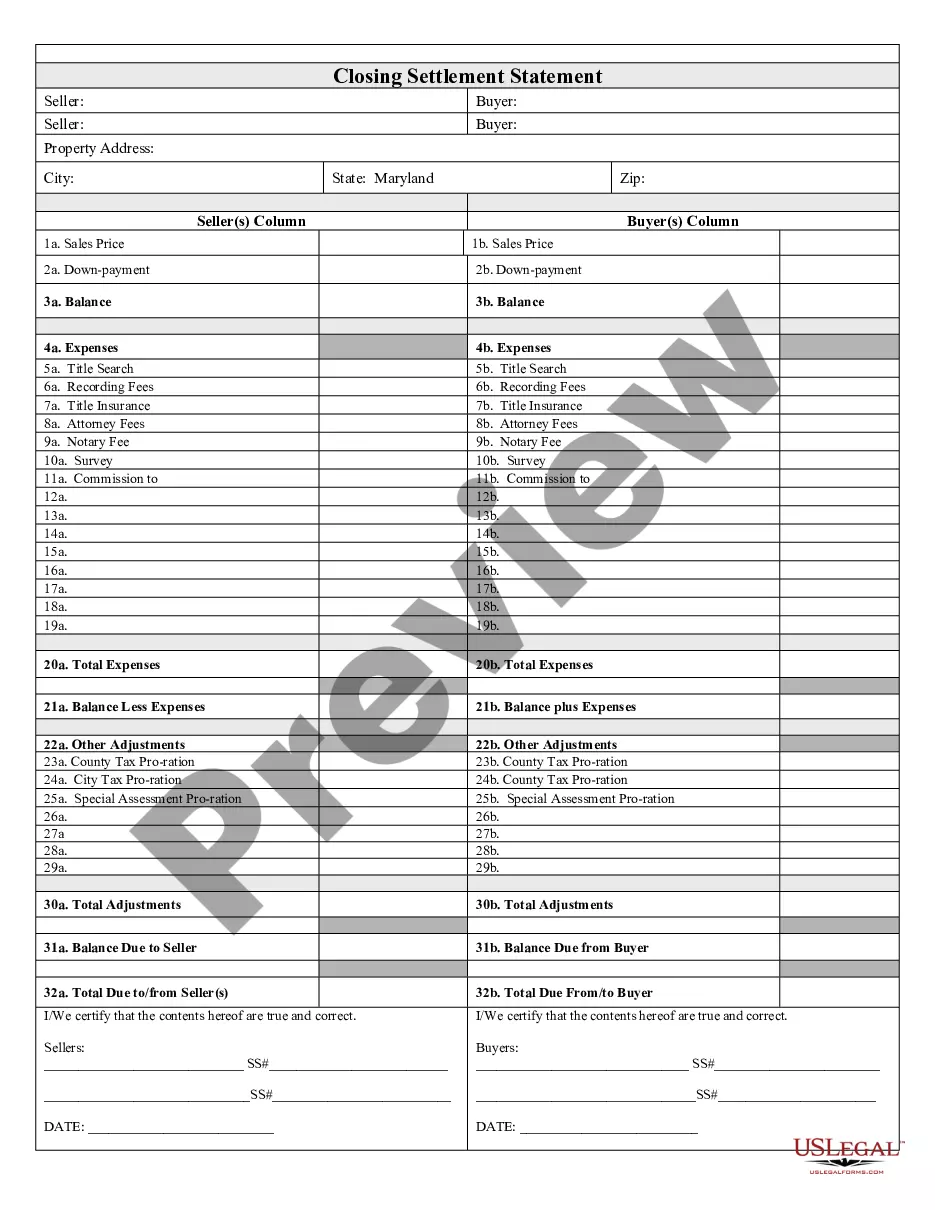

Maryland Closing Costs For Seller

Description

How to fill out Maryland Closing Statement?

The Maryland Settlement Expenses For Seller presented on this page is a versatile legal template crafted by expert attorneys in compliance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, groups, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial or personal situation. It is the quickest, most straightforward, and most dependable method to acquire the papers you require, as the service ensures bank-grade data protection and anti-malware measures.

Subscribe to US Legal Forms to access verified legal templates for all of life’s occurrences at your fingertips.

- Search for the document you require and assess it.

- Browse through the sample you searched and examine it or verify the form description to confirm it meets your needs. If it does not, utilize the search function to find the correct one. Click Buy Now once you have found the template you need.

- Subscribe and sign in.

- Select the pricing option that fits you and register for an account. Use PayPal or a credit card to swiftly complete the payment. If you already possess an account, Log In and check your subscription to move forward.

- Obtain the editable template.

- Select the format you want for your Maryland Settlement Expenses For Seller (PDF, Word, RTF) and download the sample to your device.

- Complete and sign the document.

- Print the template to finalize it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with an electronic signature.

- Download your documents once more.

- Reopen the document as needed. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

For a $300,000 house, you can expect closing costs to range from $6,000 to $15,000, depending on various factors in Maryland. These figures generally include the state’s specific taxes, title fees, and service charges associated with the sale. It’s important to evaluate the specific Maryland closing costs for seller relevant to your property sale. Using our platform can help you calculate and understand these costs in detail.

For a $300,000 home in Maryland, you can expect closing costs to be between $6,000 and $15,000. This range accounts for typical fees associated with selling the property, such as transfer taxes and settlement fees. Factoring in these costs helps you get a clearer picture of your financial outcome from the sale. Consider reaching out to platforms like UsLegalForms for detailed breakdowns and assistance.

Have you heard about the Social Security $16,728 yearly bonus? There's really no ?bonus? that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

There is no specific ?bonus? retirees can collect from the Social Security Administration. For example, you're not eligible to get a $5,000 bonus check on top of your regular benefits just because you worked in a specific career. Social Security doesn't randomly award money to people.

One must either be over the age of sixty-five, blind and/or disabled. Additionally, they must have a limited income and resources as the program is need-based and aims to assist beneficiaries to cover basic costs for food and shelter.

How to Fill Out a Social Security SS-5 Form - YouTube YouTube Start of suggested clip End of suggested clip Provide your previous social security number if you had one check the appropriate boxes to chooseMoreProvide your previous social security number if you had one check the appropriate boxes to choose your ethnicity and race. If you are applying on behalf of a dependent. Child fill out the parental.

Some ways to increase your Social Security payments include: Work at least 35 years. Earn more if possible. Work until full retirement age. Delay claiming until age 70. Claim spousal payments. Include family. Know retirement earning limits. Minimize Social Security taxes.

Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social Security card (in most areas), print a benefit verification letter, and more ? from anywhere and from any of your devices!

Complete your application online. Call our toll-free telephone number 1-800-772-1213. If you are deaf or hard of hearing, you can call us at TTY 1-800-325-0778. Call or visit your local Social Security office.

Your Social Security benefits will be permanently reduced by up to 30% if you claim "early," at age 62. However, waiting until 70 years old has the opposite effect. Your monthly benefits will receive an additional 8% "bonus" for each year you delay claiming benefits past full retirement age.