Special Durable Account For The Customer

Description

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you're a returning user, log in to your account. Ensure your subscription is active; renew it if necessary before downloading.

- For first-time users, begin by checking the Preview mode and detailed descriptions of forms. Verify that the form aligns with your needs and local jurisdiction.

- Use the Search tab if you need a different template. Find the correct form and confirm it suits your requirements.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You need to register an account for full access.

- Complete your purchase by entering your credit card information or using PayPal for your subscription.

- Download your legally sound form and save it on your device. Access it anytime in the My Forms menu of your profile.

US Legal Forms stands out with its vast collection of over 85,000 editable legal forms, providing users more value than competitors at similar costs.

Experience peace of mind knowing that you can rely on premium experts for assistance during form completion. Start using your special durable account today to simplify your legal document needs!

Form popularity

FAQ

In a power of attorney, 'durable' signifies that the document retains its power and effectiveness even if the principal becomes incapacitated. This essential characteristic allows your agent to act on your behalf without interruption. By utilizing our Special durable account for the customer, you can be assured of reliable management of your important affairs when you can’t manage them yourself.

Yes, a Durable Power of Attorney offers several advantages, including continuity in decision-making and the ability to manage your finances effectively during times of incapacity. This arrangement ensures that your affairs are handled according to your wishes. With our Special durable account for the customer, you gain peace of mind knowing that your financial interests are safeguarded.

One downside of a Durable Power of Attorney is that it requires a significant level of trust in the appointed agent since they will have considerable control over your affairs. Additionally, if not properly structured, it might lead to potential misuse of authority. By opting for our Special durable account for the customer, you can mitigate these risks by ensuring proper documentation and careful agent selection.

The Durable Power of Attorney is often recommended because it provides ongoing authority to your chosen agent, even in cases of your incapacitation. This flexibility helps maintain stability in managing your personal and financial matters. With a Special durable account for the customer, you’re empowered to make wise decisions about your future.

The term 'durable' refers to a power of attorney that remains effective even if the principal becomes incapacitated. This means that the designated agent can continue to make decisions regarding the principal's affairs. With our Special durable account for the customer, you ensure your financial and legal matters can be handled seamlessly, even in challenging situations.

A durable power of attorney (POA) primarily deals with financial and legal matters, allowing a designated person to manage your assets effectively. In contrast, a medical power of attorney grants someone the authority to make healthcare decisions on your behalf if you become incapacitated. Understanding the distinction between these two types of powers can help you safeguard your interests and ensure appropriate management of both your finances and health. This knowledge can also streamline access to essential services, like a special durable account for the customer.

A durable power of attorney is generally considered better for long-term planning because it remains valid even if you lose the ability to make decisions. This ensures continuous management of your affairs without interruption. In contrast, a general power of attorney may not cover such situations, potentially complicating access to a special durable account for the customer when you need it most. Ultimately, the choice depends on your specific circumstances and future planning needs.

A standard power of attorney (POA) typically grants authority that can cease upon the principal's incapacitation. In contrast, a durable power of attorney (DPOA) remains effective even if the principal loses the ability to make decisions. This distinction is crucial for individuals planning for future incapacity, as a durable power of attorney can facilitate access to a special durable account for the customer. Understanding these differences can help you choose the right option for your needs.

A legal power of attorney cannot make decisions regarding your own financial estate, such as changing your will or modifying a trust. Additionally, it cannot make choices about your personal healthcare, including life-support treatment decisions, unless specified otherwise. Lastly, a legal power of attorney cannot make decisions that are illegal or against public policy. For clients considering a special durable account for the customer, it’s essential to understand these limitations.

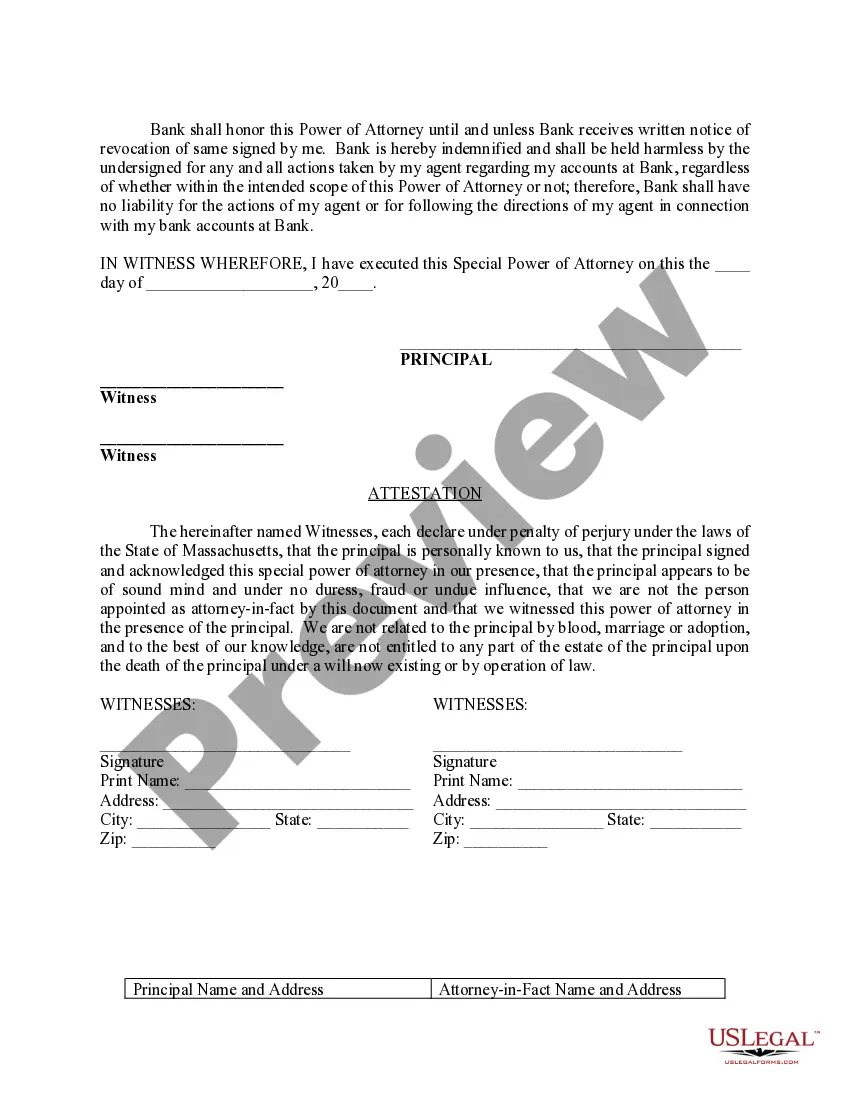

To write a power of attorney letter for a bank, clearly specify your intent to authorize someone to manage your bank transactions. Include your name, your agent's name, and describe the powers granted, especially regarding a special durable account for the customer if applicable. Make sure to sign the document in front of a notary or with witness signatures, as banks typically require this for acceptance.