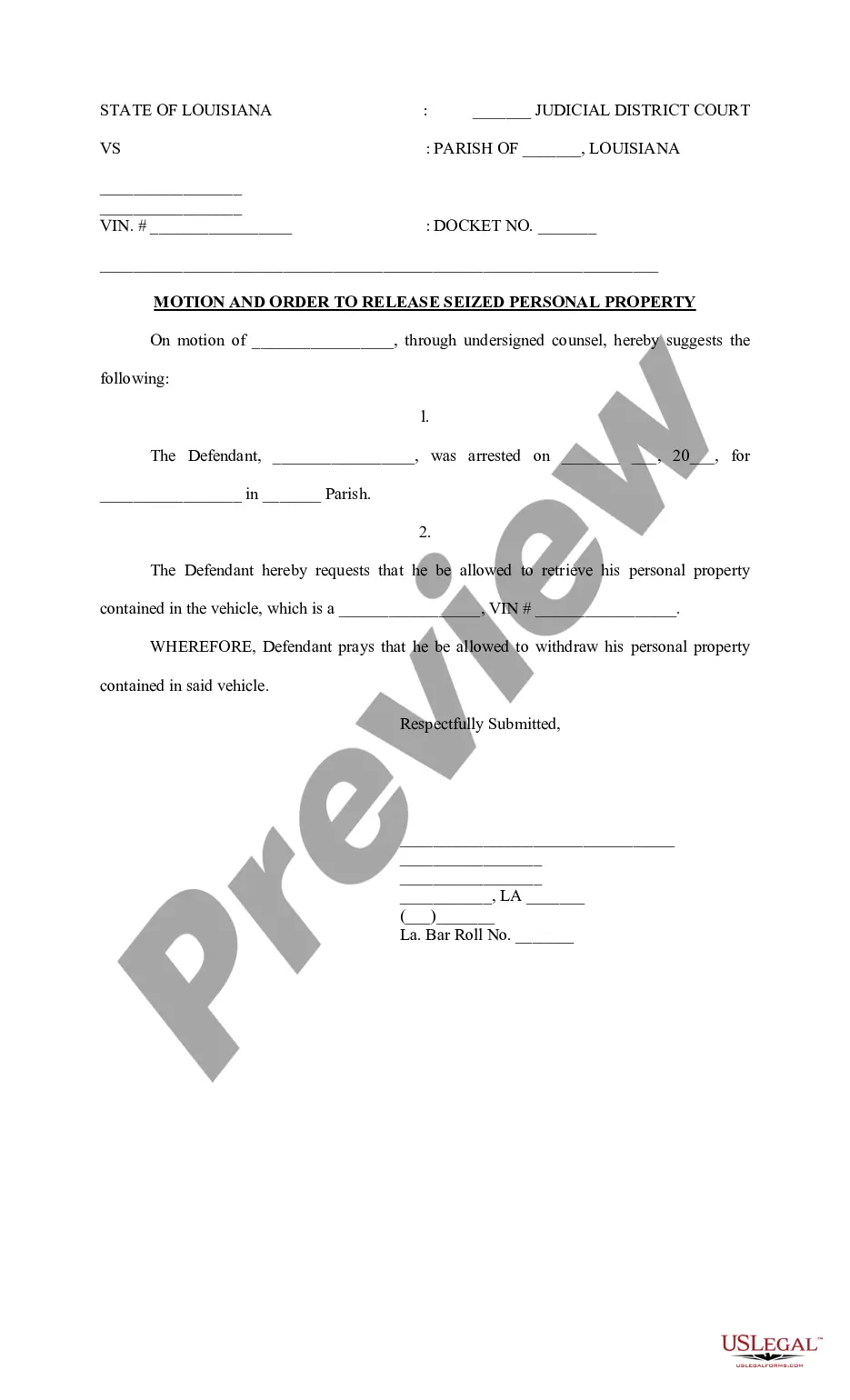

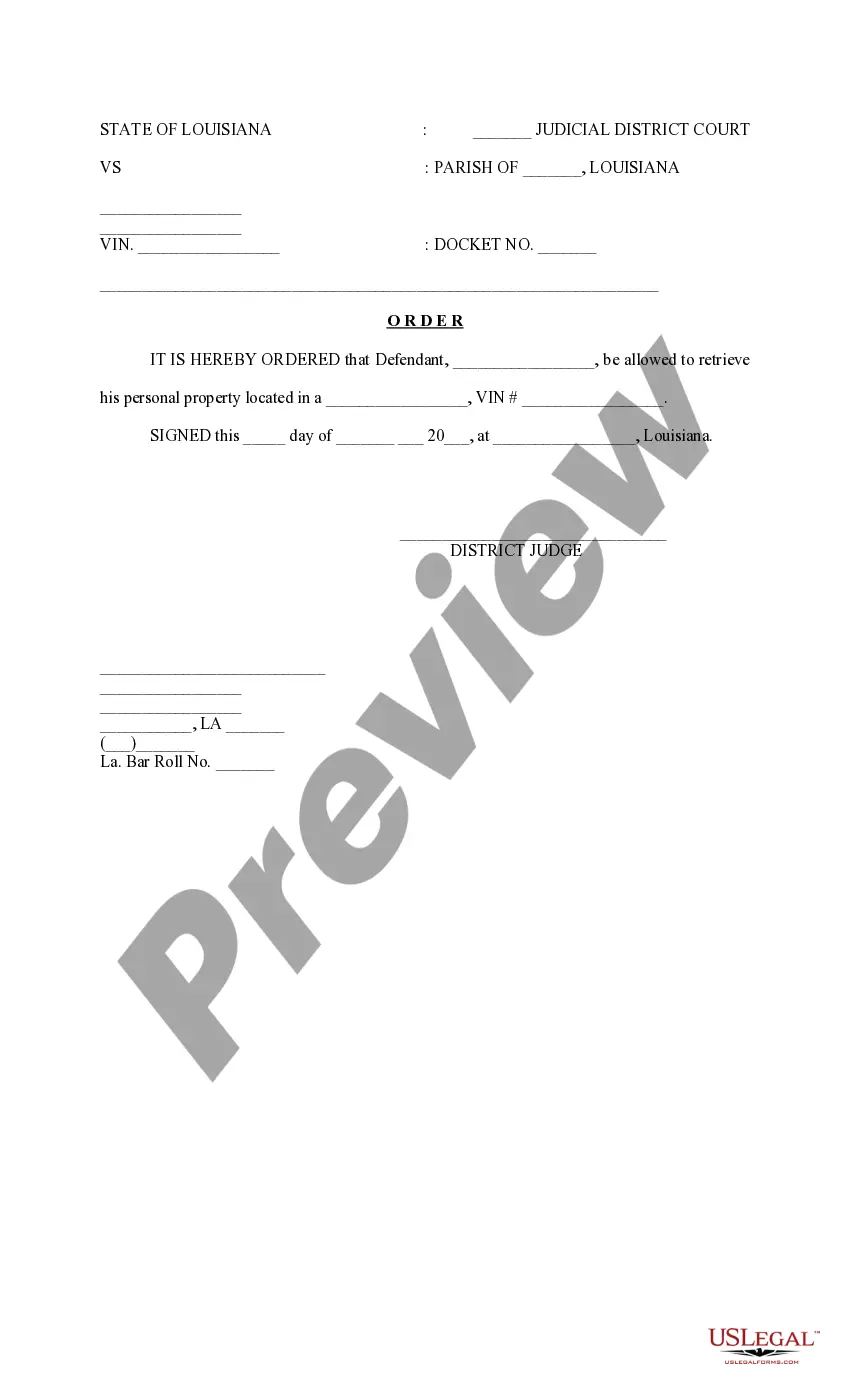

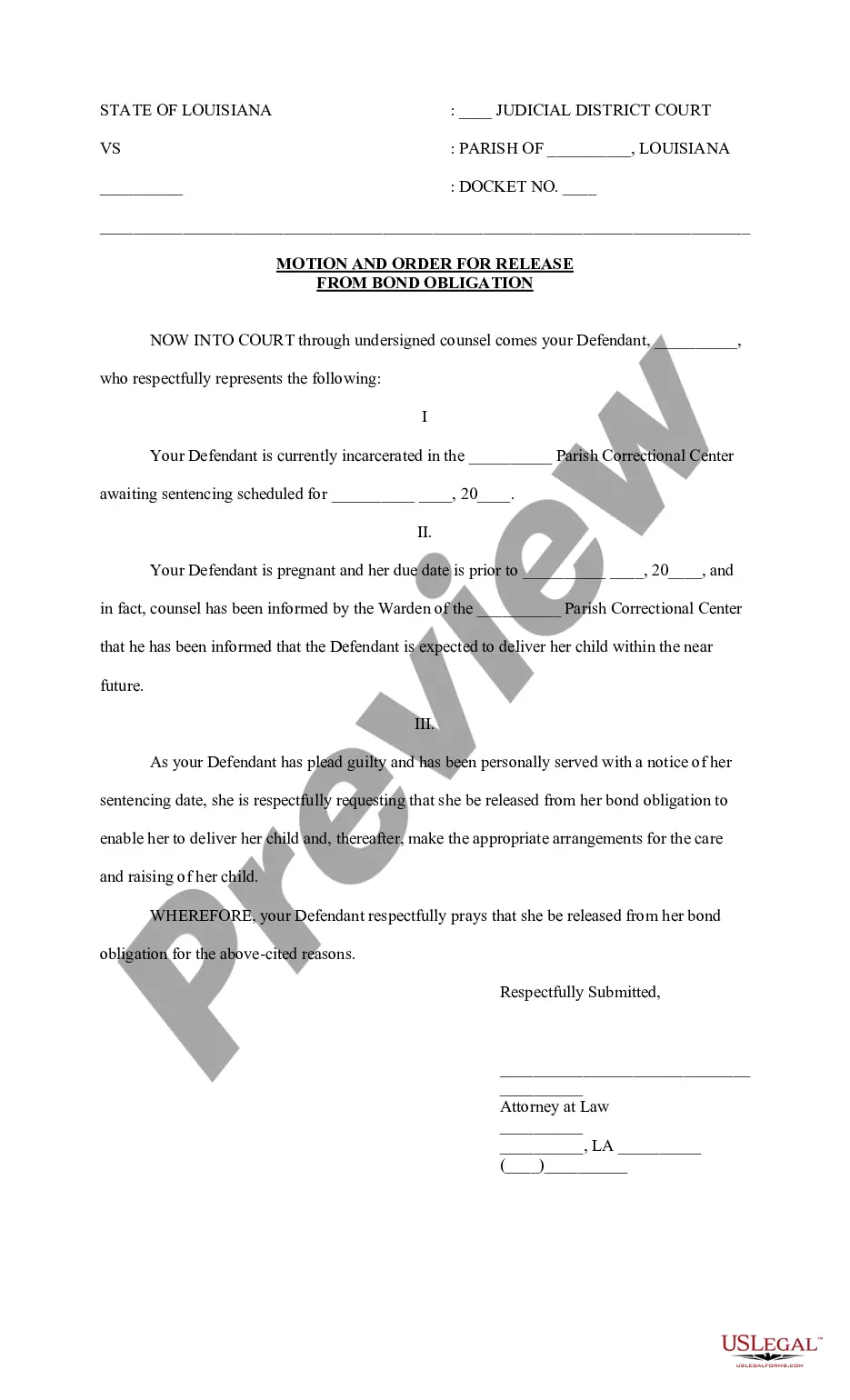

Sample Motion For Return Of Property With Liabilities

Description

How to fill out Louisiana Motion And Order To Release Seized Personal Property?

Creating legal documents from scratch can frequently be intimidating.

Certain situations may require numerous hours of investigation and significant financial investment.

If you’re looking for a simpler and more cost-effective method of preparing Sample Motion For Return Of Property With Liabilities or any other forms without unnecessary obstacles, US Legal Forms is perpetually at your service.

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can rapidly obtain state- and county-specific forms carefully prepared for you by our legal experts.

Examine the form preview and descriptions to confirm that you have found the form you seek.

- Utilize our website whenever you need a dependable and trustworthy service through which you can effortlessly locate and download the Sample Motion For Return Of Property With Liabilities.

- If you’re familiar with our services and have previously established an account, simply Log In to your account, find the template and download it or re-download it at any time in the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to create one and explore the library.

- But before diving directly into downloading Sample Motion For Return Of Property With Liabilities, adhere to these suggestions.

Form popularity

FAQ

NJ Domestic For-Profit Corporation (DP) NJ Domestic Professional Corporation (PA)

Starting a New Jersey LLC, step-by-step Choose an LLC Name. Select a Registered Agent. File a Certificate of Formation/Public Records Filing. Create an Operating Agreement. Get an EIN. File a Business Registration Application.

To start a limited liability company in New Jersey, you'll need to pay a $125 fee to the New Jersey Department of the Treasury's Division of Revenue and Enterprise Services.

N.J. Department of Treasury - Division of Revenue, On-Line Inquiry. To verify the registration status of your business and obtain a Business Registration Certificate, enter the Name Control and one of the following: Taxpayer Identification Number; or Business Entity Identification Number.

You can complete and submit this form online, by mail, or by fax. If you file online, the state will process your application within 1 to 2 days of receiving it. If you file by mail or fax without expediting, you could be waiting for up to 9 weeks. The filing fee is for an LLC is $125.

Main drawbacks: More expensive to create than a partnership or sole proprietorship. State laws for creating LLCs may not reflect the latest federal tax changes. Inability to obtain VC funding. Inability to provide employees with stock options.

To start an LLC in New Jersey, you'll need to choose a New Jersey registered agent, file business formation paperwork with the New Jersey Division of Revenue, and pay a $125 state filing fee.

You can find information on any corporation or business entity in New Jersey or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.