Louisiana Separate Property Agreement With Trust

Description

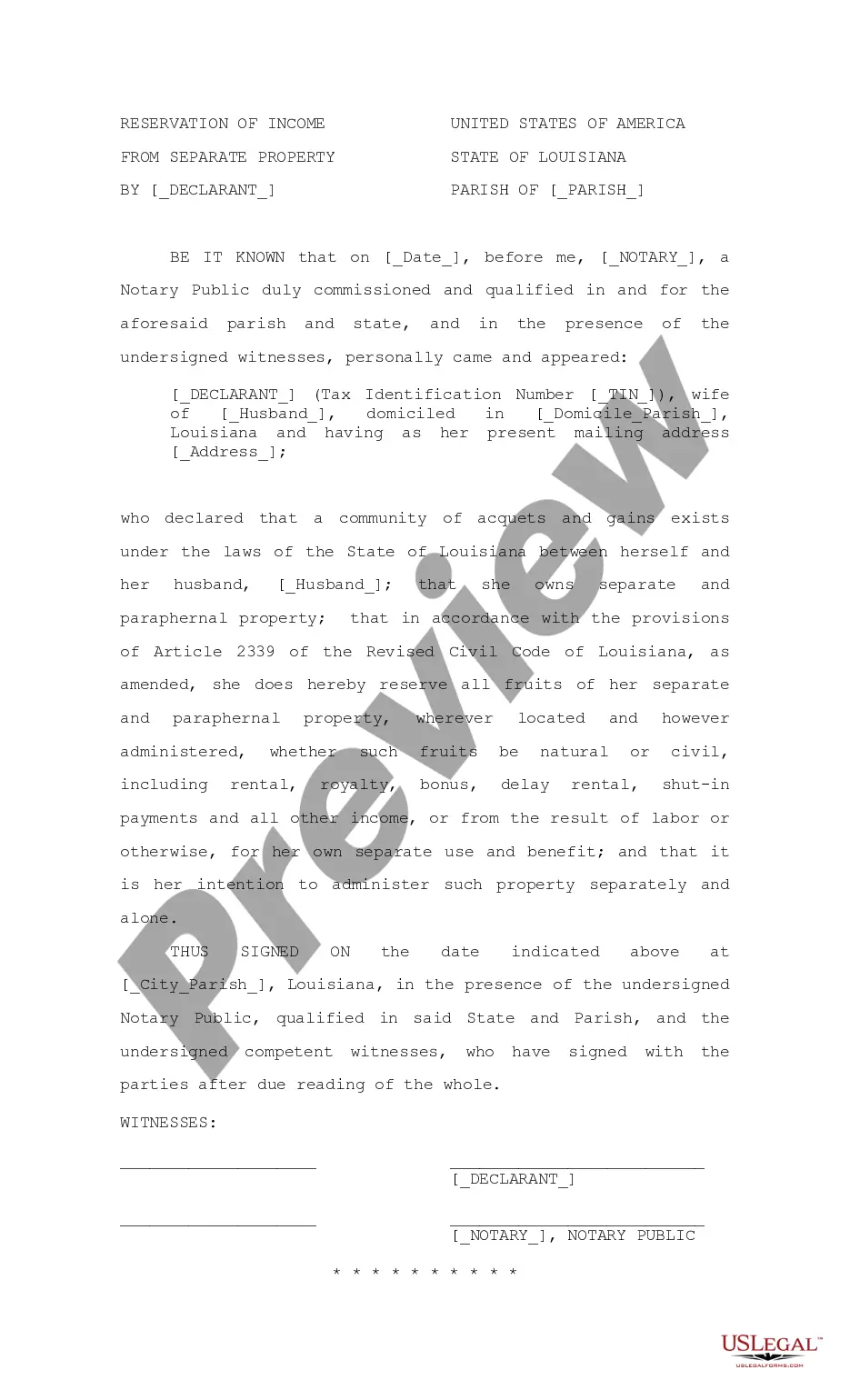

How to fill out Louisiana Reservation Of Income From Separate Property?

Managing legal paperwork and procedures can be a lengthy addition to your day.

Louisiana Separate Property Agreement With Trust and similar forms usually necessitate searching for them and comprehending how to fill them out correctly.

For this reason, whether you are handling financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms readily available will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and a variety of resources to assist you in completing your documents effortlessly.

Is this your first experience with US Legal Forms? Register and create an account within a few minutes, and you’ll have access to the form library and Louisiana Separate Property Agreement With Trust. Then, follow these steps to complete your form: Ensure you have the correct form by utilizing the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the monthly subscription plan that meets your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms boasts 25 years of expertise helping users manage their legal documents. Acquire the form you need today and simplify any process without exerting yourself.

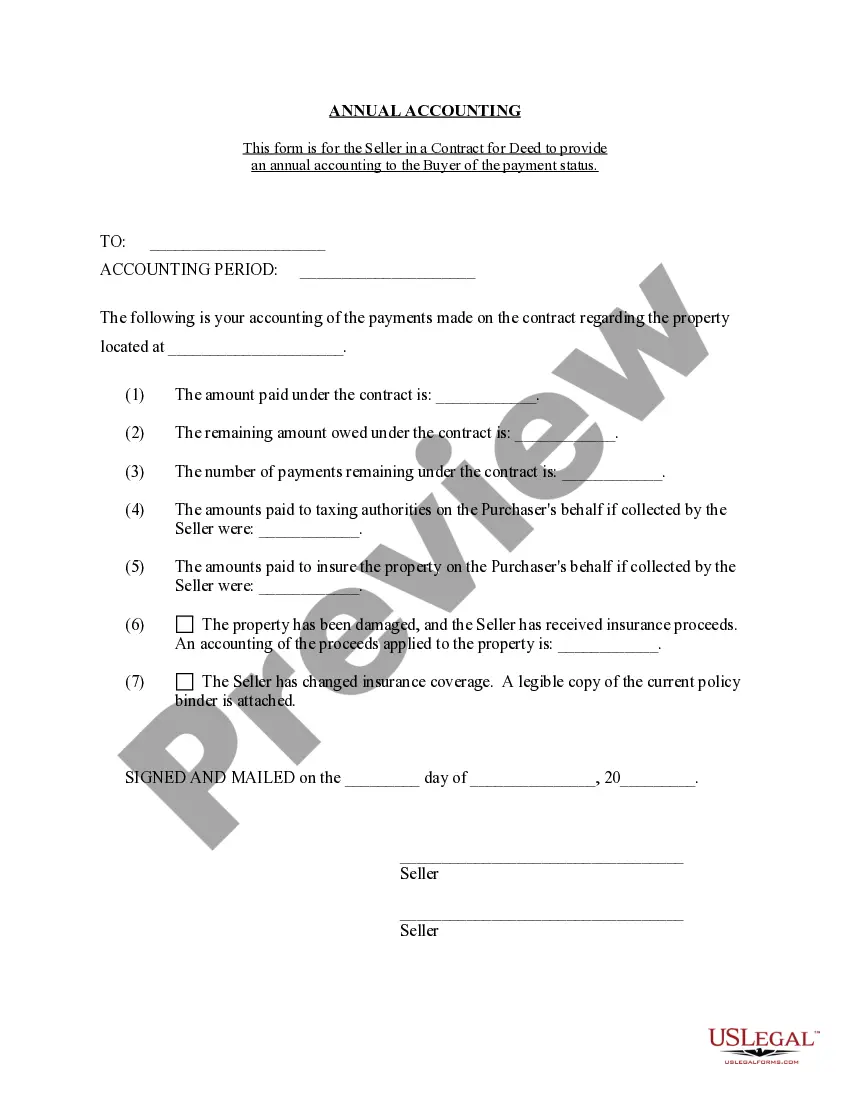

- Browse the library of relevant documents accessible to you with just a single click.

- US Legal Forms gives you state- and county-specific forms available for download at any time.

- Protect your document management processes with a premium service that enables you to prepare any form in minutes without extra or hidden fees.

- Simply Log In to your account, find Louisiana Separate Property Agreement With Trust, and download it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

With separate trusts, when the first spouse dies, their trust becomes irrevocable and a separate tax return must be filed every year. Joint trusts are not subject to higher trust tax brackets, because they do not become irrevocable until the first spouse dies.

Inheritance Laws in Louisiana. Louisiana does not impose any state inheritance or estate taxes. It's also a community property estate, meaning it considers all the assets of a married couple jointly owned.

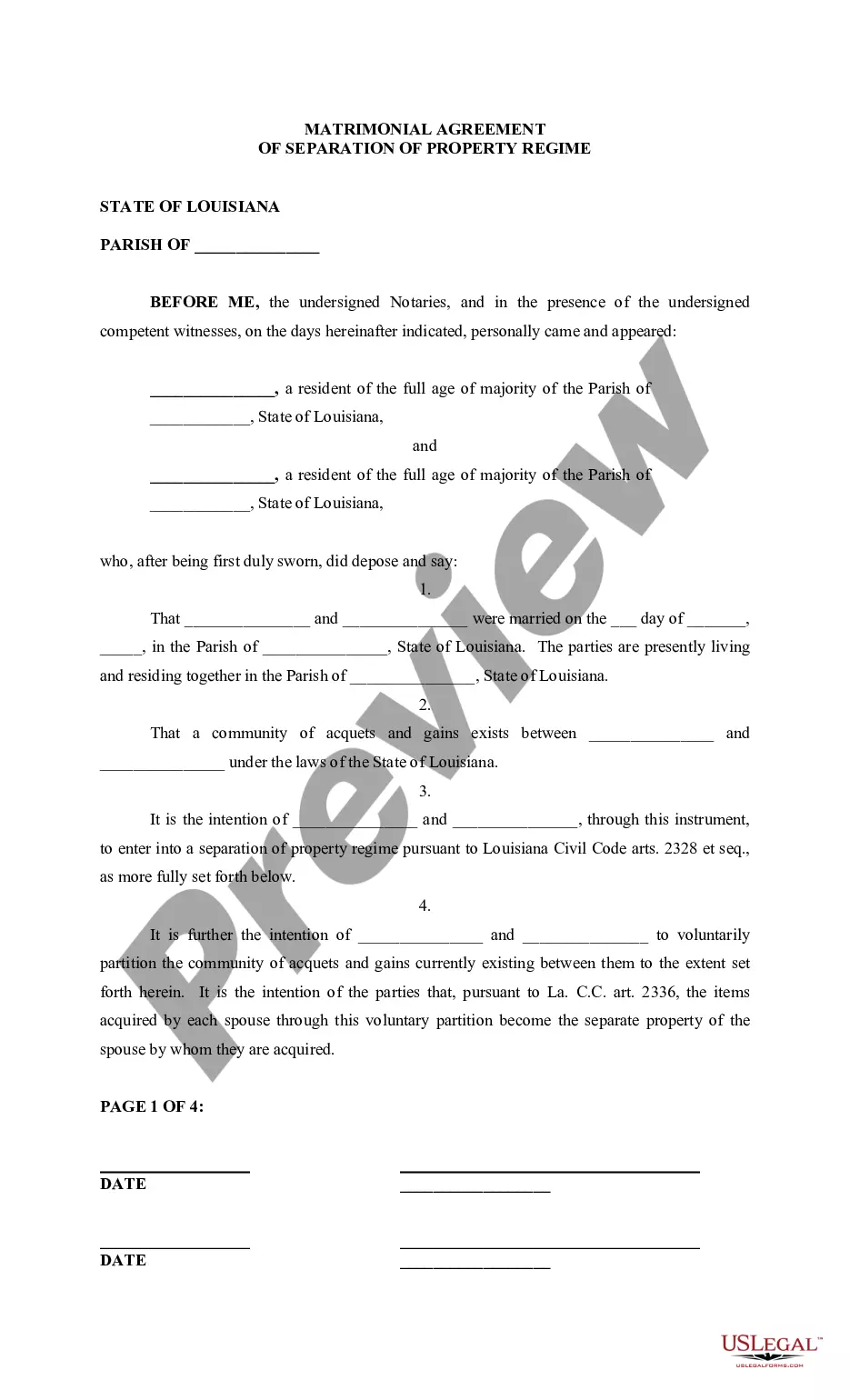

With few exceptions, the court will first value all of a couple's community property and assets. Those assets are then divided so that each spouse receives one-half of all their community property. In some cases, the court may order that certain assets be sold and the proceeds be split equally between the two spouses.

Having assets in a separate property trust allows the settlor (owner) to control their assets independently of their spouse. A person who establishes a separate property trust has sole control, while they are alive and competent, over their assets inside the trust.

Separate property is property belongs exclusively to one of two spouses. Under Louisiana law, assets acquired by a deceased person while unmarried, or acquired during the marriage by gift, is considered to be separate property.