Living Trust Louisiana For Property

Description

Form popularity

FAQ

Whether a will or trust is better in Louisiana depends on your estate planning goals. A living trust is often advantageous, especially for property, as it avoids probate and provides more control over asset distribution. However, a will can be simpler and less costly to create. Ultimately, considering your unique situation and consulting with a knowledgeable resource, like the options provided through US Legal Forms, can help you determine the best choice for your needs.

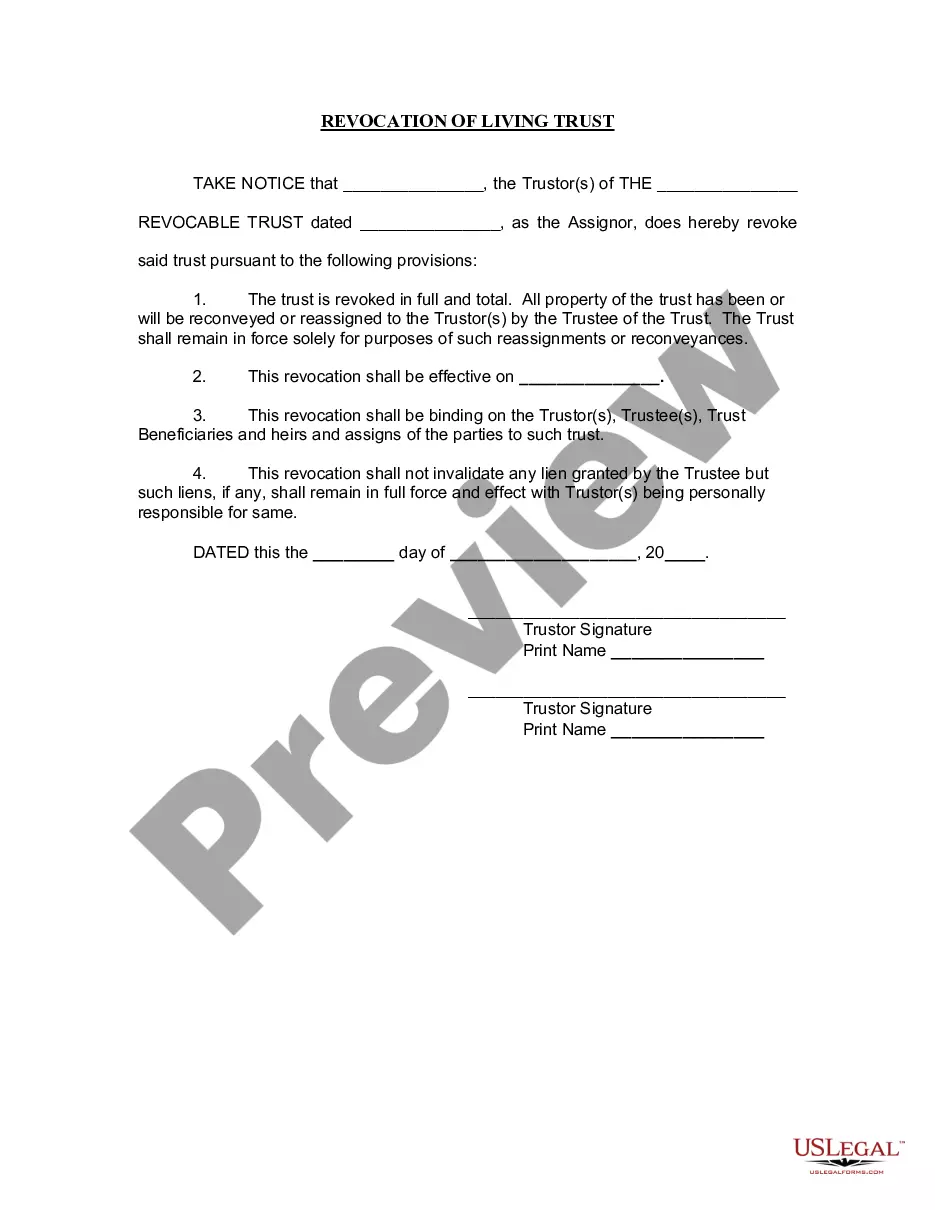

A living trust in Louisiana functions by allowing you to place your assets into the trust during your lifetime, which you can manage or change as needed. Upon your passing, the assets in the trust can be transferred to your beneficiaries without going through the probate process. This means a quicker and more private distribution of your property. Utilizing services like US Legal Forms can ensure that you understand the requirements and benefits of establishing a living trust in Louisiana for property.

To set up a trust for purchasing property in Louisiana, you first need to decide on the type of trust that suits your needs. Generally, a living trust is recommended as it allows you to manage your assets during your lifetime. You will then draft a trust agreement, outlining the terms and appointing a trustee to handle the property. Using a platform like US Legal Forms can simplify this process by providing templates and legal guidance tailored to creating a living trust in Louisiana for property.

Yes, a trust can own property in Louisiana, including real estate like your house. Establishing a living trust in Louisiana for property allows you to designate a trustee who will manage the assets according to your wishes. This can simplify the transfer of your property after your passing and avoid probate, making it a valuable estate planning tool. Be sure to consult a legal expert to guide you through the process.

Living trusts in Louisiana do not need to be recorded unless they hold real estate or are part of a legal proceeding. It's crucial to properly fund and create the trust document while keeping it private. Utilizing platforms such as UsLegalForms can help simplify the process of managing your living trust in Louisiana for property.

In Louisiana, living trusts are not recorded like wills or deeds, as they function mainly as private documents. However, if the trust holds real estate, the property title must reflect the name of the trust, which may involve recording with the local parish's office. To ensure compliance and proper documentation, consult resources like UsLegalForms, which specialize in living trust guidance.

Generally, a living trust does not need to be filed with the court in Louisiana unless it is irrevocable or if it becomes subject to other legal proceedings. However, keeping a copy of the trust document in a safe place is essential. For a smooth establishment of your living trust in Louisiana for property, consider using UsLegalForms for guidance.

A living trust in Louisiana works by allowing the trustor, or creator of the trust, to transfer ownership of their property and assets into the trust. This ensures that the assets are managed according to the terms laid out in the trust document, often providing flexibility in property distribution. The trust helps avoid probate, allowing for a smoother transfer of assets upon the trustor's passing.

One common mistake parents make when setting up a trust fund is failing to fund it properly. Many think merely creating the trust ensures their assets are protected, but they must explicitly transfer assets into the trust. Take the appropriate steps to fund your living trust in Louisiana for property, avoiding future complications.

To place your house in a trust in Louisiana, first, create a living trust document that outlines the details of the trust. You will then need to change the title of your property to reflect the name of the trust. This process may require assistance from a lawyer or a platform like UsLegalForms to ensure all legalities are thoroughly addressed.