Massachusetts Real Estate For Sale

Description

How to fill out Massachusetts Property Management Package?

Locating a primary source for obtaining the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is vital to obtain Massachusetts Real Estate For Sale samples solely from trustworthy origins, such as US Legal Forms. An incorrect template will squander your time and hinder your progress.

Eliminate the hassle associated with your legal paperwork. Explore the extensive US Legal Forms library to locate legal templates, evaluate their suitability for your circumstances, and download them instantly.

- Employ the catalog search or query box to identify your template.

- Review the form’s description to verify if it aligns with the needs of your state and locality.

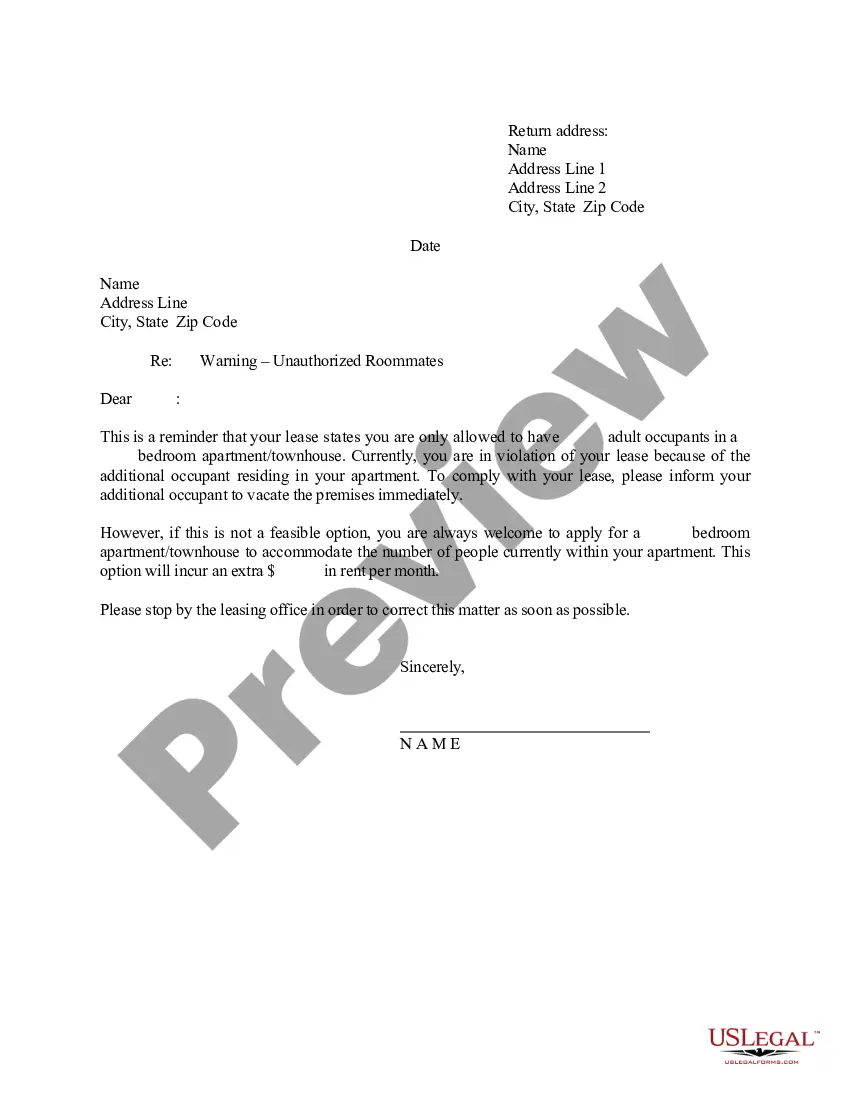

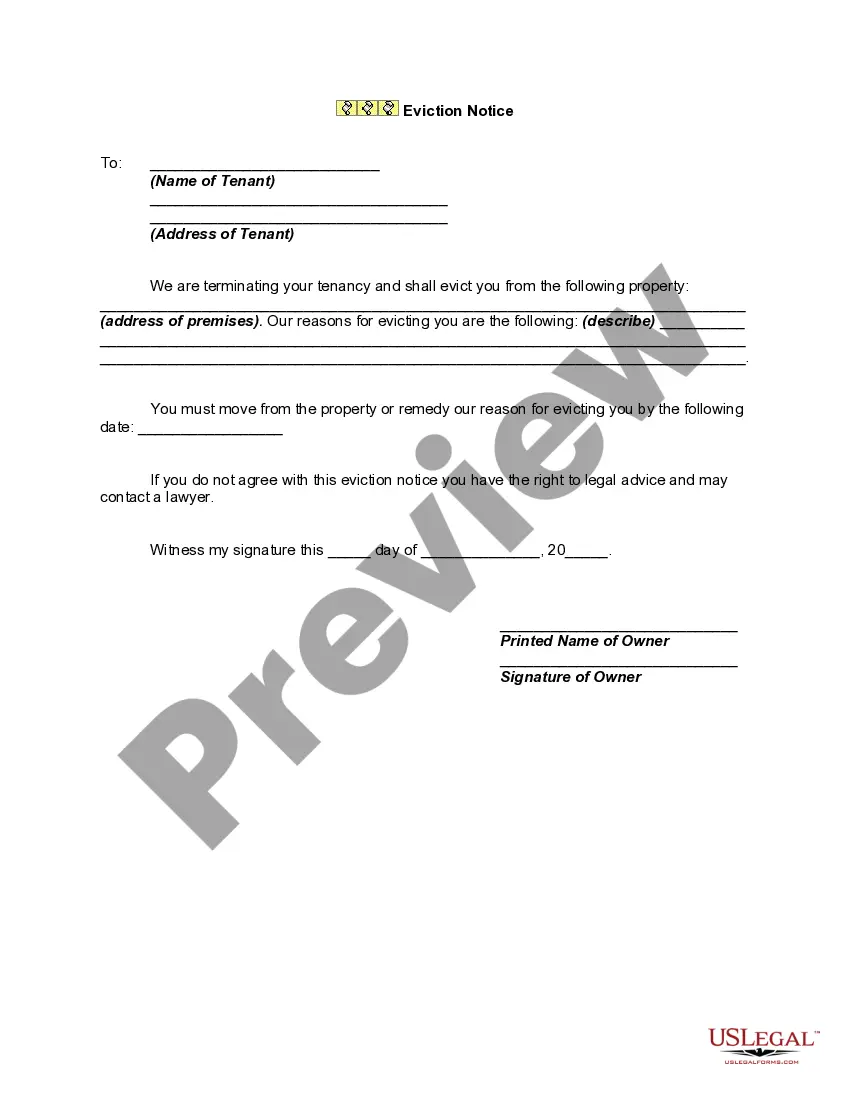

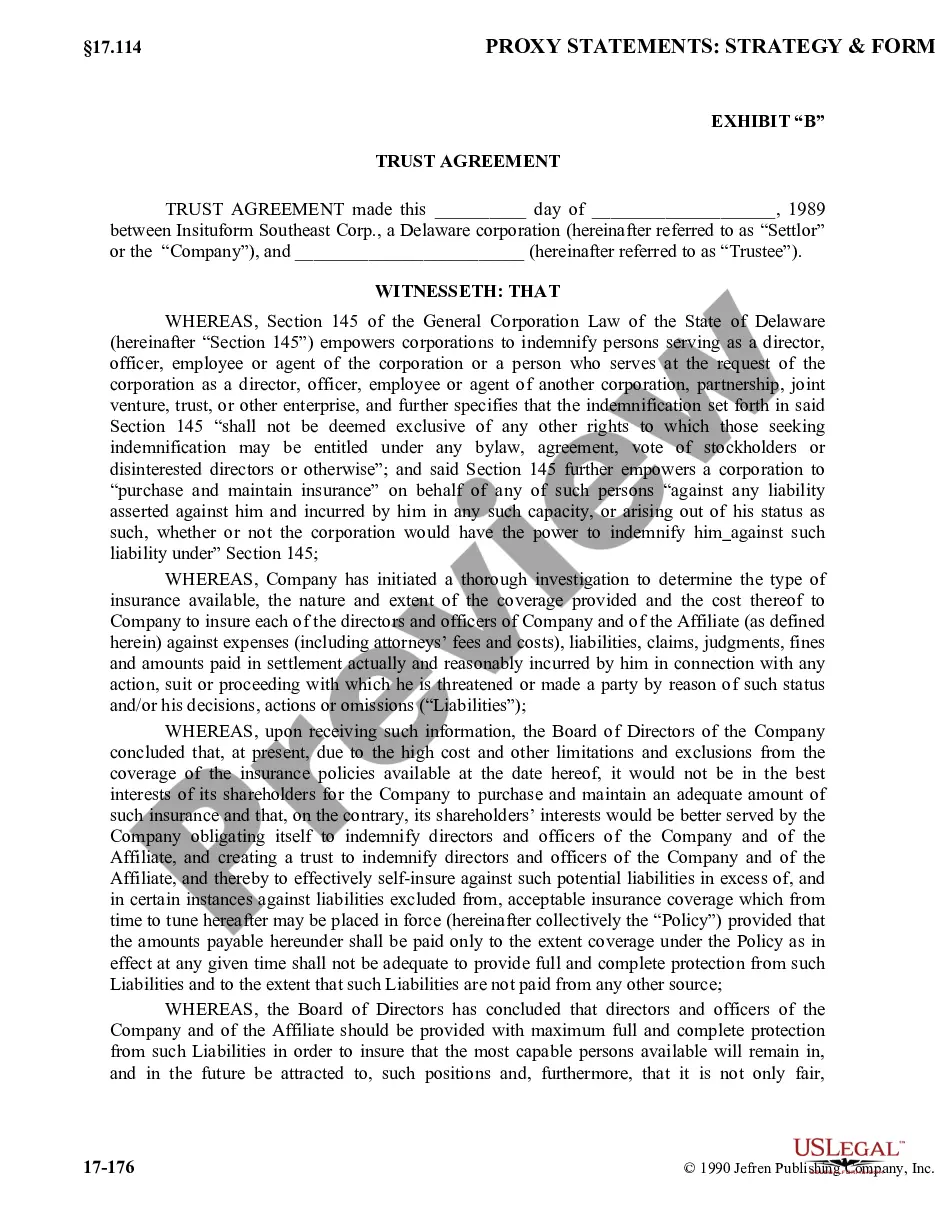

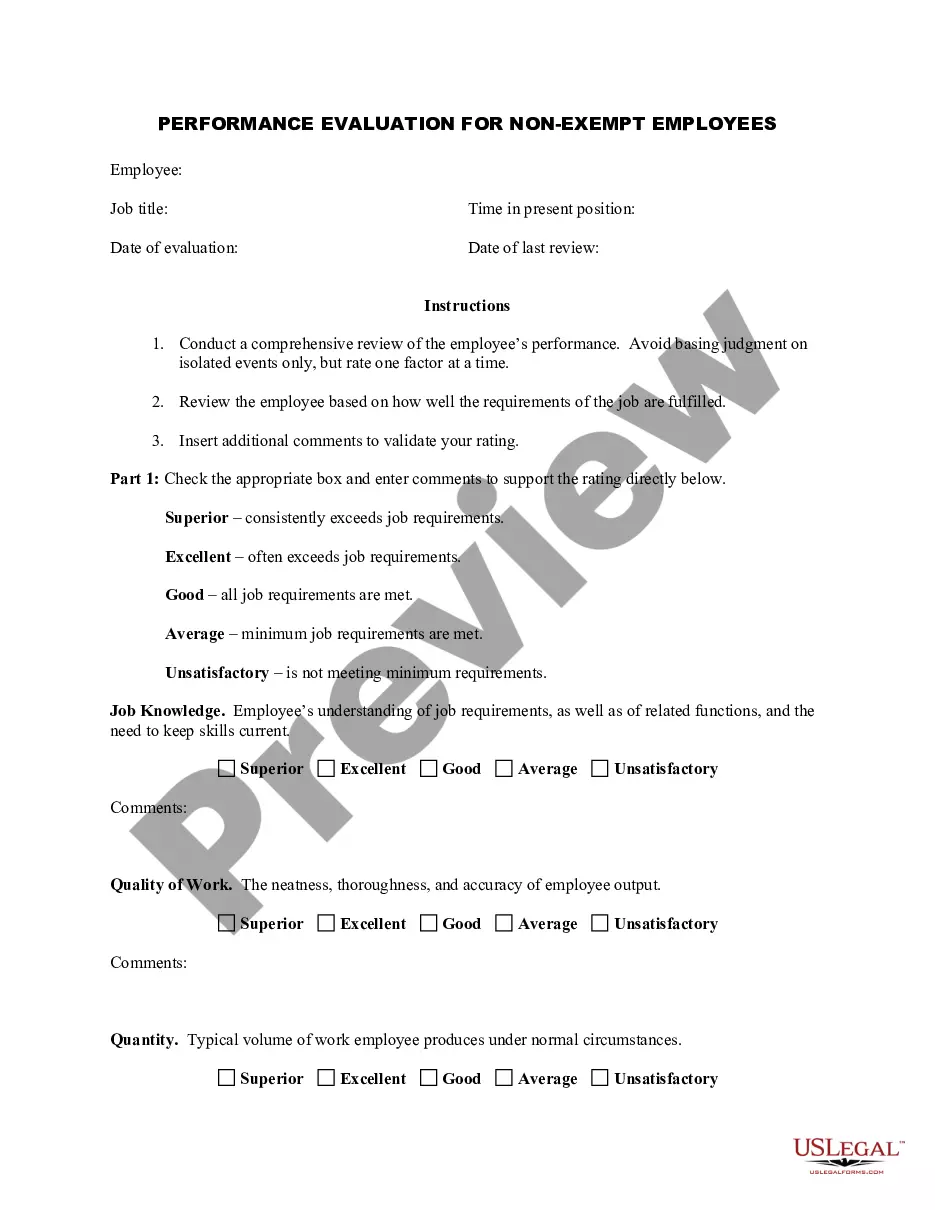

- Preview the form, if available, to confirm that it is indeed the document you seek.

- Continue searching and find the suitable document if the Massachusetts Real Estate For Sale does not meet your requirements.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you lack an account, click Buy now to acquire the form.

- Choose the pricing plan that fits your needs.

- Proceed with the registration to complete your acquisition.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Pick the file format for downloading Massachusetts Real Estate For Sale.

- After obtaining the form on your device, you can modify it with the editor or print it to fill it out by hand.

Form popularity

FAQ

Yes, you can write your own bill of sale in Massachusetts. However, it’s essential to include specific details about the transaction, such as the names of the buyer and seller, a description of the property, and the sale amount. Creating a clear and comprehensive bill of sale helps protect both parties in the transaction. You can find templates and guidance on uslegalforms to assist you in crafting an effective document.

To avoid capital gains tax on a home sale in Massachusetts, you can take advantage of the primary residence exclusion. If you have lived in the home for two of the last five years, you may exclude up to $250,000 of gain for single filers or $500,000 for married couples filing jointly. Additionally, consider reinvesting your profits into Massachusetts real estate for sale to potentially defer tax obligations. Consulting with a tax professional can provide more personalized strategies.

Buying foreclosed homes in Massachusetts can be a great investment opportunity. Start by researching listings through online platforms and attending local auctions. It’s essential to conduct a thorough inspection to understand any repairs needed. To streamline the paperwork, consider using US Legal Forms, specifically designed to help buyers navigate the complexities of Massachusetts real estate for sale.

Obtaining a real estate license in Massachusetts requires dedication and effort. You must complete a 40-hour pre-licensing course, pass a state exam, and fulfill the application requirements. While the process may seem challenging, many find it straightforward with the right resources. With a valid license, you can assist others in navigating the competitive Massachusetts real estate for sale market.

The capital gains exemption in Massachusetts allows certain homeowners to exclude a portion of their profits when selling their primary residence. This exclusion can be substantial, especially if you have owned and lived in the property for a specified time frame. Understanding these exemptions can significantly impact your real estate decisions, particularly when looking at Massachusetts real estate for sale.

To file Massachusetts sales tax, you must first register for a sales tax permit through the Department of Revenue. After obtaining the permit, you can file online or by mail, depending on your preference. If you're involved in buying or selling Massachusetts real estate for sale, ensure you understand the tax obligations related to your transactions.

Avoiding capital gains tax in Massachusetts real estate can involve several strategies. You might consider using the primary residence exclusion if you have lived in your home for a certain duration. By reinvesting in another property, you can defer taxes effectively, particularly if you are exploring Massachusetts real estate for sale that fits your needs.

Capital gains tax on real estate in Massachusetts varies based on income and the sale amount. Generally, the tax rate can be around 5% for long-term capital gains. Understanding how these rates apply to your property can benefit you when exploring Massachusetts real estate for sale. Always consult a tax professional for accurate calculations based on your situation.

In Massachusetts, you may qualify for a property tax exemption at age 70. However, qualifications may vary based on your income and property ownership status. It's advisable to check with local authorities concerning exemptions for seniors. Knowing the rules can help you manage your expenses effectively in the Massachusetts real estate market.

To avoid capital gains tax on real estate in Massachusetts, consider holding your property for more than one year. Additionally, using the primary residence exclusion can help if you meet the ownership and use tests. Engaging with professionals familiar with Massachusetts real estate for sale can provide tailored strategies to minimize tax implications.