Maryland Garnishment Rules

Description

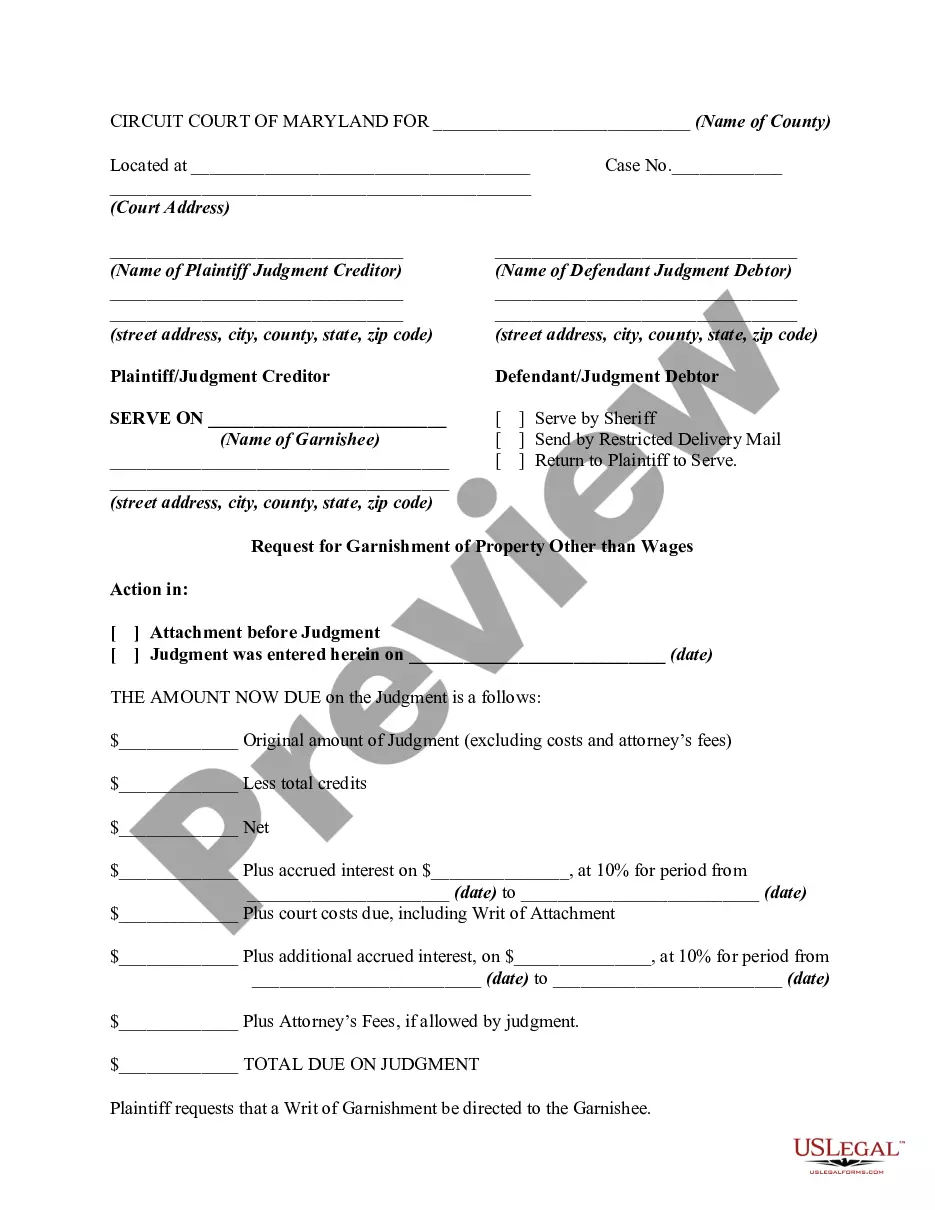

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Getting a go-to place to take the most current and appropriate legal samples is half the struggle of working with bureaucracy. Discovering the right legal documents requirements accuracy and attention to detail, which is the reason it is important to take samples of Maryland Garnishment Rules only from trustworthy sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and view all the details concerning the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to finish your Maryland Garnishment Rules:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s description to check if it fits the requirements of your state and area.

- Open the form preview, if there is one, to make sure the form is the one you are interested in.

- Resume the search and look for the right template if the Maryland Garnishment Rules does not match your requirements.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Pick the document format for downloading Maryland Garnishment Rules.

- Once you have the form on your device, you can change it with the editor or print it and finish it manually.

Eliminate the headache that comes with your legal paperwork. Explore the extensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

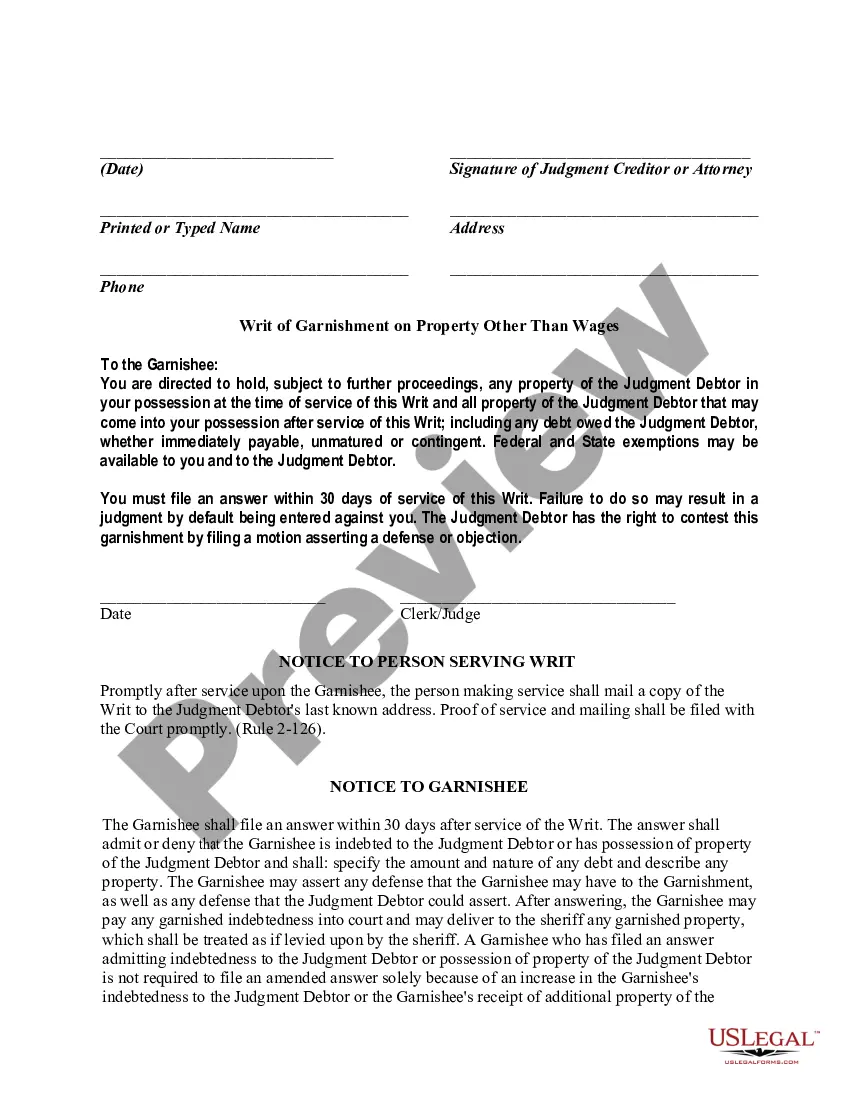

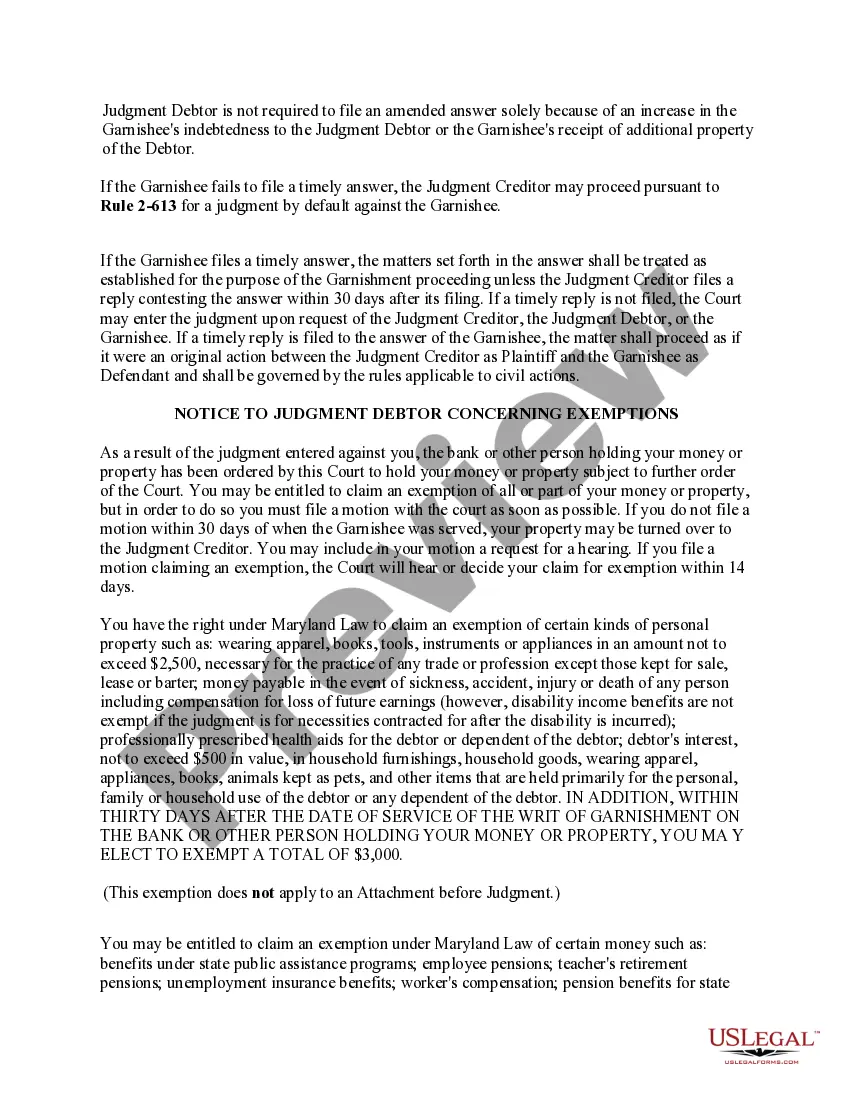

Federal law limits the amount of earnings that may be garnished to 25 percent of the debtor's disposable income. (Disposable earnings are the amount of earnings left after legally required deductions e.g., federal, state taxes, Social Security, unemployment insurance and medical insurance.)

A creditor may not garnish more than 25% of your wages per pay period. For individuals earning minimum wage or near minimum wage, you must be left with an amount equal to 30 times the Maryland minimum hourly wage.

A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

10 days following the judgment, the creditor becomes a judgment creditor and can begin the wage garnishment process. Under Md. Rules 3-646 and 2-646, the judgment creditor must file a Request for Writ of Garnishment in the case, which once issued is served upon the judgment debtor's last known address.

Maryland's wage garnishment laws say that the amount a creditor can take from your weekly earnings is whichever of these two amounts is less: 25% of your weekly disposable earnings; or. (Your weekly disposable earnings) minus (Maryland's minimum hourly wage, multiplied by 30).