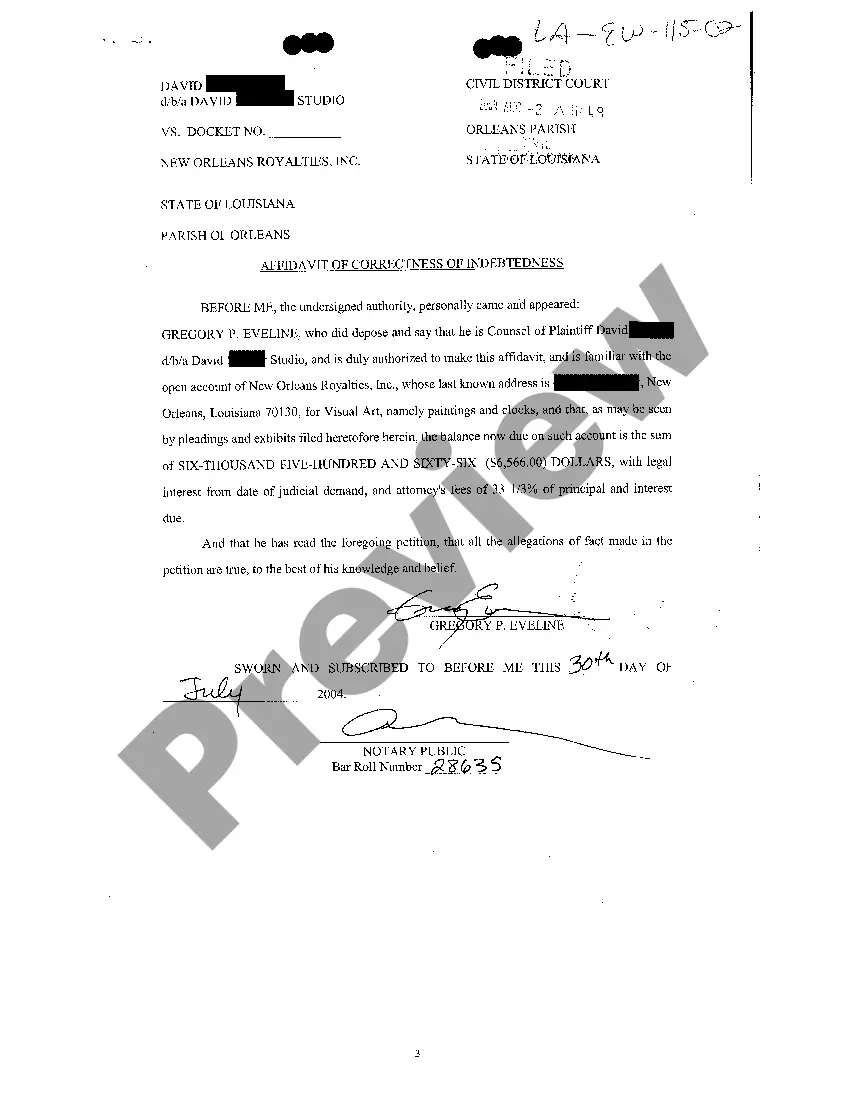

Certificate Of Indebtedness Form

Description

How to fill out Louisiana Affidavit Of Correctness Of Indebtedness - Scriveners?

When you are required to submit the Certificate Of Indebtedness Form according to your local state's statutes and regulations, there can be various alternatives to select from.

There's no requirement to scrutinize every document to confirm it meets all the legal requirements if you are a subscriber to US Legal Forms.

It is a dependable service that can assist you in acquiring a reusable and current template on any topic.

Utilizing appropriately drafted official documents becomes simple with US Legal Forms. Furthermore, Premium users can also enjoy the powerful integrated tools for online document editing and signing. Try it today!

- US Legal Forms is the most extensive online directory with a compilation of over 85,000 ready-to-use documents for both business and personal legal matters.

- All templates are verified to ensure they comply with each state's regulations.

- Therefore, when downloading the Certificate Of Indebtedness Form from our site, you can be confident that you possess a legitimate and updated document.

- Obtaining the essential sample from our platform is remarkably simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to keep access to the Certificate Of Indebtedness Form any time.

- If it's your initial experience with our website, kindly follow the instructions below.

- Review the suggested page and verify its conformity with your requirements.

Form popularity

FAQ

If you do not receive a 1099-C form but believe you should have one, contact your lender immediately to clarify the situation. The IRS expects you to report any canceled debt, regardless of whether you received this form. Utilizing support from US Legal Forms can help you navigate the requirements regarding the Certificate of Indebtedness form, ensuring compliance and accuracy.

If you lost your 1099-C form, you should first call your lender to request a duplicate. They can typically resend the form or provide you with the necessary information to file your taxes. Additionally, tools like US Legal Forms can help you better understand how to manage these documents, including the Certificate of Indebtedness form, so you stay organized moving forward.

To get a 1099-C form, first contact your lender or creditor and request it if you have not received it. Under IRS regulations, they must provide you with this form if they canceled any debt. If you prefer a smoother process for obtaining all necessary forms, including the Certificate of Indebtedness form, consider visiting US Legal Forms for quick access.

The lender or financial institution that cancels your debt sends the 1099-C form. This could include banks, mortgage companies, or credit card companies, which are obligated to report any forgiven debt to the IRS and to you. If you need additional help understanding this process, platforms like US Legal Forms offer helpful resources related to the Certificate of Indebtedness form.

You can obtain a 1099-C form directly from your lender or financial institution. They are required to issue this form if they canceled any debt during the tax year, such as in the case of a foreclosure or a debt settlement. Furthermore, platforms like US Legal Forms can guide you through the process, including providing access to a Certificate of Indebtedness form, ensuring you have the right documentation at your fingertips.

To submit Form 8879, you must complete the form and sign it electronically if you're e-filing. If you're filing by mail, print and include it with your tax return. When referencing a Certificate of indebtedness form in your submission, ensure all forms are cohesively presented for the IRS's consideration.

To claim a refund or request for abatement, submit Form 843 to the IRS, including a detailed explanation of your circumstances. Be sure to attach any necessary documents that validate your claim. If your claim involves a Certificate of indebtedness form, include this data to clarify your situation.

Receiving a 1099-C may not directly hurt your credit score, but it signifies a canceled debt, which can appear on your credit report. This could potentially lower your credit score if not managed properly. To address any negative impacts, consider using a Certificate of indebtedness form to support financial claims and demonstrate your responsible handling of debts.

You can submit a W-8 form either electronically or by mailing it to the requester. Ensure all fields are complete, and sign where indicated. If you are submitting a Certificate of indebtedness form along with it, clarify its purpose for smooth processing.

Attach your forms by placing them behind the main Form 1040 or the appropriate tax return form. Use staples or paper clips for easy handling. When you use any related forms like the Certificate of indebtedness form, ensure they are clearly marked and included in the submission.