Life Estate Deed Form Massachusetts With Powers

Description

How to fill out Massachusetts Warranty Deed To Child Reserving A Life Estate In The Parents?

Working with legal paperwork and procedures can be a time-consuming addition to your day. Life Estate Deed Form Massachusetts With Powers and forms like it typically need you to search for them and understand how you can complete them correctly. Consequently, if you are taking care of financial, legal, or personal matters, having a thorough and convenient online catalogue of forms at your fingertips will greatly assist.

US Legal Forms is the top online platform of legal templates, offering over 85,000 state-specific forms and a variety of resources to help you complete your paperwork effortlessly. Check out the catalogue of relevant papers accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Protect your papers managing procedures by using a high quality support that lets you make any form within minutes without having additional or hidden cost. Just log in to the profile, find Life Estate Deed Form Massachusetts With Powers and download it right away from the My Forms tab. You may also access previously downloaded forms.

Could it be the first time using US Legal Forms? Sign up and set up an account in a few minutes and you will gain access to the form catalogue and Life Estate Deed Form Massachusetts With Powers. Then, follow the steps listed below to complete your form:

- Ensure you have found the proper form using the Preview option and reading the form information.

- Choose Buy Now as soon as all set, and select the subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has 25 years of expertise assisting users manage their legal paperwork. Get the form you want today and improve any operation without breaking a sweat.

Form popularity

FAQ

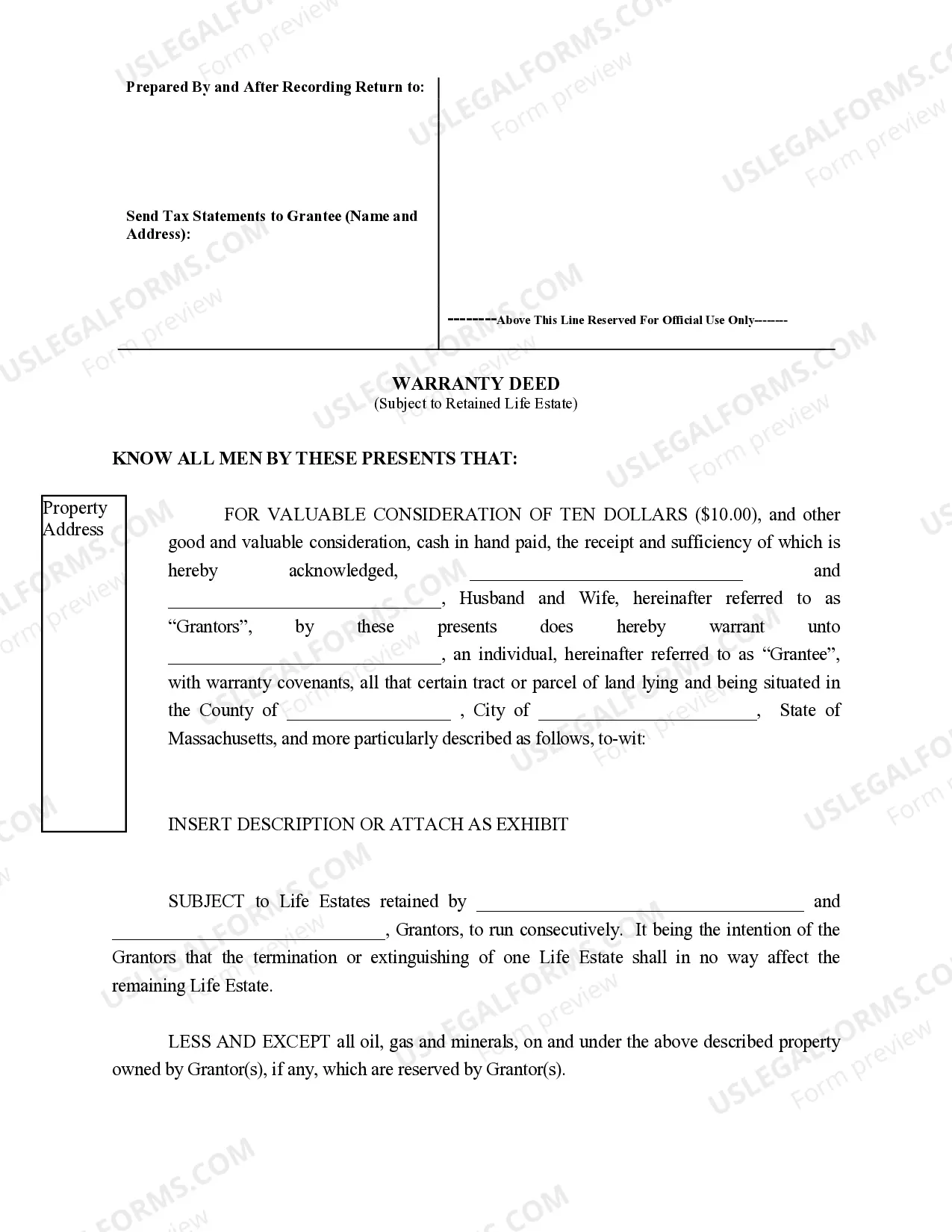

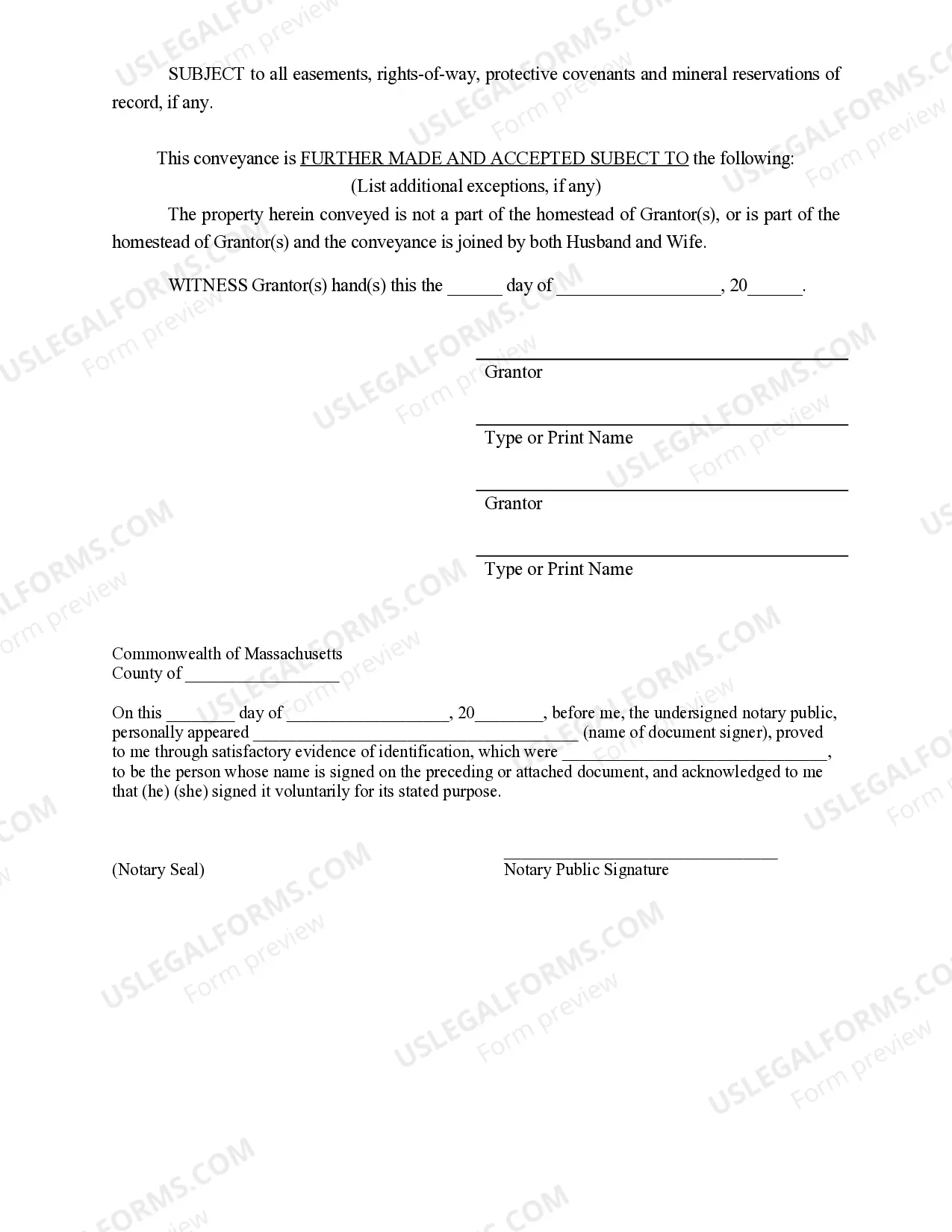

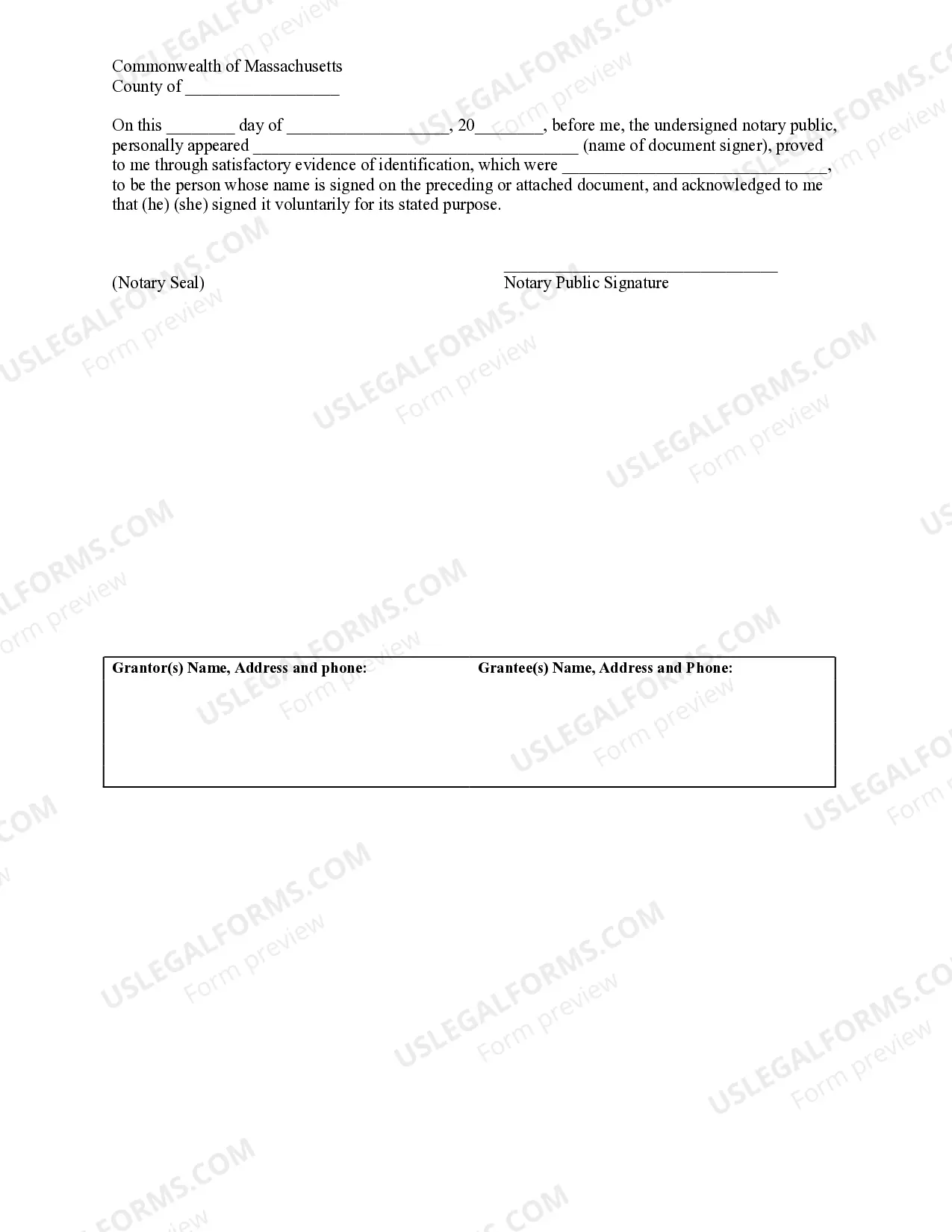

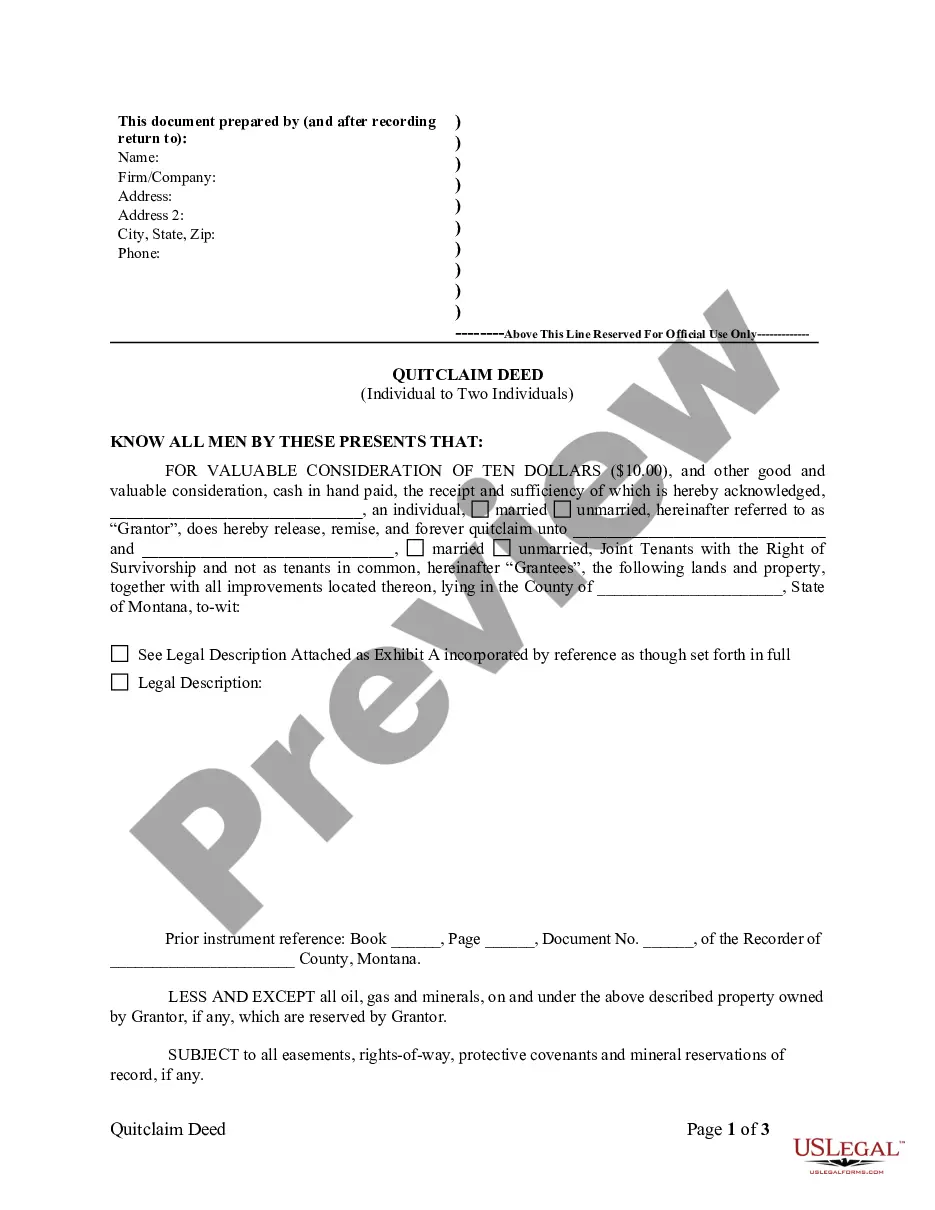

Grantor Signature ? The signature of the person/persons/entity conveying the property; Acknowledgement ? Grantor signature must be acknowledged by a notary public; Recording ? Once executed and acknowledged, a deed should be recorded at the registry of deeds. The filing fee for a deed is $155, payable by cash or check.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

In Massachusetts, real estate cannot be transferred via a TOD deed. Other methods, such as joint ownership or a revocable living trust, must be used to avoid probate for real estate. This is a significant difference from many other states and is crucial to consider when planning your estate.

The life estate ends at the death of the life tenant (or at the death of the last survivor of the life tenants if there is more than one). At that point, the so-called ?remaindermen? take over both full ownership and the right to occupy and control the property.

Grantor Signature ? The signature of the person/persons/entity conveying the property; Acknowledgement ? Grantor signature must be acknowledged by a notary public; Recording ? Once executed and acknowledged, a deed should be recorded at the registry of deeds. The filing fee for a deed is $155, payable by cash or check.