Limited Application

Description

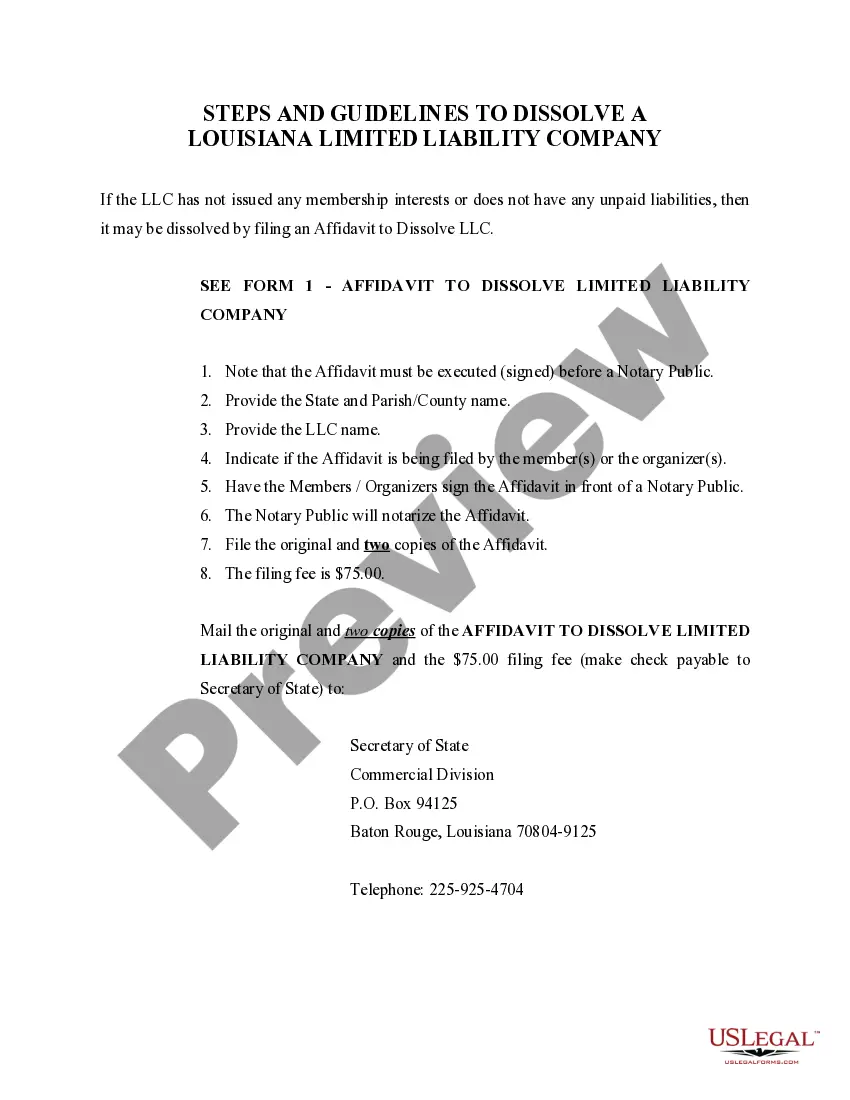

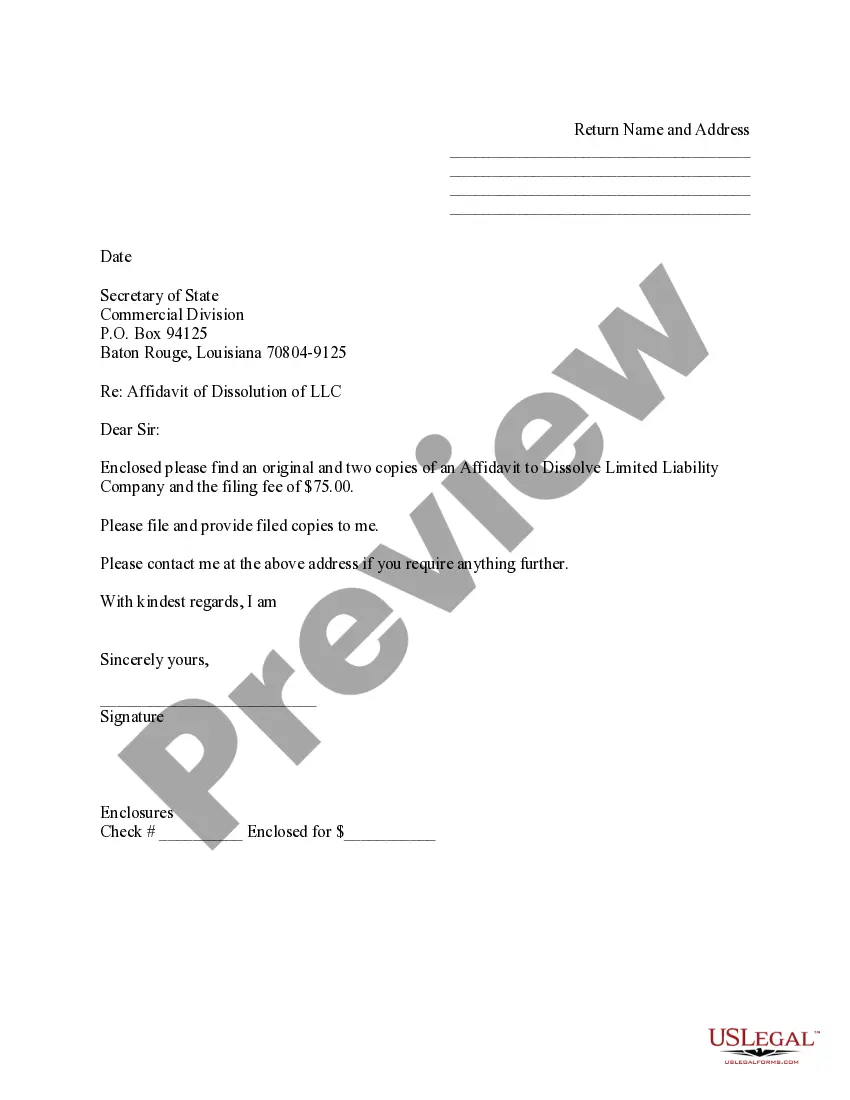

How to fill out Louisiana Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your existing account at US Legal Forms. Ensure your subscription is valid, and if not, renew it as per your payment plan.

- Preview and review the form descriptions thoroughly to confirm they fit your specific legal requirements.

- If necessary, utilize the Search feature to find an alternative template that meets your needs more appropriately.

- Select the desired document by clicking 'Buy Now' and choose a subscription plan that suits your usage.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Download the chosen form directly to your device and access it anytime through the 'My Forms' section of your profile.

By utilizing US Legal Forms, you gain access to an extensive library featuring over 85,000 fillable and editable legal documents. This resource not only saves you time but also empowers you to create legally sound documents with confidence.

Take action today and explore the benefits of US Legal Forms. Start your journey to efficient legal document management now!

Form popularity

FAQ

The primary difference between Ltd and LLC lies in their legal status and operational requirements. Ltd denotes a limited company often governed by corporate law in regions outside the U.S., while LLC represents a U.S.-specific limited liability company with unique tax benefits and operational flexibility. It's essential to understand these distinctions so you can make informed choices for your business's limited application.

The choice between a limited partnership and an LLC often involves how much control you want. An LLC provides limited liability protection to all its members, while a limited partnership consists of general and limited partners with differing levels of control and liability. If you're unsure which structure aligns with your goals, exploring your options through uslegalforms may clarify the benefits in a limited application.

Choosing between Ltd and LLC depends on various factors, including your business goals and location. LLCs offer flexibility in management and pass-through taxation, which many entrepreneurs find beneficial. On the other hand, Ltd structures may provide a perception of greater credibility in certain markets. Assessing these features can help you decide which option suits your limited application needs.

Determining whether your LLC is classified as a member-managed LLC (commonly known as CS) or a manager-managed LLC (referred to as P) hinges on how you operate your business. Often, your operating agreement outlines this classification. If you have questions or need guidance on choosing between styles in a limited application, consider consulting resources like uslegalforms to ensure proper compliance.

While both Ltd and LLC serve as business structures, they are not the same. Ltd, or limited company, is a term commonly used in the UK and other regions, while LLC, or limited liability company, is specific to the United States. Each has its own legal frameworks, tax implications, and operational requirements. Understanding these differences is crucial for anyone exploring their options in a limited application.

The requirements for forming an LLC in Michigan involve filing the Articles of Organization and designating a registered agent. You also need a unique business name that adheres to state rules, along with a proper operating agreement. Meeting these criteria sets the stage for a successful limited application, ensuring your business runs smoothly from the start.

To restrict an app, consider implementing user authentication and access controls to limit who can use the application. You can also apply licensing agreements and terms of service to specify usage rights. By clearly defining these parameters, you effectively manage the app's reach and maintain its integrity. This limited application approach helps in protecting your intellectual property.

Starting an LLC in Michigan requires a few essential steps to comply with state regulations. First, you must choose a distinctive name for your LLC and file the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs. Also, appoint a registered agent who is responsible for receiving legal notices. Following these steps ensures your limited application is on the right track in Michigan.

To start an LLC in Alabama, you must file the Certificate of Formation with the Secretary of State. Additionally, you need a unique business name and a registered agent who can receive legal documents on behalf of your LLC. It's also important to comply with local business licenses and taxes. By meeting these requirements, you create a solid foundation for your limited application.

Starting an LLC offers several benefits, but it also comes with downsides. One key drawback is the costs associated with formation, including state fees and potential legal expenses. Furthermore, while an LLC provides limited liability protection, it may not fully shield you from personal legal issues if you engage in fraud or misconduct. Overall, understanding these challenges helps in making a limited application for your business.