Odometer Disclosure Statement Massachusetts Withholding

Description

Form popularity

FAQ

Toyota Financial Services offers a grace period for missed payments, typically ranging from 10 to 15 days after the due date. During this time, you may avoid late fees and preserve your credit score. However, it’s essential to communicate any concerns regarding your payment status, especially if it involves an odometer disclosure statement Massachusetts withholding.

The RMV 1 form in Massachusetts is used for registering a vehicle. This form collects information about the vehicle, including its odometer reading, to comply with state regulations. Filling out this form correctly ensures that you also provide the necessary odometer disclosure statement Massachusetts withholding, safeguarding against potential disputes down the line.

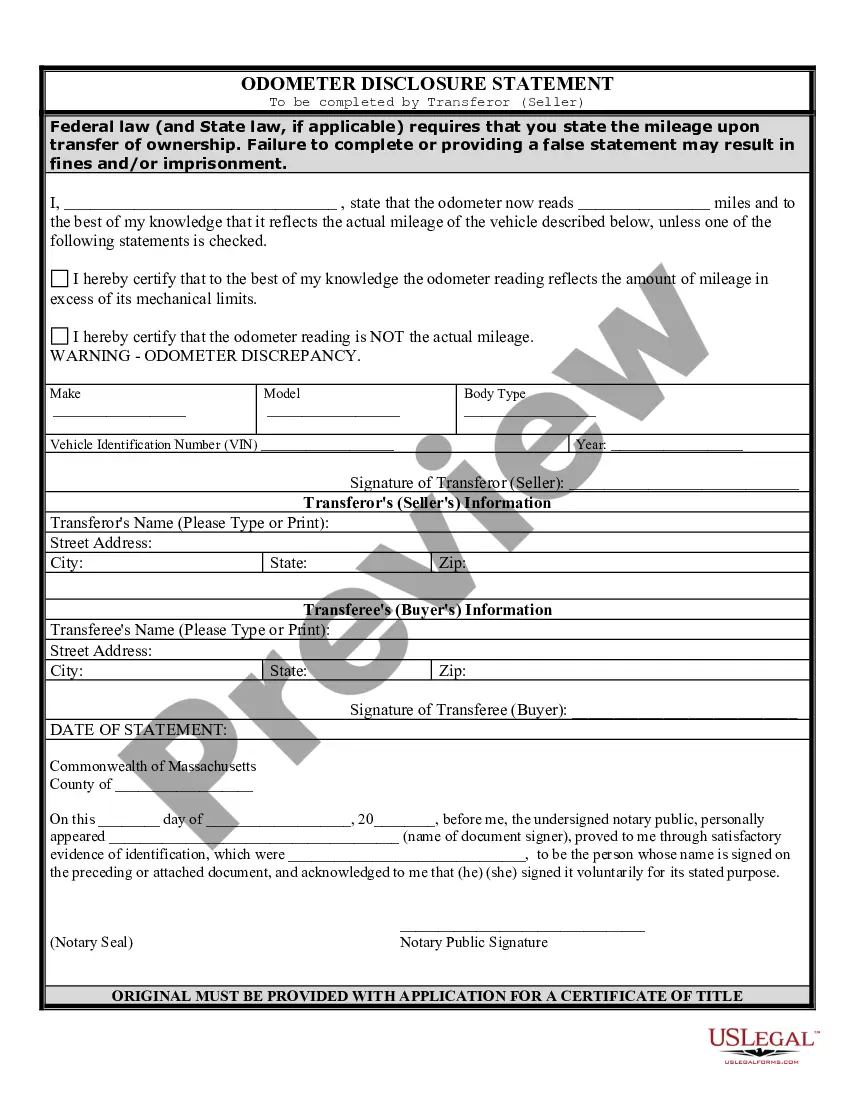

An odometer statement is a document that records the mileage on a vehicle at the time of sale or transfer. It usually indicates the current odometer reading and certifies its accuracy to prevent fraud. Proper completion of the odometer disclosure statement Massachusetts withholding is a crucial step in protecting both the buyer and seller during a vehicle transaction.

Toyota Motor Credit and Toyota Financial Services operate under the same umbrella, providing similar services. Both offer financing options for Toyota vehicles, but Toyota Financial Services encompasses a broader range of financial products. Understanding the differences can help you better navigate financing requirements, including the Odometer disclosure statement Massachusetts withholding.

Toyota Financial Services aims to deliver outstanding financial services that enhance the customer experience. Their vision focuses on providing accessible financing solutions that empower vehicle ownership. As part of this, they ensure compliance with key regulations, including the Odometer disclosure statement Massachusetts withholding, to maintain transparency during transactions.

Filling out an odometer disclosure statement in New Jersey involves providing essential information, such as the seller's name, the vehicle's VIN, and the odometer reading. You will also indicate whether the mileage is accurate or if there are discrepancies involved. This information is critical for the buyer and helps establish a clear history of the vehicle's usage. Ensuring this document is accurate will facilitate a smooth transfer of ownership.

Yes, you need an odometer disclosure statement in Massachusetts when you sell or transfer a vehicle. This statement ensures the buyer is informed about the true mileage of the vehicle, helping to prevent future disputes. It's a crucial document for ensuring transparency in the transaction process. Always complete this statement to comply with state regulations and protect your interests.

An odometer discrepancy occurs when the recorded mileage of a vehicle does not match the actual mileage on the vehicle. This can happen due to errors in reporting or tampering with the odometer. Odometer discrepancies can lead to legal issues and financial loss for buyers if not properly disclosed. It's essential to address any discrepancies promptly to maintain trust between buyers and sellers.

To fill out an odometer disclosure statement in Washington, begin with the seller's name, address, and the vehicle information, including VIN and mileage. Clearly state whether the mileage is actual, exceeds the mechanical limits, or is not the actual mileage. This transparency is crucial to prevent misunderstandings in the sale process. Once completed, ensure both parties sign the document to validate the information provided.

When filling out a title as a seller in New Jersey, start by providing your name and address in the designated seller section. Next, note the vehicle’s identification number (VIN), make, model, and year. Don't forget to accurately enter the odometer reading on the Odometer Disclosure Statement, which is vital for clarity regarding the vehicle’s history. This step ensures a smooth transfer of ownership and compliance with legal requirements.