Maryland Lien Waiver Form With Notary

Description

Form popularity

FAQ

In North Carolina, lien waivers do not need to be notarized to be effective; however, having them notarized can add an extra layer of protection. Notary certification can provide verification of the identities of the parties involved along with the authenticity of the document. Therefore, even though notarization is not a requirement, utilizing a Maryland lien waiver form with notary is a smart choice that enhances legal standing and reduces the potential for disputes.

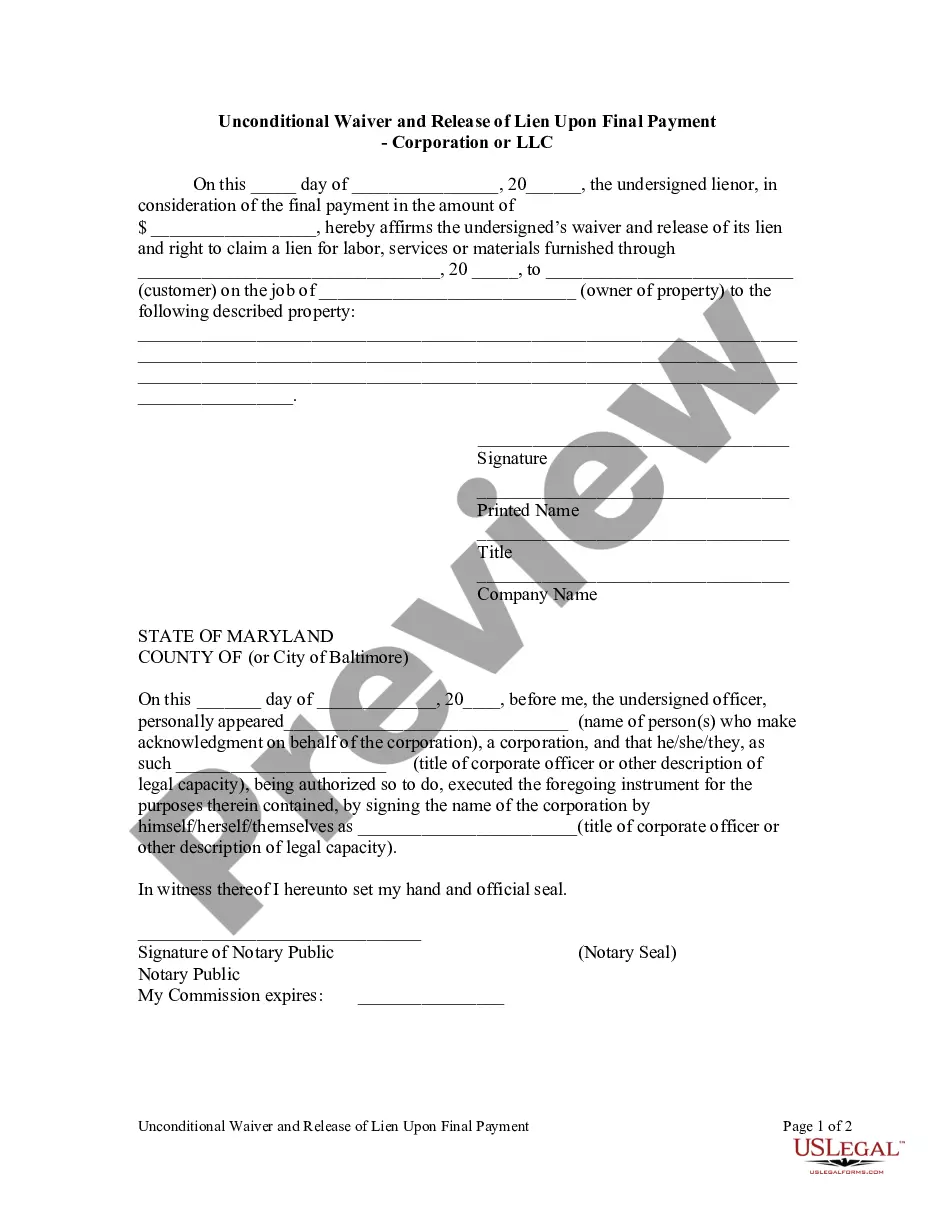

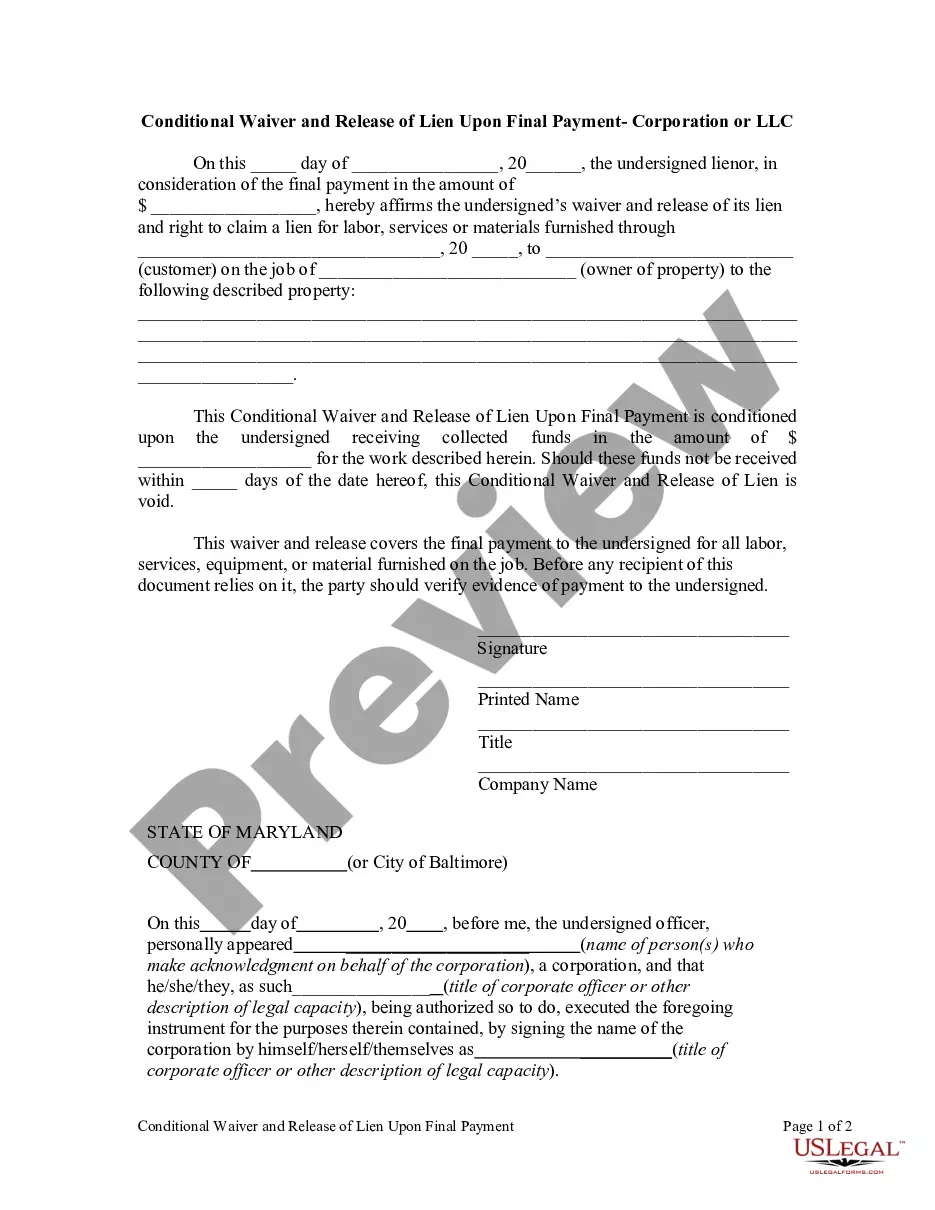

The main difference between conditional and unconditional lien waivers lies in their effectiveness regarding payment. A conditional lien waiver is valid only upon receiving payment, providing a layer of security for those who have not yet been compensated. In contrast, an unconditional waiver immediately relinquishes lien rights, creating a straightforward solution for property owners and contractors. Using a Maryland lien waiver form with notary ensures that these waivers are executed correctly.

To file a lien in Maryland, you must first prepare a lien document that includes specific information about the debt owed and the property involved. Next, you file the lien in the appropriate circuit court according to the jurisdiction where the property is located. This legal process can be complex; therefore, using resources like the Maryland lien waiver form with notary on the US Legal Forms platform can simplify your experience. Proper documentation ensures that your claim is valid and enforceable.

An unconditional release is a statement from a contractor or supplier that relinquishes their right to file a lien against a property. Once signed, this release means they acknowledge receipt of payment and do not have the ability to claim that amount again. When dealing with property in Maryland, having the right documentation, such as a Maryland lien waiver form with notary, provides security for all parties involved. This form protects the owner by ensuring lien rights are waived.

In North Carolina, there are two primary types of lien waivers: unconditional and conditional lien waivers. An unconditional lien waiver is effective as soon as it is signed, meaning the contractor or supplier gives up their right to claim a lien, regardless of whether payment has been received. On the other hand, a conditional lien waiver takes effect only when a specific condition is met, such as receiving payment. Understanding these distinctions can help you manage your project more effectively.

To determine if a property has a lien in Maryland, you can conduct a title search through the local land records office or hire a title company. This search will reveal any existing liens attached to the property, helping you avoid potential issues during a sale or transfer. Staying informed about liens is essential for property owners and buyers alike. The Maryland lien waiver form with notary can be a helpful resource in securing dealings and clearing any outstanding liens.

Yes, credit card companies can place a lien on your house in Maryland if they successfully obtain a court judgment against you for unpaid debts. This lien allows them to claim a share of the property value should you sell it. It’s important to remain proactive in managing debts to prevent such situations. To navigate this process, using the Maryland lien waiver form with notary may provide clarity and help resolve lien issues before they escalate.

In Maryland, most property liens may last for 12 years unless they are satisfied or released earlier. This timeframe can vary depending on the type of lien involved, as some may have shorter durations based on specific regulations. It’s crucial for property owners to understand the implications of existing liens, as they can affect property transfer or sale. Utilizing the Maryland lien waiver form with notary can aid in clearing up any confusion around lien durations.

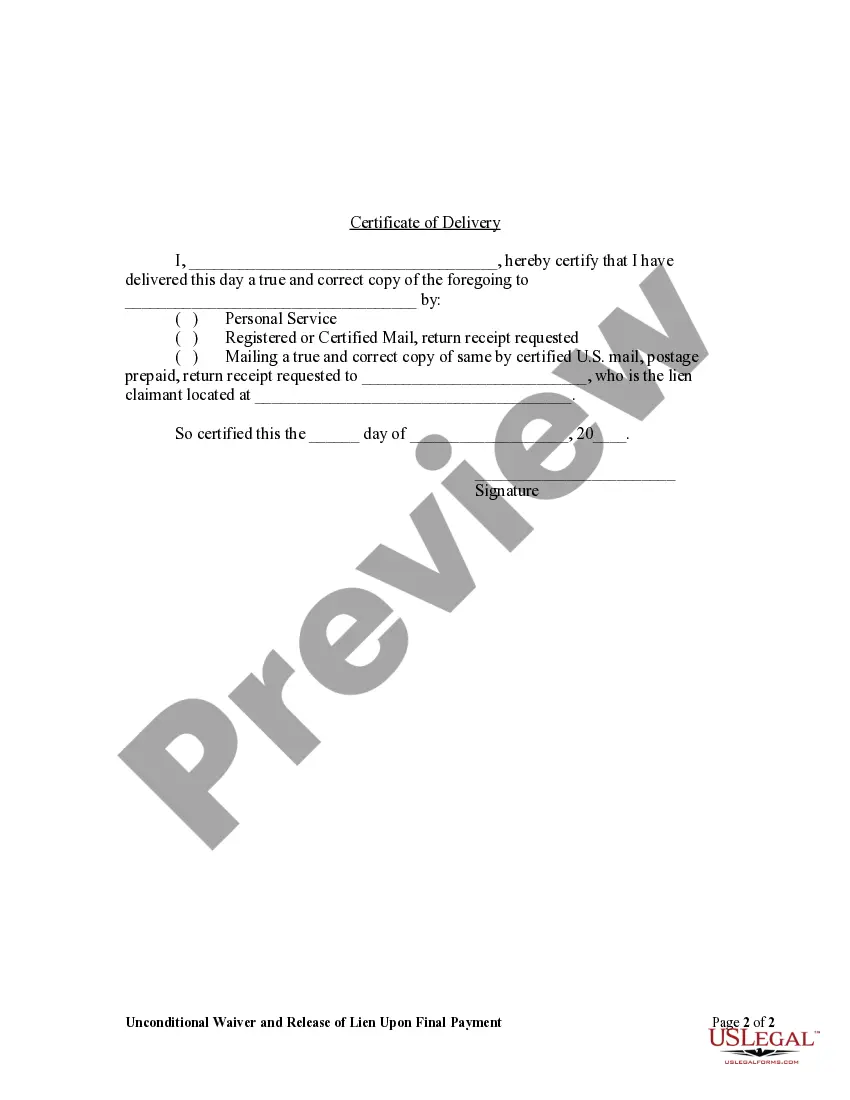

Filling out a waiver form involves gathering relevant details about the parties involved, specific amounts, and applicable project information. You should clearly indicate the effective date of the waiver, the property address, and ensure all signatories also provide their contact information. The Maryland lien waiver form with notary will require notarization to verify the authenticity of the signatures, adding an extra layer of security. This form can simplify transactions and provide peace of mind.

In Maryland, a recorded lien represents a legal claim against a property, ensuring that debt is satisfied before any sale or transfer occurs. This means that if a creditor records a lien, they can potentially force the sale of the property to recover the debt. Property owners should be aware of any such recorded liens, as they can impact property transactions. The Maryland lien waiver form with notary serves as a tool to help avoid complications from these liens.