Md Corporate Records Withdrawal

Description

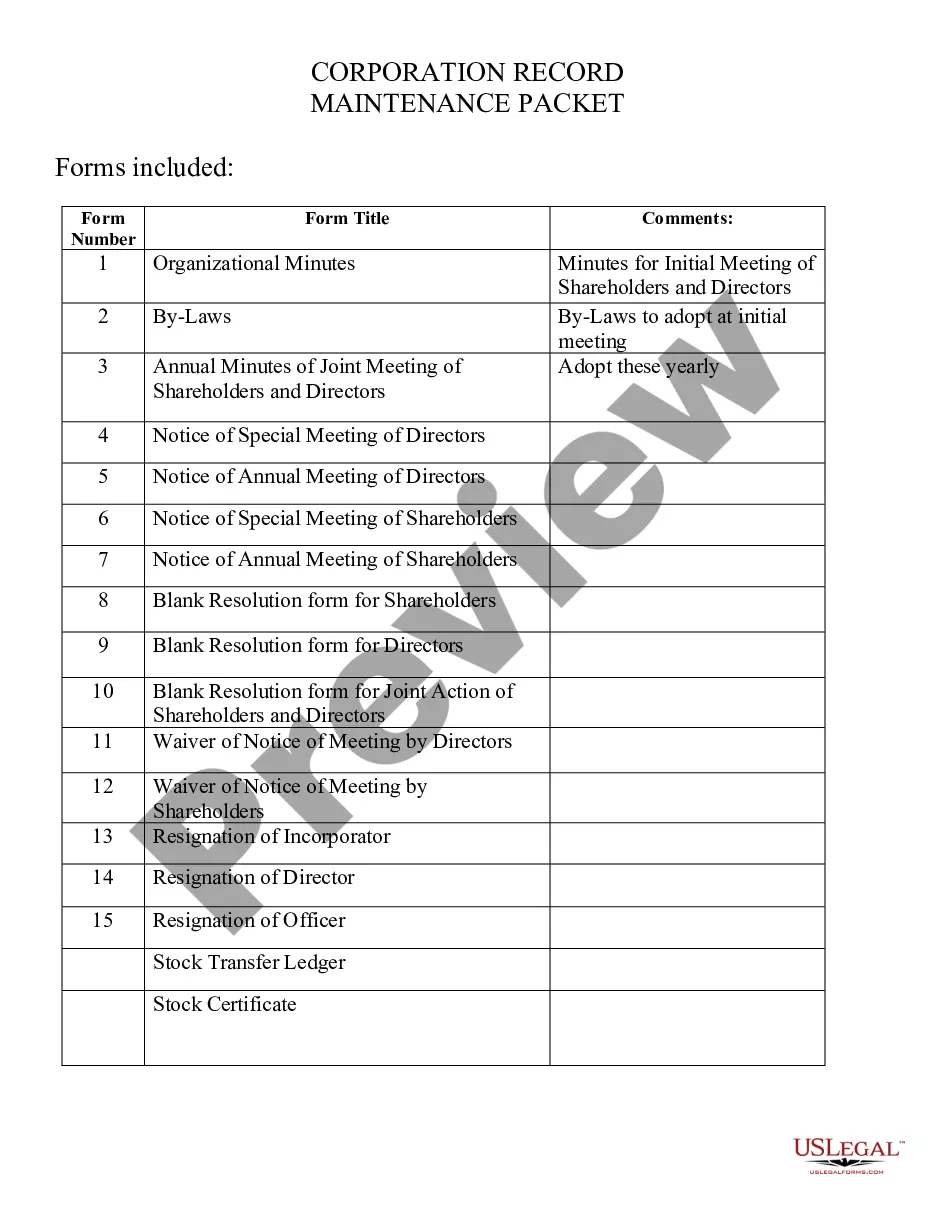

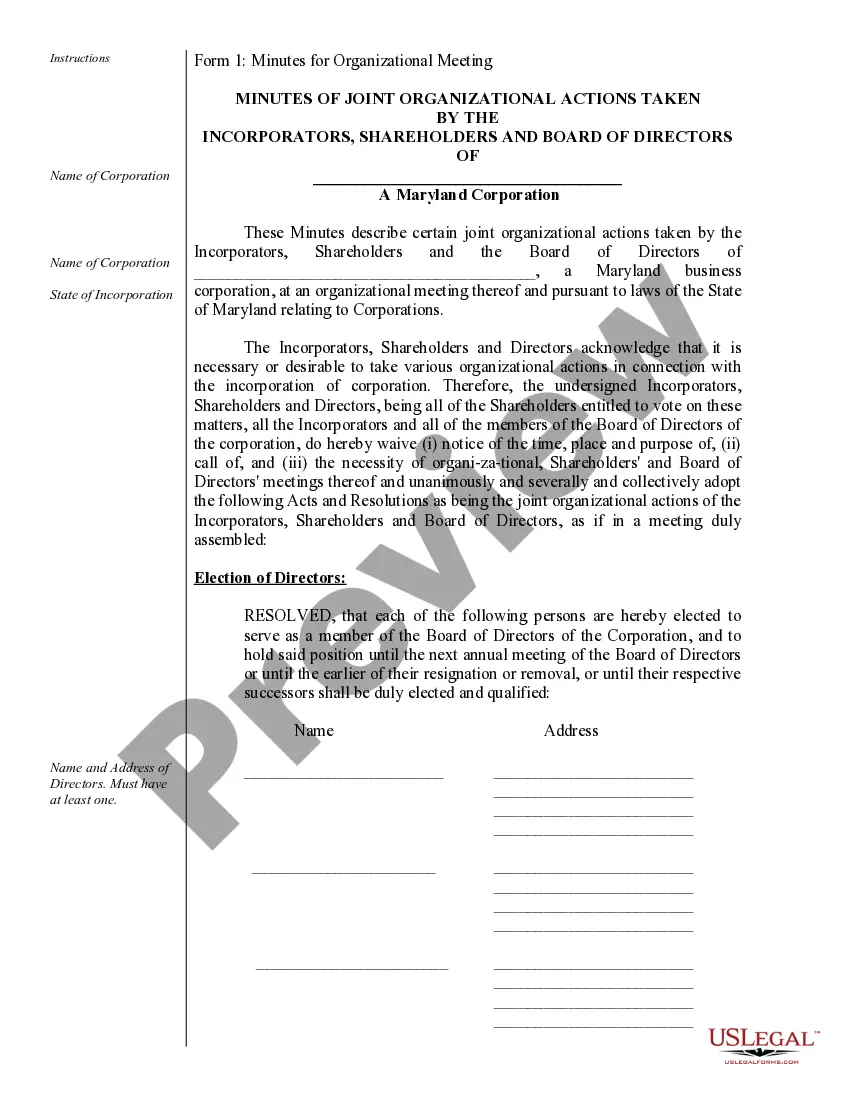

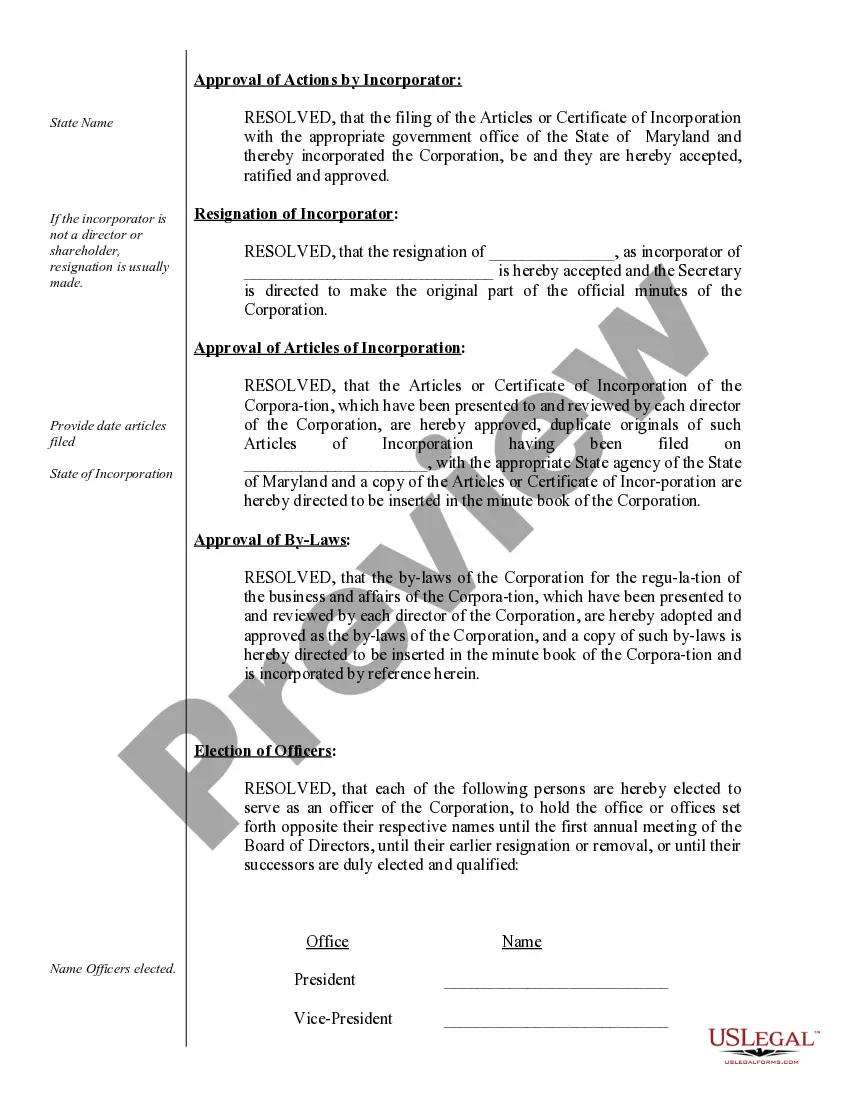

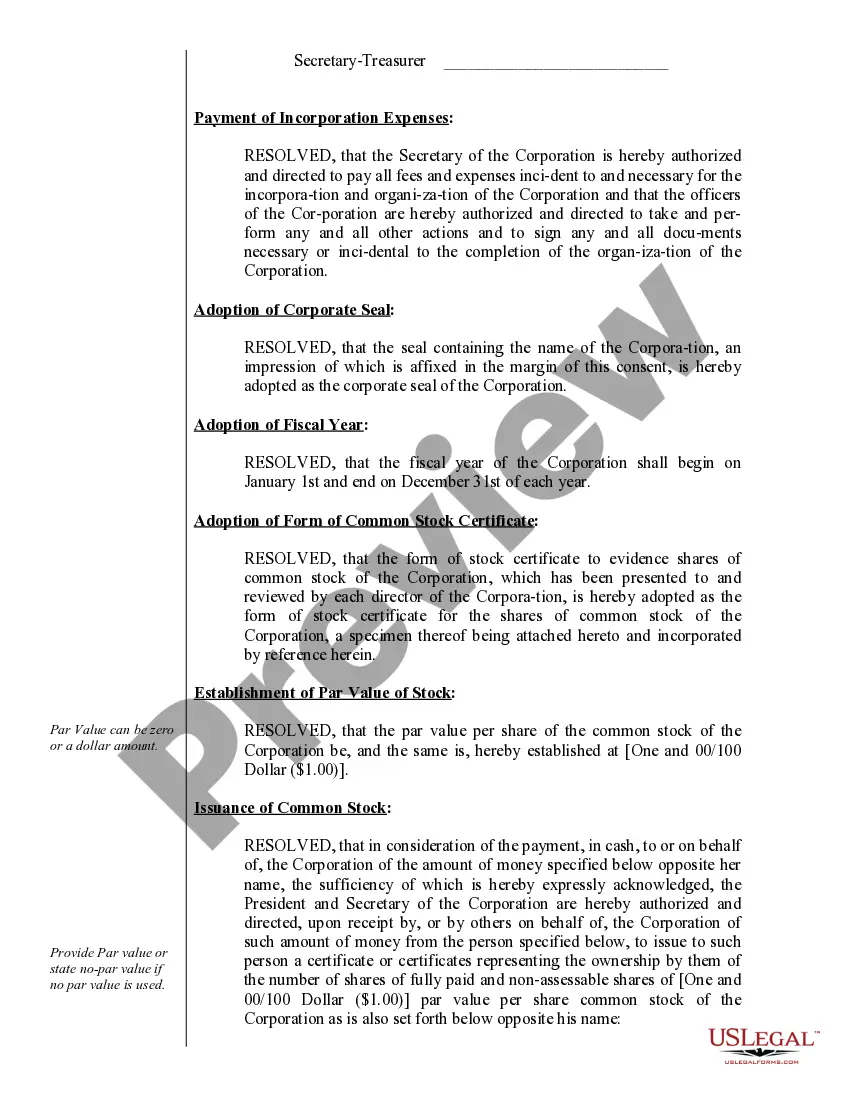

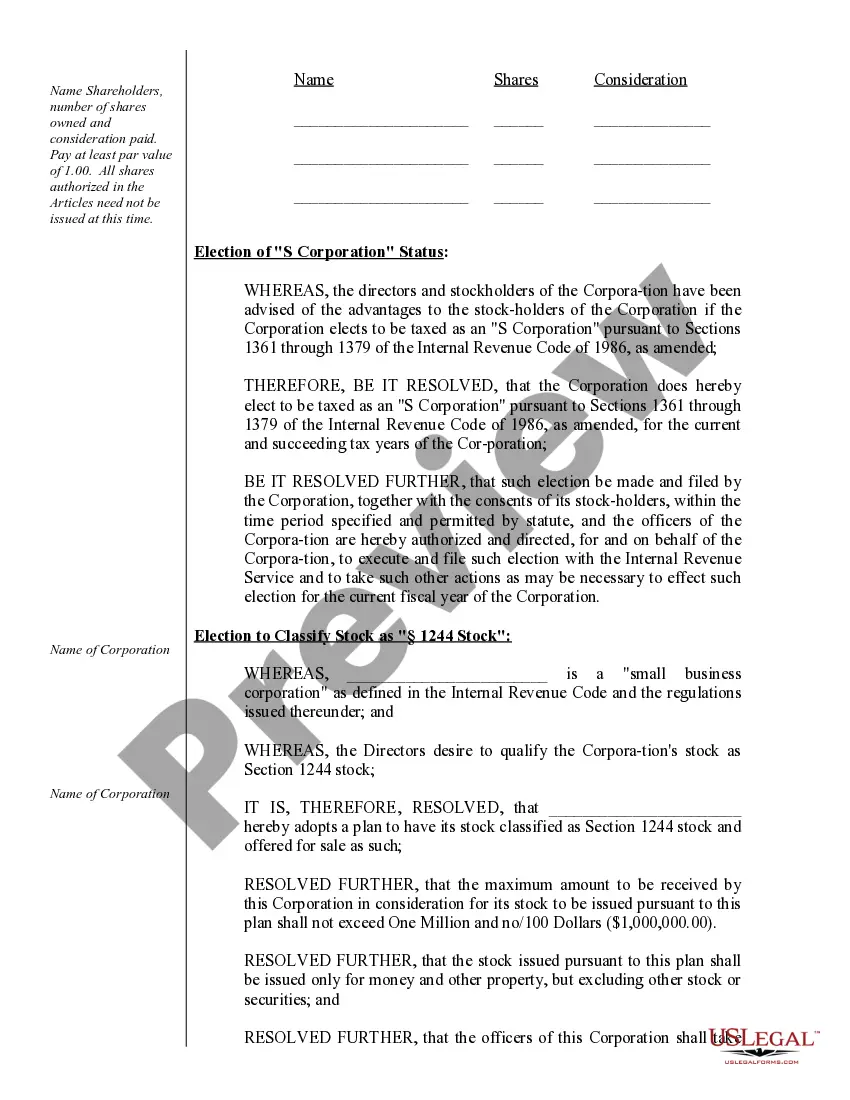

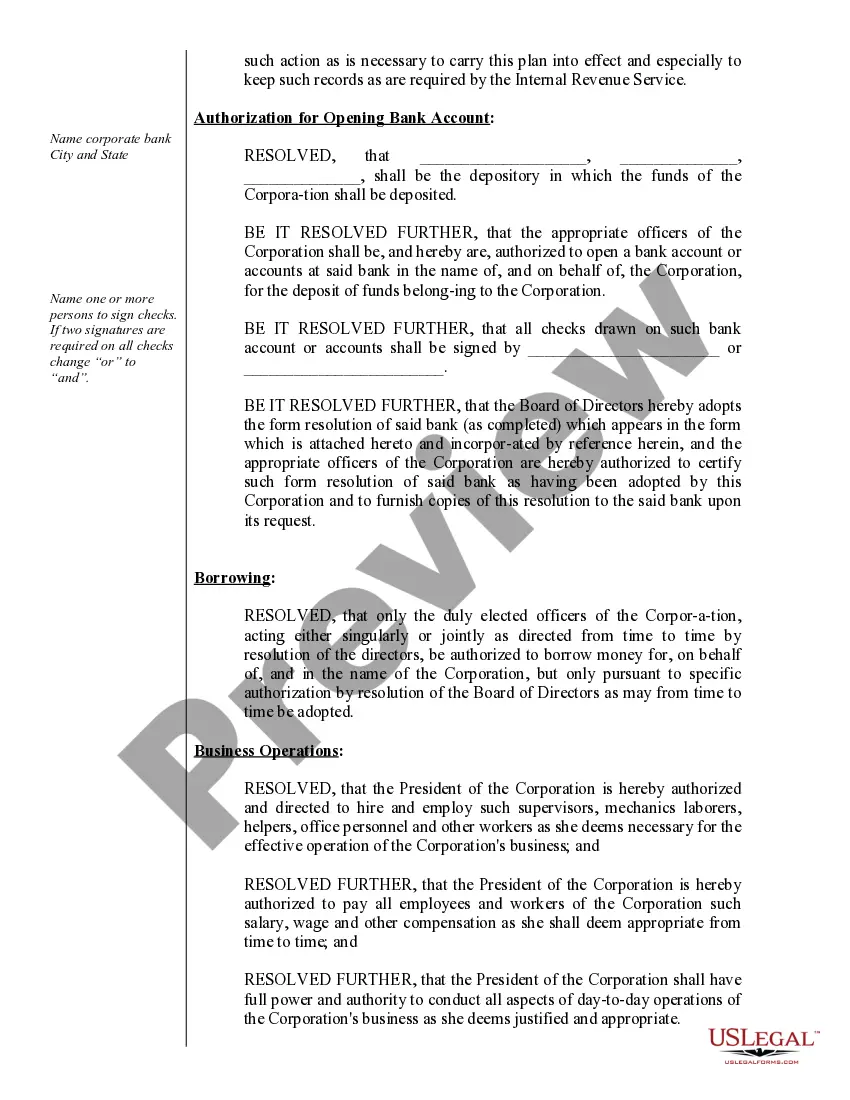

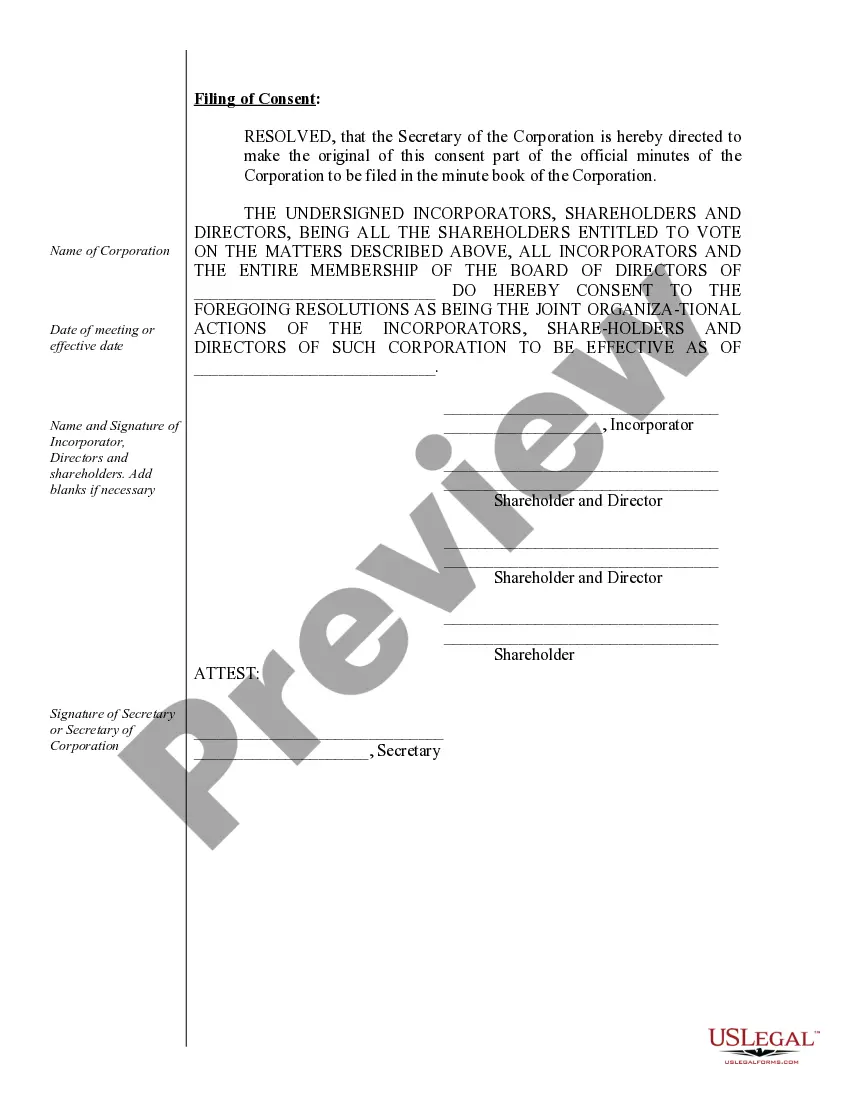

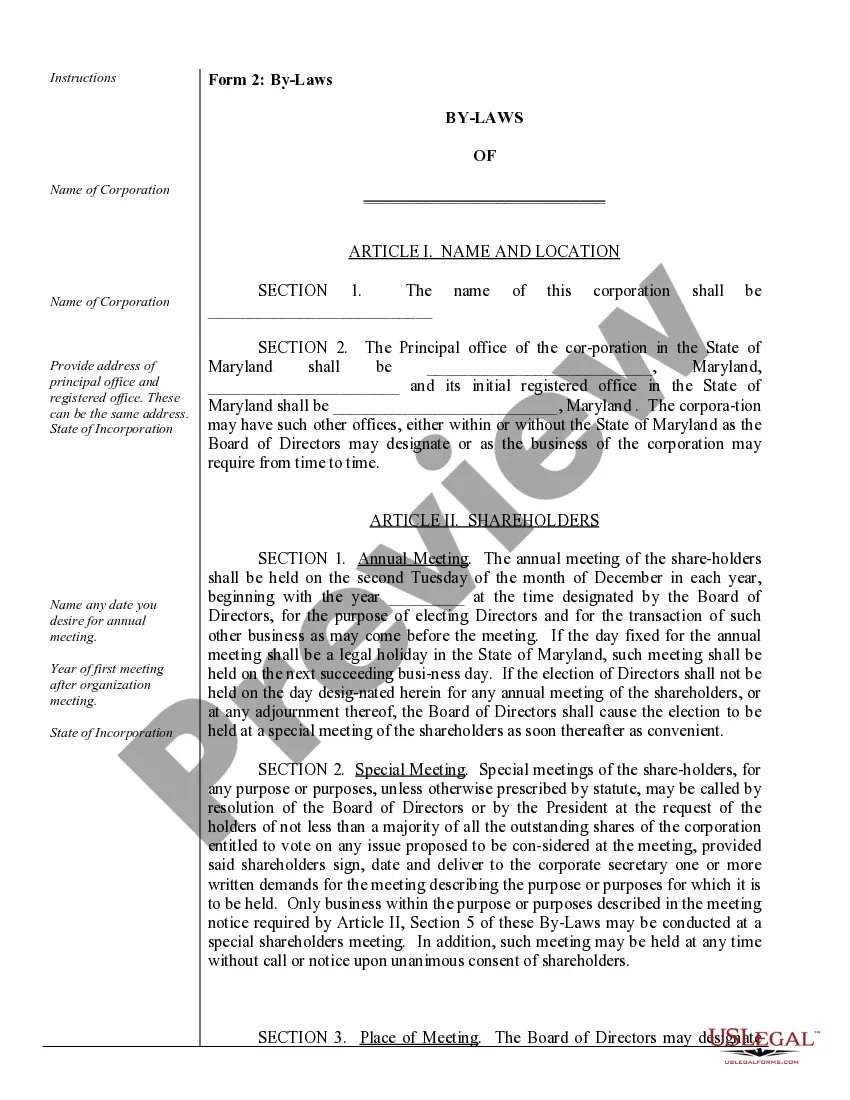

How to fill out Maryland Corporate Records Maintenance Package For Existing Corporations?

The Md Corporate Records Withdrawal displayed on this page is a versatile official template created by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most reliable way to acquire the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you prefer for your Md Corporate Records Withdrawal (PDF, Word, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the appropriate one. Click Buy Now once you have found the template you require.

- Register and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the fillable template.

Form popularity

FAQ

Maryland LLC Cost. The main cost of starting a Maryland LLC is the fee to file the Maryland Articles of Organization, which is $100 by mail or in person or $155 for expedited online filing. Maryland LLCs also need to pay a hefty $300 annual report fee every year.

Send a written request to close the account (must be on letterhead and signed by an officer, member or partner) Return license with the letter. Close-out audit may be requested. License will be closed once audit is complete. We will verify that all returns/reports/liabilities are current before the account will be closed.

Incorporation: $100 filing fee + $20 organization & capitalization fee + $50 development center fee if applying for 501(c)(3),(4), or (6) + optional $5 return mail fee + optional $50 expedite fee.

To dissolve your LLC in Maryland, you file Articles of Cancellation with the Maryland State Department of Assessments and Taxation (SDAT) by mail or in person. If you send documents to the SDAT by mail, you just need to include a check for fees.

To withdraw your foreign corporation or LLC from Maryland, you just have to file a termination or cancellation form with the Maryland State Department of Assessments and Taxation (SDAT). You can file documents with the SDAT by mail or in person.