Lien Release Form For Construction

Description

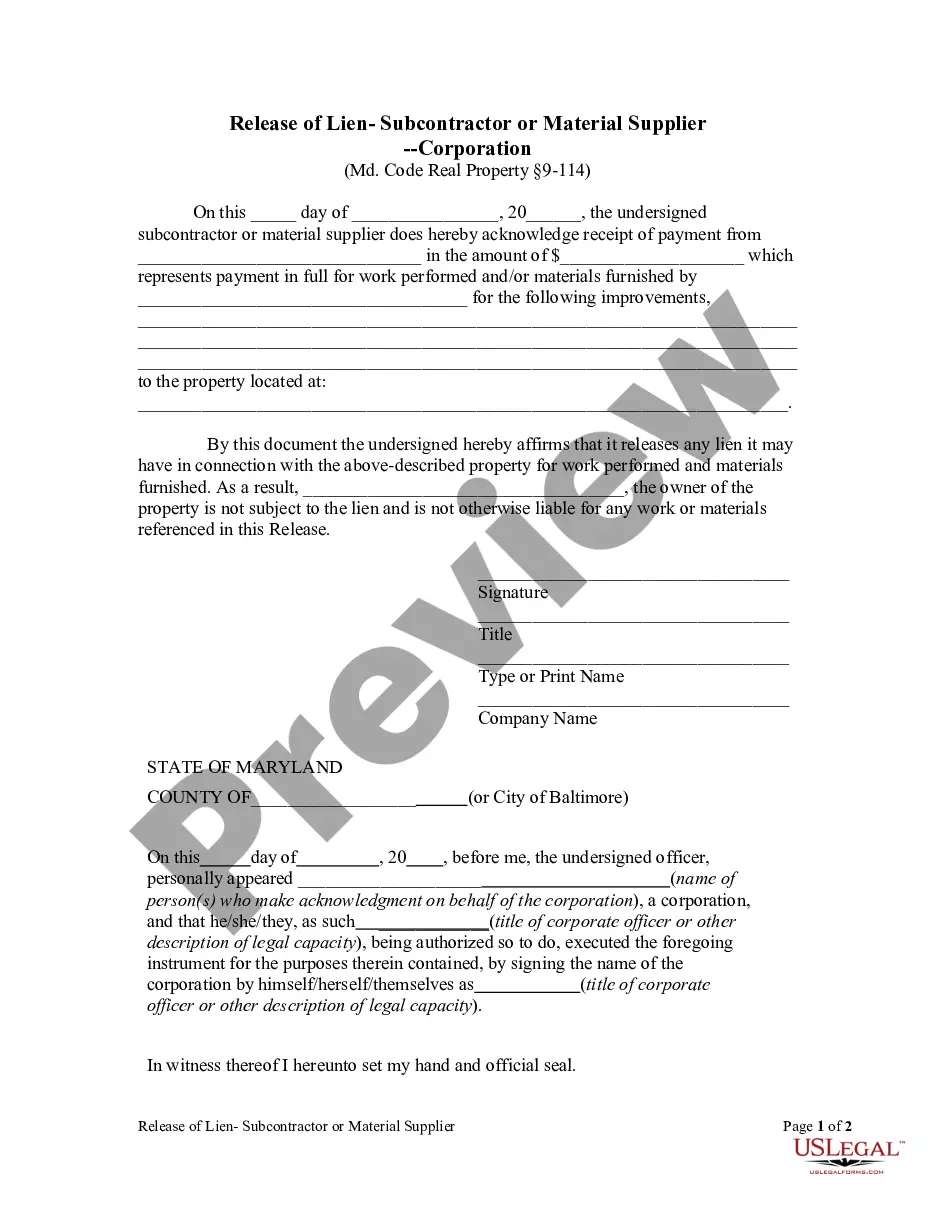

How to fill out Maryland Release Of Lien - Subcontractor Or Material Supplier - Corporation Or LLC?

- If you're an existing user, log in to your account and select the lien release form from your dashboard. Ensure your subscription is active; if not, renew it according to your payment plan.

- For first-time users, start by reviewing the form descriptions to find the lien release form that fits your requirements and is compliant with local laws.

- If necessary, utilize the Search tab to locate another template that may better serve your intentions.

- Purchase the document by clicking on the Buy Now button and select the subscription plan that aligns with your needs. An account registration is required to access the form library.

- Complete your payment using a credit card or your PayPal account to finalize your subscription.

- Download the lien release form to your device, and access it anytime from the My Forms section of your account.

By effectively following these steps, you can streamline your document acquisition process.

US Legal Forms empowers users with a vast selection of over 85,000 legal forms. Don’t wait; take advantage of their robust resources and start your legal document journey today!

Form popularity

FAQ

A final lien waiver is a document that confirms all payments have been made for the construction work completed. By issuing this waiver, the contractor agrees they have received full payment and waives any future claims against the property. Implementing a lien release form for construction ensures all parties are on the same page and establishes trust in financial dealings.

A waiver of lien by the contractor releases their claim against the property for the amount specified in the waiver. This means the contractor acknowledges receipt of payment and cannot make further claims for that amount. Using a lien release form for construction helps facilitate smoother transactions and protects property owners from unexpected financial liabilities.

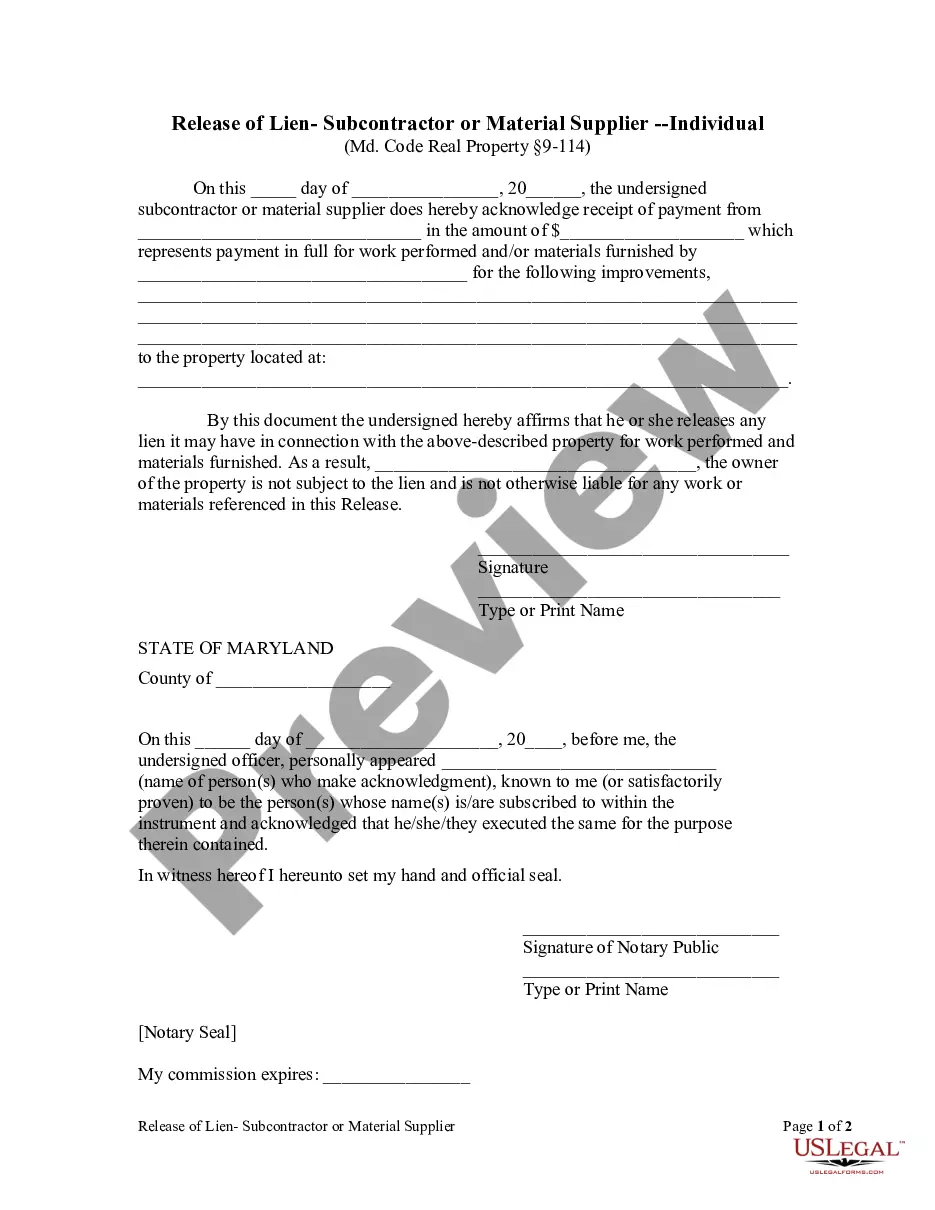

To fill out a lien affidavit, gather all relevant project and payment details, including contractor and property owner information. You should state the total amount due and attach any supporting documents, such as invoices or contracts. A well-documented lien release form for construction enhances clarity and ensures all parties understand their obligations.

Filling out a waiver of lien is straightforward. Start by including the project details, such as the property address and the name of the owner. Then, specify the amount being waived and ensure you sign and date the form. By accurately completing a lien release form for construction, you protect yourself and the property owner from any future claims.

The time it takes to get a lien release can vary based on the specific circumstances and the parties involved. Generally, once all payment obligations are fulfilled, a standard lien release can be executed quickly—often within a few days. To expedite your process, consider using a lien release form for construction from reputable platforms like US Legal Forms, which offers ready-made templates for quick completion.

To obtain a copy of a lien release from the IRS, you must request it through Form 4506, which is used for requesting tax return transcripts and associated documents. You’ll need to provide specific details about your case, including your tax identification number and the period in question. If you need a lien release form for construction related to taxes, ensure you clearly explain the context when making your request.

To obtain a lien release letter, contact the individual or company that placed the lien on your property. Request them to create and send you a lien release form for construction, confirming that you have fulfilled your payment obligations. Once you have that letter, be sure to file it with local authorities to complete the removal process.

In writing a letter to release a lien, begin with a formal greeting and state your intention to release the lien. Include details such as the debtor’s name, the property address, and confirmation that the debt has been satisfied. A concise and clear letter, accompanied by a lien release form for construction, will effectively communicate your actions.

Filling out a construction lien waiver involves entering specific information like job details, amount received, and property description. You need to indicate whether the waiver is conditional or unconditional. Using a lien release form for construction can make this process straightforward, ensuring all required sections are accurately completed.

To request a lien removal, you typically start by contacting the creditor who filed the lien. You can ask them to issue a lien release form for construction, which confirms that their claim against your property is no longer valid. Once received, you must file this form with the appropriate local authority to officially remove the lien.