Revocation Living Trust For Foreigners

Description

How to fill out Massachusetts Revocation Of Living Trust?

- If you're already a registered user, log in to your account. Verify your subscription status and download the required form template by clicking the Download button.

- If you're new to US Legal Forms, start by reviewing the various forms available. Check the Preview mode and form description to ensure you select the correct document based on your local jurisdiction.

- Use the search tab to find other templates if needed, if you notice any discrepancies. Once you've identified the right form, proceed to the next step.

- Purchase the chosen document by clicking on the Buy Now button. Select the subscription plan that best fits your needs and create an account to gain access to the legal library.

- Complete your purchase using either your credit card or PayPal for a seamless transaction.

- Download the form to your device for easy access and completion. You can find it later in the My Forms section of your profile.

In conclusion, US Legal Forms provides an efficient pathway for foreigners to navigate the process of revoking a living trust. By offering a vast library of more than 85,000 legal templates, users can be confident in finding the exact form tailored to their needs.

Start streamlining your legal document process today with US Legal Forms!

Form popularity

FAQ

A family trust, while beneficial, can create divisions among family members if not handled correctly. Beneficiaries might have differing opinions on trust management, leading to conflicts. Furthermore, setting up a revocation living trust for foreigners might include unexpected legal fees and the burden of compliance with various regulations, which can add stress to an already complex family dynamic.

One downside of putting assets in a trust is the potential loss of control over those assets. Once assets are transferred to a revocation living trust for foreigners, the trust generally manages them and may restrict how the creator accesses them. Moreover, although there are tax benefits, navigating the tax implications can sometimes complicate the overall management.

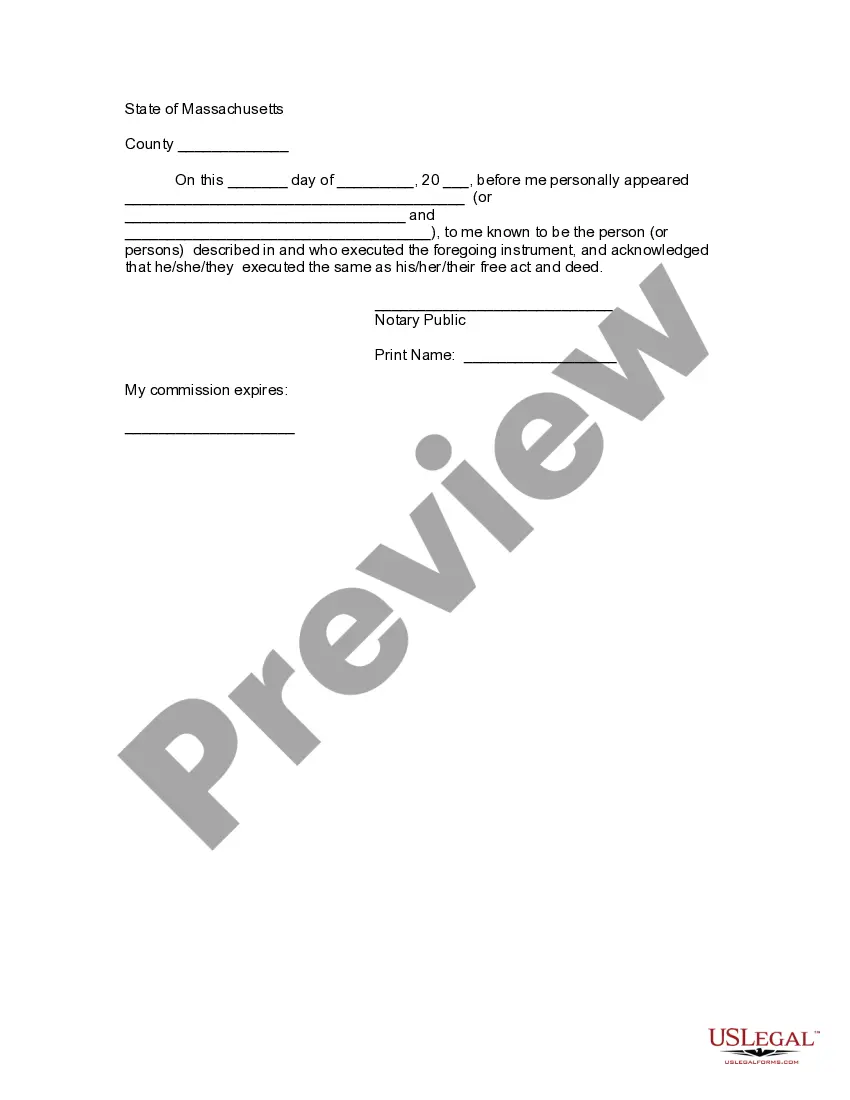

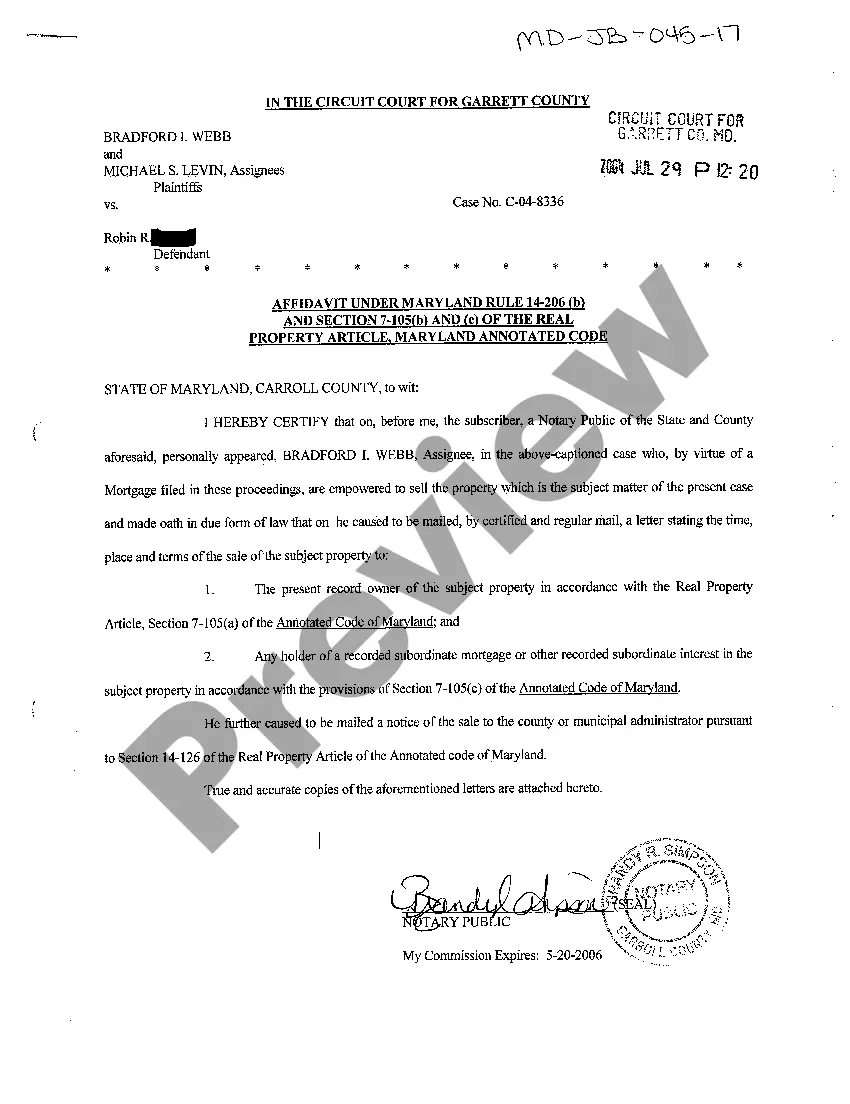

To revoke a revocable living trust, the trust creator must follow specific legal steps, which typically include drafting a trust revocation declaration. This document should clearly state the intent to revoke the trust and be signed by the creator, ensuring that it aligns with the requirements of local laws. Utilizing services like US Legal Forms can simplify this process, guiding users through necessary documentation.

It can be beneficial for your parents to consider placing their assets in a trust, especially if they aim for easy transfer upon death or wish to avoid probate. A revocation living trust for foreigners can provide flexibility in managing those assets during their lifetime. Ultimately, discussing this decision with a legal professional can help weigh the advantages and specific circumstances involved.

While trusts provide various benefits, one drawback is the potential complexity involved in creating and managing them. Establishing a revocation living trust for foreigners can require legal expertise and might entail ongoing administrative tasks. Additionally, if not properly funded, a trust may not offer the desired protections or benefits, leaving the trust creator’s intentions unmet.

A trust revocation declaration is a legal document used to formally revoke a living trust. An example would be a written statement signed by the trust creator, declaring that the existing trust, such as a revocation living trust for foreigners, is no longer valid. This document typically outlines the reasons for revocation and identifies the specific trust being revoked to avoid any confusion.

Indeed, a non-U.S. citizen can serve as a trustee of a U.S. trust, such as a revocation living trust for foreigners. However, it is important to understand the potential legal and tax obligations arising from this arrangement. To simplify this process and minimize complications, utilizing reliable platforms like uslegalforms can provide valuable resources and support. Consulting with professionals ensures compliance and protects your interests.

Yes, a foreign person can serve as a trustee for a revocation living trust for foreigners, but additional considerations may apply. Foreign trustees may face unique tax implications and legal responsibilities in the U.S. It's essential to consult with a legal expert to navigate these complexities. This guidance ensures that the trust is managed according to U.S. laws while meeting your objectives.

In the United States, nearly any adult can act as a trustee for a trust, including a revocation living trust for foreigners. However, the trustee must be able to manage and distribute the trust's assets according to its terms. Generally, this role can be filled by individuals, financial institutions, or legal professionals. Selecting a trustworthy and competent trustee is crucial for the effective management of your trust.

To invalidate a living trust, especially a revocation living trust for foreigners, you must follow specific legal procedures. This often involves creating a written statement indicating your intention to revoke the trust and ensuring all parties are notified. Engaging with a qualified attorney can help clarify the necessary steps and ensure compliance with relevant laws. Taking these actions ensures your wishes are respected properly.