Ma Mortgage Mortgagors For Sale

Description

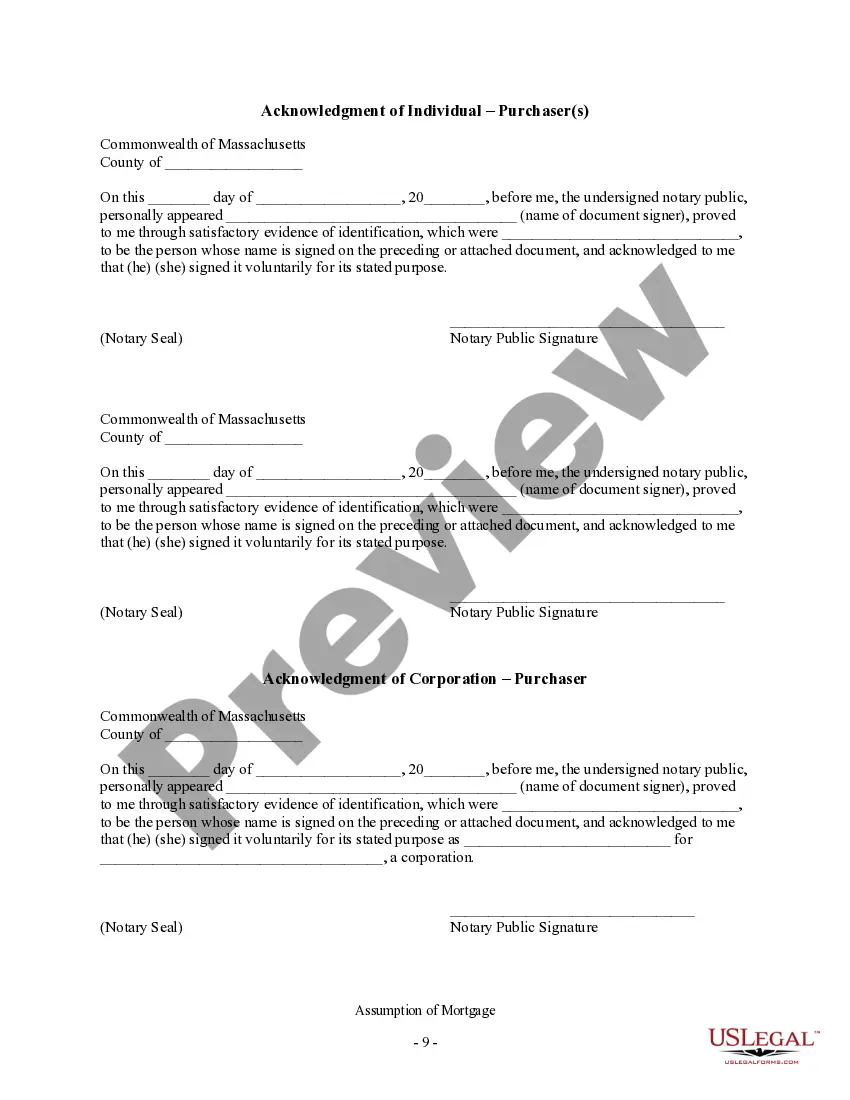

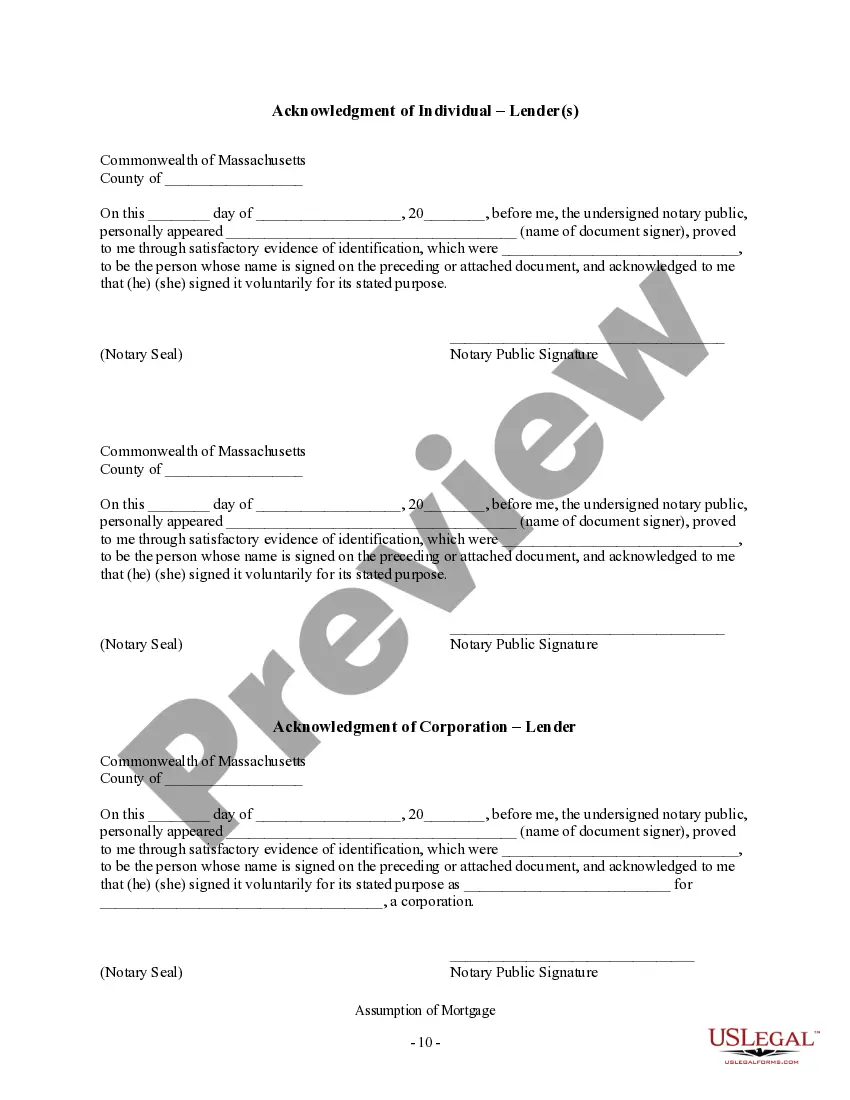

How to fill out Massachusetts Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Getting a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Choosing the right legal files requirements accuracy and attention to detail, which explains why it is very important to take samples of Ma Mortgage Mortgagors For Sale only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Consider the listed steps to finish your Ma Mortgage Mortgagors For Sale:

- Use the library navigation or search field to find your sample.

- View the form’s information to see if it matches the requirements of your state and area.

- View the form preview, if available, to ensure the form is the one you are interested in.

- Return to the search and locate the right document if the Ma Mortgage Mortgagors For Sale does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Select the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Ma Mortgage Mortgagors For Sale.

- Once you have the form on your device, you may alter it with the editor or print it and complete it manually.

Get rid of the headache that comes with your legal documentation. Check out the comprehensive US Legal Forms library where you can find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

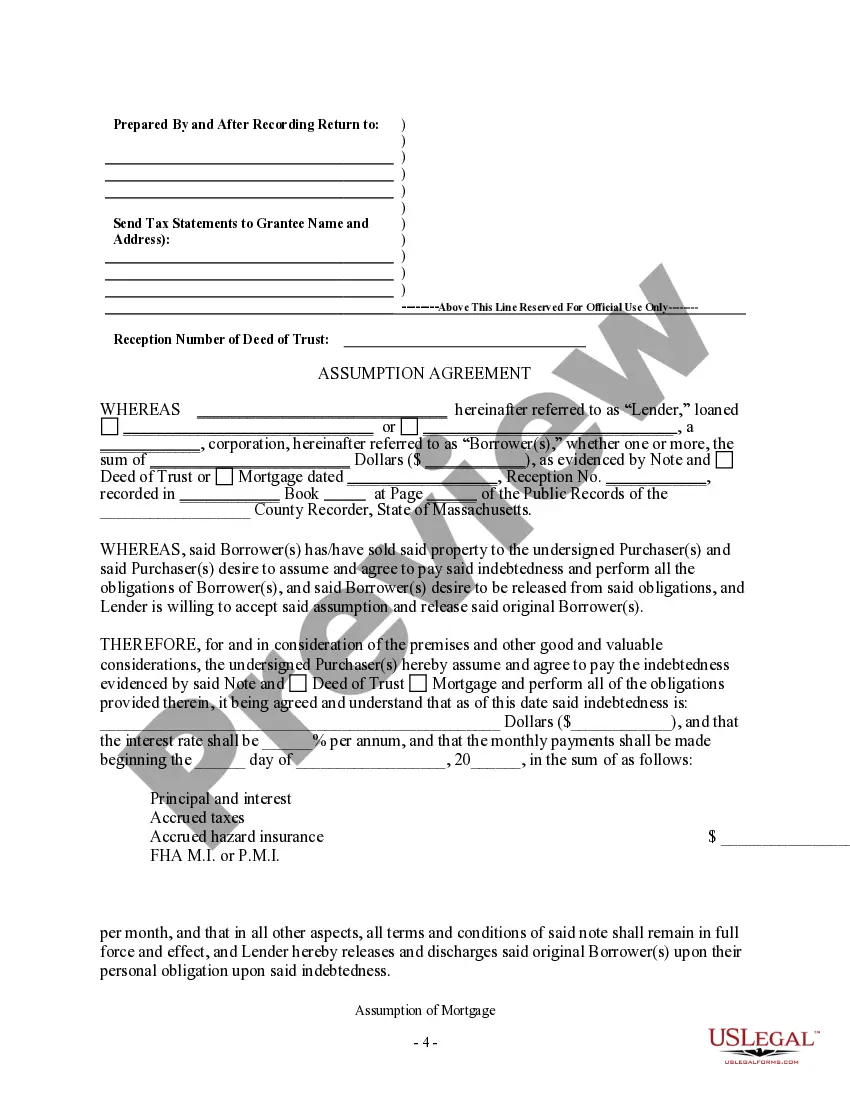

While the buyer gets a good deal on the house, the seller is able to sell his mortgaged property with its outstanding loan to the prospective homebuyer, at a decent price. However, before deciding to sell your mortgaged property, it is important to ensure that you are up-to-date with your mortgage payments.

When you purchase a home via a mortgage loan, as a borrower, you are, in fact, a homeowner free to make decisions pertinent to the property (decor, renovations, construction, landscaping and so on). Even so, do you actually own the home you were lent money to purchase? Simply put, yes; you do own your home.

Right to sale without court intervention The right to sale without court intervention allows the mortgagee to sell the property without informing the courts under certain conditions. One such condition could be if the mortgagor defaults and is unable to service the payment after three months of being served a notice.

A mortgage is a transfer of an interest in immovable property and it is given as a security for a loan. The ownership of an immovable property remains with the mortgagor itself but some interest in the property is transferred to the mortgagee who has given a loan.

In a mortgage loan the mortgagor is the party receiving the loan and the mortgagee is the party offering the loan. The mortgagor must submit a credit application and agree to the mortgage loan terms if approved for a loan.