Maryland Llc Cost With Ein Number

Description

How to fill out Maryland Limited Liability Company LLC Formation Package?

The Maryland Llc Expense With Ein Number you observe on this page is a reusable official template created by professional attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal experts more than 85,000 approved, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most reliable method to obtain the paperwork you require, as the service assures bank-level data security and anti-malware safeguards.

Print the template to finish it manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with an electronic signature.

- Search for the document you require and examine it.

- Browse through the sample you queried and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the appropriate one. Click Buy Now when you have identified the template you want.

- Choose and Log In.

- Select the pricing option that fits your preferences and create an account. Use PayPal or a credit card for a swift transaction. If you have an existing account, Log In to review your subscription and proceed.

- Obtain the editable template.

- Choose the format you desire for your Maryland Llc Expense With Ein Number (PDF, Word, RTF) and save the document on your device.

- Complete and sign the documents.

Form popularity

FAQ

To open an LLC in Maryland, you will need to choose a unique name for your business and designate a registered agent. After this, you should file Articles of Organization with the state. Moreover, obtaining an EIN number is essential for tax purposes, and understanding the Maryland LLC cost with EIN number can help you budget for this important step.

In Maryland, LLCs are required to file an annual report, along with any applicable state income taxes. Additionally, if your LLC has more than one member, it will need to file federal taxes as a partnership. To properly handle these requirements, familiarize yourself with the Maryland LLC cost with EIN number, which can simplify tax processes and compliance.

The process of forming an LLC in Maryland can typically take a few days to a few weeks. Factors that affect this time frame include the method of filing and the accuracy of your paperwork. If you file online through platforms like USLegalForms, you may expedite the process. Understanding the Maryland LLC cost with EIN number can also help ensure a smoother setup.

Setting up an LLC in Maryland typically takes about 3 to 4 weeks, depending on the processing times and the method of submission. However, if you opt for expedited services, you can significantly reduce this time frame. Keep in mind that obtaining your EIN number is a crucial step in the process that can be done concurrently. Utilizing a service like USLegalForms can help streamline your LLC formation and EIN application, ensuring a smoother experience.

Maryland LLCs are required to file both state and federal taxes. However, LLCs are ?pass-through? tax entities, so the individual LLC members must pay these income taxes, rather than the LLCs themselves. This means LLC owners are required to pay sales, self-employment, and maybe even payroll taxes to the state and IRS.

Maryland LLC's provide the business owner(s) with similar protection to what large corporations enjoy, only for a smaller business. That means that your business can reap tax benefits and liability protections afforded to LLCs.

How to Start an LLC in Maryland Choose a Name for Your LLC. ... Appoint a Registered Agent. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Comply With Other Tax and Regulatory Requirements. ... File Annual Reports.

The Maryland LLC Annual Report costs $300 per year. This fee is paid every year for the life of your LLC, and it applies to all Maryland LLCs. And every Maryland LLC must file a Business Personal Property Tax Return.

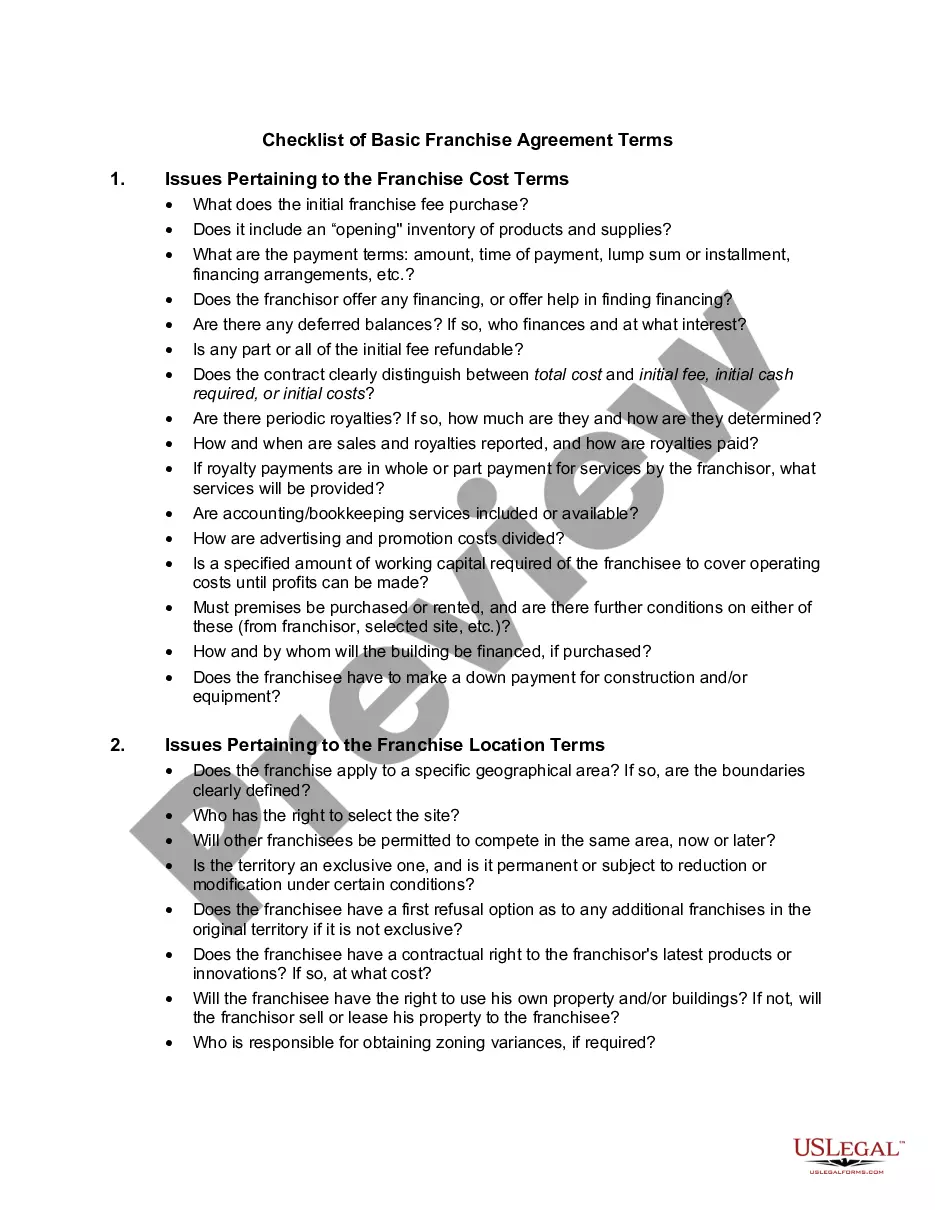

Maryland LLC Cost. The main cost of starting a Maryland LLC is the fee to file the Maryland Articles of Organization, which is $100 by mail or in person or $155 for expedited online filing. Maryland LLCs also need to pay a hefty $300 annual report fee every year.