Mortgage Endorsement For Insurance Check

Description

Form popularity

FAQ

In Florida, a mortgage company can hold an insurance check typically until they process the mortgage endorsement for insurance check. This process can take anywhere from a few days to several weeks, depending on the specific circumstances surrounding the claim. It's essential to communicate with your mortgage company regularly to understand their specific timeline and any requirements. For a smoother experience and to get timely information, consider using platforms like US Legal Forms to streamline your documentation needs.

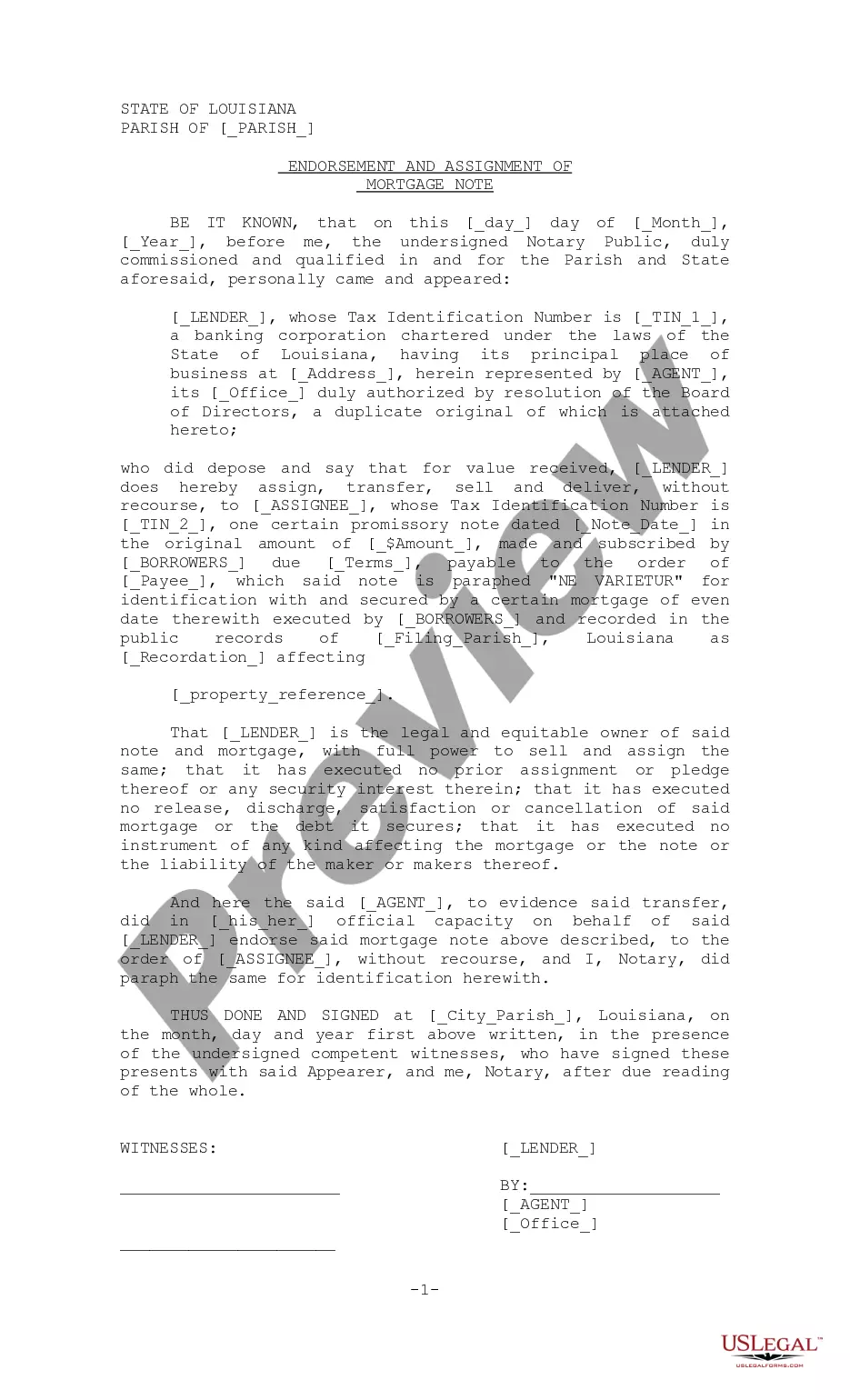

Endorsing an insurance check involves signing your name on the back of the check. Ensure that you provide any additional required information, such as your policy number. This step is vital in the mortgage endorsement for insurance check process, as it enables the proper allocation of funds to cover any claims or expenses.

To endorse an insurance policy, contact your insurance company for specific instructions. They may require a simple written request or direct authorization form. This endorsement is crucial, especially when dealing with the mortgage endorsement for insurance check, as it allows for the transfer of rights to the intended beneficiary.

In cases where a check is made out to two people, both individuals typically need to endorse it. If the check indicates 'and,' both signatures are required. However, if it states 'or,' only one endorsement suffices. Understanding these nuances can help streamline the mortgage endorsement for insurance check process.

In Florida, insurance adjusters must respond to a claim within 14 days of receiving the initial notice. This prompt response is essential for homeowners, as it directly affects the process of securing a mortgage endorsement for insurance check. If your adjuster does not meet this deadline, you may want to follow up, as delays can hinder your access to necessary funds.

Yes, some homeowners insurance companies are withdrawing from the Florida market due to increasing claims and financial risks. This change can create challenges for homeowners navigating their insurance needs, particularly when considering a mortgage endorsement for insurance check. As a reliable resource, USLegalForms can help you find alternative insurance options that meet your requirements.

Yes, you can sue your insurance company if it fails to settle your claim in a reasonable timeframe. If you feel the delay impacts your mortgage endorsement for insurance check or your financial situation, legal action may be a viable option. Consulting with an experienced attorney can provide guidance and help you understand your rights under Florida law.

In Florida, an insurance company typically has 90 days to settle a claim after receiving a completed proof of loss. This timeframe encourages timely resolutions, allowing you to access your funds quickly, especially when dealing with a mortgage endorsement for insurance check. Failure to settle within this period may prompt further action, including potential legal steps to expedite your claim.