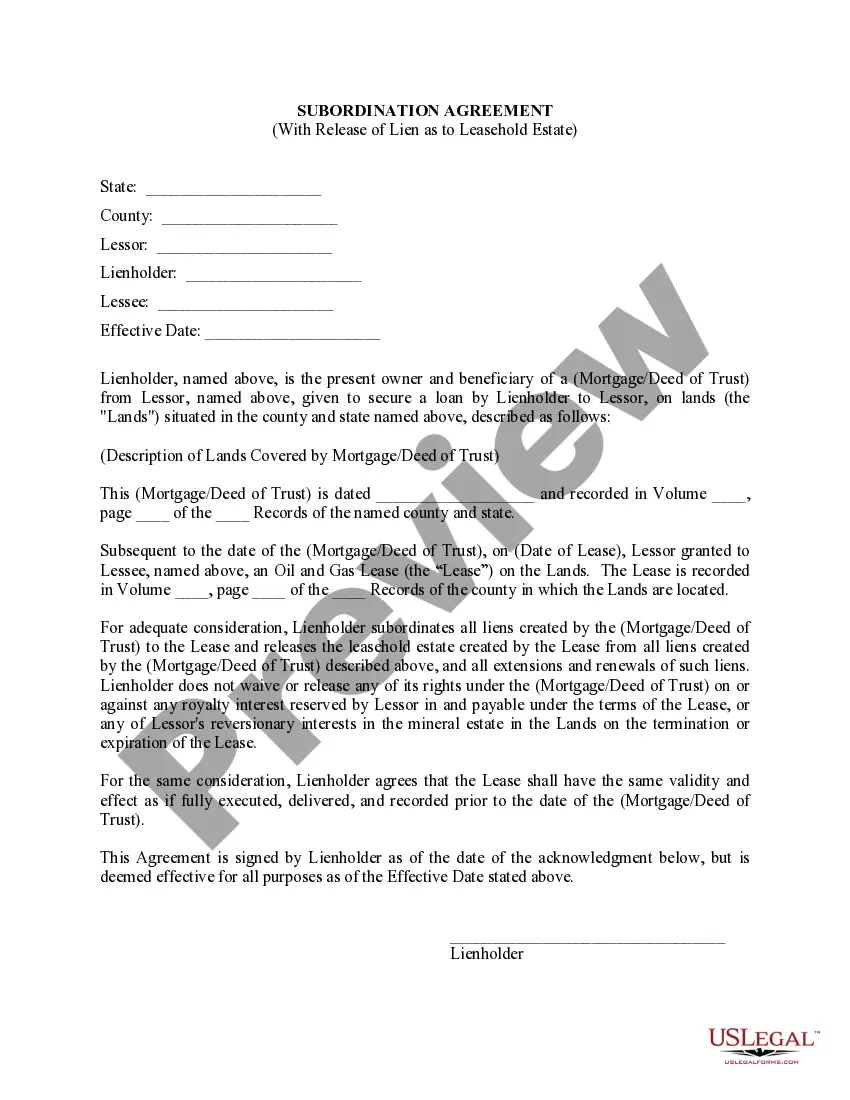

Tenant Subordination Agreement Form

Description

How to fill out Maryland Lease Subordination Agreement?

Well-structured formal documentation is one of the essential assurances for preventing issues and legal disputes, but acquiring it without the help of a lawyer may require time.

Whether you need to swiftly locate a current Tenant Subordination Agreement Form or any other templates for employment, family, or business purposes, US Legal Forms is consistently here to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button beside the selected file. Furthermore, you can access the Tenant Subordination Agreement Form later at any time, as all documents ever obtained on the platform stay accessible within the My documents section of your profile. Save time and resources on preparing formal documentation. Experience US Legal Forms today!

- Ensure the form aligns with your situation and jurisdiction by reviewing the description and preview.

- Look for another example (if necessary) using the Search bar located in the page header.

- Click Buy Now once you discover the appropriate template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method for the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Tenant Subordination Agreement Form.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Subordination of lease refers to the tenant's consent to subordinate his or her rights over a property to the rights of the bank holding the mortgage on the property. A subordination of lease agreement is created for this purpose.

Acceptable Subordinate Financing TypesMortgages with regular payments that cover at least the interest due so that negative amortization does not occur. Mortgages with deferred payments in connection with employer subordinate financing. Mortgage terms that require interest at a market rate.

Here's an example of how subordination clauses in mortgage notes work for a better understanding: John decides to buy a house. John's bank agrees to lend him the money to purchase a home on the condition that they take repayment priority. John's bank uses a subordination clause to secure its rights.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.