Child Support Termination Form For New York

Description

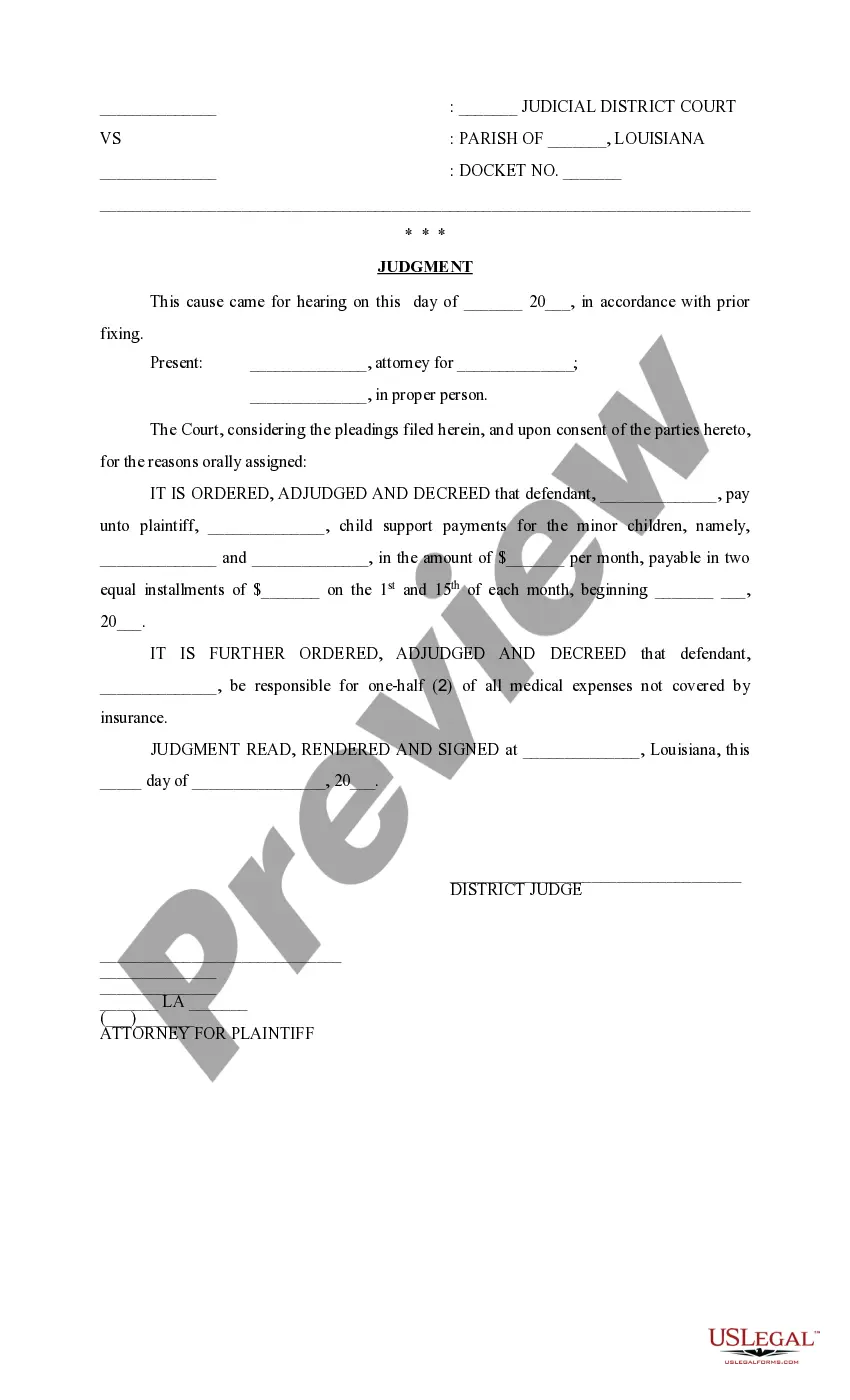

How to fill out Louisiana Consent Judgment For Termination Of Child Support?

The Kid Support Termination Document for New York that you view on this site is a versatile legal template crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, groups, and lawyers with more than 85,000 validated, state-specific documents for various business and personal situations. It’s the fastest, easiest, and most dependable method to acquire the documentation you require, as the service promises the utmost level of data safety and anti-malware measures.

Register for US Legal Forms to have validated legal templates for every circumstance at your fingertips.

- Search for the document you need and examine it.

- Scroll through the file you looked for and preview it or read the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to complete a swift payment. If you already have an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Kid Support Termination Document for New York (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the documentation.

- Print the template to finish it manually. Alternatively, use an online versatile PDF editor to swiftly and accurately fill out and sign your form with an electronic signature.

- Download your documentation once more.

- Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

To terminate child support in New York State, you should gather all relevant information and fill out the appropriate termination form. You will need to submit this form to the court along with supporting evidence for your request, such as changes in financial circumstances or the child's emancipation. Utilizing resources like USLegalForms can provide you with the necessary templates and guidance, ensuring a smoother termination process.

To cancel child support in New York, you must file a petition with the court that issued the original support order. This process typically involves submitting a completed child support termination form for New York, along with any necessary documentation. It’s crucial to follow the correct legal procedures, and using USLegalForms can guide you through each step, making it easier to navigate the cancellation process.

Yes, New York State requires a termination letter to officially end child support obligations. This letter must clearly state the reasons for termination and comply with the legal guidelines set by the state. To ensure you meet all requirements, consider using the child support termination form for New York available on platforms like USLegalForms. This resource simplifies the process and helps you avoid potential issues.

Yes, a termination letter is required in New York state for ending child support obligations. This letter serves as an official notice to inform the court and the other party involved about the intention to terminate support. You will need to fill out a Child support termination form for New York to ensure that your request is processed correctly. Using a reliable platform like US Legal Forms can help streamline this process, providing the necessary templates and guidance you need.

In New York, child support does not automatically end when a child turns 18 or graduates from high school. Instead, a parent must formally file a termination request using the child support termination form for New York. This ensures that the change in payment status is legally recognized. It’s important to understand the specific conditions that apply, and USLegalForms can provide guidance in navigating this process.

A termination letter for child support is a formal document that requests the end of child support payments. It provides a clear record and outlines the reasons for the termination. To initiate this process in New York, you will need a child support termination form for New York that adheres to state regulations. Utilizing a reliable service, like USLegalForms, can help you generate the necessary paperwork efficiently.

The non-custodial parent is responsible for bringing forward the paperwork to terminate child support to get a court order to have the payments stopped. You should never wait on the custodial parent to do this.

While typically the court will entertain a child support modification only after at least 3 years has passed since the order was entered, the exception is for a 15% change in income. One of the common reasons that noncustodial parents petition the court for a downward modification is due to a loss of employment.

A custodial parent may file a petition with their local child support agency. That petition will then be forwarded to the New York City Law Department office in the county where the non-custodial parent resides. This matter will then be litigated in the New York City Family Court located in the same borough.

Once the child reaches 21 or is married, fully employed, or joins the military (emancipated between 17 and 21), the noncustodial parent files a petition to terminate child support in NY. The court then reviews this petition, and after approval, the child support payments stop.