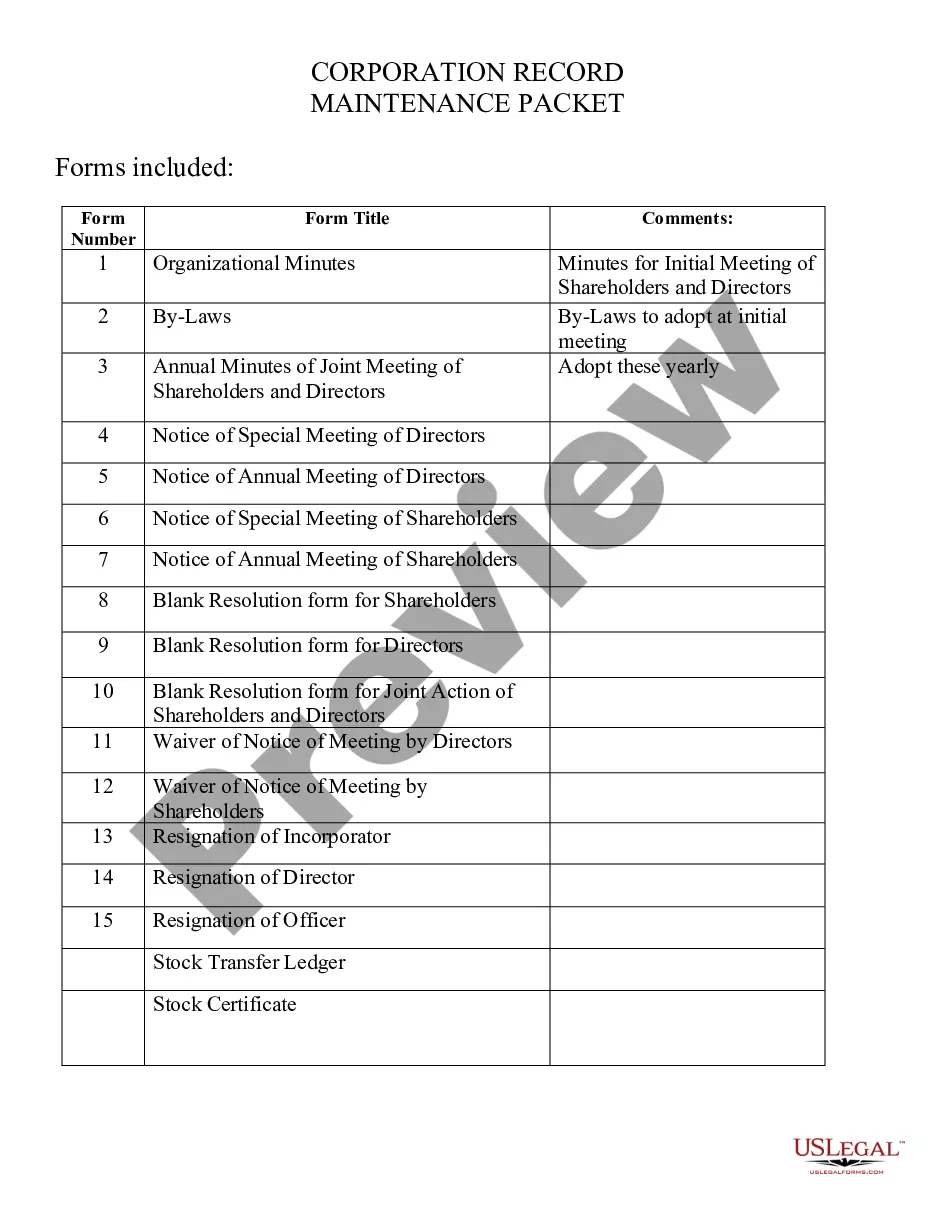

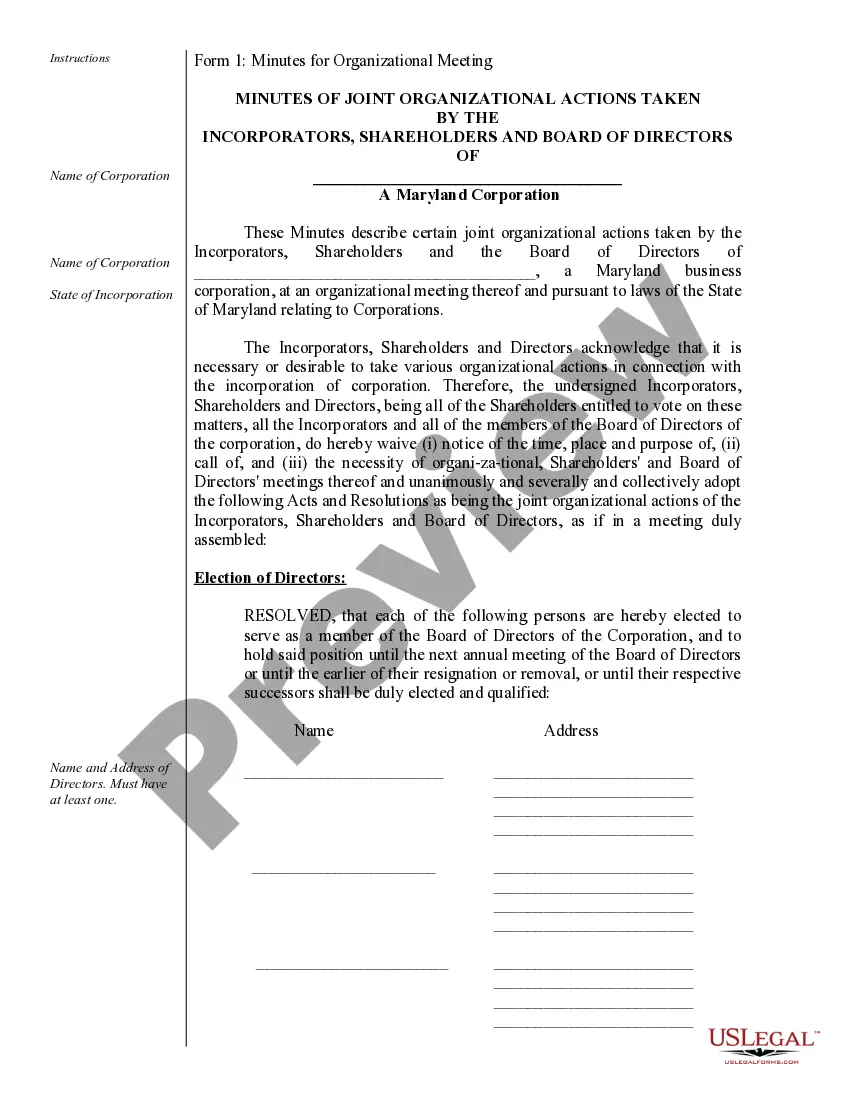

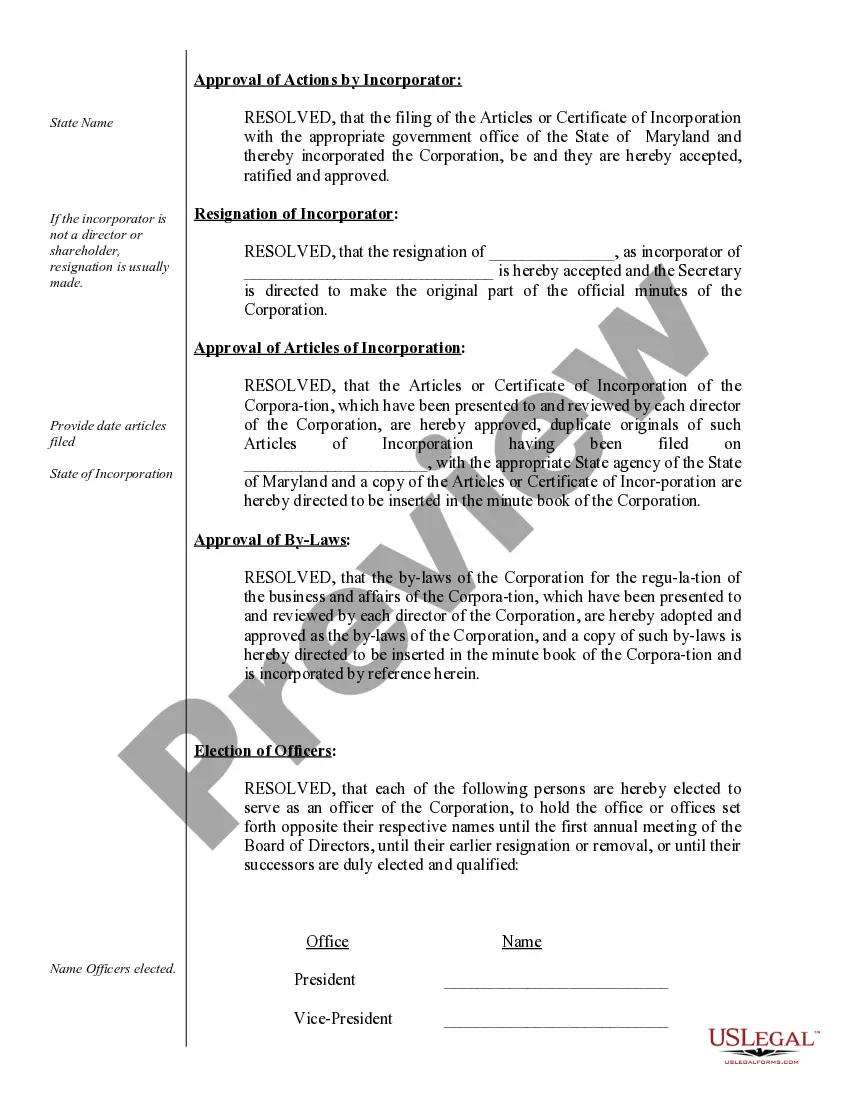

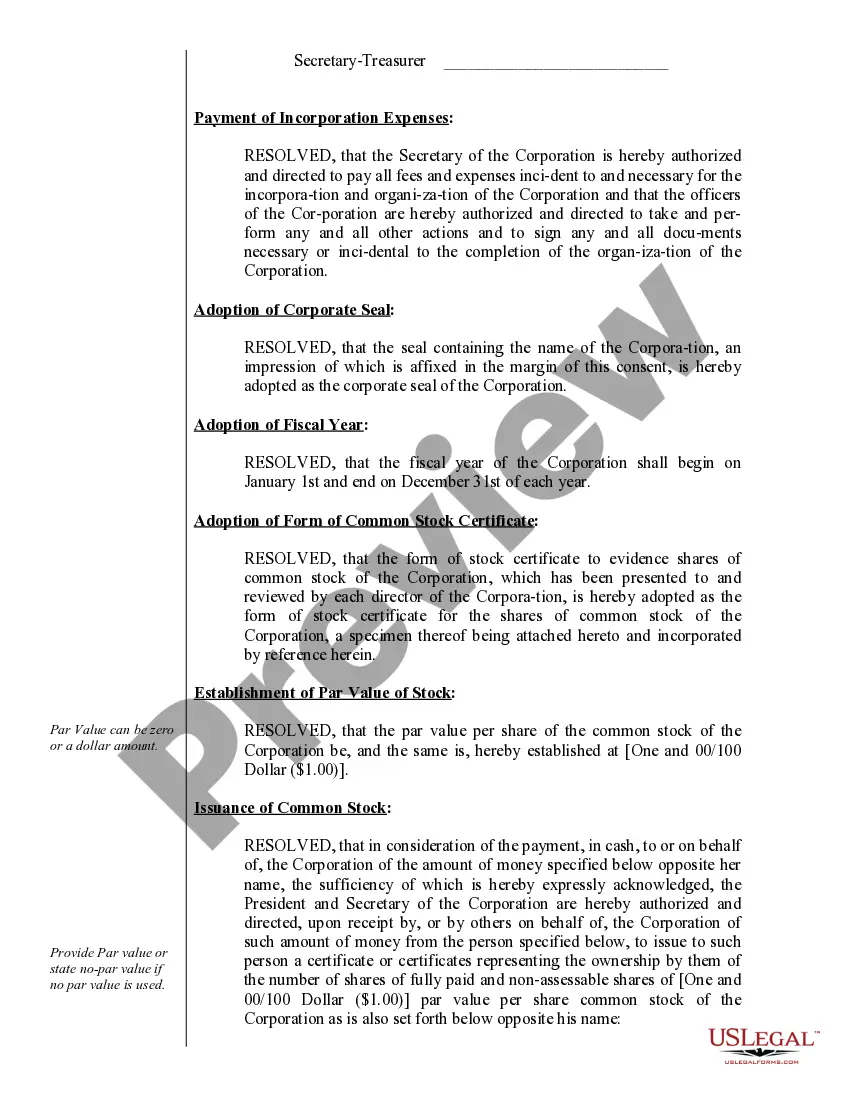

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.

Maryland Corporation Records Withdrawal

Description

How to fill out Maryland Corporation Records Withdrawal?

There's no longer a necessity to squander time searching for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and eased their accessibility.

Our platform offers over 85k templates for any business and personal legal needs organized by state and field of application.

Utilize the Search field above to find another template if the current one doesn't suit your needs. Click Buy Now next to the template name once you identify the correct document. Select the preferred subscription plan and either create an account or sign in. Complete your subscription payment with a credit card or via PayPal to proceed. Select the file format for your Maryland Corporation Records Withdrawal and download it to your device. Print your form to fill it out manually or upload the document if you prefer to use an online editor. Preparing legal documents under federal and state laws and regulations is quick and easy with our library. Try US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and verified for authenticity, ensuring that you can trust in acquiring an up-to-date Maryland Corporation Records Withdrawal.

- If you are acquainted with our service and already possess an account, it is essential to confirm that your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also access all stored documents at any time by visiting the My documents tab in your profile.

- If you have never utilized our service before, the process will require a few more steps to finish.

- Here's how newcomers can find the Maryland Corporation Records Withdrawal in our catalog.

- Carefully examine the page content to ensure it includes the sample you need.

- To achieve this, take advantage of the form description and preview options if available.

Form popularity

FAQ

To dissolve a Maryland corporation, you must file Articles of Dissolution with the Maryland State Department of Assessments and Taxation. Ensure that your corporation has settled any outstanding debts and filed necessary tax returns prior to submission. This process serves as a formal step in ensuring a clean Maryland corporation records withdrawal.

To close a Maryland withholding account, submit a closure form to the Comptroller’s Office. Make sure to indicate all final tax liabilities have been settled and any outstanding payroll reports submitted. This closure is a vital step in the Maryland corporation records withdrawal process.

To close your unemployment account in Maryland, you will need to contact the Maryland Department of Labor. They will guide you through the necessary steps, which may involve submitting documentation proving that your business no longer exists or requires unemployment insurance. This is a critical step in your Maryland corporation records withdrawal.

Closing your Maryland withholding account involves completing a specific form to indicate your desire to close the account. Submit this form to the Maryland Comptroller’s Office, ensuring all final payments and taxes are settled. Keeping clear Maryland corporation records withdrawal during this process is essential to avoid any future issues.

To remove tax withholding for your Maryland corporation, you must submit a request to the Comptroller's Office. This can often be done through a specific form or by updating your payroll system with the correct information. Consider reviewing your records carefully during this Maryland corporation records withdrawal process.

You can file Maryland form 510 online through the Maryland Comptroller's Office website. Alternatively, you may choose to submit it by mail to the appropriate state address for income tax returns. Ensure you follow the instructions to support any Maryland corporation records withdrawal.

Yes, if your corporation is doing business in Maryland, you are required to file a Maryland corporate tax return. This requirement remains even if the corporation does not earn income. Failure to file can lead to penalties, so it is crucial to manage your Maryland corporation records withdrawal properly.

To change your tax withholding in Maryland, you need to file a new W-4 form with your employer. Specify the number of allowances you wish to claim, as this will adjust the withholdings accordingly. If you require assistance with Maryland corporation records withdrawal during this process, consider using the resources available on the uslegalforms platform, which can guide you through the appropriate forms and detailed requirements.

The Maryland withholding final return form, known as Form MW508, is used to report all Maryland income withheld for the final tax year. Completing this form accurately is crucial, particularly when tied to a Maryland corporation records withdrawal. Always ensure you file this form by the deadline to avoid penalties and stay compliant with Maryland tax regulations.

To cancel your Maryland sales and use tax license, you must complete and submit the appropriate form to the Maryland Comptroller’s Office. Make sure to indicate that this request is linked to a Maryland corporation records withdrawal. After processing, they will confirm the cancellation and provide any further instructions if needed.