Owner Corporation Form With 2 Points

Description

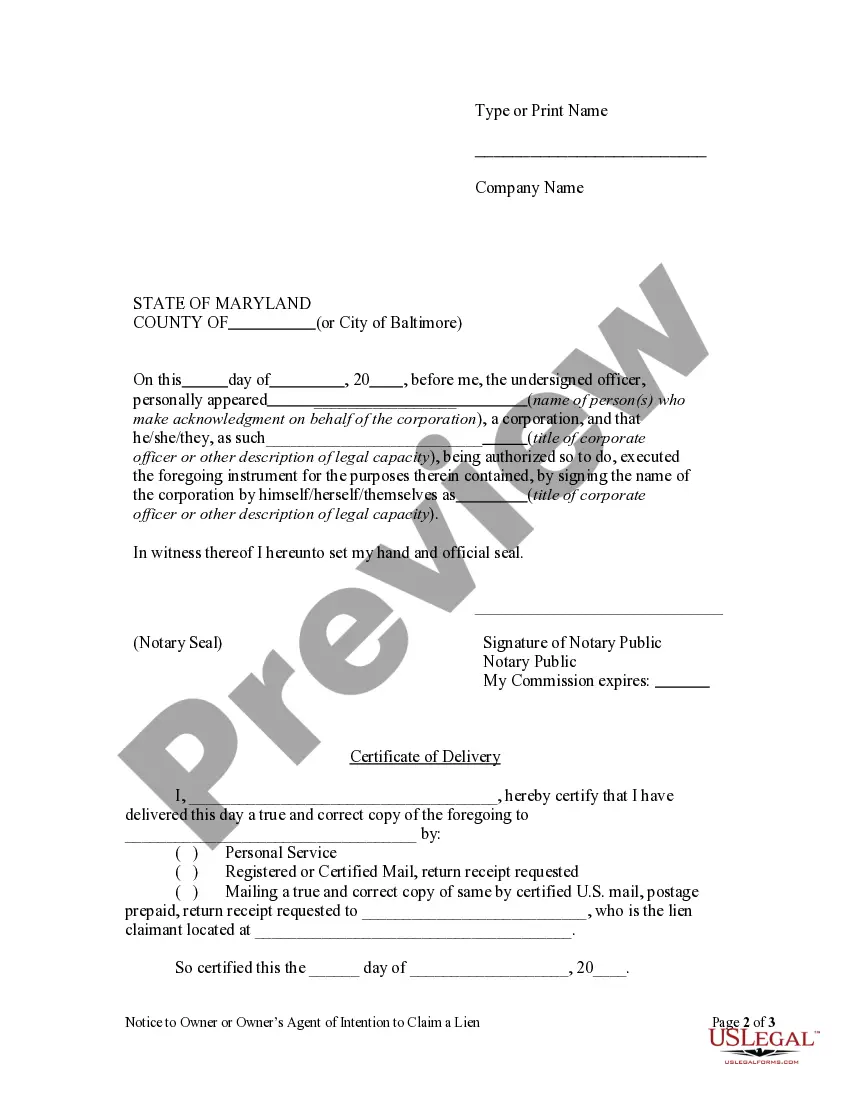

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- For returning users, log in to your account and directly download the required owner corporation form template. Always check that your subscription is active; if it's not, take a moment to renew it according to your payment plan.

- If this is your initial visit, begin by reviewing the Preview mode and the form description. Make sure you select the correct form that meets your personal requirements and complies with your local laws.

- If necessary, search for additional templates using the Search tab above to find the precise document that fits your needs.

- Once you've selected the correct form, click the Buy Now button and pick your desired subscription plan. You will need to create an account to gain access to our vast library.

- Proceed with your purchase by entering your payment information through a credit card or PayPal.

- Lastly, download your newly acquired document and save it on your device. You can access it anytime from the My Documents section of your profile.

US Legal Forms is not just about quantity; it's about quality as well. With a comprehensive library featuring over 85,000 legal forms and packages, you can rest assured that you'll find what you need. Additionally, premium expert assistance is available to guide you, ensuring that your documents are accurate and legally compliant.

Start your seamless journey with US Legal Forms today and enjoy the benefits of having all the legal resources you need right at your fingertips. Don't hesitate to visit us now!

Form popularity

FAQ

When there are two owners of a company, it is commonly referred to as a partnership or co-ownership. This structure can take various forms, including LLCs or corporations, which can provide specific benefits. Employing the owner corporation form helps clarify ownership stake and facilitate operational management among the partners.

The basic form of ownership in a corporation is through shares of stock. Shareholders own the corporation and can influence decisions through voting rights. The owner corporation form provides clear delineation of ownership and responsibilities, facilitating smoother operations and investor relations.

To effectively structure a business with two owners, you can create a partnership or a limited liability company (LLC) that suits your needs. Define the roles, responsibilities, and profit-sharing in a written agreement to avoid misunderstandings. Utilizing the owner corporation form allows for clearer governance and operational guidelines for both owners.

When deciding whether to take an owners draw or a salary, consider the specifics of your financial situation. An owners draw may provide flexibility in accessing profits, while a salary ensures stable income and can help with personal budgeting. Furthermore, using the owner corporation form can help you balance both draws and salary, optimizing your tax position.

Yes, two people can jointly own 100% of a business. This means that each person holds an equal or a predetermined percentage of ownership. To make the arrangement official and minimize disputes, using an owner corporation form with 2 points is advisable, ensuring both parties understand their roles and contributions.

Ownership of a corporation can be proven through the possession of stock certificates or shares that document each owner's stake in the company. Additionally, the company's bylaws and official records provide evidence of ownership percentages. In cases where ownership is not clearly defined, utilizing an owner corporation form with 2 points can help clarify each owner’s rights and obligations.

To set up an LLC with two owners, begin by choosing a suitable name for your business that complies with state regulations. Next, file the Articles of Organization with your state's Secretary of State. Finally, prepare an operating agreement that outlines each owner's rights, roles, and contribution, ensuring you consider the owner corporation form with 2 points for clarity in ownership structure.

Ownership of a business can be split based on the contributions of each owner, which may include capital, assets, or labor. Alternatively, owners can agree on an equal split or any ratio that reflects their agreement. Clear documentation is essential, and using an owner corporation form with 2 points can help in formalizing this structure. It ensures that both parties understand their rights and responsibilities.

A business with two owners is commonly referred to as a partnership. In this setup, both individuals share the responsibilities and profits of the business. They can also choose to form a limited liability company (LLC), which provides additional legal protections. This can be beneficial when using an owner corporation form with 2 points to structure your partnership.

Whether you must fill out form 7203 depends on your ownership structure and the distributions you have received. If you are an S corporation owner and have taken distributions, this form tracks equity and distributions accurately. To avoid any misfiled taxes, you should assess your situation carefully. Our platform is here to assist you in understanding the Owner corporation form and ensuring compliance.