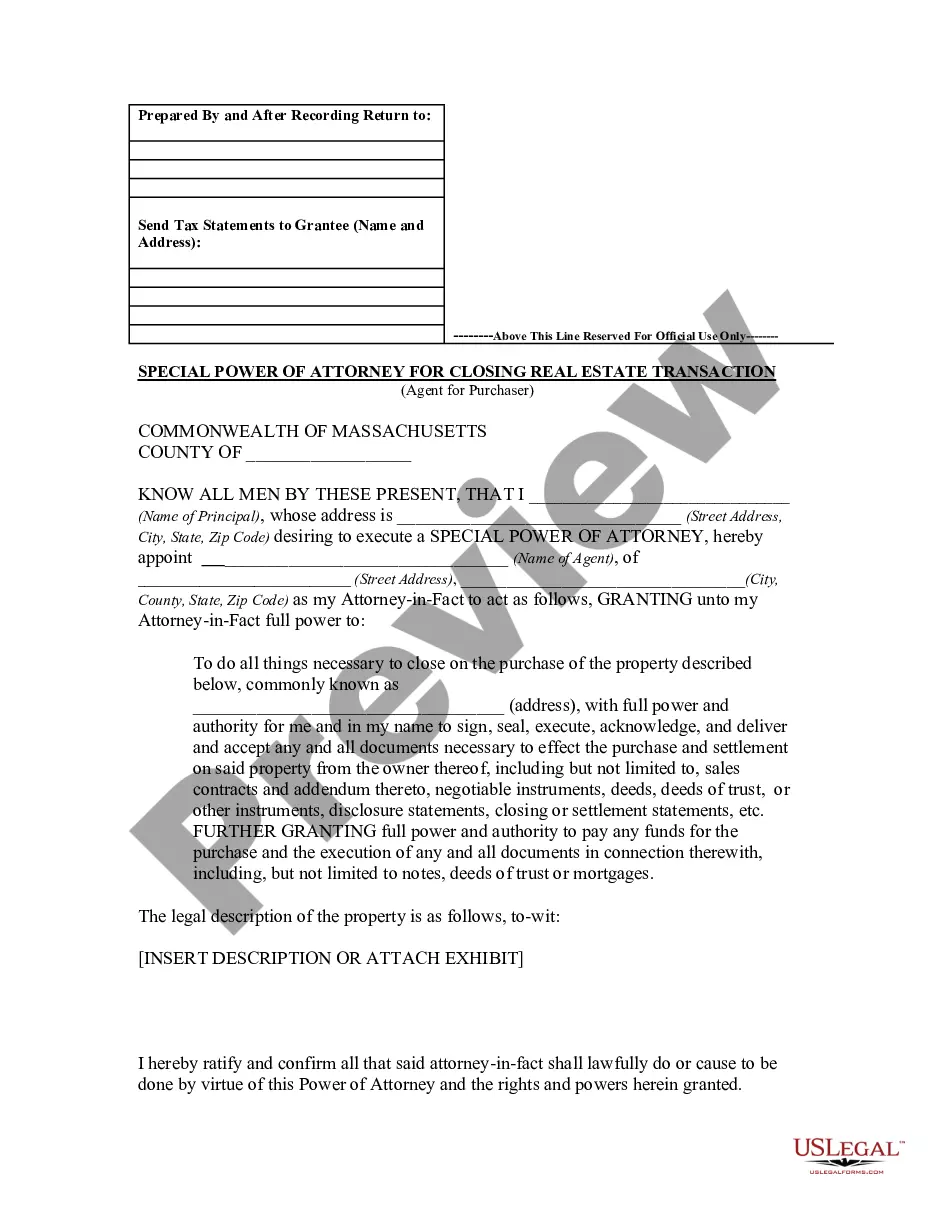

Ma Attorney Real Form Pc

Description

How to fill out Massachusetts Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Managing legal documentation and procedures can be a lengthy addition to your day.

Ma Attorney Real Form Pc and similar forms generally require you to search for them and comprehend how to fill them out accurately.

For this reason, if you are handling financial, legal, or personal issues, possessing a comprehensive and functional online repository of forms readily available will be highly beneficial.

US Legal Forms is the premier online source for legal templates, featuring over 85,000 state-specific documents and various resources that will assist you in completing your paperwork efficiently.

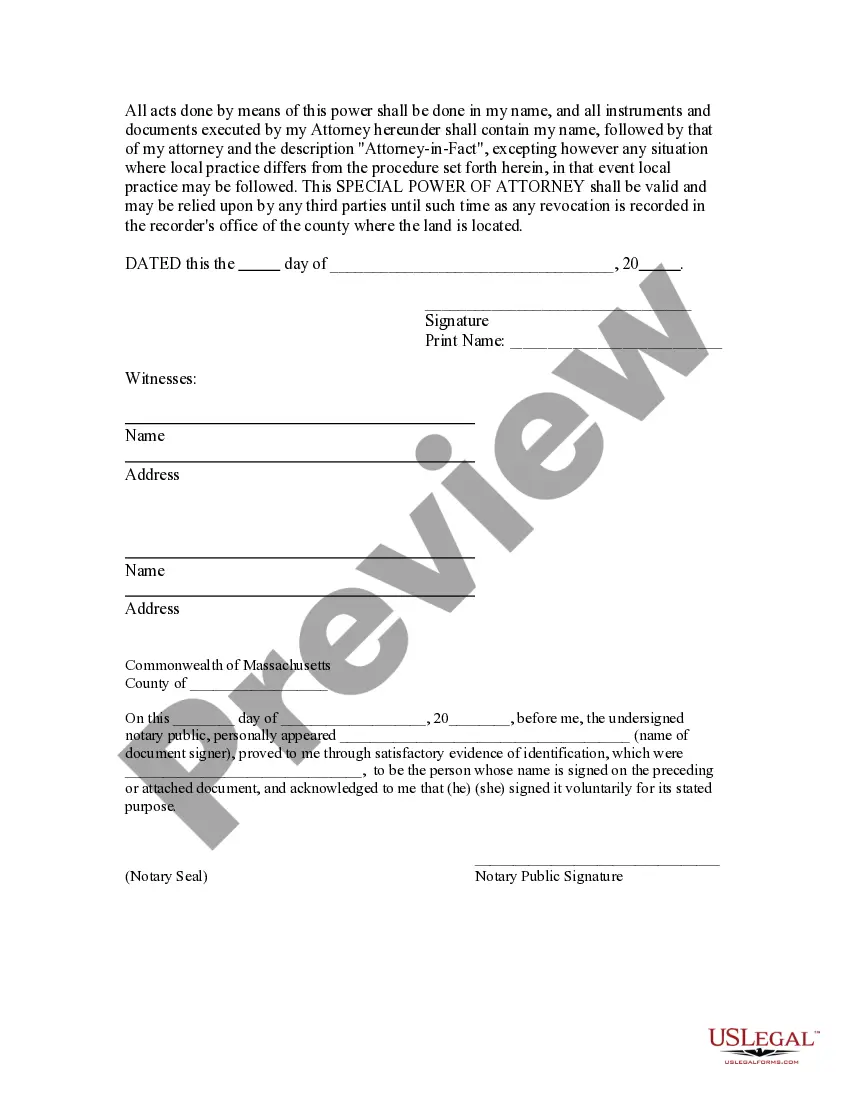

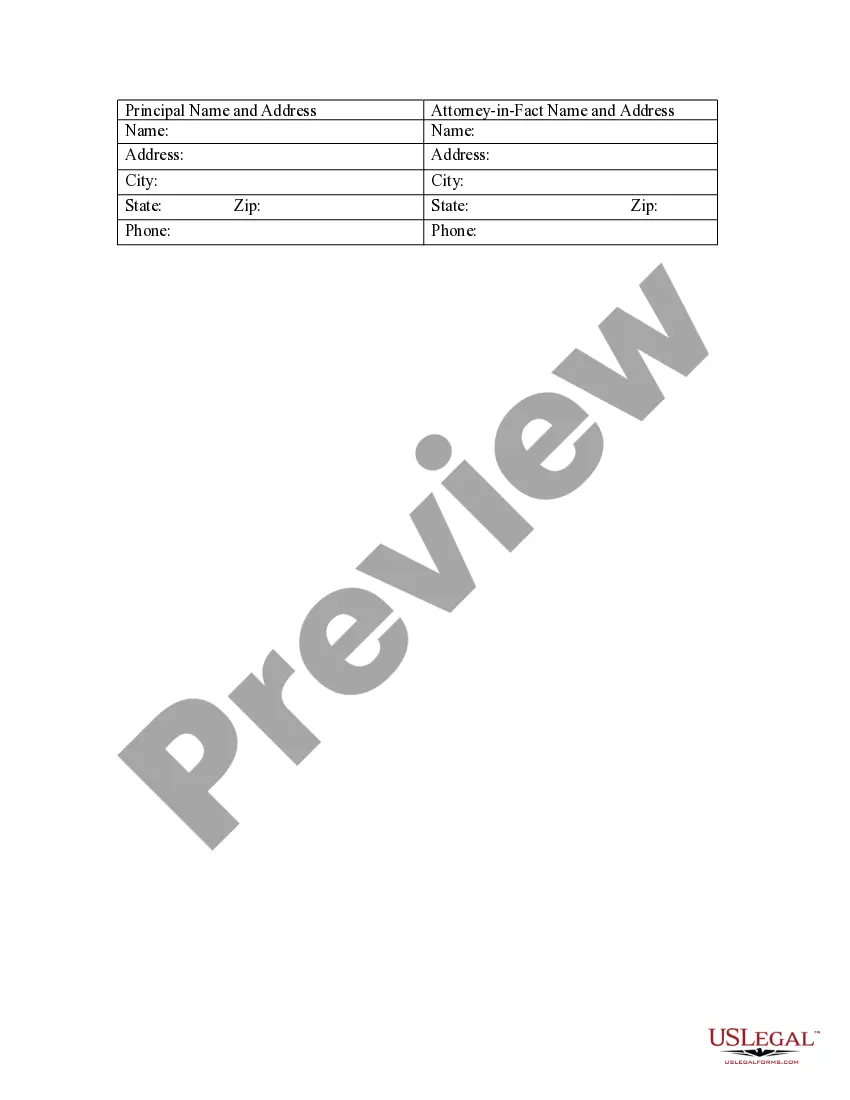

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you’ll gain access to the form library and Ma Attorney Real Form Pc. Then, follow the steps outlined below to complete your form: Ensure you have located the correct form using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the monthly subscription plan that suits you. Click Download and then complete, sign, and print the form. US Legal Forms has twenty-five years of experience helping users manage their legal documentation. Find the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents accessible to you with just one click.

- US Legal Forms supplies you with state- and county-specific documents available for download at any time.

- Protect your document management tasks by utilizing a top-notch service that enables you to create any form in minutes without additional or hidden charges.

- Simply Log In to your account, locate Ma Attorney Real Form Pc, and download it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC with the Non-Profit Organizations/Public Charities Division (the ?Division?), except organizations that hold property for religious purposes or certain federally chartered organizations.

Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC with the Non-Profit Organizations/Public Charities Division (the ?Division?), except organizations that hold property for religious purposes or certain federally chartered organizations.

Massachusetts charities, and non-Massachusetts charities operating or soliciting in the state, are required to Register with the AGO and submit Annual Filings (Forms PC), which must be done using the Online Charity Portal.

After it completes its first year of activity, the charity must file annually the Form PC along with the appropriate IRS Form 990, the correct filing fee based on its annual revenue, and any required audit or review. Annual filings are due four and one-half months after the conclusion of the charity's fiscal year.

The Form PC is filed annually by all nonprofit charitable organizations conducting business in the Commonwealth of Massachusetts. Charities must now meet their annual filing requirements through the AGO's online charities filing portal.