Louisiana Bond For Deed

Description

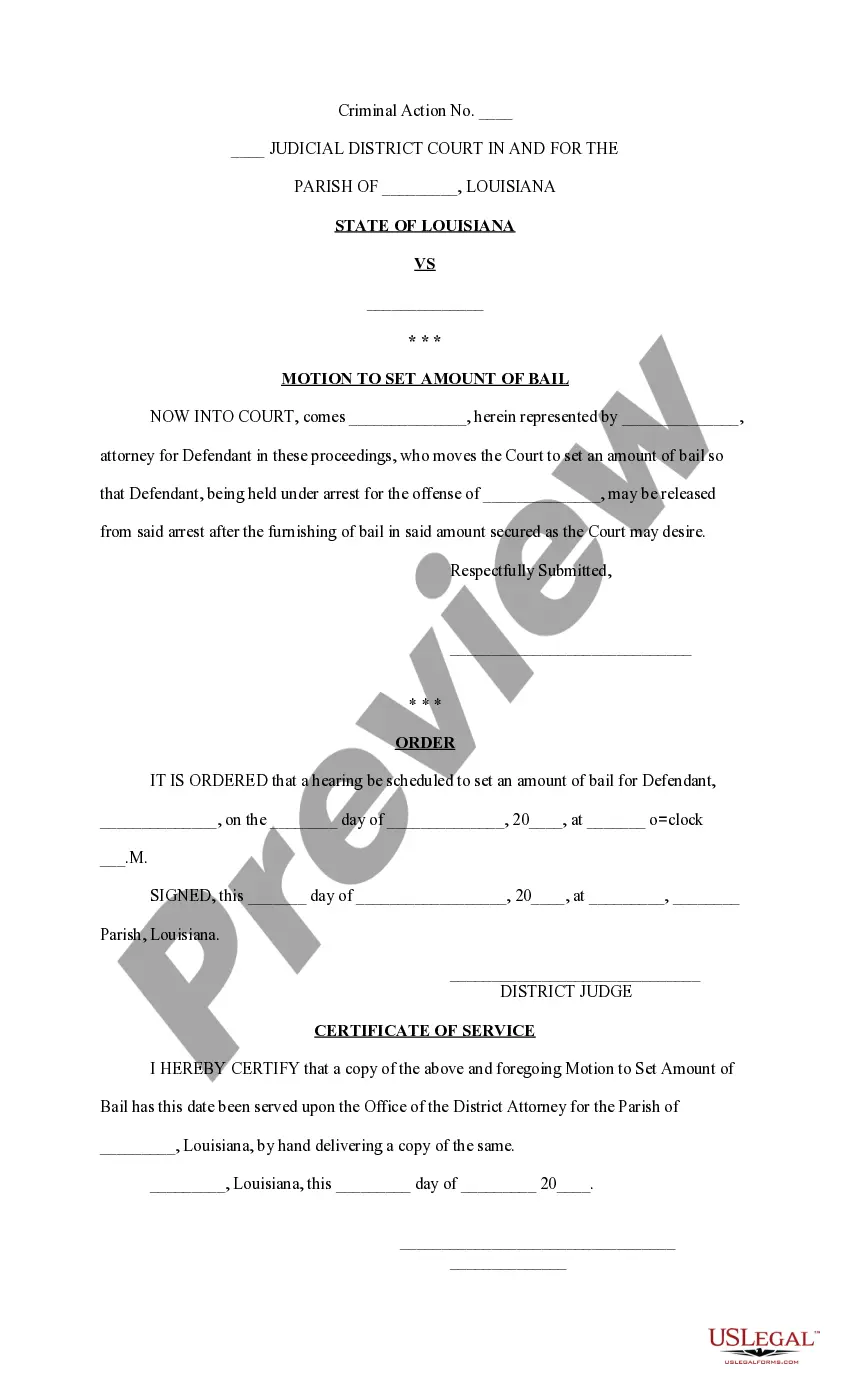

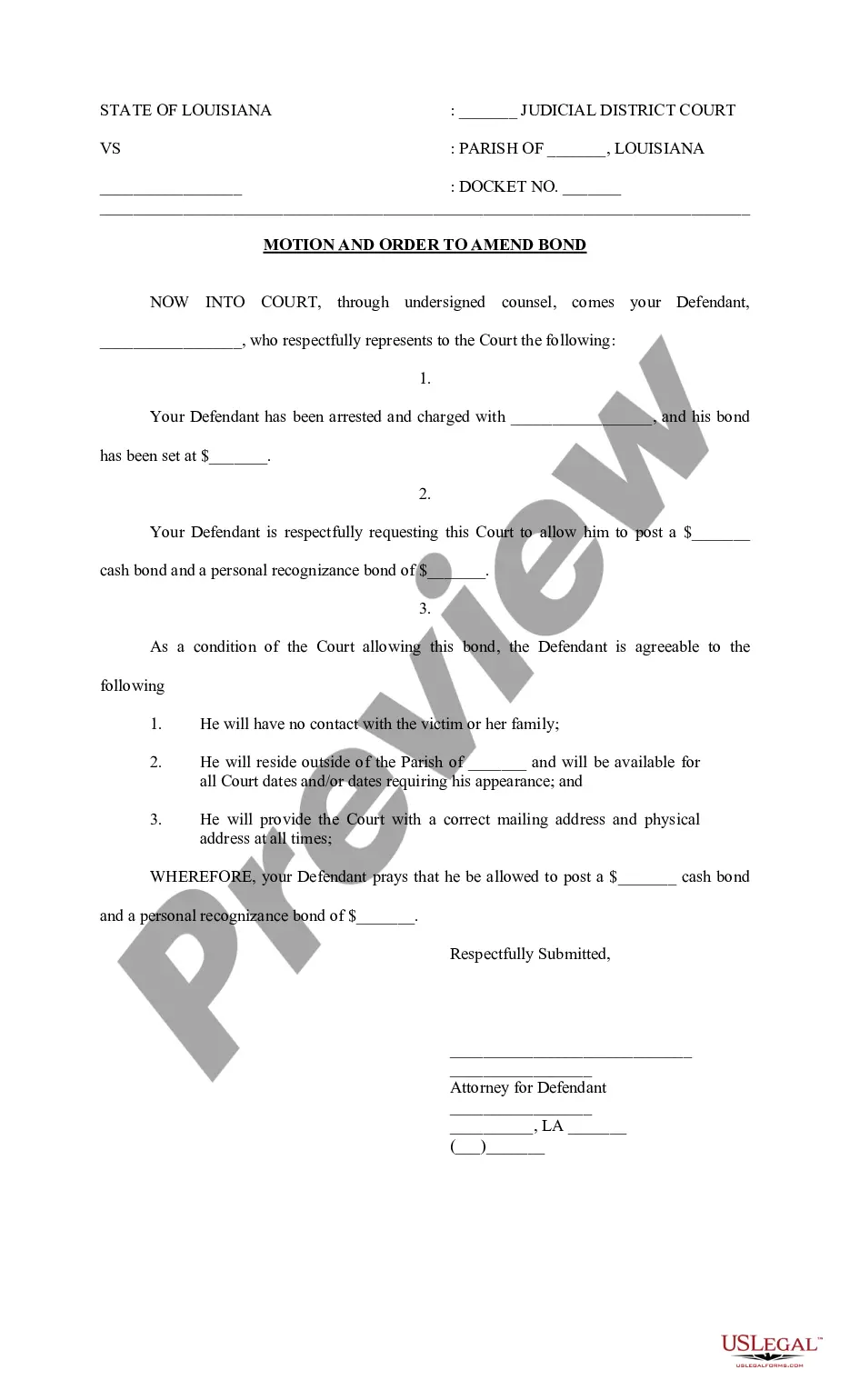

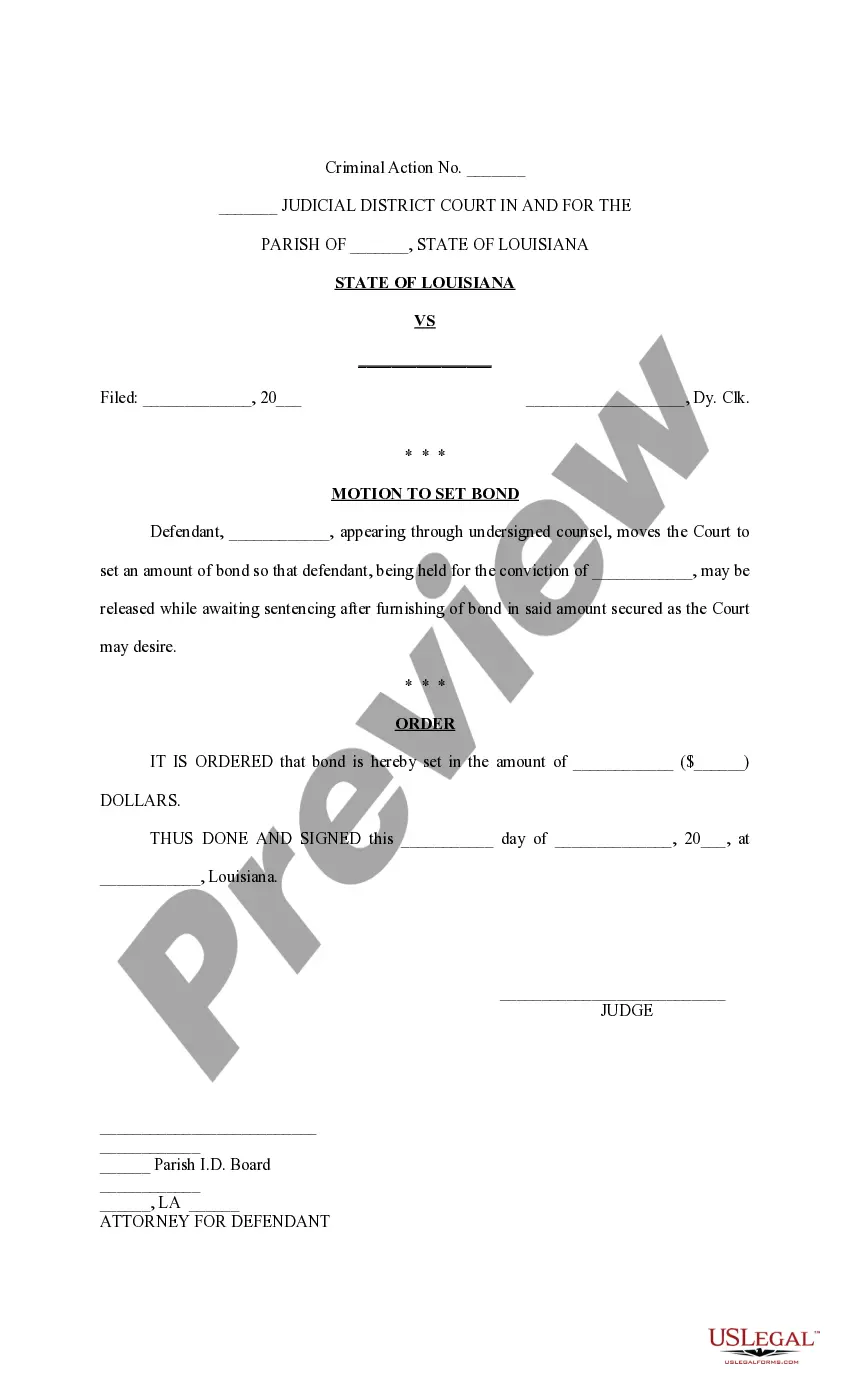

How to fill out Louisiana Motion To Set Bond?

Properly composed official paperwork is one of the crucial assurances for preventing disputes and legal actions, but acquiring it without the help of an attorney may require time.

Whether you need to swiftly locate an up-to-date Louisiana Bond For Deed or any other templates for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Furthermore, you can access the Louisiana Bond For Deed at any time later, as all the documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official paperwork. Try out US Legal Forms right now!

- Ensure that the form is appropriate for your circumstances and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Click Buy Now when you find the suitable template.

- Choose the pricing option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Louisiana Bond For Deed.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

In Louisiana, deeds are commonly referred to as 'actes.' These public records detail the transfer of property ownership and include essential information about the parties involved. It is important to understand the different types of actes when dealing with Louisiana bond for deed transactions, as this can affect your rights and obligations under the agreement.

To cancel a Louisiana bond for deed, you must follow specific legal procedures. Begin by contacting the other party involved in the agreement to discuss cancellation. Then, create a written cancellation agreement and ensure both parties sign it. Finally, file the cancellation document with the appropriate parish office to officially terminate the Louisiana bond for deed.

A property bond in Louisiana allows buyers to acquire real estate through structured payments while the seller keeps ownership until full payment is made. This Louisiana bond for deed arrangement benefits both parties, as sellers can receive steady income, while buyers build equity over time. Buyers must adhere to the terms outlined in the bond, ensuring timely payments to maintain their right to the property. Choosing this route can be a viable option for those unable to secure conventional financing.

A deed in Louisiana serves as a legal document that transfers ownership of property from one party to another. In the context of a Louisiana bond for deed, it establishes the terms under which the buyer makes payments while the seller retains legal title. This arrangement allows buyers to secure property without needing a traditional mortgage. Understanding the intricacies of deeds can help you make informed decisions when purchasing property.

Choosing a Louisiana bond for deed can be an effective option for both buyers and sellers. This arrangement allows buyers to gain equity while making payments, and sellers benefit from retaining ownership until full payment. If you’re considering this route, it’s essential to understand all terms clearly and consult with professionals, like those at USLegalForms, to ensure a smooth process.

To secure a surety bond in Louisiana, start by identifying the type of bond you need based on your specific obligations. Reach out to licensed surety bond companies or agents who can guide you through the application process. They will assess your creditworthiness and may require documentation before issuing the bond, helping you meet any legal obligations associated with your Louisiana bond for deed.

In Louisiana, a bond for deed is a financing arrangement where the buyer makes payments directly to the seller instead of a bank. The seller retains ownership of the title during the payment period, which means they can recover the property if payments are missed. This method can simplify transactions for buyers facing challenges with traditional financing, making it a viable option for many.

Obtaining a property bond in Louisiana typically involves finding a seller willing to enter into a bond for deed agreement. Start by searching for properties that are listed for seller financing. Once you identify a potential property, engage in discussions with the seller to establish mutual terms and secure the bond agreement, ensuring that both parties are satisfied with the arrangement.

To establish a property bond in Louisiana, begin by drafting a formal agreement detailing the terms of the transaction. This agreement should outline the payment schedule, interest rates, and any additional conditions that both parties must meet. Additionally, consider consulting with a legal professional to ensure compliance with Louisiana laws and to draft a bond for deed that protects your interests.

In Louisiana, a bond is typically determined by assessing the value of the property and the obligations associated with it. Legal standards dictate how these values are calculated, often involving an appraisal or assessment of comparable properties. This process ensures that both parties involved in a Louisiana bond for deed agree on the property's value, establishing a fair basis for the transaction.