Maryland District Court Lien Form

Description

Form popularity

FAQ

A Maryland lien release is a formal document stating that a previously filed lien has been satisfied and is no longer enforceable. The document includes information such as the original lien details and the date of satisfaction. Once completed, it must be filed with the Maryland District Court to officially clear the lien from public records. Leveraging the Maryland district court lien form for this process is crucial for transparency.

A writ of garnishment of property in Maryland allows a creditor to seize a debtor's property to satisfy a debt. This legal order can reach various assets, including bank accounts and other valuables. To initiate this process, proper documentation, including a Maryland district court lien form, is often required. This process helps protect your interests as a creditor.

The statute of limitations on debt collection in Maryland is typically three years for most debts. This time frame starts from the date of the last payment or acknowledgment of the debt. After this period, creditors cannot legally pursue collection through the court. A well-structured Maryland district court lien form can help you secure your rights during this process.

In Maryland, a lien is generally valid for a period of 12 years from the date it is filed. However, you can extend the validity by re-filing the lien before it expires. This means you need to stay proactive about monitoring your lien status. Always utilize the Maryland district court lien form correctly to maintain its validity.

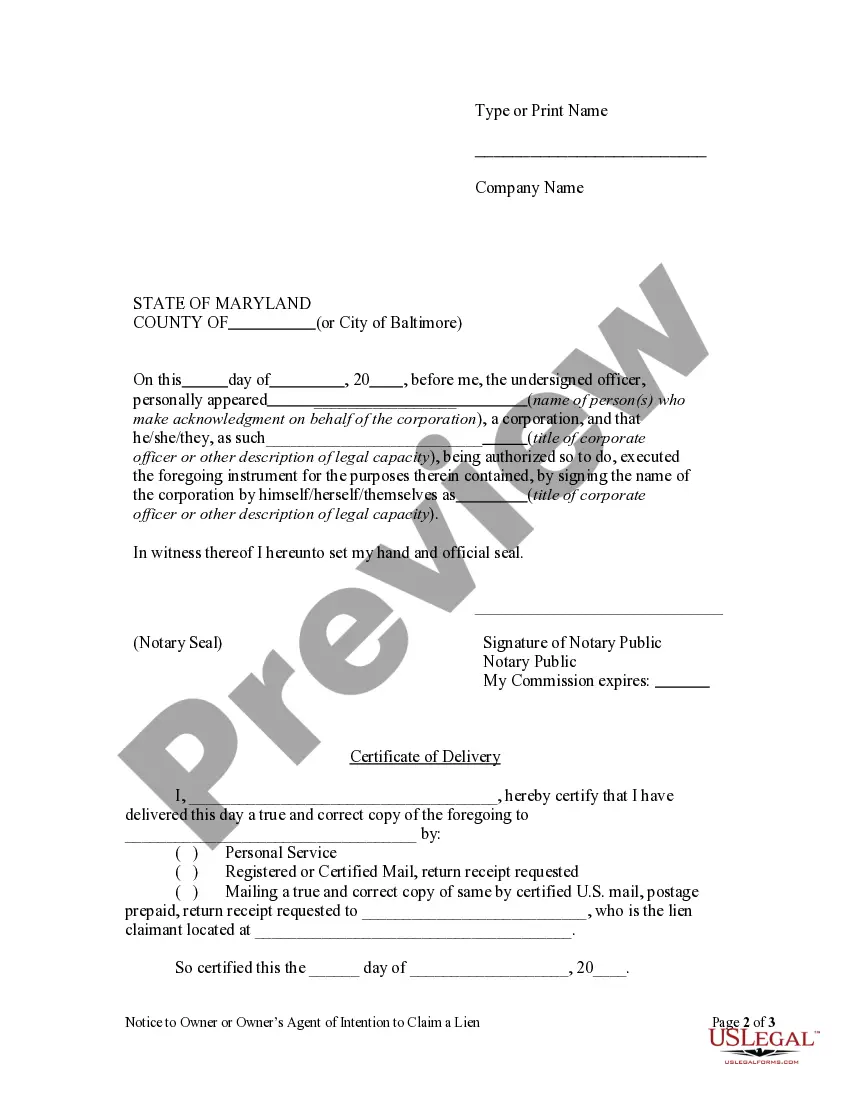

To file a property lien in Maryland, you need to complete a Maryland district court lien form. First, gather the necessary details about the debtor and the property. Then, submit the completed form to the appropriate Maryland District Court, along with any required fees. It is essential to ensure accurate information to avoid delays in processing.

Rule 3 643 in Maryland addresses the dismissal of certain lien claims if they do not meet specific legal criteria. This rule ensures that only valid and properly document claims remain active. Knowing this rule is vital when completing the Maryland district court lien form, as it helps you ensure that your lien is legally solid and retains its effect in court.

A time barred debt in Maryland refers to a debt that cannot be legally enforced due to the expiration of the statute of limitations. The time limit for collecting certain debts varies, and if this period has passed, the creditor cannot pursue legal action. Understanding the implications of time barred debt is crucial when filling out the Maryland district court lien form, as it impacts whether or not a lien is valid.

A lien of judgment in Maryland allows a creditor to claim a debtor's property to secure payment of a judgment. By filing a Maryland district court lien form, creditors can protect their rights in the event of non-payment. This lien remains effective until the judgment is satisfied, making it a powerful tool for creditors seeking financial recovery.

Rule 3 641 in Maryland describes the procedures for appeals related to lien judgments. This rule outlines who may appeal and the timeline for doing so. Familiarizing yourself with this rule is important if you are considering contesting a lien judgment, and it can guide you in properly preparing the Maryland district court lien form.

Rule 3 626 A in Maryland pertains to the stipulations regarding notice of lien judgments. Under this rule, you must notify the relevant parties about the lien filed against them. This aspect is critical when you are filling out the Maryland district court lien form, as providing proper notice ensures compliance with the law and protects your rights.