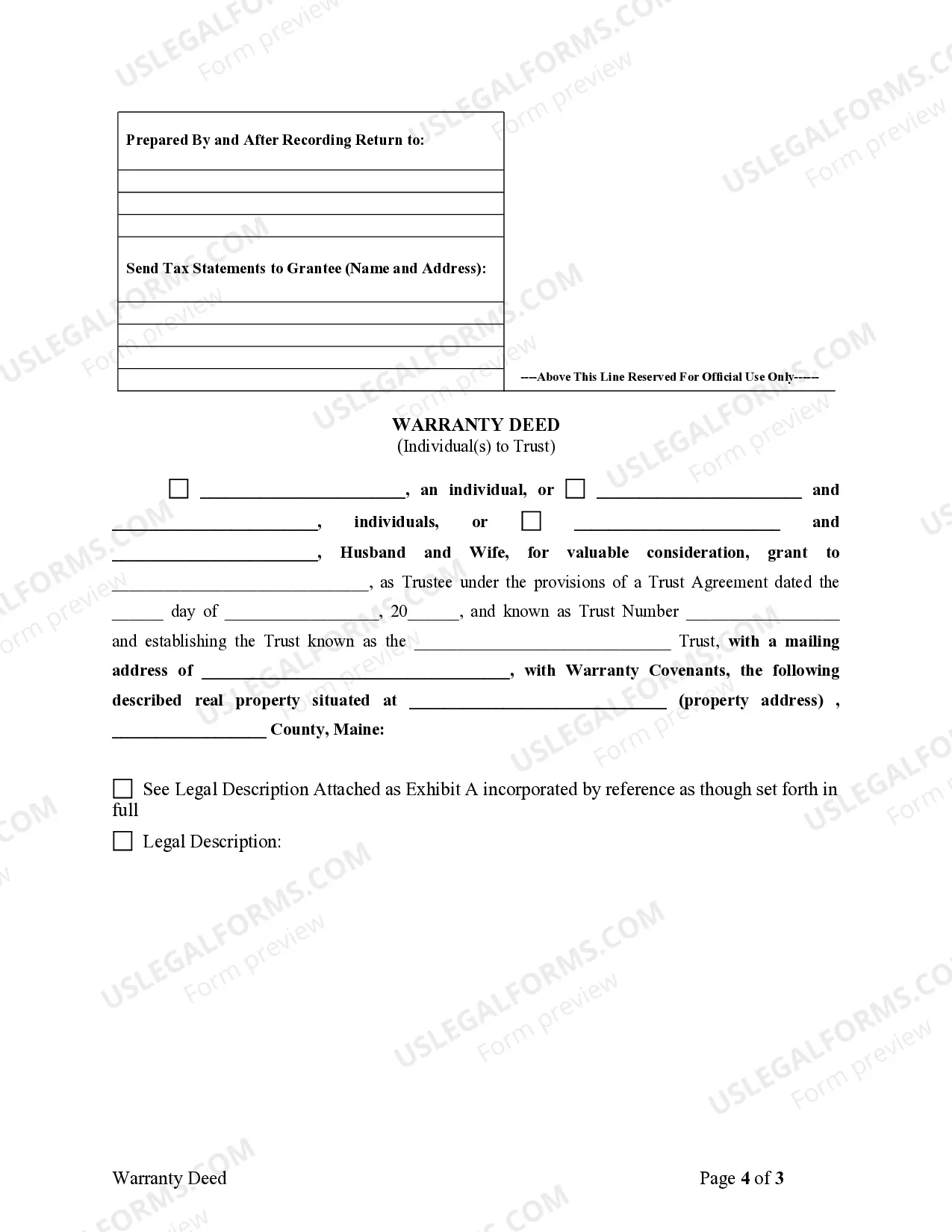

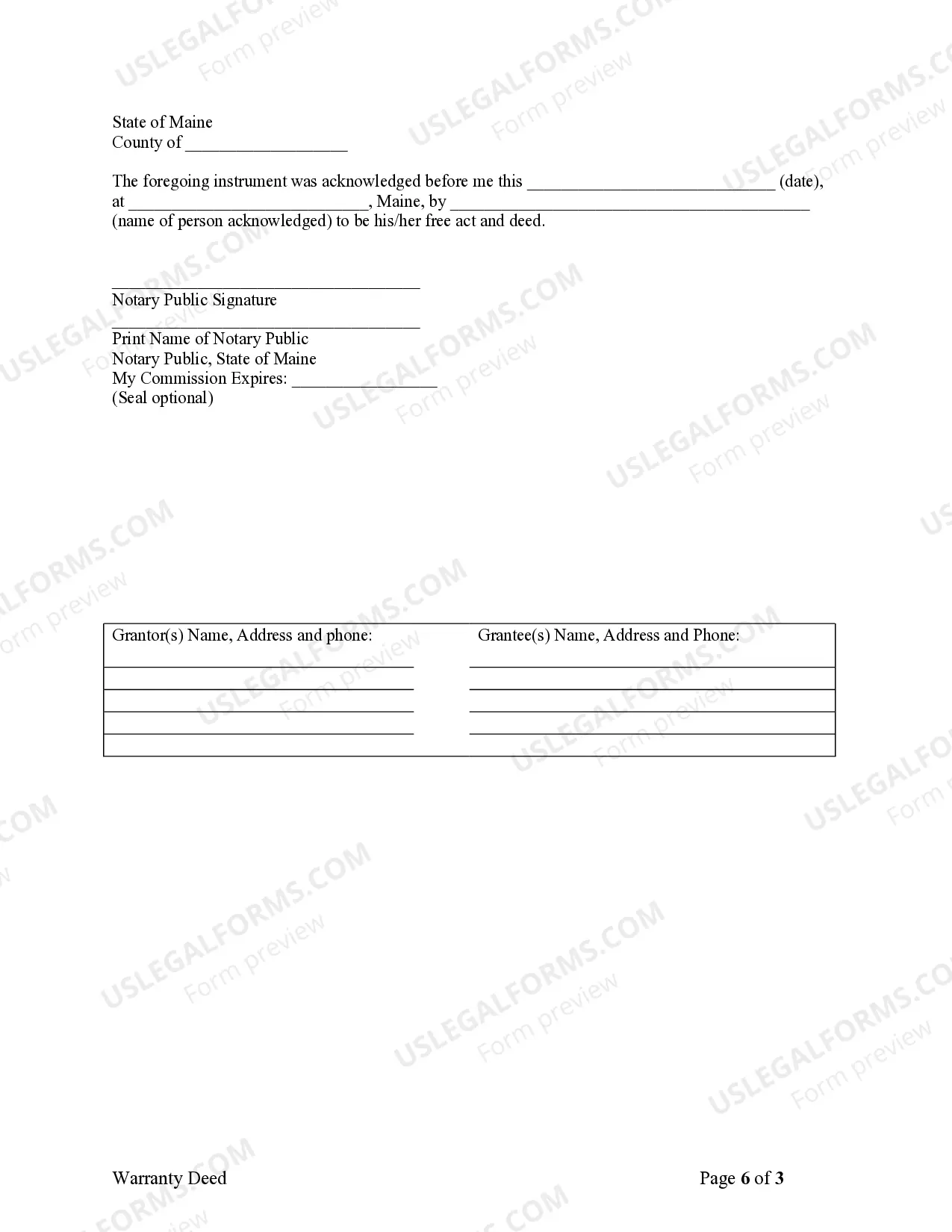

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust.

Maine Warranty Deed from Individuals to a Trust

Description

How to fill out Maine Warranty Deed From Individuals To A Trust?

Amid countless complimentary and paid instances that you discover online, you cannot guarantee their precision and dependability.

For instance, who developed them or whether they possess the expertise necessary to manage what you need from them.

Stay composed and make use of US Legal Forms! Find Maine Warranty Deed from Individuals to a Trust templates crafted by experienced attorneys and evade the costly and prolonged task of searching for a lawyer and subsequently compensating them to create a document for you that you can obtain yourself.

Once you’ve registered and purchased your subscription, you can employ your Maine Warranty Deed from Individuals to a Trust as many times as needed or for as long as it remains valid in your area. Modify it using your preferred offline or online editor, complete it, sign it, and produce a hard copy. Accomplish more for less with US Legal Forms!

- Verify that the document you locate is acceptable in your region.

- Examine the template by perusing the description using the Preview feature.

- Press Buy Now to initiate the purchase process or seek another template using the Search box in the header.

- Select a pricing option and register an account.

- Complete the subscription payment via your credit/debit card or Paypal.

- Retrieve the form in your desired file format.

Form popularity

FAQ

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

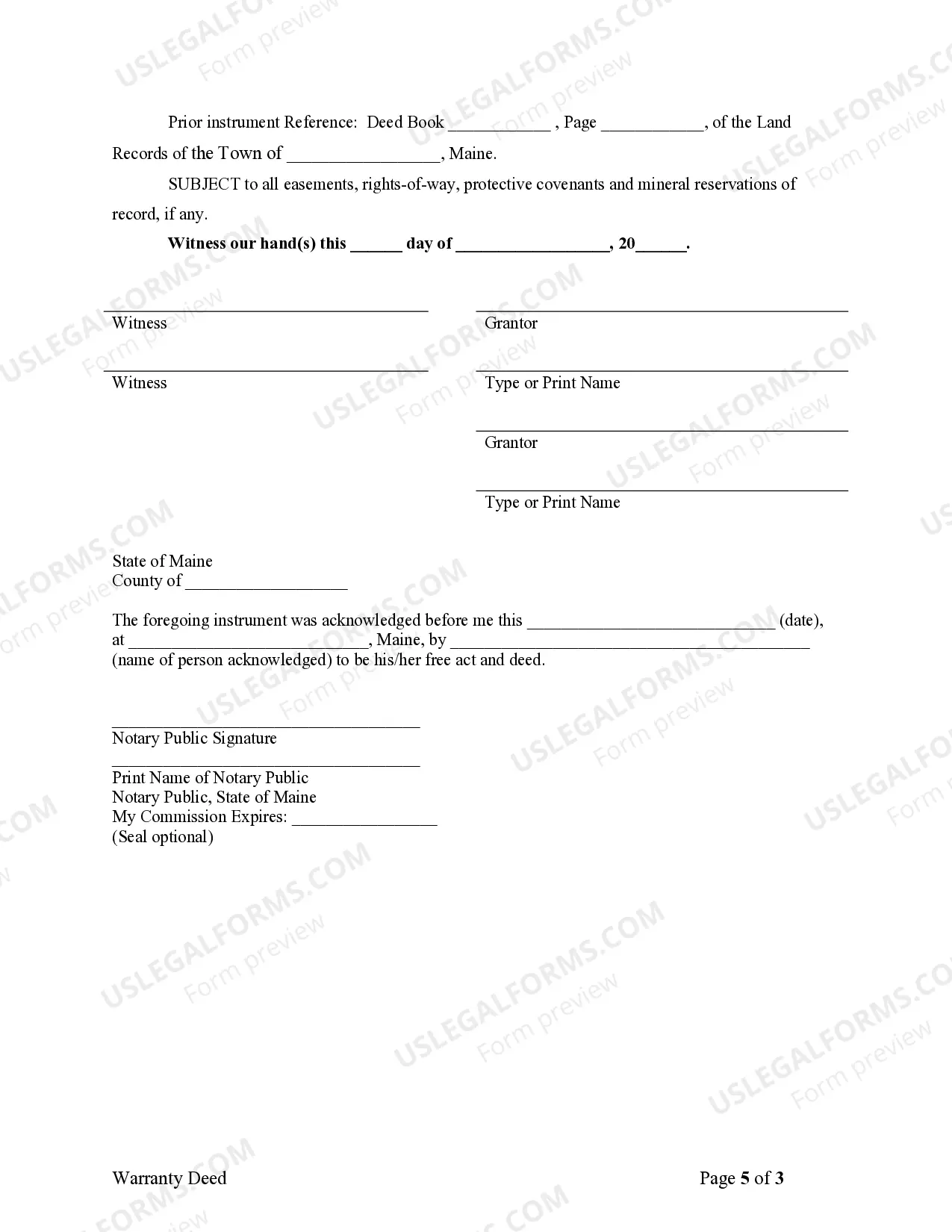

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A trustee deed offers no such warranties about the title.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.