Maryland Information With Third Parties

Description

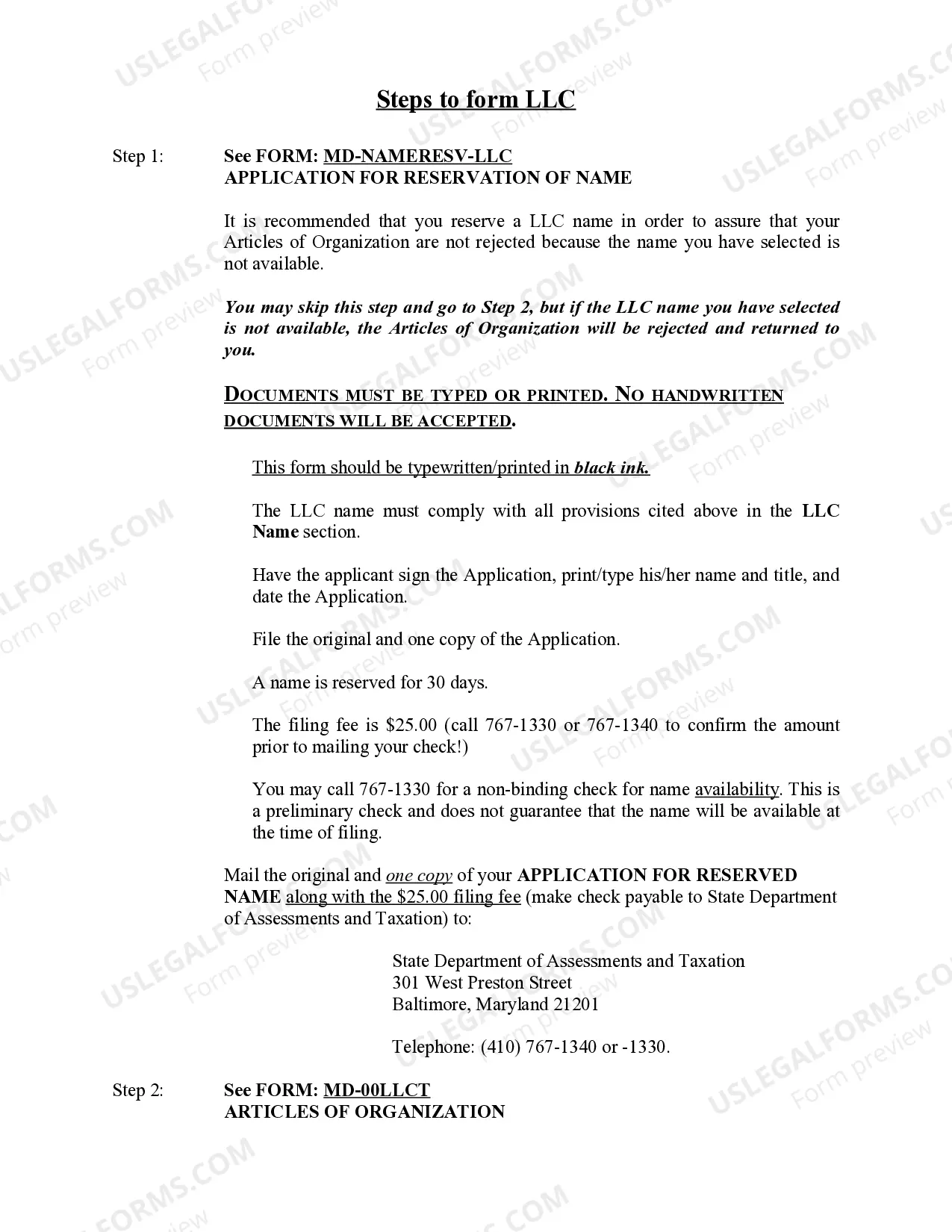

How to fill out Maryland Limited Liability Company LLC Formation Package?

Finding a go-to place to take the most current and relevant legal samples is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs precision and attention to detail, which is why it is very important to take samples of Maryland Information With Third Parties only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and see all the information about the document’s use and relevance for your situation and in your state or region.

Consider the following steps to finish your Maryland Information With Third Parties:

- Make use of the library navigation or search field to locate your template.

- Open the form’s information to see if it suits the requirements of your state and county.

- Open the form preview, if available, to make sure the form is the one you are looking for.

- Return to the search and find the right template if the Maryland Information With Third Parties does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (bank card or PayPal).

- Select the file format for downloading Maryland Information With Third Parties.

- Once you have the form on your device, you can alter it with the editor or print it and finish it manually.

Eliminate the inconvenience that accompanies your legal documentation. Check out the comprehensive US Legal Forms catalog to find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

A Maryland state tax return is only required if you earned money in the state of Maryland in the tax year. For tax year 2019, you would need to file a Maryland State tax return if you earned at least $12,200.

Non-Resident: You can be required to file a Maryland state income tax return even if you do not live in the state or spend a significant amount of time here.

All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.