Maryland Information Case Foreclosure

Description

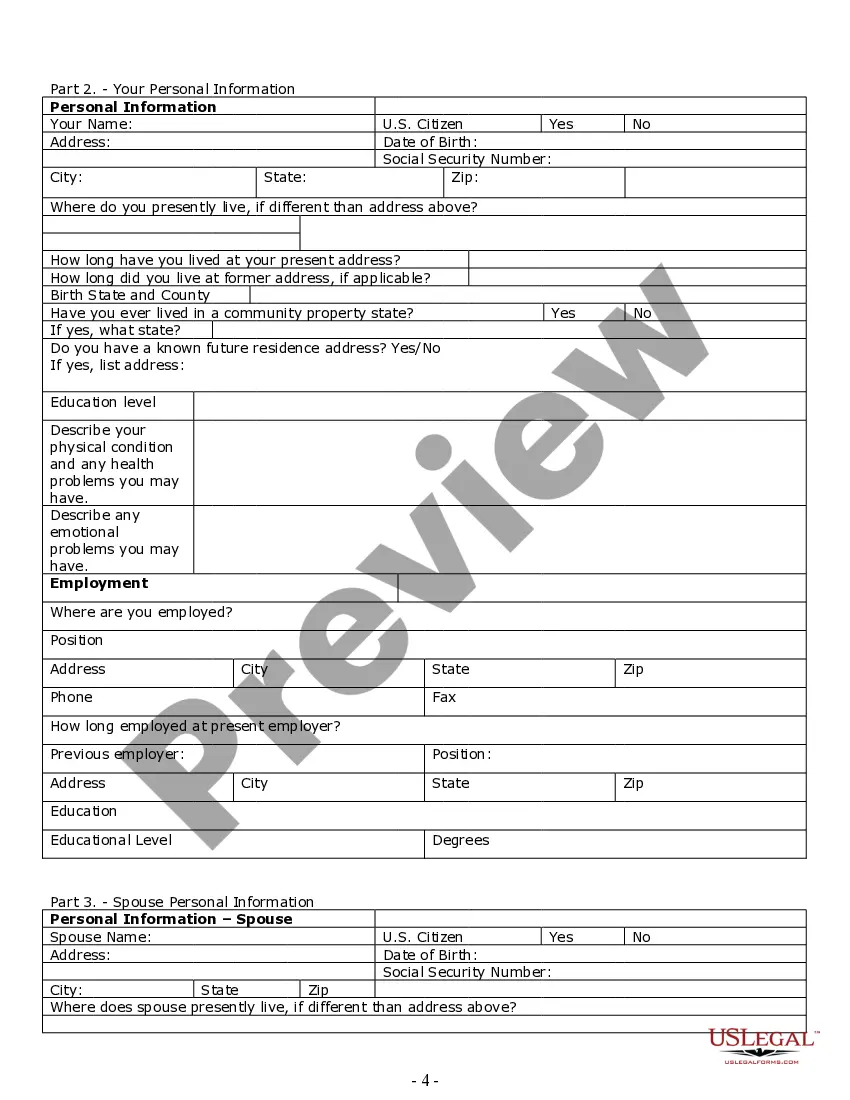

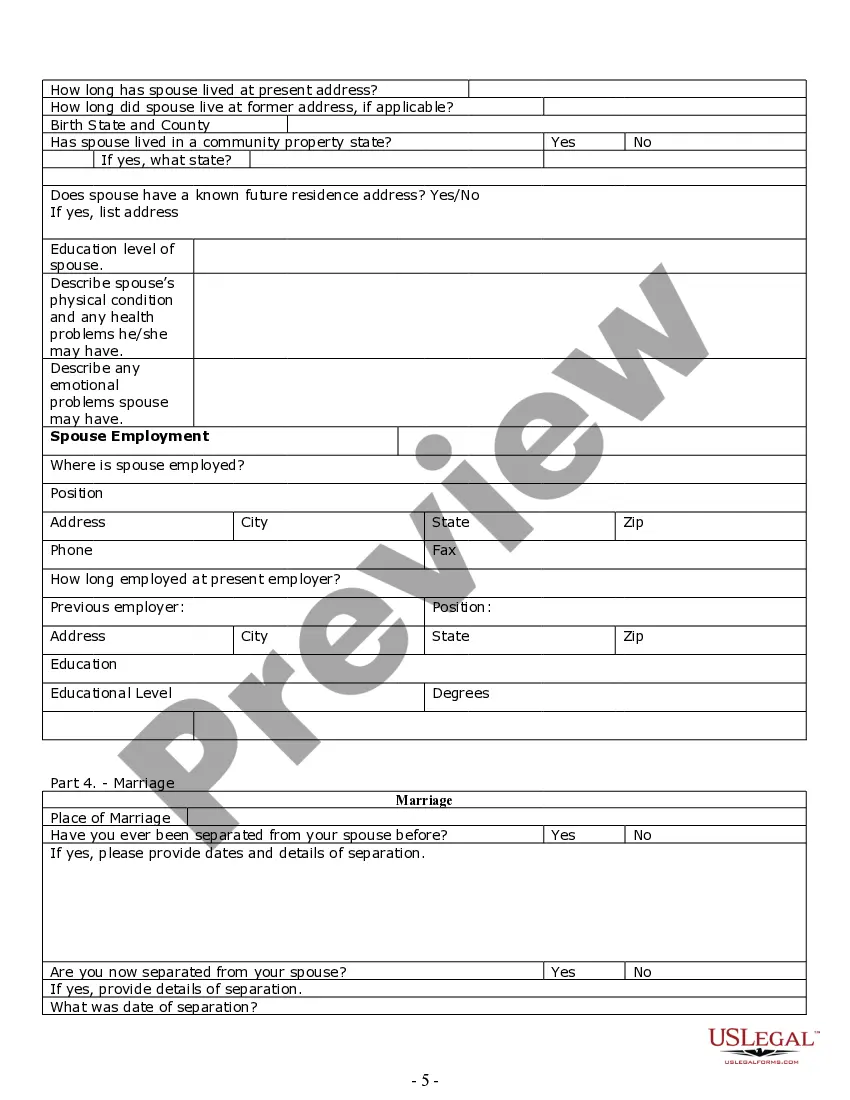

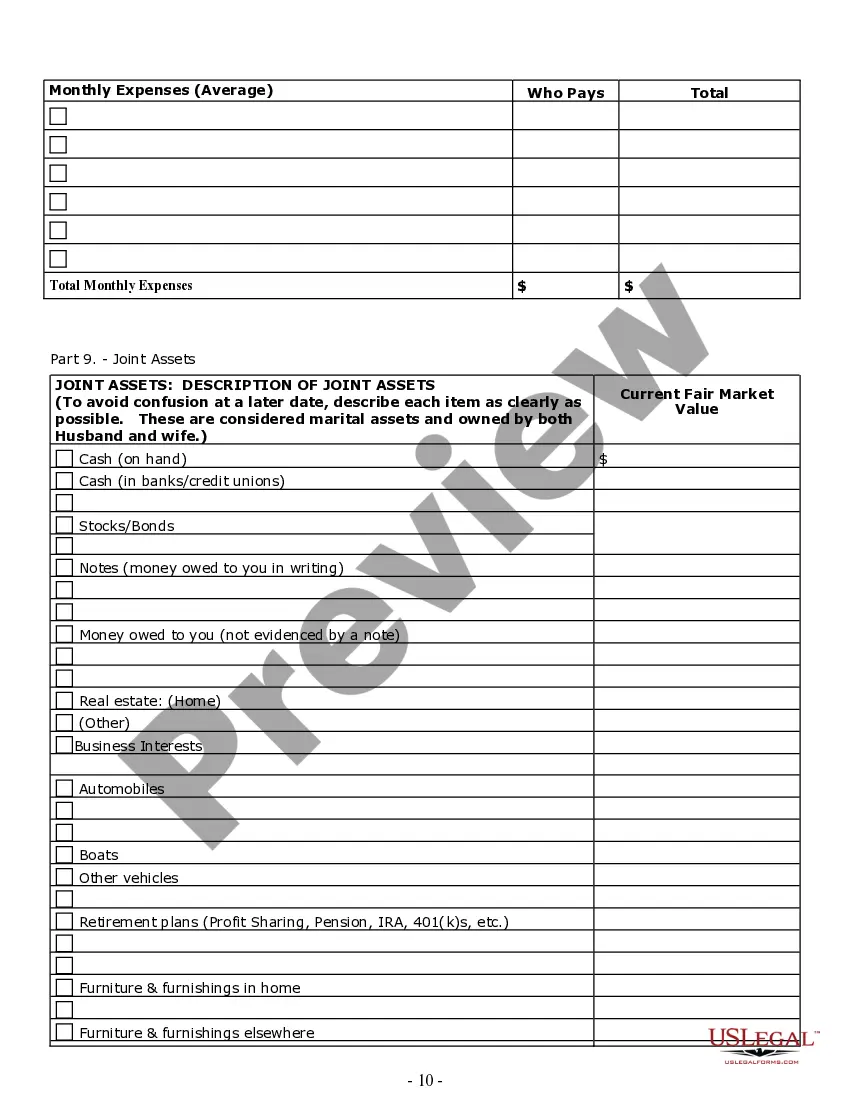

How to fill out Maryland Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Engaging with legal papers and processes may be a lengthy addition to your overall schedule.

Maryland Information Case Foreclosure and similar forms often necessitate that you search for them and comprehend how to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, possessing a thorough and functional online library of forms at your disposal will significantly assist you.

US Legal Forms is the leading online platform for legal templates, boasting more than 85,000 state-specific forms and numerous resources to aid you in swiftly completing your documents.

Is this your first experience using US Legal Forms? Register and create an account within minutes to access the form library and Maryland Information Case Foreclosure. Next, follow the steps outlined below to fill out your form.

- Browse the collection of suitable documents accessible with just one click.

- US Legal Forms provides you with state- and county-specific forms available for download at any moment.

- Protect your document management processes by utilizing a superior service that enables you to create any form in mere minutes without additional or hidden charges.

- Simply Log In to your account, locate Maryland Information Case Foreclosure, and download it immediately from the My documents tab.

- You can also access previously saved forms.

Form popularity

FAQ

A residential eviction after foreclosure sale follows this timeline: purchaser buys the property at foreclosure sale. purchaser notifies tenant of termination of tenancy, giving the tenant 90 days to move. if tenant does not leave, purchaser files a Motion for Judgment of Possession.

You may be able to avoid a foreclosure by talking with the lender to find out what options are available to you. There is not much time to find a remedy for your situation. If you do not contest the foreclosure, the process may take as little as 90 days to complete in Maryland.

The lender or mortgage servicer mails a Notice of Intent to Foreclose (NOI) to the homeowner after the first missed payment or other contractual default on a mortgage. The NOI is a warning notice that a foreclosure could be filed in court. It must be sent no less than 45 days before the foreclosure is filed.

Bankruptcy Is The Only Guaranteed Way to Stop Foreclosure in Maryland. Chapter 13 and Chapter 11 bankruptcy is the only guaranteed way to stop a foreclosure and pay back what you owe, short of paying off the amount that you are behind in full as reinstatement.

How Long Does the Typical Foreclosure Process Take in Maryland? Non judicial foreclosures in Maryland occur relatively quickly. Typically, it takes about 90 days to foreclose on a Maryland property if the borrower does not object to the foreclosure.