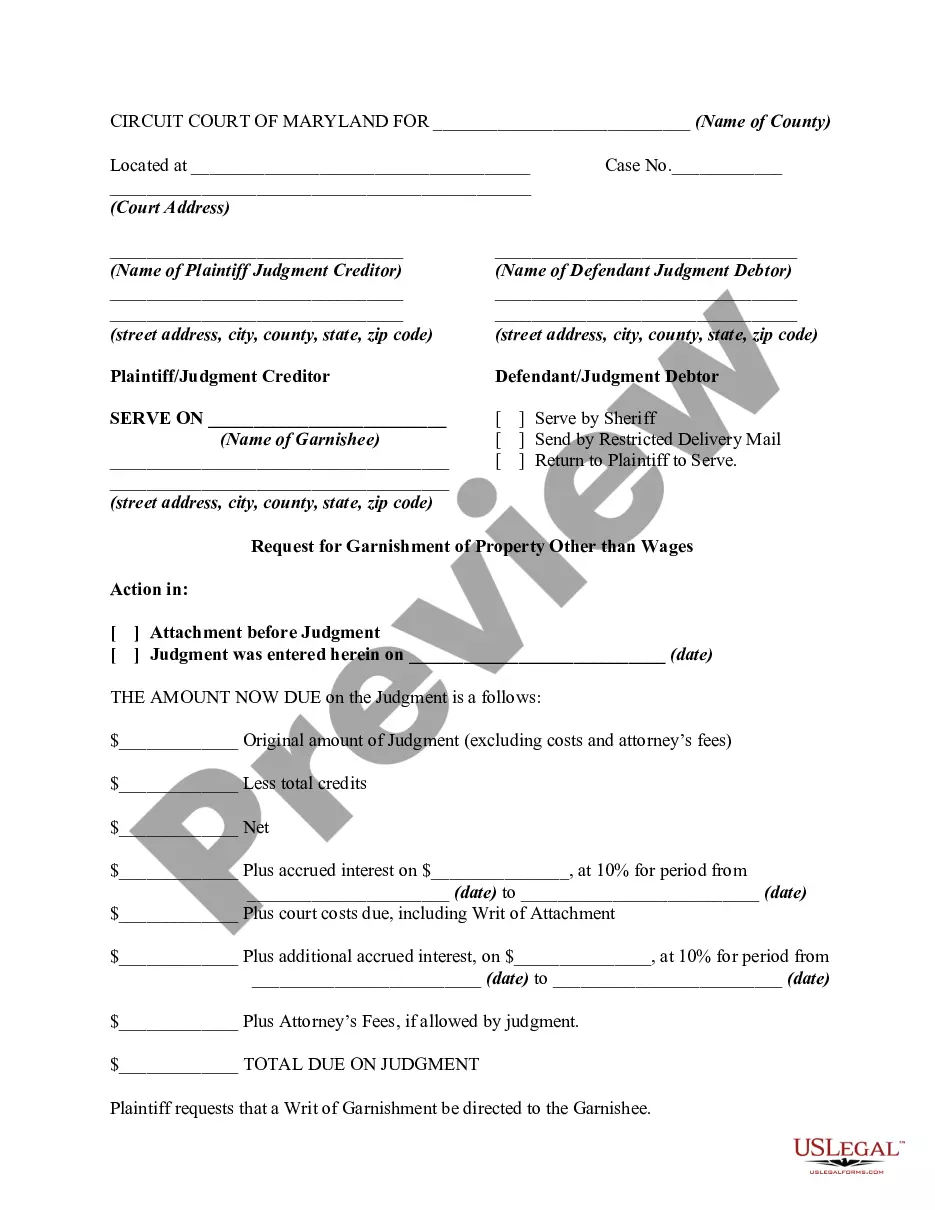

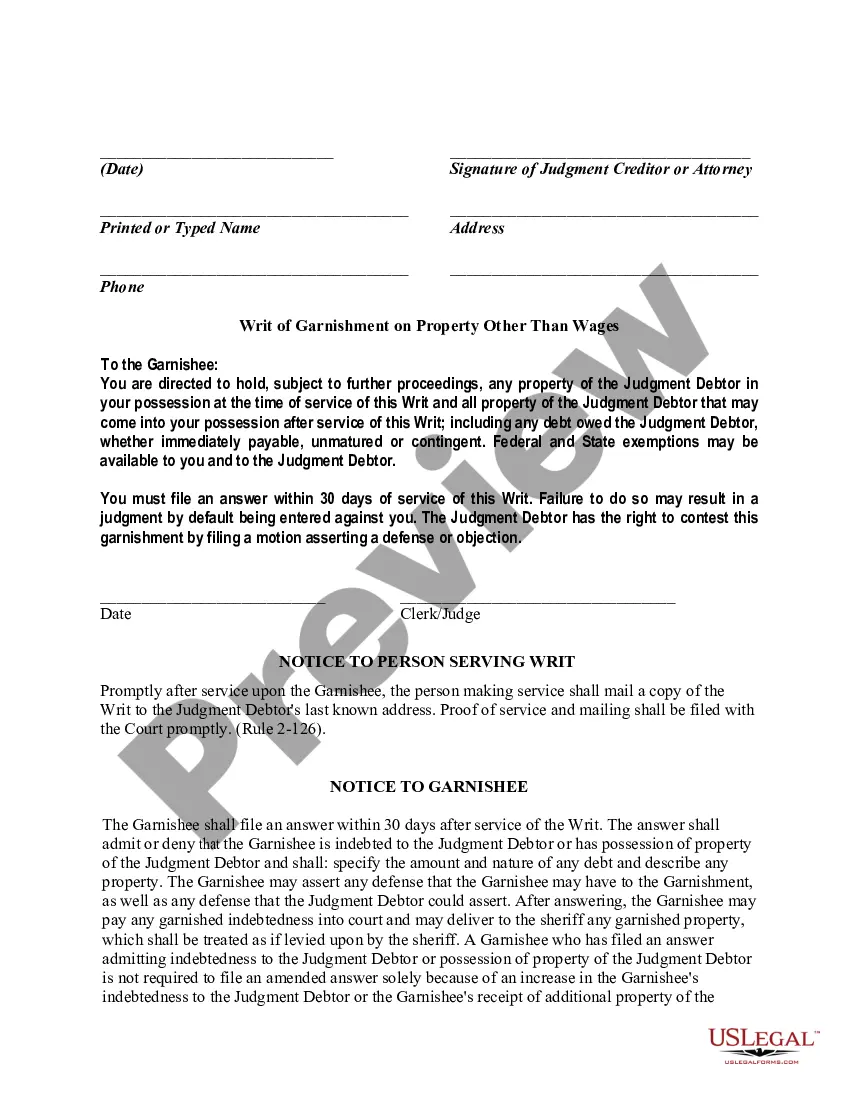

The judgment creditor may obtain issuance of a writ of garnishment by filing in the same action in which the judgment was entered a request that contains (1) the caption of the action, (2) the amount owed under the judgment, (3) the name and last known address of each judgment debtor with respect to whom a writ is requested, and (4) the name and address of the garnishee. Upon the filing of the request, the clerk shall issue a writ of garnishment directed to the garnishee.

Maryland Wage Garnishment Form

Description

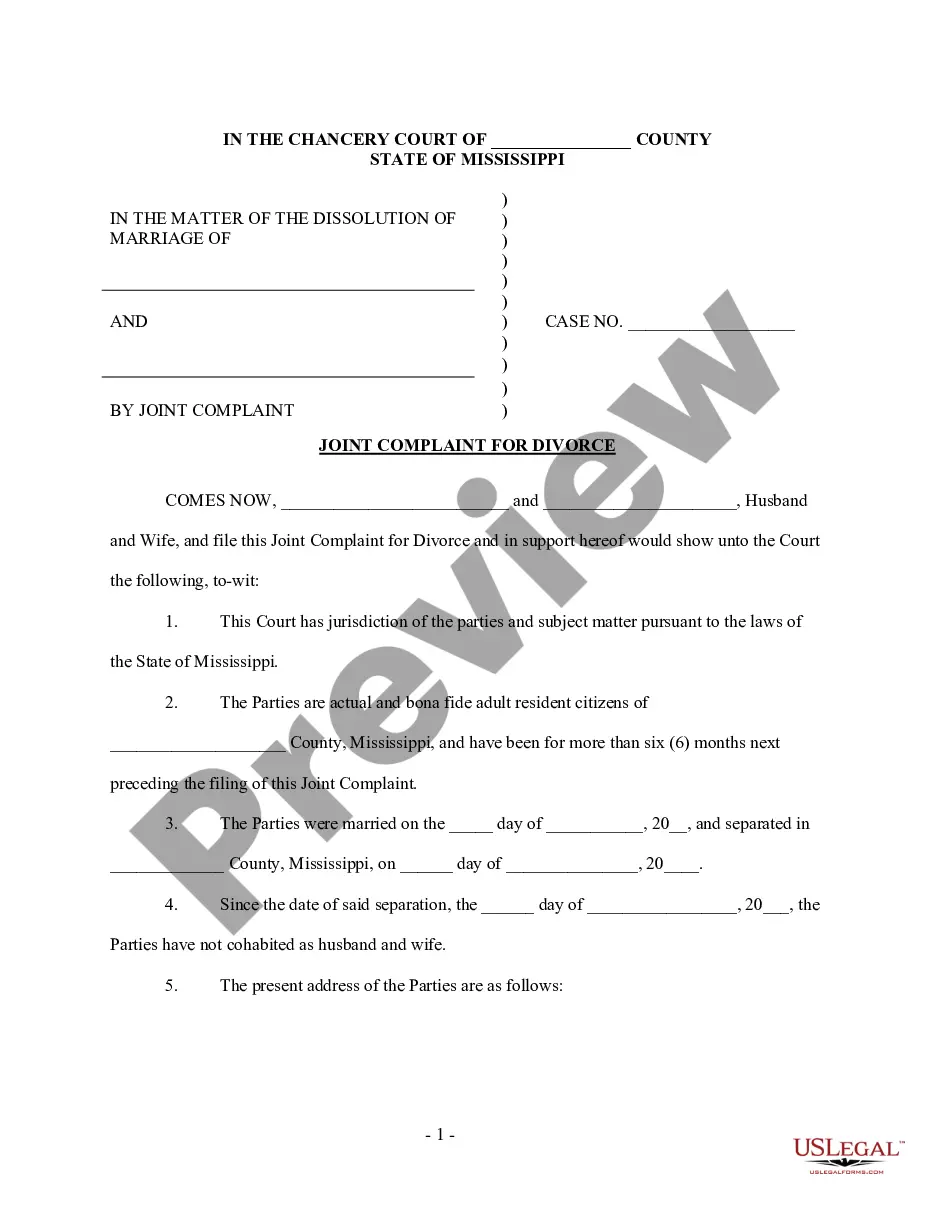

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Bureaucracy demands exactness and correctness.

If you don't handle filling out forms like the Maryland Wage Garnishment Form regularly, it may lead to some errors.

Choosing the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avoid any hassles of re-submitting a file or starting the same task entirely anew.

Obtaining the correct and latest samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and optimize your paperwork process.

- Find the template using the search bar.

- Ensure the Maryland Wage Garnishment Form you found is valid for your state or county.

- Review the preview or consult the description that includes the specifics on the sample's use.

- When the result aligns with your search, click the Buy Now button.

- Select the appropriate option from the available subscription packages.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Save the document in your preferred format.

Form popularity

FAQ

In Maryland, a creditor cannot garnish your wages without notifying you first. You will receive a notice regarding the garnishment, allowing you to address the debt before any wage deductions. Awareness of this process is critical for safeguarding your financial well-being. Utilizing a Maryland wage garnishment form from US Legal Forms can equip you with the necessary information to respond efficiently.

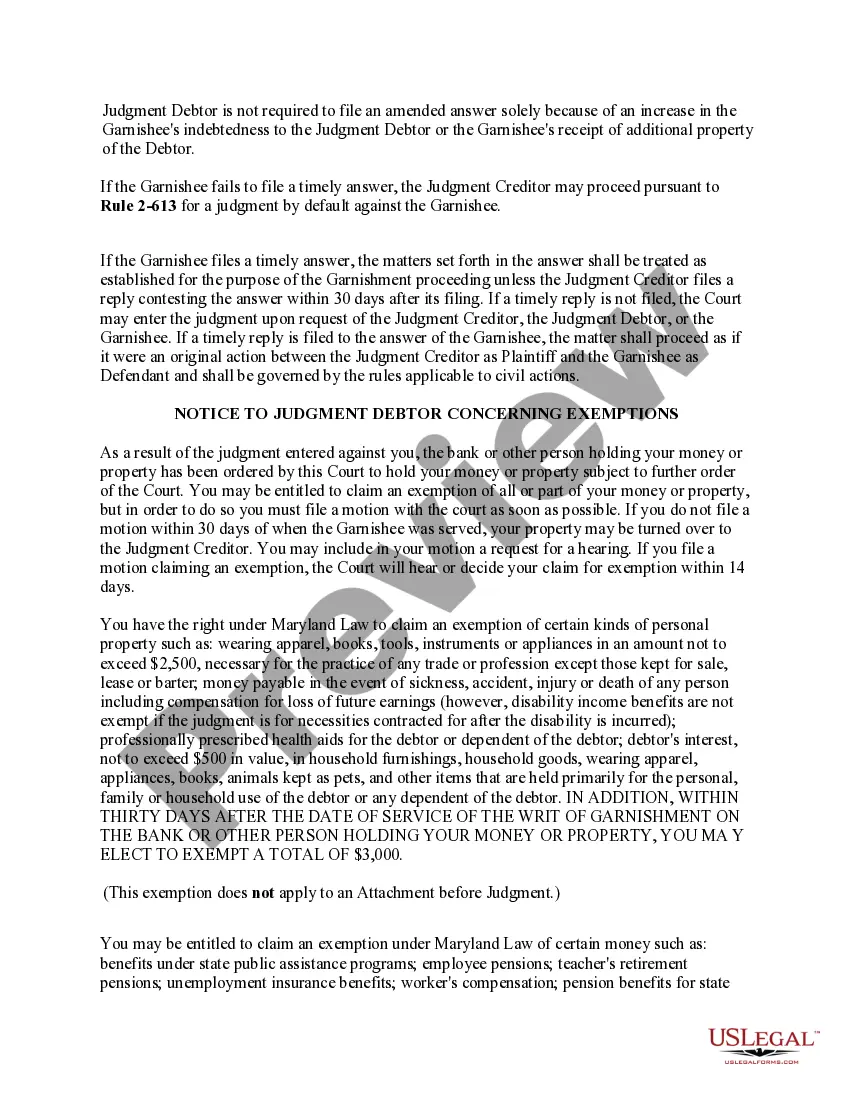

The maximum amount that can be garnished from a paycheck in Maryland is generally 25% of your disposable income. Alternatively, if it’s less than 30 times the federal minimum wage, that amount would be exempt from garnishment. Knowing this cap can help you budget better and avoid financial distress. Using a Maryland wage garnishment form can assist in calculating your specific situation and maintaining clarity.

You will receive written notice before wage garnishment begins, allowing you to respond. Creditors must notify you about the garnishment in advance, providing information about the amount owed and your rights. This notification is crucial, as it gives you an opportunity to resolve the debt before any deductions start. Reviewing a Maryland wage garnishment form can help you understand the details of your situation better.

Writing a hardship letter for wage garnishment involves clearly stating your financial difficulties and seeking relief. Begin by explaining your situation, including reasons why wage garnishment creates a significant burden. You can emphasize your attempt to resolve the debt and highlight any changes in your financial circumstances. Using a Maryland wage garnishment form from US Legal Forms can help streamline this process and ensure your request is well-organized.

To notify an employee of wage garnishment, you should prepare the Maryland wage garnishment form to ensure compliance with state laws. Clearly indicate the amount to be garnished and the reasons for the garnishment in your communication. Providing a copy of the garnishment order is also essential, as it helps the employee understand the situation fully. Using a reliable platform like US Legal Forms can simplify the process, allowing you to generate the necessary documents efficiently.

To garnish wages in Maryland, a creditor must first obtain a judgment against you in court. After the judgment, they can file for wage garnishment, and you will receive a notice about the garnishment process. Completing a Maryland wage garnishment form as part of this procedure can ensure that all requirements are met and that the process is handled legally and efficiently.

The maximum amount that can be garnished from your paycheck varies by state law, but typically it is capped at 25% of your disposable income or the amount by which your income exceeds a specific threshold. In Maryland, this cap is adhered to strictly to protect your financial well-being. Understanding these limits is crucial, and using a Maryland wage garnishment form can help you calculate the precise amount that can be garnished.

Filling out a challenge to garnishment form requires you to provide accurate information about your financial situation and the grounds for your challenge. Start by consulting your court’s guidelines on what specific details to include. Make sure to thoroughly complete the Maryland wage garnishment form, as it can streamline the process and clearly convey your objections to the court.

The formula for garnishment generally includes determining the disposable income—your earnings after mandatory deductions such as taxes. From this amount, a percentage based on federal and state laws is applied, which limits how much can legally be garnished. Understanding this formula is crucial, and completing a Maryland wage garnishment form can help clarify how much of your earnings may be subject to garnishment.

To write an objection letter for wage garnishment, begin by addressing the appropriate court or agency and identifying the case details. Clearly state your reasons for opposing the garnishment, whether due to incorrect debt amounts or financial hardship. It is important to submit a Maryland wage garnishment form alongside your objection letter as evidence of your claims and to properly file your response.