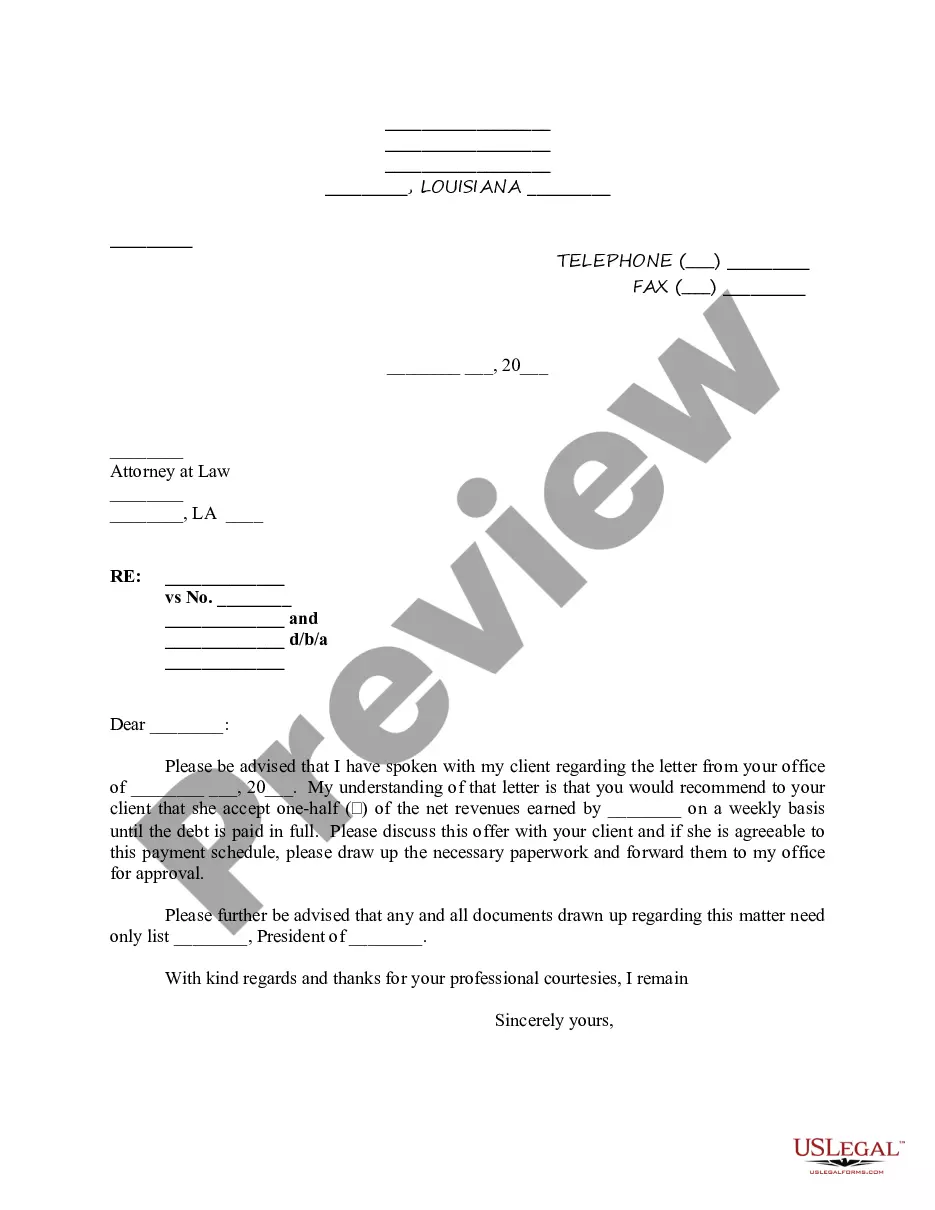

Debt Collection Letters For Unknown Person

Description

How to fill out Debt Collection Letters For Unknown Person?

Regardless of whether you deal with documents regularly or occasionally need to send a legal paper, it is essential to have a reference source that contains all relevant and current samples.

One important task when dealing with Debt Collection Letters For Unknown Person is to verify that you have the most recent version, as it determines its acceptability for submission.

If you aim to simplify your search for the latest document samples, utilize US Legal Forms.

To acquire a form without an account, follow these instructions: Use the search tool to locate the necessary form. Review the preview and outline of the Debt Collection Letters For Unknown Person to ensure it meets your requirements. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log Into your existing one. Use your credit card or PayPal account to finalize the transaction. Choose the document format for download and confirm your selection. Eliminate any confusion associated with legal documentation. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms serves as a repository of legal documents featuring virtually any form template you may need.

- Locate the templates you want, check their relevance immediately, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Acquire the Debt Collection Letters For Unknown Person samples in just a few clicks and store them in your account at any time.

- A US Legal Forms account permits you to conveniently access all necessary templates with less hassle.

- Simply click Log In in the website header and navigate to the My documents section to find all your required forms at your fingertips.

- This way, you won't waste time looking for the ideal template or verifying its legitimacy.

Form popularity

FAQ

Proving a debt is not yours requires clear communication and documentation. Start by gathering any evidence, such as billing statements or identification, to support your claim. You must respond to the debt collector in writing, clearly stating that you do not owe the debt. Utilizing resources like US Legal Forms can help you draft the necessary documents to assert your rights effectively against debt collection letters for unknown persons.

Receiving debt collection letters for unknown persons can be confusing and concerning. The first step is to avoid ignoring these letters. You should clearly indicate that the debt collection letters are for an unknown person by writing back to the sender. Additionally, you may consider notifying the credit reporting agencies to ensure this does not affect your credit report.

The seven seven rule for debt refers to a general practice where a creditor should aim to make seven collection attempts within seven days before considering further action. This guideline promotes due diligence in debt collection while respecting the rights of the debtor. Incorporating debt collection letters for unknown person can enhance your strategy by documenting your attempts and clarifying your position.

To legally send someone to collections, you must first ensure that the debt is valid and that you have made multiple attempts to collect it directly. Afterward, hiring a collections agency or utilizing templates for debt collection letters for unknown person can streamline the process. This formal step not only increases the chances of recovering the debt but also ensures compliance with applicable laws.

The 777 rule refers to a guideline within debt collection that suggests that a collector should make seven attempts to contact you over a period of seven days before deeming the debt collection unsuccessful. It emphasizes persistent communication while ensuring that the collector operates within legal bounds. When sending debt collection letters for unknown person, adhere to this rule to maintain fairness and transparency in your approach.

Typically, a debt can become uncollectible after a set period, often ranging from three to six years, depending on state laws. If a debt remains unpaid for this duration, creditors may find it challenging to enforce payment. Using debt collection letters for unknown person can help you address debts efficiently. However, understanding your state’s specific statutes of limitations is crucial.

Stopping debt collection calls for someone else involves a few clear steps. First, you should communicate with the debt collector, explaining that the calls are intended for another individual and you have no knowledge of them. You can also consider using services like US Legal Forms which can help you draft official letters, making it easier to inform collectors about your situation and protect your rights.

If you're frequently receiving letters for someone else, act promptly. Begin by writing a response to the debt collector, advising them that you do not recognize the person in question. Additionally, you can reach out to your local post office to report the situation, and they may assist in stopping the delivery of such letters to your address.

The 777 rule relates to fair debt collection practices and serves as a guideline for consumers. It states that if you receive three or more debt collection letters from a creditor within a certain time, you should take action to dispute the debt. This rule can help protect you from debt collection letters for unknown persons, as it encourages consumers to communicate with collectors to clarify their situation.

Receiving debt collection letters for someone else can be confusing. First, do not ignore the letters, as it is important to respond. You should write a letter to the debt collector informing them that you are not the person they are seeking. Make sure to include the details of the letters you received and ask them to stop contacting you regarding this unknown person.