Special Durable Account For The Future

Description

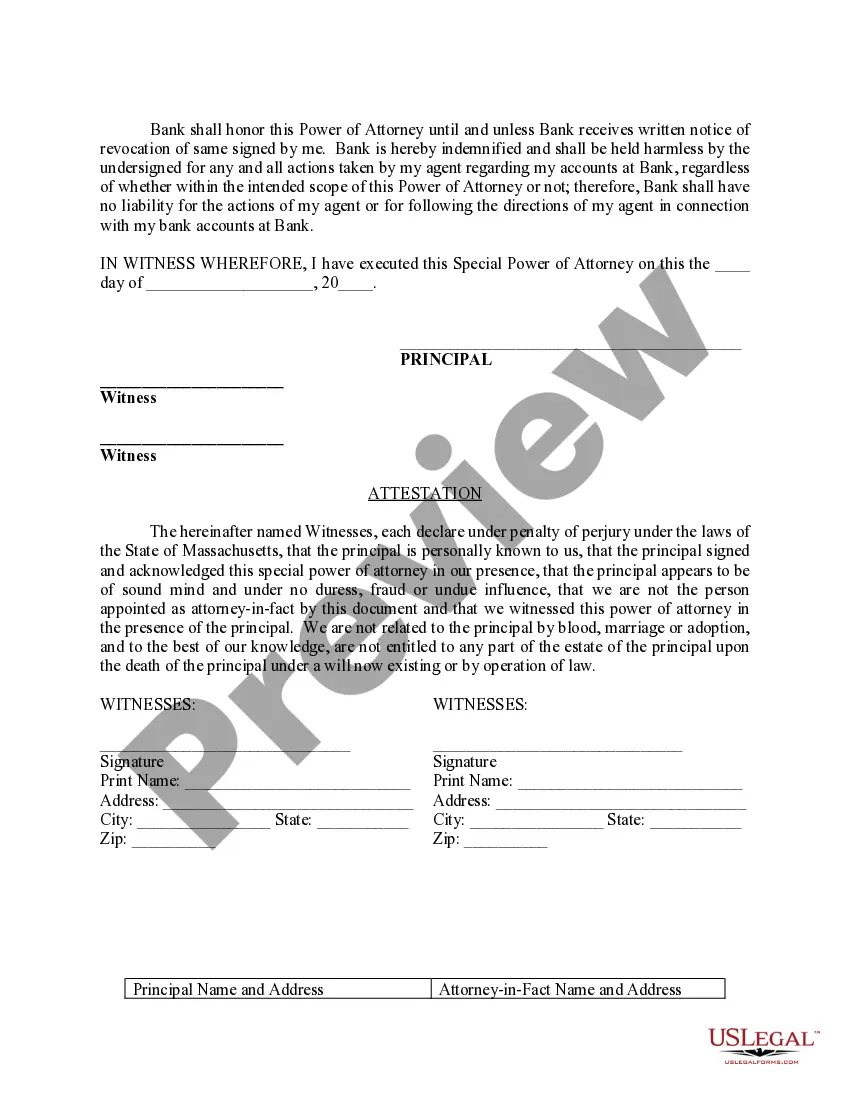

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you're a returning user, log in to your account to access the template you need. Ensure your subscription is current; if not, renew it as necessary.

- For first-time users, start by previewing the form and ensuring it fits your local jurisdiction requirements. Make sure it aligns with your specific needs.

- If adjustments are needed, utilize the Search tab to find alternative documents that may better suit your requirements.

- Once you've found the right document, click the Buy Now button to select your preferred subscription plan. Create an account to gain access to our extensive library.

- Proceed with your purchase by entering your payment details, either through credit card or PayPal.

- Finally, download your legal form and save it to your device. You can always revisit the document in the My Forms section of your profile.

US Legal Forms empowers you to navigate legal documentation effortlessly, providing a vast library of over 85,000 fillable and editable templates. This ensures that whether you are a layperson or a lawyer, you can find the right document quickly.

In conclusion, setting up a special durable account for the future is a straightforward process with US Legal Forms. Empower yourself with the right legal tools and explore our platform today!

Form popularity

FAQ

The most complete power of attorney usually is a durable power of attorney, which covers a wide range of financial and legal matters. This type remains valid even if you become incapacitated, ensuring your affairs are managed properly. Additionally, you can enhance this by incorporating a special durable account for the future to specify certain powers. Overall, using tools from USLegalForms helps you create a power of attorney that meets your comprehensive needs.

Determining the best power of attorney depends on your unique circumstances and needs. Many prefer a durable power of attorney because it remains valid even if you lose capacity. However, if you want to set up specific limitations, a special durable account for the future might be the right choice. Always consider consulting a legal expert to find the best fit for your situation.

The four main types of power of attorney include general power of attorney, durable power of attorney, healthcare power of attorney, and special durable account for the future. A general power of attorney grants broad authority to manage financial and legal matters. On the other hand, a durable power of attorney remains effective if you become incapacitated. Healthcare power of attorney focuses specifically on medical decisions, while a special durable account for the future allows you to designate specific powers for certain situations.

The type of power of attorney that grants the greatest powers is often known as a general durable power of attorney. This document provides extensive authority to the designated agent, covering various financial matters under a special durable account for the future. When created correctly, this arrangement allows your agent to act with broad financial authority, ensuring your needs are met even in challenging circumstances. Utilizing the uslegalforms platform can simplify the creation of such documents, ensuring they meet legal standards.

Legally, access to your bank account is granted to individuals you designate as authorized agents, such as those with a power of attorney. A special durable account for the future allows you to empower someone to manage your finances in your absence. You may also choose joint account holders or beneficiaries who are permitted to access funds. Always verify that the permissions are documented clearly to protect your assets.

A legal power of attorney generally cannot make decisions related to the withdrawal of life support, change a will, or make medical decisions without specific authority. It’s essential to understand that a special durable account for the future focuses on financial matters and may not cover personal or healthcare decisions. A well-drafted document clearly outlines the limitations, allowing you to maintain control over sensitive areas of your life. Thus, plan accordingly.

Yes, a power of attorney can make bank withdrawals if the document explicitly grants that authority. When setting up a special durable account for the future, you can specify the powers your agent has, including accessing funds and managing your bank accounts. This flexibility ensures that your agent can effectively handle your finances when needed. Always ensure the powers are clearly defined to avoid any confusion.

The most powerful power of attorney typically is a special durable account for the future. This type of power of attorney allows you to designate an agent who can make decisions on your behalf, even during periods of incapacity. It empowers your chosen individual to act in financial matters, ensuring that your interests are safeguarded. This is especially beneficial for long-term planning and financial continuity.

To fill out a power of attorney form, start with accurate personal information for both you and your chosen agent. Clearly outline the specific powers granted and include any limitations as needed. This attention to detail helps secure your interests, especially concerning your special durable account for the future.

The best person to serve as your power of attorney should be someone you fully trust, as they will manage your affairs. This person should understand your values, particularly when handling your special durable account for the future. It's wise to consider a family member or a close friend who has your best interests at heart.