Owner Corporation Form For The Financial Statements

Description

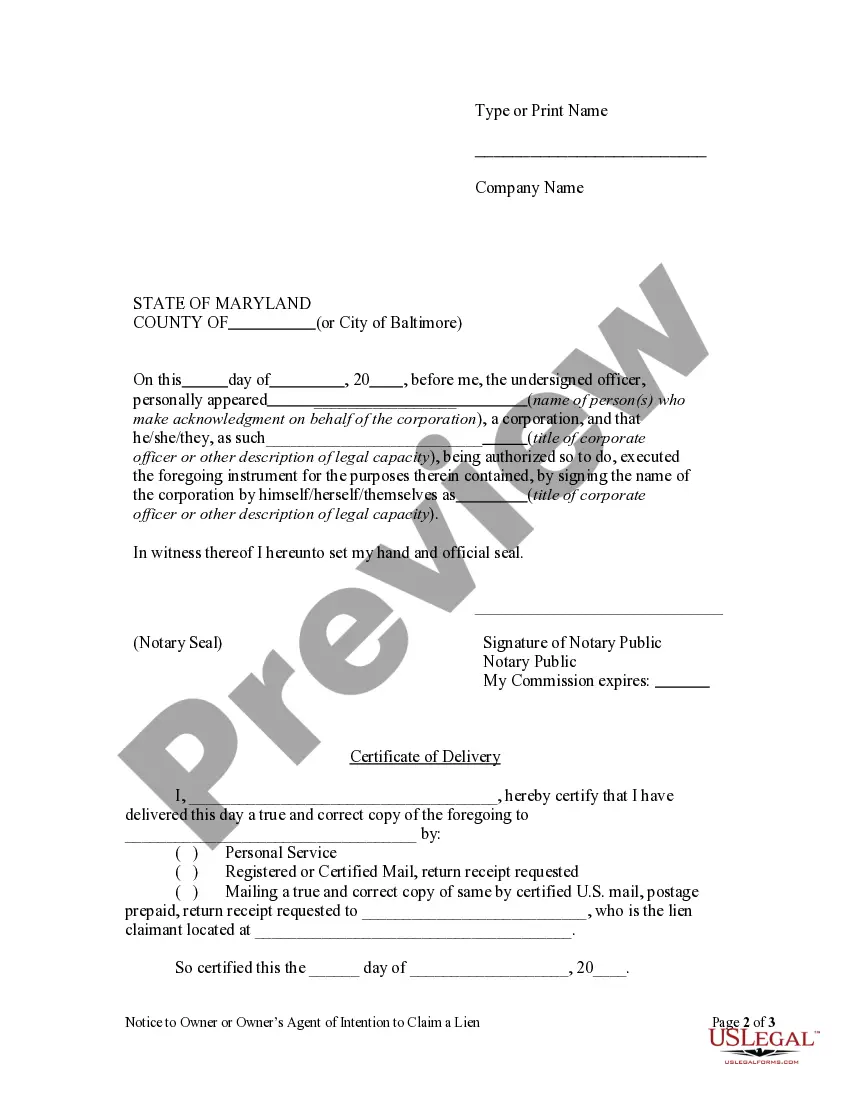

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- Log in to your existing US Legal Forms account. Ensure your subscription is active to proceed with your downloads.

- If you’re new to US Legal Forms, start by exploring the library. Use the Search function to find the Owner Corporation Form that fits your needs and jurisdiction.

- Review the form description and preview mode to confirm it's the correct template before moving on.

- Select the Buy Now option and choose your preferred subscription plan. Registration is necessary to gain access to extensive resources.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the completed form to your device, ensuring you can return to it anytime through the My Forms section of your profile.

This simple process not only saves you time but also guarantees you access to a robust collection of more than 85,000 forms, tailored to meet various legal needs.

Ready to simplify your legal paperwork? Visit US Legal Forms today and equip yourself with the Owner Corporation Form for Financial Statements effortlessly!

Form popularity

FAQ

You can submit Form 1120 either electronically or via mail, depending on your preference and the IRS regulations for your situation. If you choose to file electronically, you'll need to use an approved e-file provider. On the other hand, if you prefer to mail it, send the completed form to the appropriate IRS address listed in the instructions. Having the correct owner corporation form for the financial statements allows you to maintain proper records.

If your LLC has multiple members, it is generally required to file Form 1065, which reports the income, deductions, and credits of the partnership. Each member receives a Schedule K-1 that outlines their share of the LLC's income. This form is essential for accurate tax reporting and helps ensure compliance. When preparing, be sure to keep the owner corporation form for the financial statements organized.

To verify ownership of a corporation, you can check the state’s business registry or the Secretary of State's office where the corporation is registered. Most states provide online access to this information, allowing you to see ownership details and corporate filings. Additionally, the owner corporation form for the financial statements may include information regarding ownership for clarity.

Limited Liability Companies (LLCs) can file either a 1040 or 1120 depending on how they are taxed. A single-member LLC is generally treated as a sole proprietorship and will report income on Schedule C of the 1040. However, if it chooses to be taxed as a corporation, it would file Form 1120. Understanding the nuances of the owner corporation form for the financial statements can enhance your reporting accuracy.

Business owners file different forms depending on their business structure. Sole proprietors often use Schedule C attached to the 1040 form, while partnerships typically file Form 1065. If you run a corporation, you may use Form 1120. Properly completing the owner corporation form for the financial statements can help solidify your financial standing and compliance.

The 1040 form is primarily used by individual taxpayers to report their personal income. However, if you are a sole proprietor, you can report your business income on Schedule C, which is attached to your 1040 form. Therefore, while the 1040 itself isn’t exclusively for business owners, it is the starting point for reporting personal income, including business earnings. Utilizing the correct owner corporation form for the financial statements can help streamline your tax reporting.

1120 is required for foreign corporations doing business in the U.S. This filing ensures that they report any U.S. source income, complying with tax laws. If you're managing an Owner corporation form for the financial statements, understanding your filing responsibilities is critical to mitigate risks associated with noncompliance.

IRS Schedule F is used to report farm income and expenses, providing key details about agricultural activities. It’s particularly beneficial for farmers operating as sole proprietorships or partnerships, streamlining their tax process. If your Owner corporation form for the financial statements involves agricultural business, utilizing Schedule F can help you accurately reflect your income.

Form 1120-F is necessary for foreign corporations that engage in business activities within the U.S. All foreign entities that receive income from U.S. sources must file this form, regardless of whether they have a physical presence in the country. Ensure your financial documentation, including the Owner corporation form for the financial statements, is filed correctly to avoid penalties.

Form 1120 F is utilized by foreign corporations to report their income, expenses, and taxable income in the United States. This form plays a crucial role in determining tax liability for foreign entities operating in America. When completing the Owner corporation form for the financial statements, understanding the appropriate forms ensures compliance and accurate tax reporting.