Owner Corporation Form With Business

Description

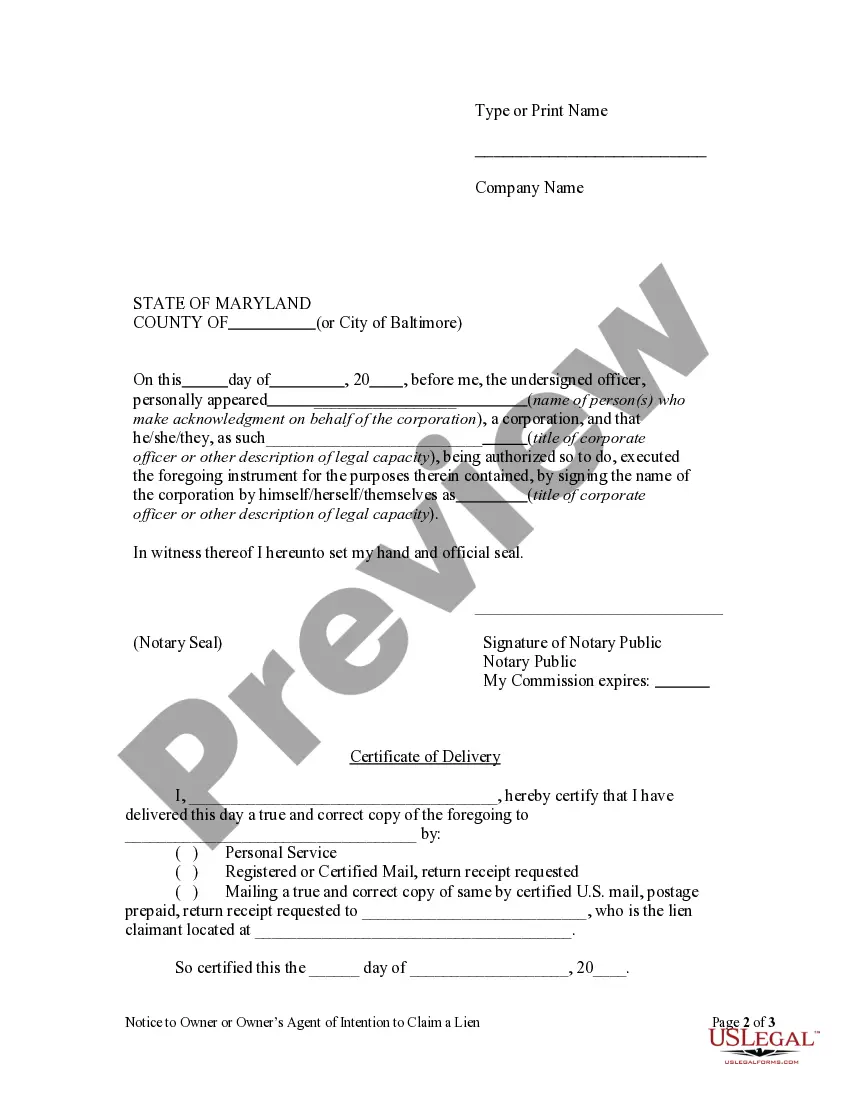

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- Log in to your US Legal Forms account if you are a returning user and ensure your subscription is active. Click the Download button to retrieve the desired form.

- If you are new to the service, start by checking the Preview mode and form description to confirm that it aligns with your requirements and complies with local jurisdiction.

- If necessary, use the Search tab to find an alternative template that meets your needs.

- Select the document by clicking the Buy Now button and choose your preferred subscription plan. You will need to create an account for full access.

- Proceed to payment by entering your credit card information or opting for PayPal to complete your purchase.

- Finally, download the form to your device. You'll also find it in the My Forms section of your profile for future reference.

With US Legal Forms, the process is designed to be user-friendly, providing access to a robust collection of forms at a competitive cost.

Start your journey towards efficient legal documentation today by exploring the extensive library at US Legal Forms!

Form popularity

FAQ

Determining whether to start an LLC or a corporation depends on your strategic vision for your business. If you seek simplicity and flexibility, an LLC could be your best bet. In contrast, if your focus is on acquiring investors or creating a more formal structure, a corporation might be the way to go. We recommend evaluating your goals and potential need for growth before making a decision.

The biggest disadvantage of an LLC may be the limited ability to raise capital. Unlike corporations, LLCs cannot issue stock, which can hinder fundraising efforts. Additionally, some states impose specific limitations on ownership, which can restrict expansion. As such, it may be wise to consider an owner corporation form with business if you plan on significant growth or investment.

Whether it is better to operate as a corporation or an LLC largely depends on your specific business goals. Corporations can offer enhanced credibility and investment opportunities, while LLCs provide greater management flexibility and simpler setups. Weigh the benefits of each structure against your operational needs, and consider using platforms like US Legal Forms to simplify the formation process.

Tax liability between an LLC and a corporation can vary depending on structure and income. Typically, LLCs enjoy pass-through taxation, meaning profits go directly to owners without being taxed at the corporate level. In contrast, corporations may face double taxation, where income is taxed at the corporate level and again when dividends are distributed to shareholders. Understanding these tax implications is essential when deciding on an owner corporation form with business.

Deciding whether your startup should be an LLC or a corporation depends on your business needs and goals. An LLC offers flexibility and simplicity in management while protecting your personal assets. On the other hand, forming a corporation can attract investors and provide stock options. Consider your growth plans and how you intend to manage liability to make the right choice.

Turning your business into a corporation involves filing the appropriate owner corporation form with business authorities in your state. First, choose a unique name that complies with state regulations. Next, prepare and file the articles of incorporation, which detail your business structure, purpose, and registered agent. Completing this process properly can provide you with valuable legal protections.

Transforming a small business into a corporation involves several key steps, starting with filing the appropriate owner corporation form with business authorities. You'll need to choose your corporate name, prepare articles of incorporation, and set up a board of directors. Our platform, USLegalForms, offers valuable resources and templates to guide you through this process smoothly. By becoming a corporation, you gain new opportunities for investment and growth.

A corporate form of business ownership, often referred to as incorporation, allows you to create a separate legal entity for your business. This means that your personal assets are generally protected from business liabilities, promoting limited liability. An owner corporation form with business can help you transition into this unique structure effectively. It's a popular choice among entrepreneurs seeking to grow and protect their ventures.

As a business owner, you typically need to file an owner corporation form with business registration documents. This form legally establishes your company as a corporation, giving it a distinct identity. Additionally, you may need to provide specific information about your business structure, activities, and ownership. Using platforms like USLegalForms can simplify this process by providing ready-made templates and guidance.

To obtain S Corp status for your LLC, you must meet specific IRS criteria and file Form 2553. This form serves as your official election to be taxed as an S Corporation. By completing the appropriate owner corporation form with business, you position your LLC to benefit from S Corp advantages, such as pass-through taxation.