Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

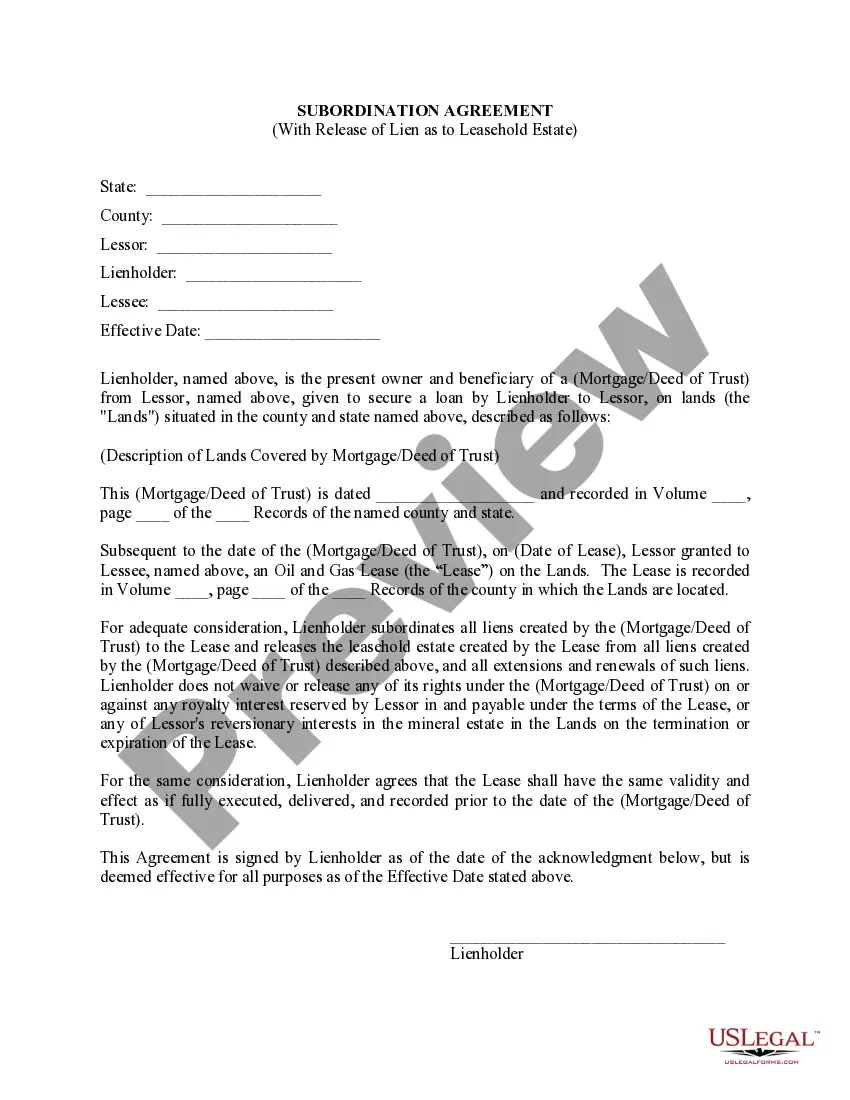

Tenant Subordination Agreement For Second Lien Holders

Description

How to fill out Tenant Subordination Agreement For Second Lien Holders?

Precisely prepared official documentation is one of the essential assurances for preventing issues and lawsuits, yet acquiring it without the assistance of a lawyer may require time.

Whether you need to swiftly locate a current Tenant Subordination Agreement For Second Lien Holders or any other forms for employment, family, or business contexts, US Legal Forms is consistently available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the chosen file. Furthermore, you can access the Tenant Subordination Agreement For Second Lien Holders anytime later, as all documents purchased on the platform remain accessible in the My documents section of your profile. Save time and expenses on preparing official documents. Discover US Legal Forms today!

- Ensure the document is appropriate for your situation and jurisdiction by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Click on Buy Now once you identify the suitable template.

- Select the pricing option, Log Into your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Tenant Subordination Agreement For Second Lien Holders.

- Click Download, then print the form to complete it or add it to an online editor.

Form popularity

FAQ

The most common type of subordinate lien is a second mortgage. When you get a second mortgage loan, the lender records the lien, representing its claim on the collateral: your real estate. Because your first mortgage provider has the first claim on the property, the second mortgage is considered a subordinate lien.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

The existing second loan moves up to become the first loan. The lender of the first mortgage refinancing will now require that a subordination agreement be signed by the second mortgage lender to reposition it in top priority for debt repayment.

A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, then the second mortgage can take its place as the primary loan. As a second mortgage, the lender will be taking on more risk.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.