Affidavit Of Heirship Massachusetts For Mineral Rights

Description

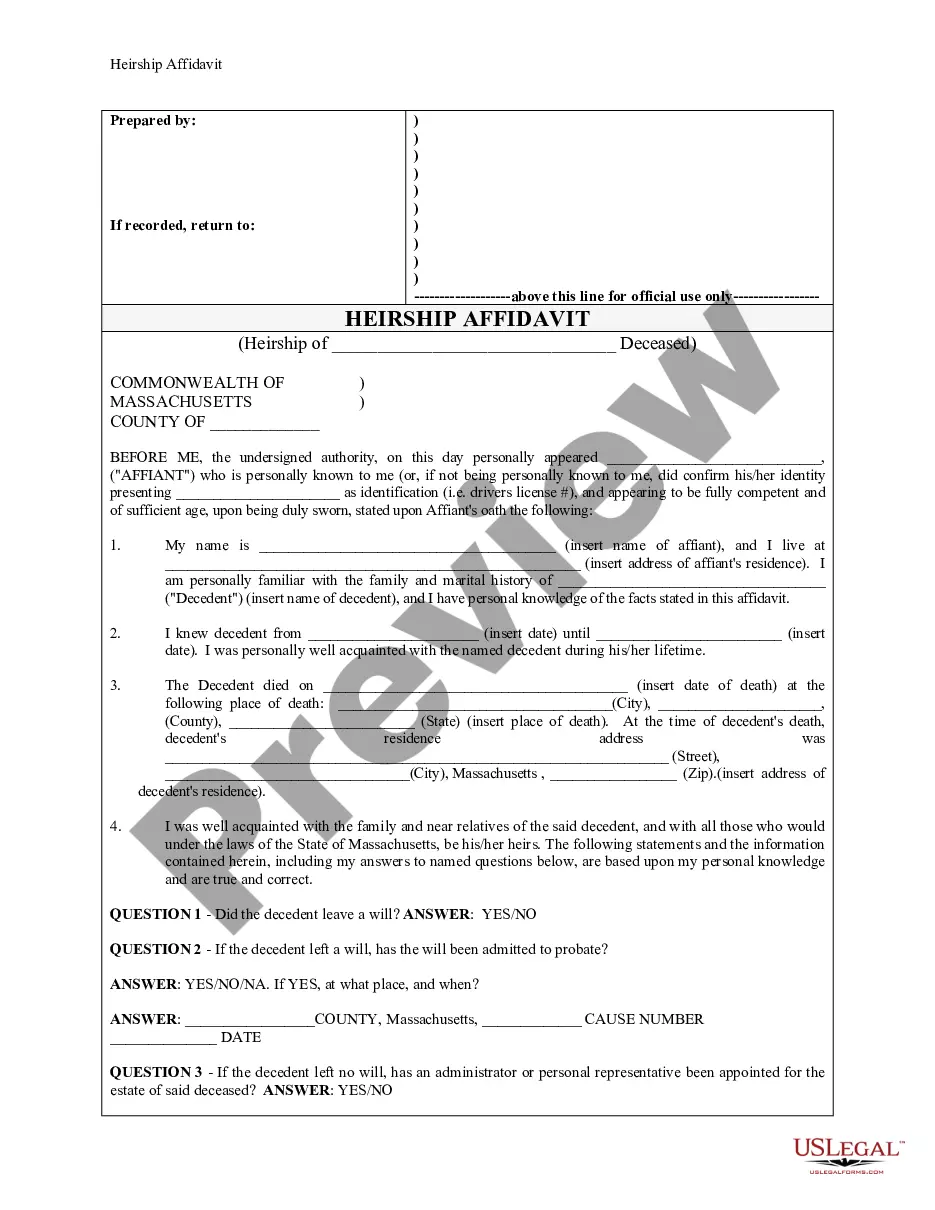

How to fill out Massachusetts Heirship Affidavit - Descent?

Bureaucracy necessitates exactness and diligence.

If you do not regularly handle documentation like the Affidavit Of Heirship Massachusetts For Mineral Rights, it might lead to some misunderstanding.

Selecting the correct template from the start will ensure that your document submission proceeds smoothly and avoid any hassles of re-submitting a form or repeating the same task from scratch.

If you are not a subscribed user, finding the required template will take a few additional steps: Locate the template using the search field. Verify that the Affidavit Of Heirship Massachusetts For Mineral Rights you have found is applicable for your state or county. Open the preview or read the description containing the details on how to use the template. If the result corresponds with your search, click the Buy Now button. Select the appropriate option among the proposed pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal account. Receive the form in your desired format. Acquiring the correct and current samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Eliminate the bureaucracy uncertainties and enhance your efficiency when working with forms.

- You can always locate the right template for your paperwork at US Legal Forms.

- US Legal Forms is the largest online repository of forms, housing over 85 thousand samples across various sectors.

- You can find the most current and suitable version of the Affidavit Of Heirship Massachusetts For Mineral Rights by simply searching on the website.

- Find, save, and download templates in your account or consult the description to confirm that you have the correct one at your disposal.

- With an account at US Legal Forms, you can effortlessly gather, store in one location, and browse the templates you save to access them in just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, head to the My documents page, where your document list is kept.

- Review the forms' descriptions and download the ones you need at any time.

Form popularity

FAQ

The estate must be valued at or below $25,000 with no real estate and excluding the value of an automobile.

Heirs at law are persons entitled to receive the Decedent's property under the intestacy succession laws if there is no will. For dates of death on or after March 31, 2012, the Massachusetts Uniform Probate Code, G. L. c. 190B, § 2-101, et seq., should be consulted.

By Massachusetts statute, a probate case must be kept open for twelve months to allow creditors to file any claims against the estate and before final distributions should be made to the heirs. The good news is that not all estates must go through probate. Certain factors determine whether probate is necessary.

The Spouse's Share in Massachusetts. In Massachusetts, if you are married and you die without a will, what your spouse gets depends on whether or not you have living parents or descendants children, grandchildren, or great grandchildren. If you don't, then your spouse inherits all of your intestate property.

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...