Requesting Mortgage Online Without Credit Check

Description

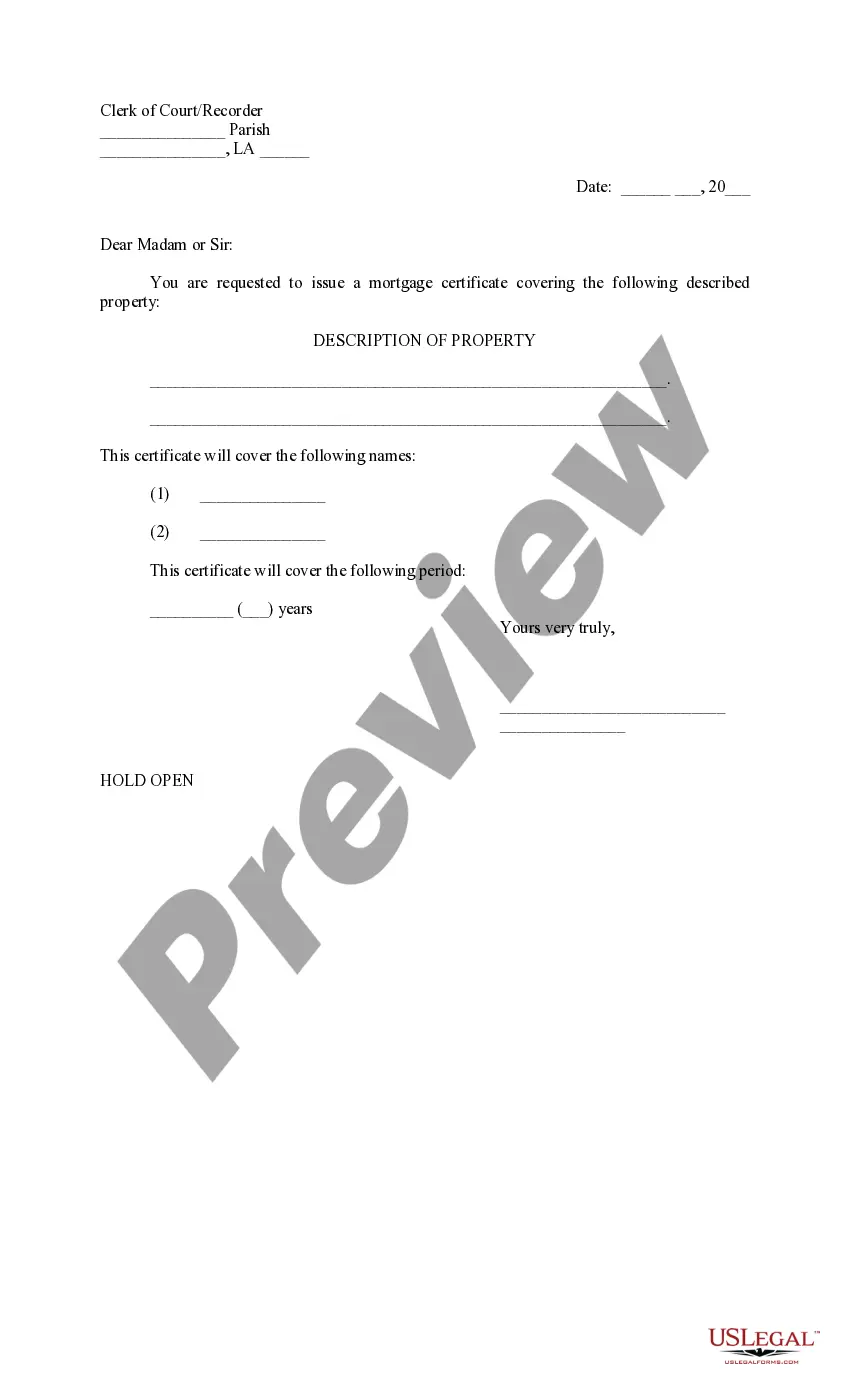

How to fill out Louisiana Letter To Clerk Of Court Requesting Issuance Of Mortgage Certificate?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, beginning from picking the correct form template. For example, if you select a wrong version of the Requesting Mortgage Online Without Credit Check, it will be turned down once you submit it. It is therefore crucial to have a reliable source of legal files like US Legal Forms.

If you need to get a Requesting Mortgage Online Without Credit Check template, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to locate the Requesting Mortgage Online Without Credit Check sample you require.

- Get the file when it meets your needs.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Choose the document format you want and download the Requesting Mortgage Online Without Credit Check.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time looking for the appropriate sample across the web. Take advantage of the library’s simple navigation to get the proper template for any situation.

Form popularity

FAQ

Hear this out loud PauseAll of this said, some lenders use the terms ?prequalification? and ?preapproval? interchangeably. Be sure to confirm the prequalification doesn't require a hard credit check before moving forward.

A mortgage prequalification is like a preapproval, but it may not be as accurate. With a prequalification, you won't have to provide as much financial information, and your lender won't pull your credit. Without your credit report, your lender can only give you rough estimates.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

3 Things Never to Say to Your Mortgage Lender You don't want to tell the mortgage lender that the house is in disrepair. You also don't want to suggest you don't know where your down payment money is coming from. Finally, don't give your lender reason to worry if your income will stay stable.

You can attempt to get a loan by talking with the bank or credit union you've been working with about any kind of deals they could offer an established member. Other viable options include having a co-signer, using a credit builder loan or borrowing from friends or family members.