Maryland I Formation Without Consent

Description

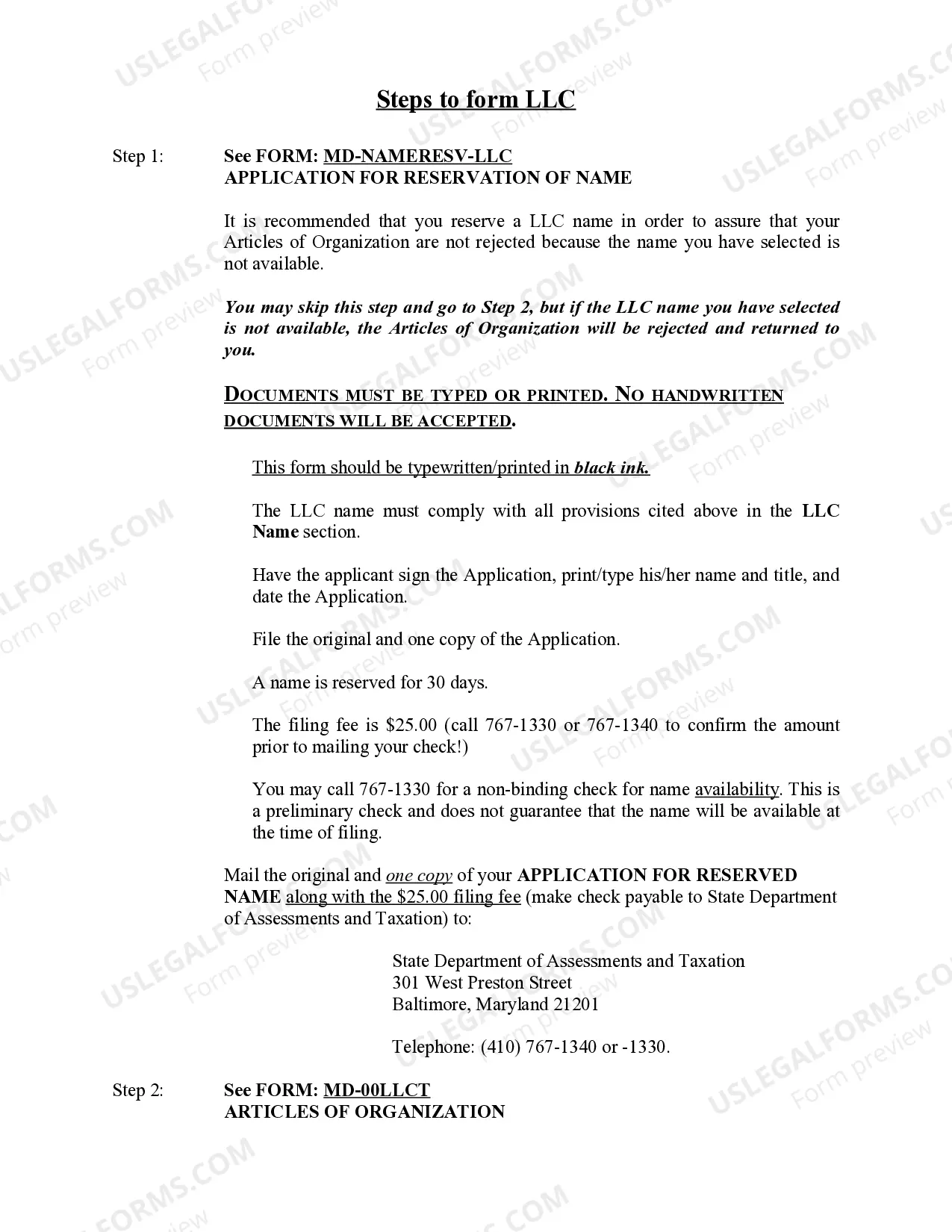

How to fill out Maryland Limited Liability Company LLC Formation Package?

Getting a go-to place to take the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is why it is very important to take samples of Maryland I Formation Without Consent only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the information about the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to complete your Maryland I Formation Without Consent:

- Make use of the library navigation or search field to locate your template.

- Open the form’s information to see if it fits the requirements of your state and region.

- Open the form preview, if available, to ensure the form is definitely the one you are searching for.

- Go back to the search and locate the appropriate template if the Maryland I Formation Without Consent does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Choose the document format for downloading Maryland I Formation Without Consent.

- When you have the form on your device, you can change it with the editor or print it and complete it manually.

Get rid of the headache that comes with your legal paperwork. Discover the comprehensive US Legal Forms catalog where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

Maryland Form 1 is the Annual Report and Business Personal Property Return that is required to be filed by all Maryland business entities. Form 1 can be filed online through . Form 1, along with the filing fee, is due by April 15th.

Sole proprietorships and general partnerships registered to do business in Maryland MUST file an Annual Report (Form 2, no fee). For general assistance with the Annual Report, contact the Maryland State Department of Assessments & Taxations office at 410-767-1330 or sdat.cscc@maryland.gov.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.