Requesting Mortgage Online With Amortization

Description

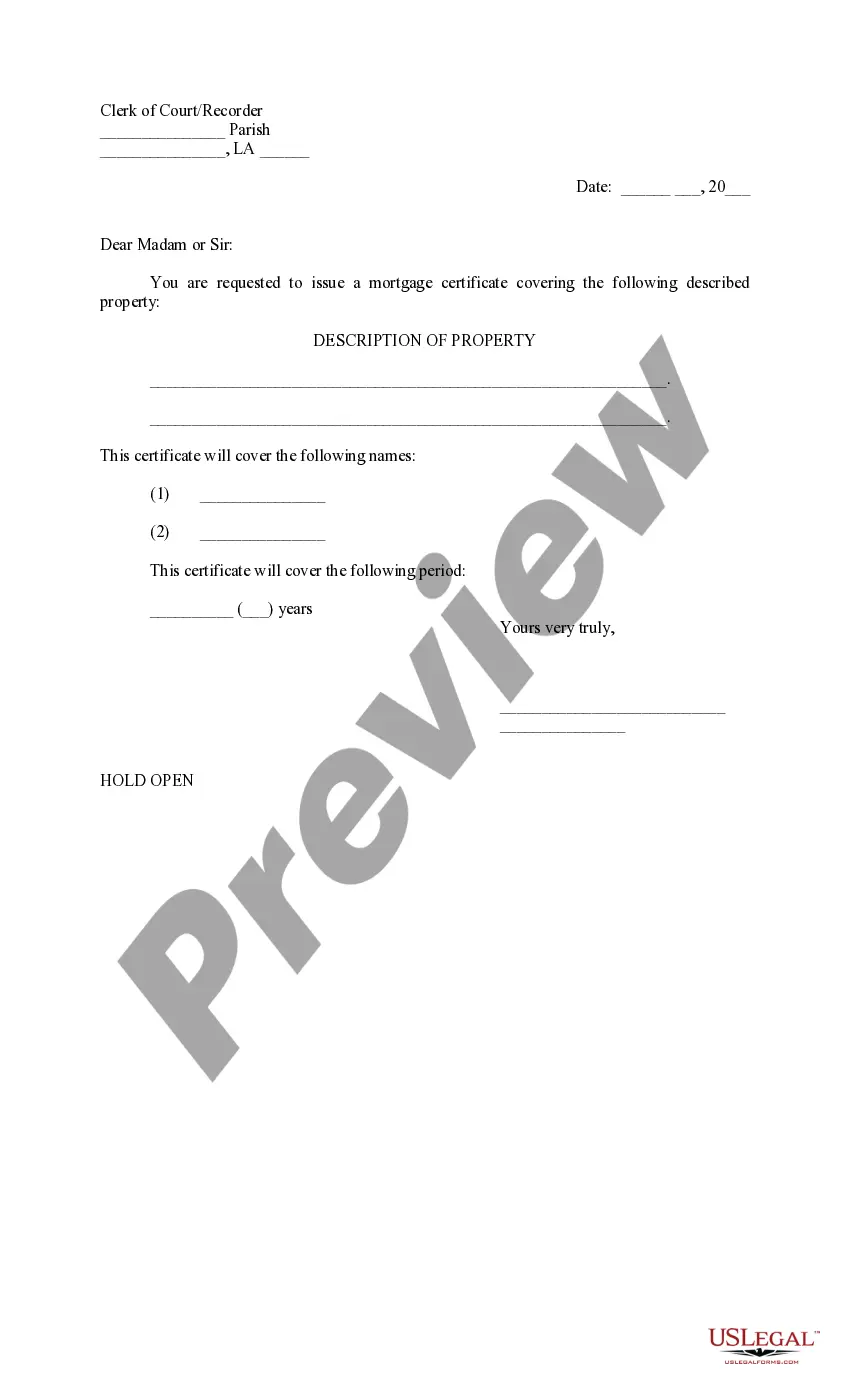

How to fill out Louisiana Letter To Clerk Of Court Requesting Issuance Of Mortgage Certificate?

Handling legal documents and procedures could be a time-consuming addition to your day. Requesting Mortgage Online With Amortization and forms like it usually require you to search for them and understand the best way to complete them properly. As a result, if you are taking care of financial, legal, or individual matters, using a extensive and practical online library of forms when you need it will greatly assist.

US Legal Forms is the top online platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to assist you complete your documents effortlessly. Explore the library of appropriate documents accessible to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your papers management procedures with a high quality service that allows you to prepare any form in minutes without having additional or hidden cost. Simply log in to the profile, locate Requesting Mortgage Online With Amortization and download it right away from the My Forms tab. You may also access formerly downloaded forms.

Would it be your first time utilizing US Legal Forms? Register and set up an account in a few minutes and you will have access to the form library and Requesting Mortgage Online With Amortization. Then, adhere to the steps below to complete your form:

- Make sure you have found the right form using the Review feature and reading the form description.

- Select Buy Now once all set, and select the subscription plan that is right for you.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has 25 years of expertise assisting users manage their legal documents. Get the form you require today and streamline any process without having to break a sweat.

Form popularity

FAQ

If an amortization schedule is not provided to you, you can ask them for one. You can also create your own schedule using an amortization schedule calculator available for free, online.

How to calculate loan amortization. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

Subtract the residual value of the asset from its original value. Divide that number by the asset's lifespan. The result is the amount you can amortize each year. If the asset has no residual value, simply divide the initial value by the lifespan.

For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12. For example, a four-year car loan would have 48 payments (four years × 12 months).

The first column will be ?Payment Amount.? The second column is ?Interest Rate,? and it's optional if you're using a pen and paper. The third column is ?Remaining Loan Balance.? The fourth column is ?Interest Paid.? ?Principal Paid? is the fifth column, and ?Month/Payment Period? is the sixth and last column.