Maryland Lien Waiver Form

Description

Form popularity

FAQ

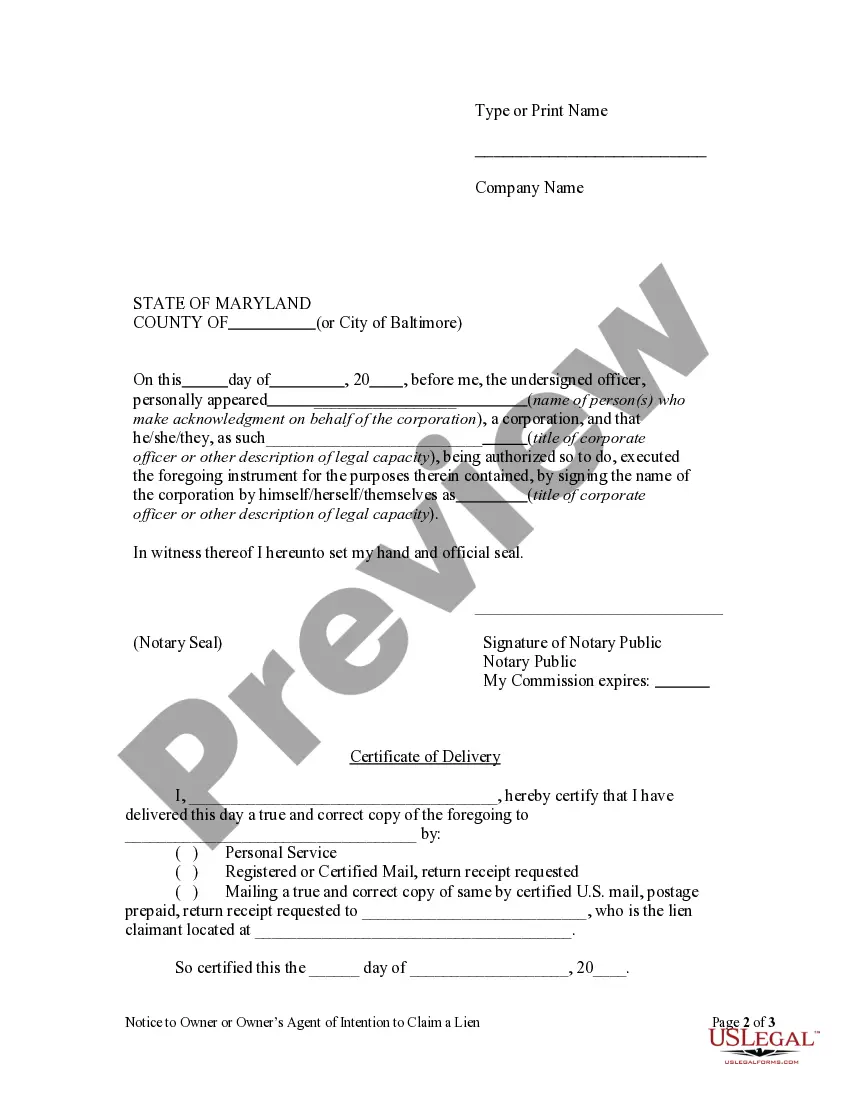

To file a lien in Maryland, you must complete the necessary Maryland lien waiver form along with documentation detailing the labor or materials provided. First, ensure you have all pertinent details about the property and the amount owed. Next, file the lien with the appropriate circuit court in the county where the property is located. Proper filing protects your rights as a contractor or supplier, ensuring you can collect what is due.

A waiver of lien is a legal document that relinquishes the right to claim a lien against a property. Essentially, when a contractor or supplier signs a Maryland lien waiver form, they confirm that they have received payment and agree not to file a lien. This process protects property owners by ensuring that all debts are settled before work begins. It clarifies financial transactions in construction projects, enhancing trust among all parties.

In Maryland, the liens that usually have the highest priority are tax liens and the first recorded mortgage liens. Tax liens take precedence over all other liens, regardless of the order of recording. This hierarchy is essential for property owners and creditors alike. A Maryland lien waiver form may serve as a protective tool when negotiating these complex scenarios.

Maryland is not classified as a super lien state. In super lien states, certain liens, like homeowner association dues, can take priority over previously recorded mortgages. In Maryland, liens are prioritized primarily by their recording date, making it important to file for lien waivers appropriately using a Maryland lien waiver form.

In Maryland, the priority of liens is generally determined by the date of recording. The first lien recorded usually has the highest priority. However, certain types of liens, such as tax liens, may take precedence regardless of recording dates. Understanding these priorities is essential when dealing with a Maryland lien waiver form.

Filing a property lien in Maryland involves completing the appropriate form and submitting it to the circuit court in the county where the property is located. You must include details such as the property owner's name, the amount owed, and any relevant dates. After filing, ensure you obtain a copy for your records. Consider using a Maryland lien waiver form to address any disputes related to the lien.

To place a lien on a property in Maryland, you must file a claim with the appropriate court. This process includes gathering the necessary documentation, detailing the amount owed, and submitting the required forms. It may also be wise to utilize a Maryland lien waiver form for clarity and compliance throughout the process.

The most common type of lien found on property is a mechanics' lien, which typically arises from unpaid services or labor related to property improvements. Such liens can be problematic for property owners, making it crucial to address any outstanding payments promptly. Using a Maryland lien waiver form can help avoid these situations.

For property owners, an unconditional lien waiver is often recommended once payment is completed. This type of waiver provides immediate reassurance that no further claims can be made against the property. When using a Maryland lien waiver form, ensure it aligns with your financial transactions for optimal protection.

In Maryland, lien waivers do not typically require notarization to be valid. However, having a notary sign can add an extra layer of authenticity and may be beneficial in certain situations. Always consult the specific requirements based on your project to ensure you use the correct Maryland lien waiver form.