Owner Corporation Form With Ein Number

Description

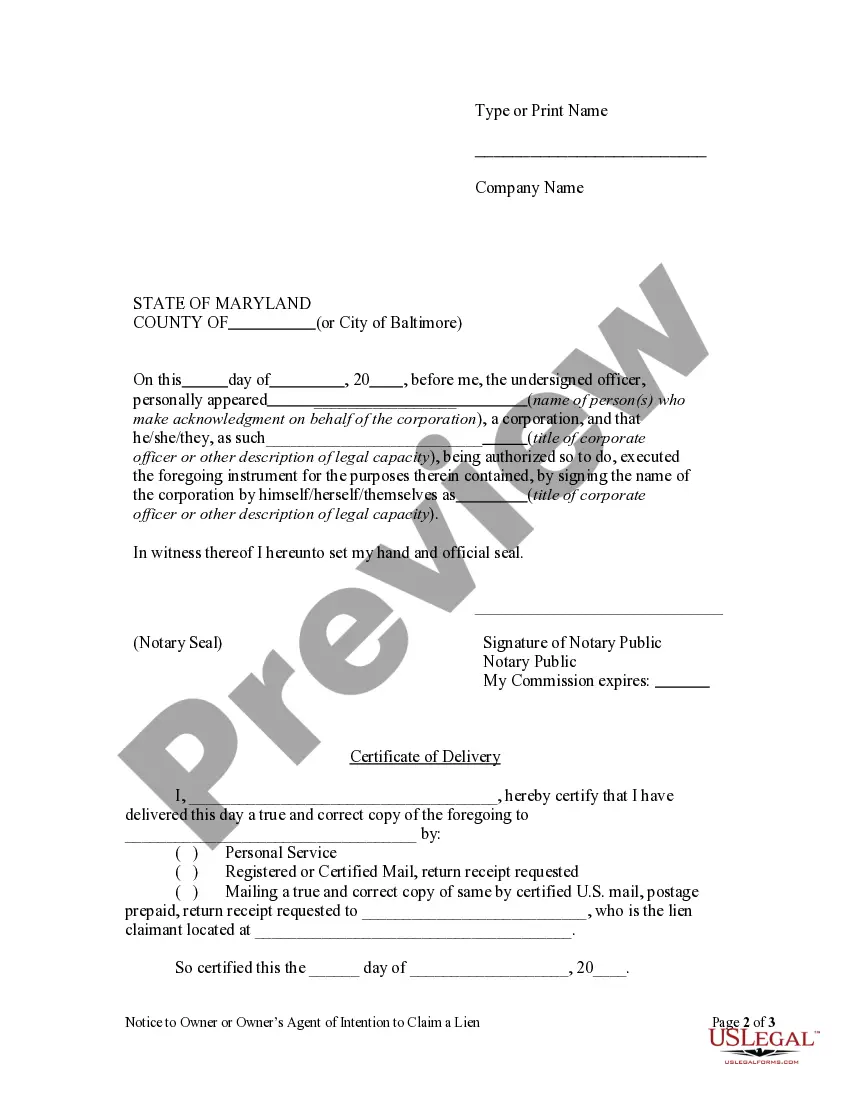

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- If you have used US Legal Forms previously, simply log in to your account and download the desired form by clicking the Download button, ensuring your subscription is active.

- For new users, start by checking the Preview mode and read the form description to confirm it meets your needs and complies with your local laws.

- If necessary, search for additional templates using the Search tab to ensure you find the perfect form.

- Purchase your document by clicking the Buy Now button and selecting your subscription plan, which requires account registration for full access.

- Complete your transaction by entering your payment information via credit card or PayPal.

- Finally, download your form and save it to your device. You can access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms streamlines the process of obtaining legal documents, helping individuals and attorneys efficiently execute necessary forms. Our expansive library empowers you to find and complete legal paperwork with confidence.

Don't wait any longer; start your legal journey today with US Legal Forms and ensure your documents are handled with precision!

Form popularity

FAQ

To verify ownership of a business, you may refer to the Owner corporation form with EIN number, which is essential. Also, check with your local business registry or relevant government office for additional documents proving ownership. Companies like USLegalForms can guide you in creating and organizing these essential documents conveniently.

An EIN, or Employer Identification Number, indicates that your business is registered with the IRS. This number links your business to its tax responsibilities and verifies its legitimacy. When filling out your Owner corporation form with EIN number, this verification is crucial for establishing your business's credibility.

Typically, a business license, operating agreement, or the Owner corporation form with EIN number serves as proof of ownership for a business. These documents show that you are the legal owner and can conduct business activities. For ease of access and legality, consider using a service like USLegalForms to ensure your documents are accurate.

No, you cannot directly look up who owns an EIN due to privacy laws. However, if you have the Owner corporation form with EIN number, you can often find information about the business ownership through public records or by contacting the issuing agency. Using platforms like USLegalForms can simplify this process by providing tailored documents.

Yes, you can obtain a copy of your EIN letter online through the IRS website. Simply visit their site, log in to your account, and request a replacement EIN confirmation letter. It is an efficient way to retrieve your important documents related to your Owner corporation form with EIN number.

No, an LLC is not the same as an owner's EIN. The EIN is a unique identification number assigned to your business for tax purposes, while the LLC is a type of business structure. You can file the owner corporation form with ein number to obtain your EIN when you establish your LLC, ensuring that your business is properly recognized by the IRS.

An LLC, or limited liability company, is a specific type of business entity that offers personal liability protection and flexible management options. In contrast, an owner refers to an individual or entity that holds legal rights to a business. It is essential to understand these distinctions, and using the owner corporation form with ein number can clarify your business structure and responsibilities.

Having an EIN does not automatically mean that you are an LLC. The EIN serves as a unique identification number for your business, whether you are a sole proprietor, LLC, or corporation. To officially become an LLC, you must file the appropriate documents, and obtaining an owner corporation form with ein number is a crucial step in this journey.

Yes, a corporation needs an EIN to conduct business legally in the United States. The EIN serves as the corporation's taxpayer identification number, allowing it to file taxes and open bank accounts. Completing the owner corporation form with ein number simplifies this process, making it easier for businesses to comply with federal regulations.

No, forming an LLC does not automatically grant you an EIN. You must apply for your EIN separately through the IRS. By completing the owner corporation form with ein number, you can ensure that you have this essential identification for business tax purposes and banking needs.