Process Server For Debt Collection

Description

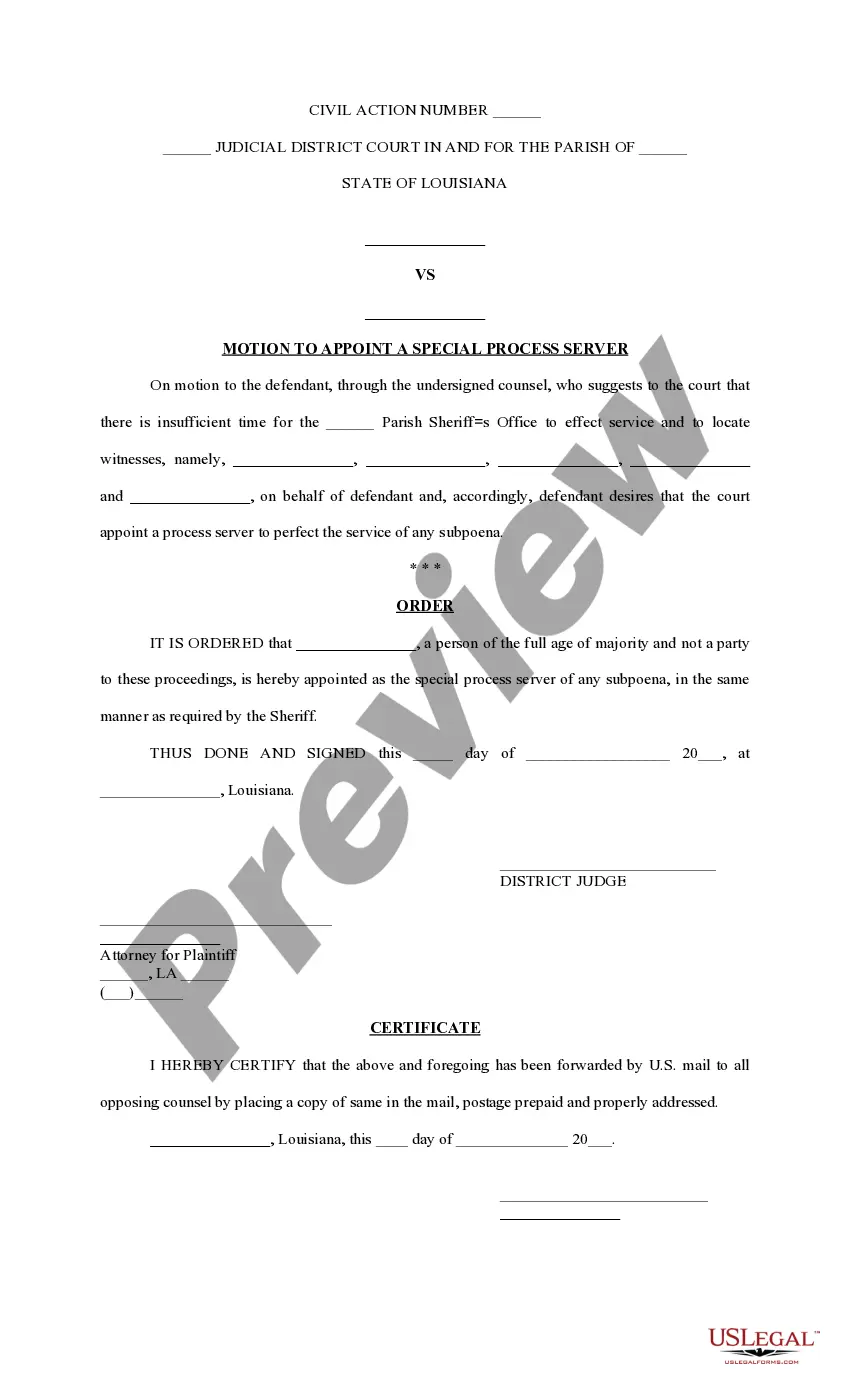

How to fill out Louisiana Motion To Appoint Special Process Server?

Handling legal paperwork and procedures can be a lengthy addition to your day.

Process Server For Debt Collection and similar forms often necessitate searching for them and comprehending how to fill them out proficiently.

For this reason, whether you are managing financial, legal, or personal affairs, utilizing a comprehensive and user-friendly online library of forms at your disposal will greatly assist.

US Legal Forms is the premier online resource for legal templates, providing more than 85,000 state-specific forms and a range of tools to help you complete your documents effortlessly.

Is this your first experience with US Legal Forms? Register and create a free account in a matter of minutes, granting you access to the form library and Process Server For Debt Collection. Then, follow the steps below to finalize your form: Ensure you have located the correct form using the Review option and checking the form details. Choose Buy Now when ready, and select the subscription plan that meets your requirements. Click Download then complete, sign, and print the form. US Legal Forms has 25 years of expertise aiding clients in managing their legal documents. Obtain the form you need today and streamline any process effortlessly.

- Explore the collection of pertinent documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your documents management processes by utilizing a high-quality service that enables you to create any form in minutes without additional or concealed fees.

- Simply Log In to your account, find Process Server For Debt Collection, and obtain it immediately from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

You may settle your case at any time prior to having the court make a decision (a judgment) by either: Paying the full amount of the debt (plus any fees, costs, and interest required) Negotiating to pay a lesser amount and having the other side agree to accept that amount as full payment.

Hear this out loud PauseSend a letter of demand to the debtor with the exact amount owed, detailed instructions on how to pay and a deadline by which to pay. Start court proceedings and give the debtor at least 14 days to respond.

Hear this out loud PauseOnce you receive the validation information or notice from the debt collector during or after your initial communication with them, you have 30 days to dispute all or part of the debt, if you don't believe that you owe it. If you receive a validation notice, the end date of the 30-day period will be specified.

Hear this out loud PauseThe creditor or its attorney will serve you with a court summons and a copy of the Petition after filing the Petition with the court. The summons lets you know that the creditor has initiated the legal process. Often, the summons will come from a third-party debt collector instead of the original creditor.

Is it Possible to Settle a Debt After Receiving a Summons? Yes, you can settle a debt after being served with a lawsuit by a creditor.