Massachusetts Deed Of Trust

Description

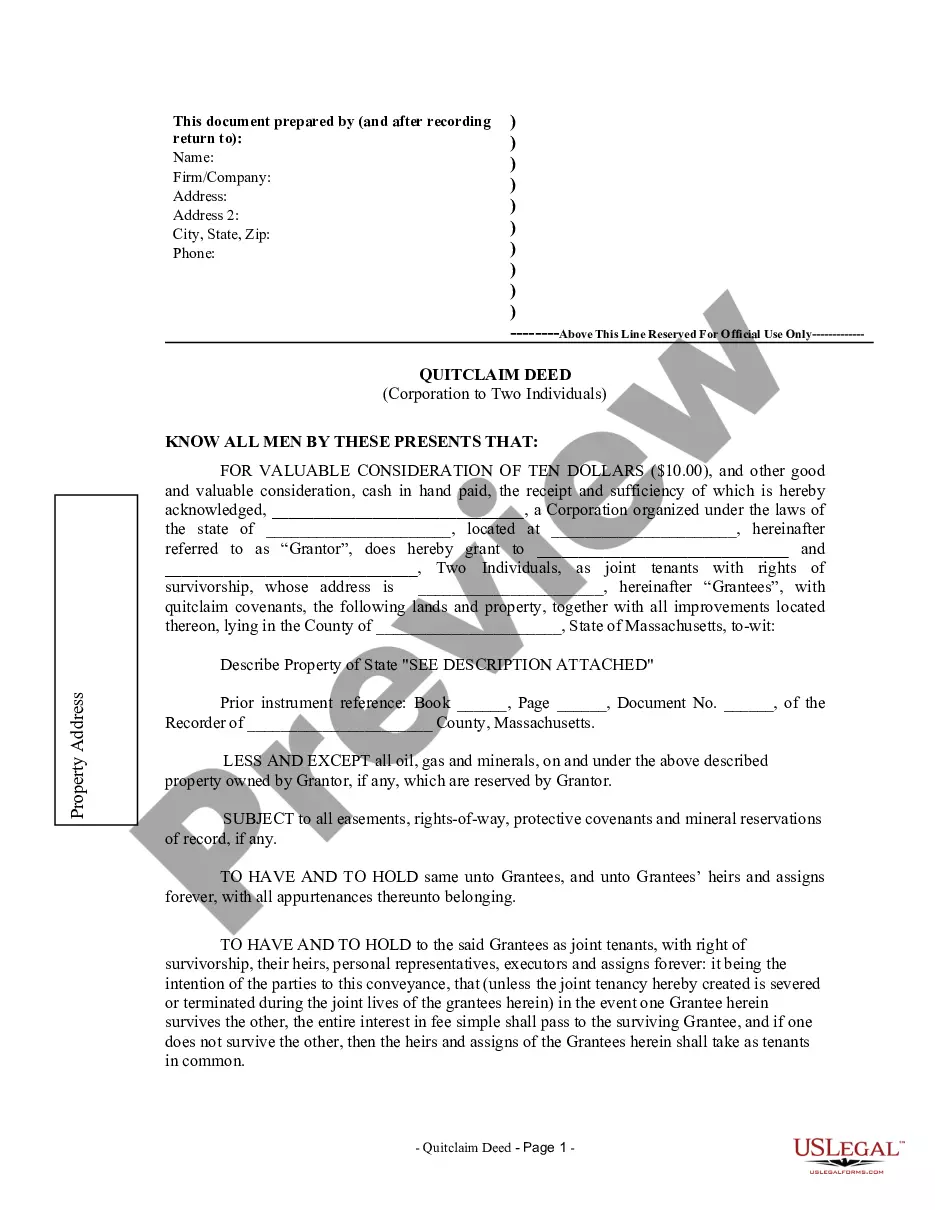

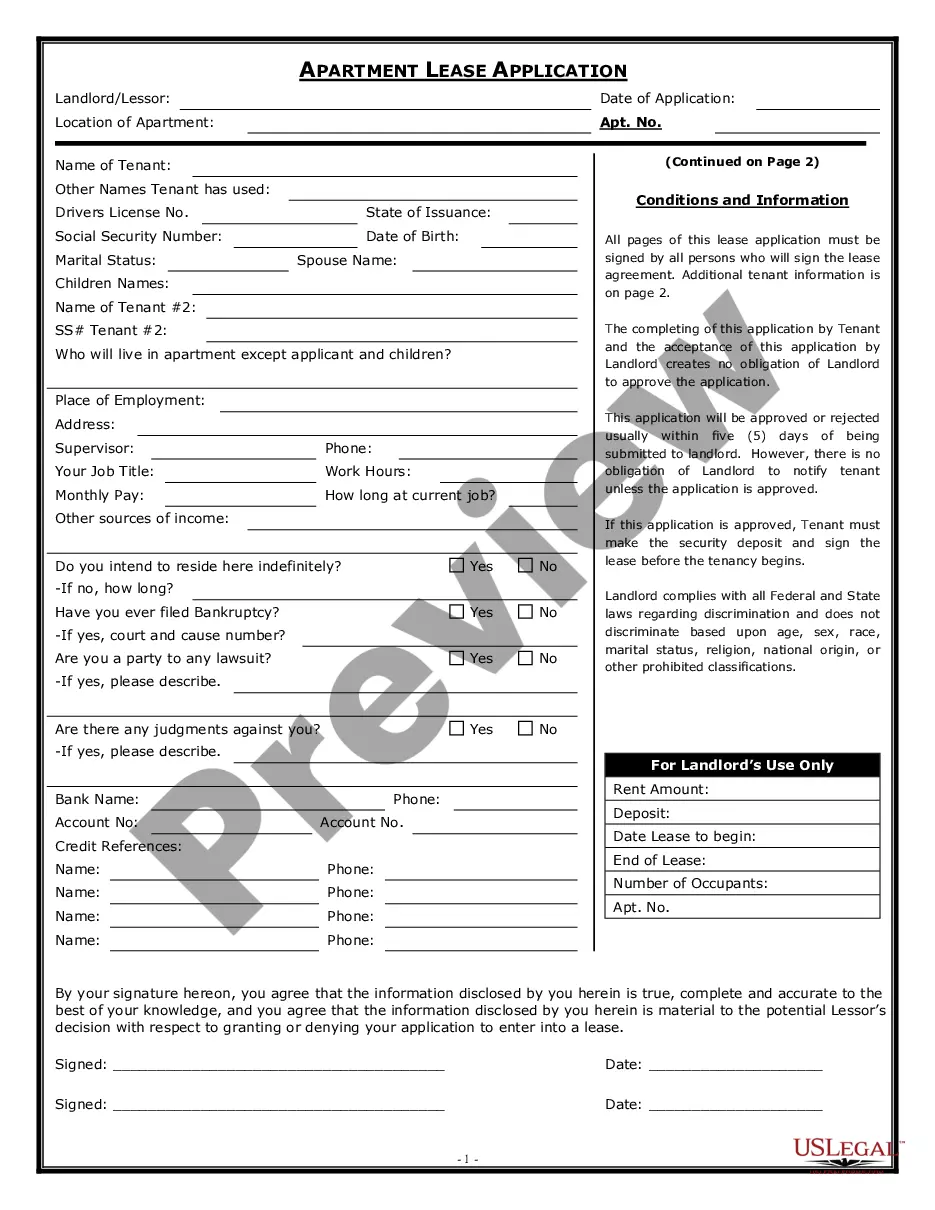

How to fill out Massachusetts Quitclaim Deed From Corporation To Two Individuals?

There's no longer a justification for wasting time searching for legal documents to satisfy your local state regulations. US Legal Forms has compiled all of them in one place and enhanced their availability.

Our platform provides over 85,000 templates for any business and personal legal needs, organized by state and area of application. All forms are properly drafted and verified for accuracy, ensuring you receive a current Massachusetts Deed Of Trust.

If you are accustomed to our service and already possess an account, make sure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all stored documents whenever necessary by opening the My documents section in your profile.

Print your form to complete it manually or upload the sample if you wish to fill it out using an online editor. Creating official paperwork under federal and state laws is quick and straightforward with our library. Try US Legal Forms today to maintain your documentation in order!

- If you're new to our service, the procedure will require a few additional steps to complete.

- Ensure to examine the page content thoroughly to confirm it includes the sample you require.

- To assist you, utilize the form description and preview options if available.

- Use the Search field above to locate another template if the current one does not suit your needs.

- Click Buy Now next to the template title when you discover the right one.

- Select the preferred pricing plan and either create an account or Log In.

- Process your payment for your subscription using a credit card or via PayPal to continue.

- Choose the file format for your Massachusetts Deed Of Trust and download it to your device.

Form popularity

FAQ

To file a deed in Massachusetts, start by preparing the deed document with all necessary property details. After that, you need to sign the deed before a notary public. Finally, submit the signed document to the appropriate county registry of deeds for recording, which establishes your ownership publicly.

Deeds can pose challenges, especially regarding the potential for complex legal obligations. A Massachusetts deed of trust can complicate property sales, since both the borrower and lender have interests in the title. Furthermore, if not managed properly, this can lead to unintended consequences such as foreclosure.

One disadvantage of a Massachusetts deed of trust is that it may limit your ability to refinance. If the property is in a trust, lenders can sometimes view it as less straightforward compared to traditional mortgages. Additionally, in the event of default, the process can move faster, making it essential to understand the nuances before committing.

To file a trust in Massachusetts, you need to prepare the trust document that outlines the terms and conditions of the trust. It's advisable to consult with an attorney to ensure compliance with state laws. Once the document is ready, you may need to record it with the appropriate county office, but always check local requirements for any specific steps.

The trust deed UK template typically serves as a legal framework to facilitate property transactions in the United Kingdom. While this template outlines essential components similar to a Massachusetts deed of trust, it's crucial to remember that laws and requirements differ by jurisdiction. Understanding these differences ensures compliance whether you are dealing with a UK trust deed or a Massachusetts deed of trust.

Yes, a Massachusetts deed of trust must be notarized to be legally binding. This step involves a notary public verifying the identities of the parties involved and witnessing their signatures. Notarization provides an added layer of security and helps prevent fraudulent activities in property transactions.

A typical trust deed contains several crucial elements that establish the agreement between the borrower and the lender. In Massachusetts, key contents include the property description, the borrower's obligations, and the lender's rights in the event of default. This document serves as a bridge between the buyer and the lender, ensuring all parties understand their roles and responsibilities.

A Massachusetts deed must include specific information to be valid. This typically includes the names of the parties involved, a description of the property, the consideration amount, and the signature of the grantor. Additionally, a Massachusetts deed of trust will require acknowledgment by a notary public to ensure legality and enforceability.

A trust deed may have several disadvantages, particularly in Massachusetts. One common concern is the potential for foreclosure if the borrower defaults, which can lead to the loss of property. Additionally, trust deeds can involve complex legal requirements and fees, making them less accessible for some individuals. It's essential to review these factors carefully before proceeding with a Massachusetts deed of trust.

Placing your house in a trust in Massachusetts can provide numerous advantages. It helps you avoid probate, which can be a lengthy process, and it allows for easier management and distribution of your property. Additionally, this strategy can offer privacy and potential tax benefits, making it a smart choice for many homeowners.