Living Trust Form With Respect To

Description

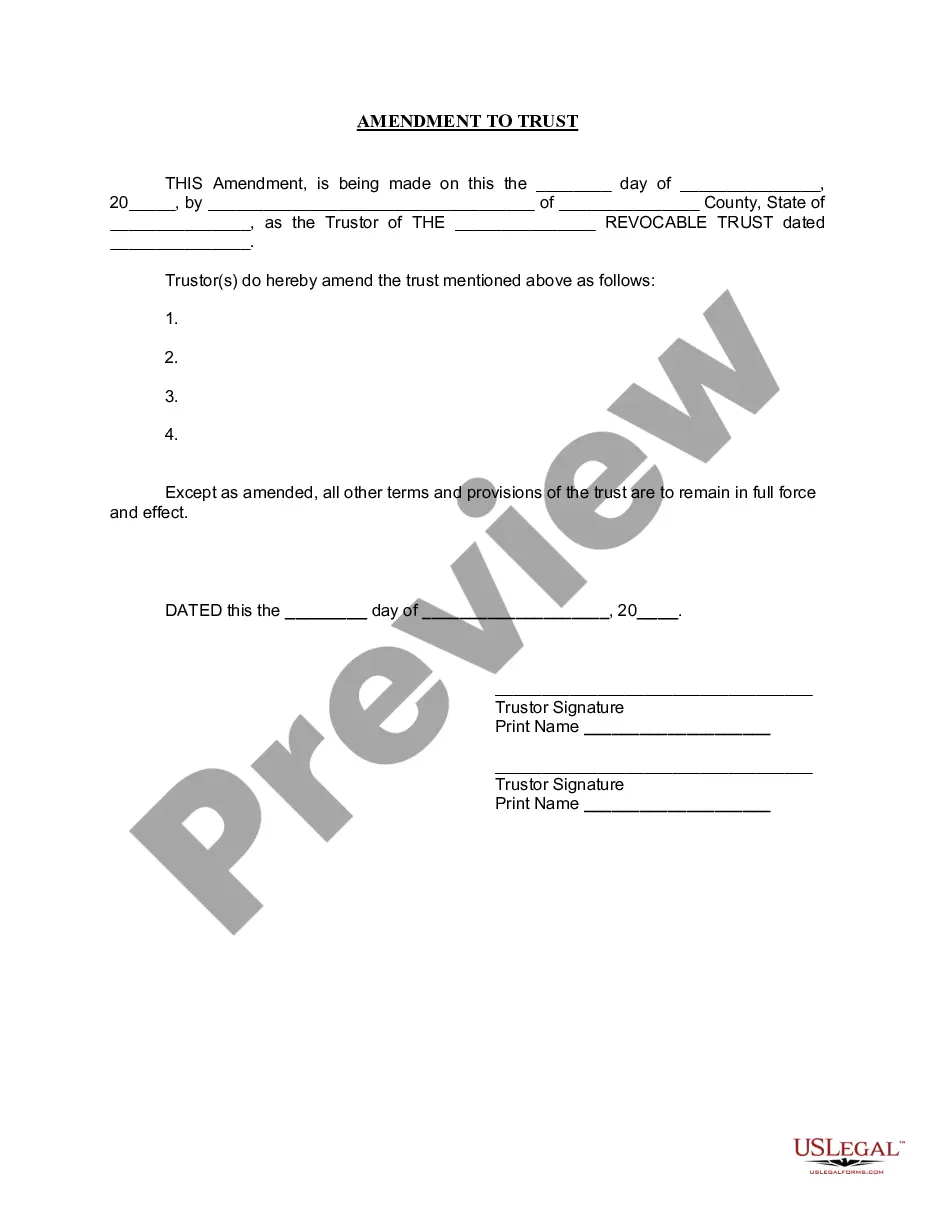

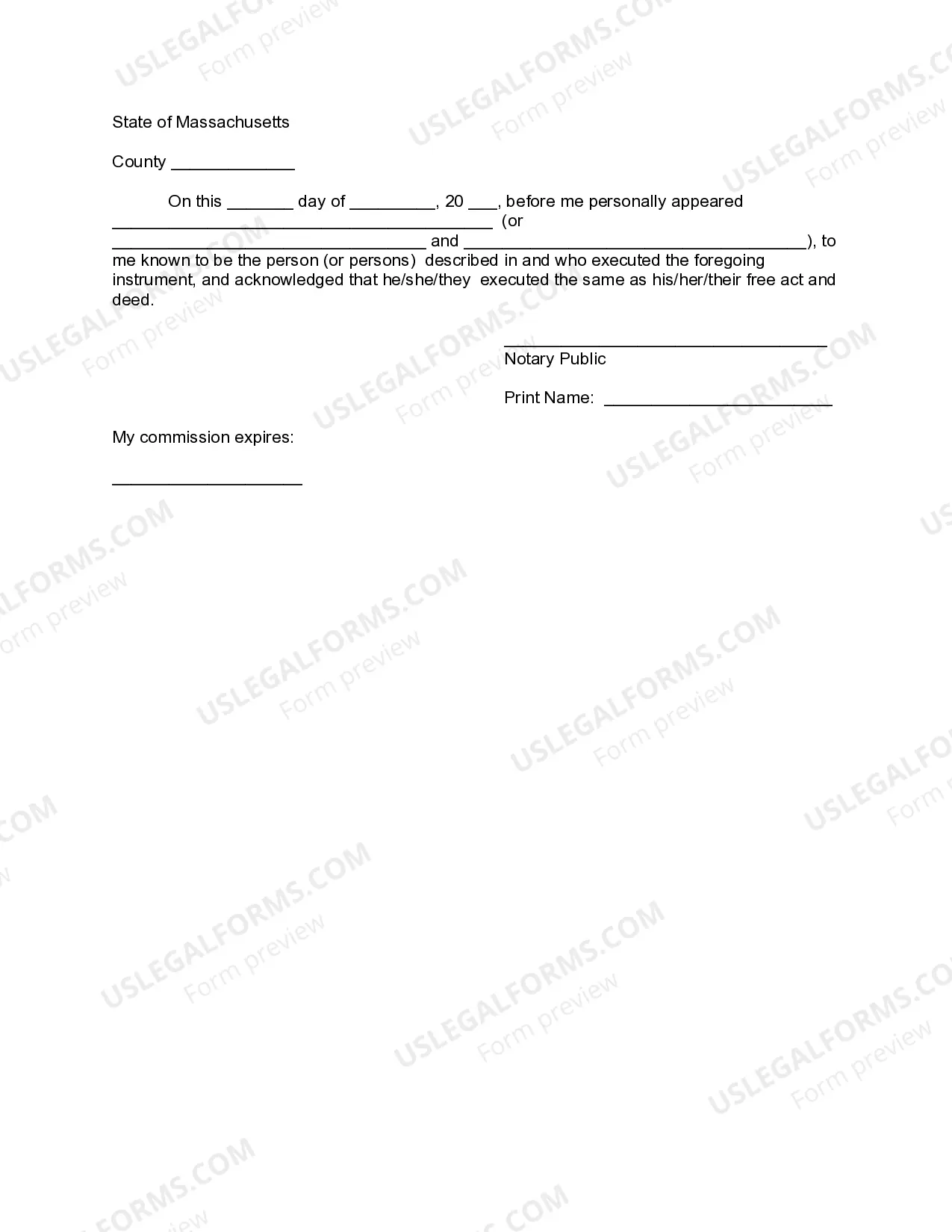

How to fill out Massachusetts Amendment To Living Trust?

- Log in to your US Legal Forms account if you've used the service before. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by reviewing the form descriptions in the Preview mode to find the living trust form that fits your local jurisdiction requirements.

- If you see any discrepancies, use the Search tab to find the correct template. Once you locate the suitable form, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Select your desired subscription plan and create an account to access the library.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Download the form and save it to your device. You can always access it later in the My Forms section of your profile.

By following these straightforward steps, you'll be able to effortlessly obtain the living trust form you need. US Legal Forms not only offers a vast selection of legal templates but also connects you with premium experts for assistance, ensuring the documents are both accurate and compliant.

Start organizing your estate today by accessing US Legal Forms. Visit their website to discover more!

Form popularity

FAQ

Filling out a living trust involves gathering information about your assets and deciding how you want them managed after your passing. Start by accurately completing the living trust form with respect to your specific requirements and wishes. If you encounter challenges, platforms like US Legal Forms can provide easy-to-use templates and guidance to ensure completeness and compliance.

The downside of putting assets in a trust includes the irrevocable nature of certain trusts, meaning you might not be able to access those assets freely later on. When you fill out the living trust form with respect to your assets, it’s essential to consider how these limitations may affect your financial flexibility in the future.

A notable disadvantage of a family trust is the potential for family disputes. If beneficiaries disagree on management or distribution, conflicts can arise. Moreover, you should carefully complete the living trust form with respect to clearly defining terms and roles to mitigate these risks and maintain family harmony.

Some assets should generally be excluded from a trust, including vehicles that require titles and certain retirement accounts. When you fill out the living trust form with respect to your estate planning, ensure you retain assets like these in your name to avoid complications later. It is wise to consult with a professional for guidance tailored to your situation.

One potential downfall of having a trust is the complexity involved in setting it up. You must be thorough when filling out the living trust form with respect to your specific assets and wishes. Additionally, maintaining a trust can involve ongoing management costs, such as legal fees and taxes. It's essential to weigh these factors before deciding.

Creating a living trust form with respect to your needs involves several key steps. First, determine your assets and who you wish to benefit from your trust. Next, use a reliable platform like USLegalForms to access user-friendly templates and instructions. By carefully filling out the living trust form with respect to your requirements, you can ensure that your wishes are legally documented and that your loved ones receive their benefits seamlessly.

A common mistake parents make is not adequately funding the trust after its establishment. They may forget to transfer assets into the trust or misjudge what should be included. This oversight can render the trust ineffective at fulfilling its purpose. When you work with a living trust form with respect to managing your children's future, ensure to fund it as intended to avoid these pitfalls.

Placing your house in a trust can limit your control over it, as you'll need to follow the trust's terms for selling or refinancing. You may also encounter tax implications when you transfer ownership. Furthermore, it can create complications with your mortgage company, especially if they do not recognize the trust. Therefore, using a living trust form with respect to your home requires careful planning and consultation.